Navigating the Waters of Secondary Stock Sales in Startups

By Lior Ronen | Founder, Finro Financial Consulting

When people think about startups, the focus is often on innovative ideas, ambitious growth plans, and funding rounds that fuel expansion. But there’s a part of the startup ecosystem that doesn’t always get the attention it deserves: secondary stock sales.

Secondary stock sales allow early investors, founders, and employees to sell their shares to new buyers, without the company issuing new stock. It’s a way for shareholders to cash out before a big exit, like an IPO or acquisition. While it may seem like a niche transaction, it has become increasingly relevant as startups stay private longer and the demand for liquidity grows.

In this article, we’ll break down what secondary stock sales are, why they’re becoming more common, and what both startups and investors need to know to navigate these transactions effectively.

Secondary stock sales allow early shareholders, such as employees, founders, and investors, to sell their shares to new buyers, providing liquidity without the company issuing new stock. These transactions have grown in popularity as startups delay public exits, offering financial flexibility to early stakeholders while attracting new investors to late-stage private companies.

Though secondary sales offer benefits like liquidity, employee retention, and investor access, they also pose challenges, including legal complexities, potential conflicts among shareholders, and valuation risks. As secondary stock sales become more common, the emergence of dedicated platforms, increasing institutional participation, and potential regulatory developments will continue shaping this evolving part of the startup ecosystem.

- What Are Secondary Stock Sales?

- Why Are Secondary Stock Sales on the Rise?

- The Pros and Cons of Secondary Stock Sales

- Case Study: Uber’s Use of Secondary Stock Sales

- The Process of Secondary Stock Sales

- Navigating Secondary Stock Sales: Practical Advice for Startups and Investors>

- Looking Forward: The Future of Secondary Stock Sales

What Are Secondary Stock Sales?

When you hear about startup funding, you typically think of the company raising capital by selling new shares—this is what’s known as a primary stock sale.

But there’s another side to startup share ownership that plays an important role, especially for early investors and employees: secondary stock sales.

Let’s break it down into manageable pieces to understand how these transactions work.

Primary vs. Secondary Sales: The Basics

To understand secondary stock sales, it helps to compare them to the more familiar primary sales.

Primary Stock Sales: When a company raises money by issuing new shares, this is a primary sale. The company directly benefits by getting fresh capital to fund its operations, product development, or market expansion. Think of this as the company selling a new batch of tickets to its event, bringing in new money.

Secondary Stock Sales: In a secondary sale, the company isn't involved in raising new funds. Instead, existing shareholders—often early employees, founders, or investors—sell their shares to new buyers. This transaction provides liquidity to the sellers, but the company doesn’t receive any money directly. If we stick with the event analogy, this is like selling your existing ticket to someone else. The event doesn't make more money, but the seller gets liquidity.

In summary, while a primary sale is about raising funds for the company, a secondary sale focuses on providing liquidity for existing shareholders.

It’s an important mechanism, especially in startups that are staying private for longer, as it offers a way for early stakeholders to monetize their shares.

Key Players in Secondary Stock Sales

Now that we’ve covered the difference between primary and secondary sales, let’s look at the key people involved in a secondary transaction. Typically, there are three main groups that play a part:

The Seller: This could be a founder, early employee, or investor who holds shares in the startup. They are often looking to cash in on the value of their equity without waiting for the company to go public or be acquired. The motivation here is straightforward: liquidity. Early-stage shareholders may have held their equity for years and want to realize some financial gain.

The Buyer: On the other side of the transaction is the buyer, usually a new investor. They’re interested in acquiring shares in a growing startup with strong potential, hoping to benefit when the company eventually exits. Buyers in secondary sales tend to be later-stage investors, often attracted to the fact that the company has already demonstrated some level of success, making it a relatively safer bet compared to investing in earlier rounds.

