Gaining Traction: The Key to Startup Valuation

By Lior Ronen | Founder, Finro Financial Consulting

If you've explored startup valuations before, you understand they're not straightforward like checking a price tag at a store.

It's more about putting together pieces of a puzzle, with user growth and engagement being crucial components.

Think about launching an exciting new video game that no one plays.

No matter how great it is, without players to enjoy and engage with it, the game's value diminishes. The same goes for startups.

Even if they have groundbreaking products, without a growing number of users and their active involvement, the startup's attractiveness to investors might decline.

We're going to explore these important elements, focusing on key metrics such as Monthly Active Users, Churn Rate, and Session Duration.

These indicators help us understand how well a startup is doing and what drives investment decisions.

We’ll also look at real-world examples to show how these factors can significantly impact a startup's value.

Let's get started.

User growth and engagement are crucial for determining the valuation of startups. User growth indicates a startup's potential by showing an increase in its user base, suggesting that the market is receptive to its product or service. On the other hand, user engagement reflects the value a startup provides to its users, with metrics like how often and how long users interact with the product indicating their satisfaction and loyalty.

Essential metrics such as Monthly Active Users (MAU), Churn Rate, and Session Duration provide insights into a startup's health and potential. Real-world case studies demonstrate that a combination of high user growth and strong user engagement can significantly enhance a startup's valuation, highlighting the necessity of not only attracting users but also keeping them engaged to achieve long-term success and attract investors.

Understanding Key Concepts: User Growth and Engagement

Before we start exploring the metrics and diving into case studies, let's get familiar with the two main characters of our story: 'user growth' and 'user engagement.'

They're the dynamic duo that can significantly influence a startup's journey and its valuation.

Let's start with 'user growth.'

This term refers to the increase in a startup's user base over a specific period. Imagine you've opened a new coffee shop. At first, you have a handful of customers each day. But as word spreads about your exceptional brew, more and more people start visiting.

This increase in the number of customers is what we call 'user growth' in the startup world. The faster your user base grows, the more potential your startup has to become a big player in the market.

Rapid user growth can be a strong indicator that your product or service is in demand and that you're successfully reaching your target audience.

Now, onto 'user engagement.'

This term is about how much and how often users interact with a startup's product or service.

Going back to our coffee shop analogy, it's great to have a lot of customers, but how many of them are regulars? How many enjoy your coffee so much that they come back every day or every week?

In the digital world, user engagement could mean anything from how long a user spends on an app, how often they log in, or how much they interact with the service. High user engagement signifies that users find value in a startup's product or service, leading to customer loyalty and, often, word-of-mouth promotion.

User growth and engagement are critical to a startup's success and valuation.

User growth shows potential. It's a sign that there's a market for what the startup is offering. User engagement, on the other hand, is a testament to a startup's ability to deliver value to its users, encouraging them to stick around and continue using the product or service.

When combined, these factors create a compelling story of a startup's potential.

Now, armed with a clear understanding of user growth and user engagement, we are ready to take the next step.

In the following section, we'll explore how these concepts translate into measurable metrics, often known as 'traction' metrics. We'll see how these numbers help us understand the performance and potential of a startup, influencing its valuation in the eyes of investors.

So, let's move forward and decode these crucial metrics!

Metrics for Measuring Traction: MAU, Churn Rate, and Session Duration

Stepping into our next stage, let's talk about 'traction' - a term that helps us quantify user growth and engagement.

In the startup world, traction is like the heartbeat of a company. It gives us insight into how healthy and vibrant a startup is and whether it has the momentum to keep going.

One of the key metrics to measure traction is the Monthly Active Users (MAU).

It tells us how many unique users interact with a product or service monthly.

Let's go back to our coffee shop.

If we counted all the customers who came into our shop in a month, that would be our MAU. High MAUs can indicate a large user base and potentially strong user growth.