The Company: While the company itself isn’t a direct party to the transaction, its involvement is usually necessary. Companies often have the right to approve or deny secondary sales, as these sales can impact the company’s cap table (the ownership structure). The company might also facilitate the transaction by helping connect buyers and sellers or providing necessary documentation.

Understanding these key roles helps frame the bigger picture of how secondary sales work and why they’re an essential part of startup financing, especially as companies grow and evolve.

By breaking down the fundamentals of secondary stock sales and outlining the major players, you can start to see why these transactions are gaining momentum in the startup world.

Up next, we’ll dive into the reasons behind this rise and why secondary sales are becoming more popular.

Why Are Secondary Stock Sales on the Rise?

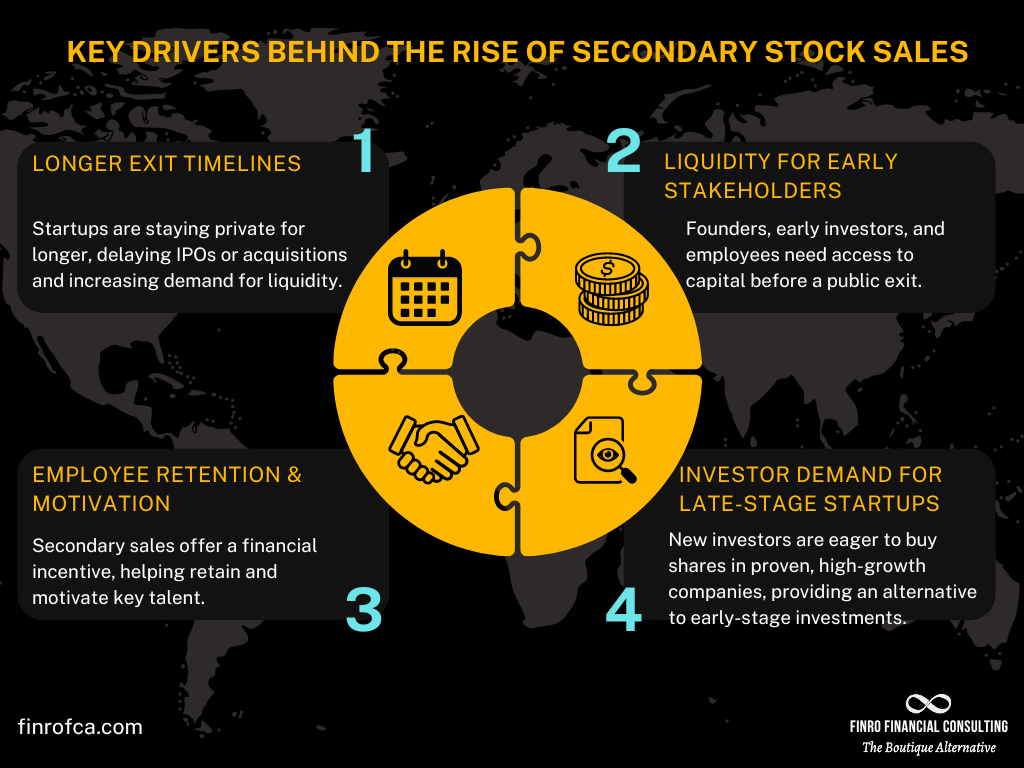

In recent years, secondary stock sales have become more common in the startup world. This isn’t happening by chance—several key factors have contributed to their increasing popularity.

From the way startups grow to how they retain talent and attract investors, secondary sales now play a strategic role in shaping the startup landscape.

1. Liquidity Challenges in Private Startups

Historically, startups used to go public or get acquired within a relatively short timeframe, often within 5 to 7 years. Today, it’s a different story. Successful startups are staying private longer, sometimes for 10 years or more. This delay in exits creates a challenge: early investors, employees, and even founders can have a significant portion of their net worth tied up in the company’s shares with no clear path to liquidity.

Secondary stock sales offer a solution to this. They provide a way for early shareholders to sell part of their stake before the company goes public or is acquired. This flexibility is crucial, particularly for employees and early investors who might want to cash in on their hard work and investment without waiting for an uncertain future exit. As startups take longer to reach those big liquidity events, the demand for secondary sales has naturally grown.

Think of it as a safety valve—secondary sales allow early stakeholders to realize some financial gain without waiting for an exit that could still be years away.

2. Retention and Motivation of Key Employees

Startups often use equity as a key part of their compensation packages to attract and retain talented employees. Offering stock options and equity creates a sense of ownership and investment in the company’s future success. But for employees, especially those who have been with the company for a long time, that equity can feel like a locked asset—they see the value on paper but can’t access it for years.

Secondary sales help solve this problem. By allowing employees to sell a portion of their equity, startups provide a tangible financial reward for their hard work. This has two key benefits:

Retention: Employees are more likely to stay with the company if they can realize part of the value of their shares over time, instead of waiting for an IPO or acquisition.

Motivation: When employees see that their equity translates into real financial gain, it keeps them motivated to contribute to the company’s growth.

In short, secondary stock sales allow startups to turn equity compensation into a more effective retention and motivational tool, helping companies keep their key talent engaged for the long haul.

3. Investor Appetite for Late-Stage Startups

Investors are always looking for the next big opportunity, and secondary stock sales provide a unique way for them to gain access to late-stage startups. As more companies delay their public listings, investors who may have missed out on earlier funding rounds can now enter the game by buying shares through secondary sales.

These investors are often more risk-averse than early-stage venture capitalists, as they prefer to invest in companies that have already shown success and have a clear path to growth. By purchasing shares in secondary transactions, they can gain exposure to high-growth startups without the risks typically associated with earlier-stage investments.

For late-stage startups, this creates a win-win situation. Secondary stock sales offer a way to attract new investors, bringing in fresh interest and expertise without diluting existing shareholders or raising new capital. It’s an appealing way to satisfy investor demand while maintaining control over the company's ownership structure.

The rise of secondary stock sales is no accident. The longer timelines for exits, the need for liquidity among early stakeholders, and the increased interest from late-stage investors have all contributed to their growing importance in the startup ecosystem. Secondary sales have become a flexible tool that benefits both early shareholders and new investors while helping companies maintain employee engagement and attract fresh capital.

Next, we’ll explore the pros and cons of secondary stock sales, so you can better understand how these transactions can shape the future of a startup.

The Pros and Cons of Secondary Stock Sales

Secondary stock sales can be a powerful tool for startups, founders, employees, and investors, but they also come with their own set of advantages and potential downsides.

Much like any important decision in a growing company, secondary sales should be weighed carefully. In this section, we'll look at both the benefits and the challenges of these transactions to give you a well-rounded view.

Pros of Secondary Stock Sales

Liquidity for Early Stakeholders

Secondary stock sales provide much-needed liquidity to early stakeholders—whether they are founders, early investors, or employees. For these groups, a significant portion of their net worth is often tied up in the company’s equity. A secondary sale allows them to unlock some of that value without waiting for an IPO or acquisition, offering financial freedom and security.

Example: Early employees may want to cash in on some of their stock options to buy a house, pay off debt, or invest in other opportunities. Secondary sales give them the flexibility to do this without needing to wait for years.

Retention and Motivation of Employees

Equity-based compensation is a common tool startups use to attract and retain top talent. However, if employees can't realize the value of that equity, it may eventually lose its appeal. Allowing employees to participate in secondary sales boosts their motivation and helps retain them for longer periods. Employees are more likely to stay with the company if they can see a tangible financial benefit from their hard work.

Example: If an employee can sell a portion of their shares in a secondary transaction, they get immediate financial gain while still holding onto some equity for future growth.

Opportunity for New Investors

For investors, secondary stock sales open up opportunities to buy into startups that may have already proven their business model and shown significant growth. By entering at a later stage, investors reduce some of the risk that comes with early-stage investments. These transactions allow new investors to participate in the company’s future growth without the startup needing to raise new capital through a primary round.