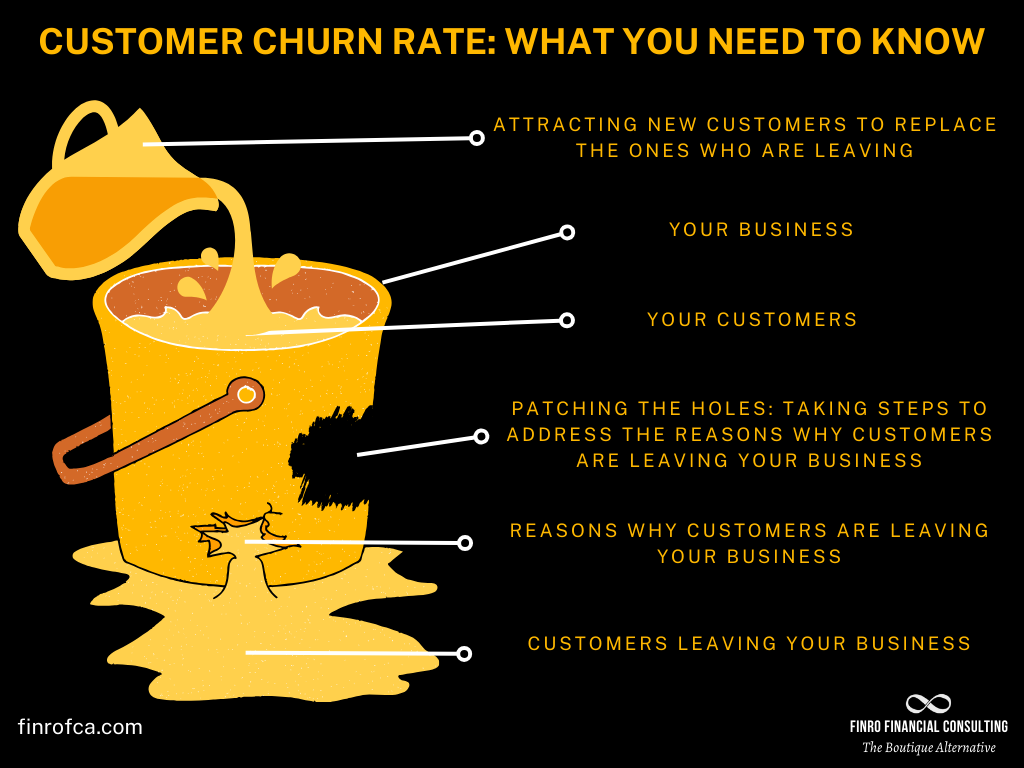

Next up is the Churn Rate.

The Churn Rate tells us how many users stop using a product or service over a certain period. It's like tracking how many regulars stop coming to our coffee shop.

A high Churn Rate can be a red flag for investors, indicating that users are not staying engaged, which might lead to slower user growth.

Then we have Session Duration.

This metric shows us how long, on average, a user spends interacting with a product or service each time they use it. In the coffee shop scenario, it's like knowing how long our customers stay and enjoy their coffee.

A longer Session Duration can suggest high user engagement as users find value in the product or service and spend more time using it.

Understanding how these metrics connect is crucial.

MAU is directly tied to user growth, as it reflects the size of the user base. On the other hand, churn Rate and Session Duration are tied to user engagement.

If the Churn Rate is high, it means users are not staying engaged and leaving. If the Session Duration is long, it suggests users are highly engaged.

All three metrics together provide a comprehensive picture of a startup's traction.

They show whether a startup is attracting new users, whether it's keeping those users engaged, and how much value those users are getting from the product or service.

This way, they play a vital role in determining a startup's health and potential value to investors.

As we transition into the next section, we'll explore how these metrics influence investor decisions and impact a startup's valuation. So, let's continue our journey and see these metrics in action!

How Investors View Traction?

Now that we understand the key metrics for measuring traction, it's time to switch gears and look at things from an investor's perspective.

After all, investors are the ones who often hold the keys to a startup's future growth and success.

Investors are a bit like treasure hunters. They're always on the lookout for gems - startups that have the potential to grow rapidly and deliver a high return on investment.

And just like treasure hunters use maps and clues to find their treasure, investors use metrics like Monthly Active Users (MAU), Churn Rate, and Session Duration to gauge a startup's potential.

User growth, as measured by MAU, is often one of the first things an investor looks at. A high MAU can signal that a startup's product or service is in demand and that there's potential for future growth. It's a sign that the startup is doing a good job of attracting new users.

But attracting users is just the first step. The next step is keeping them engaged, and that's where Churn Rate and Session Duration come in. A low Churn Rate and a high Session Duration can indicate that users are finding value in the startup's product or service, which bodes well for long-term success.

After all, a startup with highly engaged users is more likely to develop a loyal customer base and generate consistent revenue over time.

However, investors don't just look at these metrics in isolation. They also consider how these metrics interrelate.

For example, if a startup has a high MAU but also a high Churn Rate, it could indicate that while the startup is good at attracting users, it's struggling to keep them engaged.

On the other hand, a startup with a lower MAU but a long Session Duration might show that while growth is slow, the users they do have are highly engaged.

In the next section, we'll examine some real-life examples to illustrate how these metrics can play out in different scenarios. We'll see how different combinations of user growth and engagement can impact a startup's valuation.

So, let's get ready to see these metrics in action!