Example: Late-stage investors might be interested in acquiring shares of a high-growth startup that is nearing an IPO but still private, making secondary sales an attractive option.

Cons of Secondary Stock Sales

Potential for Lower Valuation Signals

Secondary stock sales, especially if executed at a price lower than the company’s most recent valuation, can send a negative signal to the market. It may suggest that early investors or employees are losing confidence in the company’s future, which can influence perceptions of the startup's stability or growth prospects.

Example: If employees are eager to sell their shares at a discount, potential buyers might question whether the company is as successful as it appears on paper.

Legal and Logistical Complexities

Secondary sales involve a range of legal and logistical challenges. These transactions need to comply with securities regulations, and there are often significant administrative tasks involved, such as updating the cap table and managing shareholder agreements. Startups and investors need to carefully navigate these aspects to avoid legal complications and ensure the transaction is executed smoothly.

Example: Handling the legal due diligence, compliance, and updating the cap table with every secondary transaction can be time-consuming and expensive.

Potential for Conflict Among Shareholders

Secondary stock sales can sometimes cause friction among shareholders. For instance, some shareholders may prefer to hold onto their shares until the company exits, while others might want to cash out. These differing perspectives can lead to disagreements about whether secondary sales should even be allowed, as well as tension over who can sell and at what price.

Example: Founders may resist secondary sales because they worry it could dilute their control over the company or lead to unwanted investors entering the cap table.

| Pros | Cons |

|---|---|

| Provides liquidity for shareholders | May signal lack of confidence |

| Boosts employee retention & motivation | Legal and logistical complexities |

| Attracts new investors | Potential conflicts among shareholders |

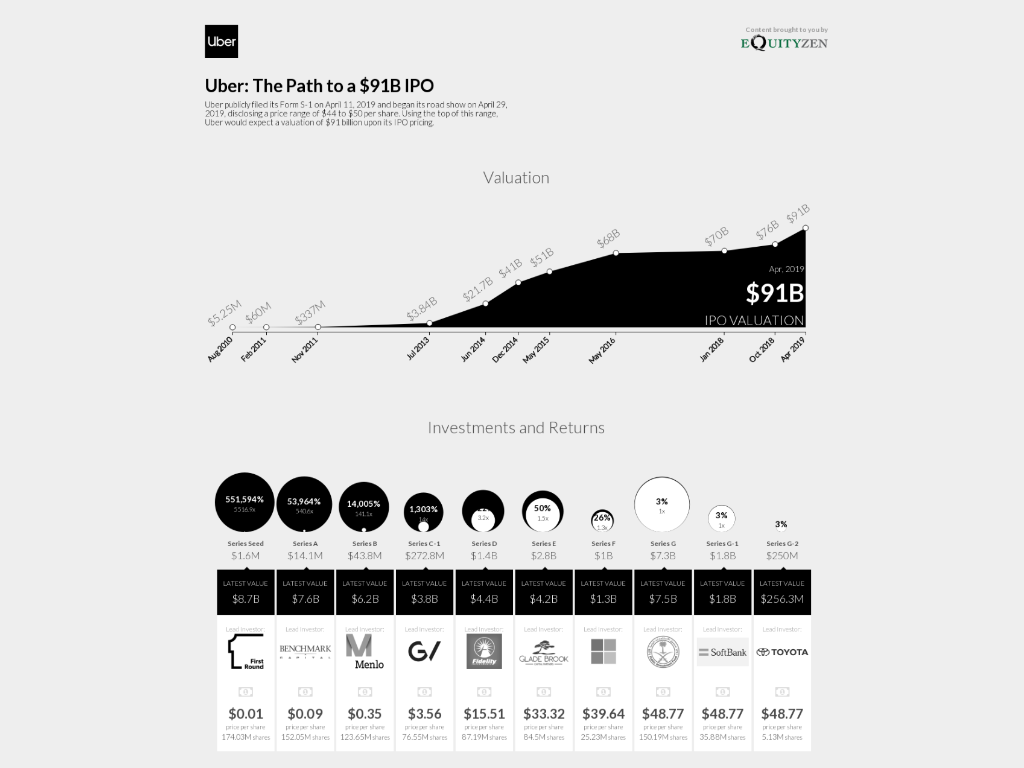

Case Study: Uber’s Use of Secondary Stock Sales

To better understand how secondary stock sales work in the real world, let’s look at a well-known example: Uber. This case shows how secondary sales can offer significant advantages to both early shareholders and new investors, while also demonstrating the potential impact on the company as a whole.

Uber: Driving Liquidity Through Secondary Sales

Uber, the global ride-hailing giant, has been at the forefront of innovation—not just in its business model, but also in how it approached secondary stock sales. Uber stayed private for many years, far longer than most startups, and during that time, it raised billions of dollars in capital through traditional funding rounds. However, many of its early shareholders, including employees, investors, and executives, faced a common challenge: their wealth was tied up in Uber’s stock, with no clear exit in sight.

To solve this liquidity problem, Uber allowed multiple rounds of secondary stock sales, giving its early shareholders the opportunity to sell a portion of their equity to new investors.

Benefits for Early Shareholders

For early employees and investors, Uber’s secondary sales provided a much-needed financial lifeline. By selling their shares in these transactions, they were able to access cash without waiting for Uber to go public or be acquired—an exit event that was delayed several times as Uber continued to grow.

Liquidity Without Exit: Uber's employees and investors could monetize their shares, gaining financial flexibility without having to wait for an IPO or acquisition.

Boosting Employee Morale: These secondary sales acted as a powerful retention tool. Employees could see the value of their equity in tangible terms, creating a sense of security and accomplishment. This financial reward helped keep top talent at Uber, even during periods of uncertainty.

Opportunities for New Investors

For the buyers in these secondary transactions, Uber represented a rare opportunity. By the time Uber allowed secondary sales, it was already a global brand, with a proven track record of growth and scalability. New investors were eager to buy shares in a company that was still private but carried the potential for massive returns when it eventually went public.

Access to Late-Stage Private Stock: Investors were able to purchase shares in a well-established, high-growth company that had already passed the risky early stages of development.

Anticipation of Future Gains: These investors were betting on the long-term success of Uber, expecting significant returns when the company ultimately went public. This payoff materialized when Uber conducted its IPO in 2019, giving these secondary shareholders the opportunity to realize substantial gains.

The Company’s Role

Although Uber itself didn’t raise new capital from these secondary sales, it played a crucial role in facilitating the transactions. The company had the power to approve or deny secondary stock sales, allowing it to maintain control over who owned shares and manage its cap table. Uber also set certain terms to ensure the transactions aligned with the company’s long-term goals.

Cap Table Management: By carefully managing who was allowed to buy shares in these secondary transactions, Uber was able to maintain a healthy ownership structure, avoiding any disruption to its operations.

Protecting Company Interests: Uber’s involvement in the secondary sale process ensured that the company’s interests were protected, even as shares changed hands.

Key Takeaways from Uber’s Secondary Sales

Successful Liquidity: Uber’s use of secondary sales provided liquidity for its early stakeholders while continuing to grow and attract new investors.

Retention and Motivation: Secondary stock sales kept employees engaged and motivated by allowing them to realize the value of their equity over time.

Investor Interest: The transactions allowed late-stage investors to buy into a proven company, giving Uber the financial flexibility to keep operating without rushing toward an IPO.

Uber’s secondary stock sales offer a compelling example of how these transactions can be used strategically to benefit both shareholders and the company itself. By providing liquidity to early investors and employees while attracting new investors, Uber was able to maintain its growth trajectory, keep its workforce engaged, and manage its ownership structure effectively. Secondary stock sales, when handled correctly, can provide a vital tool for companies navigating the challenges of delayed exits and growing investor demand.