Case Studies: Traction Metrics in Action

To bring all these concepts to life, let's dive into some real-world case studies. These examples will show how user growth, user engagement, and the metrics we've discussed can significantly influence a startup's valuation.

Case Study 1: The High-Growth, High-Engagement Startup

Our first example is a startup that's been making waves with its rapid user growth and high user engagement. With a steadily climbing MAU, this startup has demonstrated its ability to attract new users consistently.

But where it really shines is in its Churn Rate and Session Duration. With a low Churn Rate and an impressive Session Duration, it's clear that users aren't just flocking to this startup - they're sticking around and actively using the product.

This combination of high user growth and engagement caught the attention of investors, leading to a successful funding round and a significant increase in valuation.

Case Study 2: The High-Growth, Low-Engagement Startup

Now, let's consider a different scenario. This startup experienced rapid user growth, with its MAU skyrocketing in the first few months. However, its Churn Rate was also high, and its Session Duration was relatively low.

This suggested that while the startup was successful in attracting users, it struggled to keep them engaged. As a result, despite its impressive user growth, investors were cautious, and its valuation didn't see as significant a bump as the first case study.

Case Study 3: The Low-Growth, High-Engagement Startup

Lastly, let's look at a startup that had a relatively slow user growth but high user engagement. While its MAU growth was modest, its Churn Rate was low, and its Session Duration was high. This indicated that while the startup was attracting users slowly, those who did use the product or service were highly engaged. In this case, investors saw the potential for sustainable, long-term growth, leading to a positive valuation outcome.

Each of these case studies underscores the importance of both user growth and user engagement in shaping a startup's valuation. As we've seen, high user growth can attract investors' attention, but it's the combination of growth and engagement that can truly drive a startup's success and valuation.

In the next and final section, we'll wrap up our journey, summarizing what we've learned about the power of traction in influencing a startup's valuation. So, let's bring it all home!

| Attributes/Aspects | Case Study 1: High-Growth, High-Engagement | Case Study 2: High-Growth, Low-Engagement | Case Study 3: Low-Growth, High-Engagement |

|---|---|---|---|

| Monthly Active Users (MAU) | High MAU number | High MAU number | Low MAU number |

| Churn Rate | Low Churn Rate number | High Churn Rate number | Low Churn Rate number |

| Session Duration | High Session Duration number | Low Session Duration number | High Session Duration number |

| User Growth Over Time | High growth rate | High growth rate | Low growth rate |

| User Engagement Over Time | High engagement rate | Low engagement rate | High engagement rate |

| Investor Perception | Positive description | Mixed description | Positive/Mixed description |

| Startup Valuation | High Valuation number | Medium Valuation number | Medium-High Valuation number |

Traction’s Impact on Startup Valuation

As we've journeyed through the landscape of startup valuation, one message rings clear: traction matters. Traction, as represented by user growth and user engagement, holds significant sway over how a startup is valued.

Just like a ship needs wind in its sails to move forward, a startup needs user growth to propel it towards success.

A high Monthly Active Users (MAU) count shows that a startup's product or service is gaining acceptance and drawing interest, which can be an encouraging sign for potential investors.

But growth is just one part of the story.

Like a ship's crew needs to work together to keep it on course, a startup needs engaged users to maintain its momentum.

Metrics like Churn Rate and Session Duration offer insight into how well a startup is keeping its users engaged, which is critical for long-term success and sustainability.

Remember, while high user growth can pique investors' interest, it's the combination of growth and high user engagement that can really drive a startup's valuation. If a startup can show it's not only attracting users but also keeping them engaged, it sends a strong signal that it's delivering real value to its customers. This can lead to increased investor confidence and, ultimately, a higher valuation.

In a nutshell, the power of traction is undeniable. It's a vital consideration for any startup looking to attract investment and increase its value. So, understanding the dynamics of user growth and engagement can offer valuable insights into the fascinating world of startup valuation.

And there we have it! We've navigated the complex terrain of startup valuation, and hopefully, you now have a deeper understanding of the vital role traction plays. Happy startup journeying!

Conclusion

In conclusion, the importance of traction in the form of user growth and engagement cannot be overstated when it comes to startup valuation. These elements are fundamental indicators of a startup's market acceptance and operational health.

A robust increase in user numbers shows potential and market demand, while high levels of engagement reflect a product’s value and the likelihood of forming a loyal customer base.

By effectively monitoring and optimizing key metrics such as Monthly Active Users, Churn Rate, and Session Duration, startups can not only attract but also retain investors' interest. These metrics provide a clearer picture of a startup's trajectory, aiding investors in making informed decisions.

Ultimately, a balanced combination of user growth and engagement forms the cornerstone of a startup's success and contributes significantly to its perceived value in the competitive marketplace.