Next, we’ll dive into the process of secondary stock sales, offering practical steps and insights for startups and investors considering these transactions.

The Process of Secondary Stock Sales

Now that we’ve explored the concept of secondary stock sales and looked at a real-world example, let’s break down how these transactions actually happen. Like any financial transaction, secondary stock sales require careful planning and coordination to ensure all parties are aligned and the transaction runs smoothly.

Below, we’ll walk through the main steps involved in the process of a secondary stock sale, highlighting key considerations for both startups and investors.

1. Decision to Conduct a Secondary Sale

The process usually starts when existing shareholders—whether they’re founders, early employees, or investors—express a desire to sell some of their equity. At this point, several discussions take place:

Internal Discussions: The company’s leadership must decide whether to allow secondary stock sales. This includes considering how such sales will impact the company’s cap table, ownership structure, and overall strategy.

Key Considerations: Startups often need to balance liquidity for early shareholders with the potential risks of allowing new, external investors onto the cap table. Some companies may limit who can sell shares or how much can be sold, to prevent major shifts in ownership that could disrupt operations.

For example, a founder might want to sell a portion of their shares to achieve some financial security, but the company must first decide if such a sale aligns with its long-term goals and whether it fits within existing shareholder agreements.

2. Valuation and Pricing

Once the decision to conduct a secondary sale is made, the next critical step is determining the price at which the shares will be sold. Valuation plays a significant role here, as it impacts both the selling shareholders and the potential buyers.

Setting a Price: The price of shares in secondary sales can be tricky to establish, especially if the company has not recently raised a funding round or undergone a formal valuation. To get an accurate figure, companies may bring in third-party advisors or rely on the most recent funding round valuation as a benchmark.

Negotiation: Buyers and sellers may negotiate the final price based on factors such as the company’s growth prospects, its financial health, and market conditions. A secondary sale at a price lower than the company’s last valuation could signal issues, so this step requires careful consideration.

For instance, if an employee is selling shares in a startup that hasn’t raised funds in over a year, the company may need to perform a fresh valuation to ensure the price is fair for both the seller and the buyer.

3. Legal and Compliance Considerations

Secondary stock sales are subject to various legal requirements and securities regulations, especially in different jurisdictions. This step involves handling the necessary legal documentation to ensure the transaction is compliant with relevant laws.

Securities Laws: Secondary sales must comply with securities laws to ensure the transaction is legal and that no unregistered securities are being sold. Companies often consult with legal counsel to review the sale terms and ensure compliance.

Shareholder Agreements: Shareholder agreements may include clauses that restrict or control secondary sales. For instance, many companies have a “right of first refusal” (ROFR) provision, which gives the company or existing shareholders the right to purchase shares before they’re sold to external buyers.

For example, before an early investor can sell shares to a new party, the company might have the option to buy those shares first. Legal counsel would facilitate this process and ensure all parties understand their rights and obligations.

4. Execution of the Transaction

Once the valuation, pricing, and legal aspects are in place, the actual transfer of shares happens. This step involves transferring ownership of the shares from the seller to the buyer.

Facilitating the Sale: The company often plays a role in facilitating the transfer of shares. This may include helping the buyer and seller navigate any required documentation and ensuring that all records, such as the cap table, are updated accordingly.

Payment and Transfer: The transaction typically involves the buyer wiring funds to the seller or using an escrow service, and the company officially transfers the shares to the buyer’s name. Once the payment is confirmed, the shares are transferred, and the transaction is complete.

For instance, a founder might sell 10,000 shares to a new investor, and after the funds are received, the company updates its cap table to reflect the new ownership structure.

5. Post-Transaction Administration

After the transaction is complete, there are several post-sale tasks that the company must handle to ensure everything is in order:

Updating the Cap Table: The company’s cap table, which outlines who owns what percentage of the company, must be updated to reflect the changes from the secondary sale. This is critical for maintaining accurate records of ownership and ensuring transparency.

Tax Implications: Both the seller and the buyer must consider the tax implications of the transaction. Sellers may face capital gains taxes on their earnings, while buyers need to understand the tax responsibilities associated with holding private company stock.

For example, a former employee who sells shares might need to work with an accountant to understand how the sale impacts their personal tax situation, while the company adjusts its internal records to account for the new shareholder.

Secondary stock sales involve more than just a handshake and the transfer of money. They require thoughtful consideration, careful planning, and coordination between the company, sellers, and buyers. From deciding to conduct a sale, to determining the price, navigating legal requirements, and managing post-transaction details, secondary sales are a multi-step process that requires attention to detail.

In the next section, we’ll provide practical advice for both startups and investors, offering tips on how to navigate the complexities of secondary stock sales with confidence.

Navigating Secondary Stock Sales: Practical Advice for Startups and Investors

By now, we’ve explored what secondary stock sales are, why they’ve become popular, the pros and cons, and how the process unfolds. The next step is to provide some practical advice to help both startups and investors navigate these transactions smoothly.

Whether you're a startup considering allowing secondary stock sales or an investor looking to buy shares in a promising private company, there are important things to keep in mind to ensure the transaction is a success.

For Startups:

Consult with Experienced Advisors Secondary stock sales can be complex, involving financial, legal, and regulatory factors. It’s crucial to engage with experienced advisors, such as legal counsel and financial consultants, who can guide you through the process. They will ensure that the transaction complies with all relevant laws, such as securities regulations, and that the company’s interests are protected.

Tip: Having the right experts on board helps avoid potential legal or financial missteps that could disrupt the company’s operations or ownership structure.

Establish Clear Policies It's important for startups to set clear policies around secondary stock sales early on. This includes defining who is allowed to sell shares, under what conditions, and how much of their stake can be sold. Having these rules in place avoids confusion and helps maintain control over the company’s ownership structure.

Tip: Consider putting policies in writing through shareholder agreements, which could include provisions like a "right of first refusal" or limits on how much equity employees can sell at one time.

Maintain Transparency with Shareholders Secondary stock sales can sometimes lead to misunderstandings or tensions within the company. To avoid this, startups should be open and transparent with all shareholders about the reasoning behind allowing secondary sales. This includes explaining how the sales align with the company’s broader strategy and long-term vision.

Tip: Host regular updates or shareholder meetings to communicate the company’s approach to secondary sales and ensure all stakeholders are aligned.

For Investors:

Perform Thorough Due Diligence Just like with any investment, it’s essential to do your homework before buying shares in a secondary sale. While buying shares in a late-stage startup may seem like a safer bet than investing early on, you still need to carefully evaluate the company's financial health, market position, and growth prospects.

Tip: Don’t rely solely on the company’s past success. Review the most recent financial statements, talk to management if possible, and consult any legal and financial documents available to you.

Negotiate Fair Terms The terms of a secondary sale can vary widely, so it’s important to ensure you're getting a fair deal. Aside from negotiating the price, you should also pay attention to other key terms such as lock-up periods, voting rights, and any restrictions on future sales. Make sure the terms align with your investment goals and risk tolerance.

Tip: Seek legal advice if you’re unsure about any terms in the purchase agreement, especially when it comes to rights and obligations tied to the shares.

Take a Long-Term Perspective When buying shares in a secondary sale, you need to be prepared for the possibility of a long investment horizon. While late-stage startups may have a clearer path to an IPO or acquisition, these events can still take years to materialize. Be ready to hold onto your shares for the long haul and understand the liquidity risks involved.

Tip: Align your expectations with the company's timeline and be prepared for changes in the market or business strategy that could delay an exit.

Secondary stock sales can offer significant benefits to both startups and investors, but they require careful planning and execution. For startups, consulting with experienced advisors, establishing clear policies, and maintaining open communication with shareholders is key to avoiding potential pitfalls. For investors, thorough due diligence, negotiating favorable terms, and having a long-term perspective can help ensure a successful transaction.

In the final section, we’ll take a forward look at the future of secondary stock sales, examining how trends in the startup ecosystem and regulatory changes may continue to shape this growing market.

Looking Forward: The Future of Secondary Stock Sales

As startups continue to delay going public and private equity markets grow more robust, the role of secondary stock sales is likely to expand. With the increased demand for liquidity and access to high-growth private companies, secondary sales are becoming a central part of the startup ecosystem.

Let’s explore what we can expect in the future for this type of transaction.

1. Evolving Startup Landscape

Startups are staying private longer than ever, with many delaying IPOs in favor of raising additional private capital. This extended timeline means early shareholders—especially employees—need access to liquidity before a company reaches its exit stage. As this trend continues, secondary sales will become a more widely accepted method for providing early stakeholders with financial flexibility.

Impact: Secondary stock sales are set to become a standard practice in the lifecycle of late-stage startups, especially as more employees and early investors look for liquidity well before an IPO or acquisition.

What to Watch: As more startups offer liquidity options earlier, expect to see greater adoption of formalized secondary sales programs managed directly by companies to streamline the process.

2. Emergence of Secondary Market Platforms

The rise of secondary stock sales has spurred the development of dedicated platforms that facilitate these transactions, such as SharesPost, Forge Global (formerly Equidate), and EquityZen. These platforms connect sellers and buyers while ensuring compliance with legal requirements, making the process easier for both parties.

Impact: As these platforms grow in popularity, they’ll offer more transparency and liquidity to the market. Startups will also likely leverage them to provide controlled liquidity options to employees and early investors.

What to Watch: The expansion of these platforms could lead to new services, such as real-time price discovery, enhanced legal protections, and improved liquidity for shareholders. They may also play a role in democratizing access to late-stage private companies for smaller investors.

3. Increasing Institutional Participation

Traditionally, secondary stock sales were largely dominated by individual buyers and smaller investment groups. However, as more institutional investors—like venture capital firms and private equity funds—recognize the value of late-stage startup investments, they are starting to participate in these transactions in larger volumes.

Impact: The influx of institutional capital into the secondary market could provide startups with additional avenues for liquidity while also driving up demand for shares in high-growth companies. This increased demand may push valuations higher and provide more flexibility for sellers.

What to Watch: Institutional investors’ growing interest in secondary markets could lead to greater sophistication in deal structuring and terms, potentially introducing new ways to manage liquidity while minimizing disruption to the cap table.

4. Regulatory Developments

As secondary stock sales become more common, they will likely attract increased attention from regulatory bodies. Governments around the world may introduce new securities laws to provide more structure and oversight to these transactions. This could include enhanced protections for investors or more stringent requirements on how startups manage secondary sales.

Impact: Increased regulation could standardize secondary sales, providing clearer guidelines for startups and investors alike. While this could reduce some of the flexibility startups currently enjoy, it may also make the market safer and more accessible for a broader range of participants.

What to Watch: Stay informed about new regulatory changes that may affect the ability of companies to conduct secondary sales. Startups may need to adapt their policies to comply with new legal frameworks as governments react to the growing market.

Secondary stock sales are rapidly becoming a key component of the startup financing ecosystem. As startups continue to stay private for longer, secondary sales provide much-needed liquidity to early stakeholders, while also giving investors the opportunity to gain access to high-growth private companies.

Looking ahead, we expect secondary stock sales to play an even bigger role in the startup world, driven by the growing need for liquidity, the rise of dedicated platforms, increased institutional participation, and potential regulatory developments. For both startups and investors, staying informed about these trends will be crucial for navigating the evolving landscape of secondary stock sales with confidence.

Thank you for joining us on this exploration of secondary stock sales. Whether you're a founder, employee, or investor, we hope this guide has provided you with valuable insights into how these transactions work and how they could shape the future of your company or investment strategy.