AI Revenue Multiples: 2025 Insights & Trends

By Lior Ronen | Founder, Finro Financial Consulting

Staying on top of valuation trends is crucial for anyone navigating the AI industry. With AI transforming industries and driving innovation, understanding how revenue multiples shift across niches like cybersecurity, health tech, and LLM vendors isn’t just helpful—it’s essential.

For 2025, we’ve analyzed the latest data across public companies, private startups, and AI M&A deals. This article breaks it all down: what’s driving these numbers, how niches compare, and what it means for founders, investors, and acquirers.

The analysis reveals that AI companies maintain an average revenue multiple of 23.4x, highlighting robust valuations across the industry.

Want to dig deeper? We’ve compiled a comprehensive spreadsheet covering 180+ AI companies, which you can download for €29.90.

Let’s walk through the key takeaways, highlight the numbers, and uncover actionable insights. Ready to access the most comprehensive AI valuation database for 2025? Click below to get insights into 180+ companies across key niches.

AI valuation trends in 2025 reveal a dynamic market where Infrastructure remains a leader with the highest revenue multiples, while Cybersecurity and Health Tech show strong growth due to rising demand and enterprise adoption. Data Intelligence continues to thrive, driven by the need for scalable analytics solutions, and LLM Vendors see adjustments as their market matures.

Key drivers such as market maturity, increasing adoption of AI-powered solutions, macroeconomic conditions, and shifting investor priorities shape these valuations. Understanding these trends provides critical insights for navigating opportunities across public companies, private startups, and M&A deals in the evolving AI landscape.

- What is Artificial Intelligence?

- Understanding Startup Valuation

- Valuing AI Startups

- Revenue Multiples Across AI Niches

- Cycle-Over-Cycle Comparison

- Top-Performing Niches in 2025

- AI Valuation Database: Your Go-To Resource for 2025 Insights

- Navigating the AI Valuation Landscape in 2025

- Key Takeaways

- Answers to The Most Asked Questions

What is Artificial Intelligence?

Artificial Intelligence, or AI, refers to the ability of machines to mimic human intelligence by learning from data, identifying patterns, and making decisions or predictions. Unlike traditional software, which follows rigid, pre-set instructions, AI systems adapt and improve as they process more information. This flexibility allows them to perform tasks ranging from simple automation to complex problem-solving.

AI applications span almost every industry. In healthcare, AI is used to analyze medical data, predict patient outcomes, and streamline diagnoses. In finance, it powers fraud detection, automated trading, and personalized financial advice.

Retail leverages AI for inventory management and personalized shopping experiences, while manufacturing uses it to optimize production lines and reduce waste. Even creative fields, like content generation and design, are increasingly relying on AI tools.

The transformative impact of AI goes beyond operational efficiency. It’s enabling businesses to uncover opportunities that were previously unimaginable, driving innovation and reshaping industries at an unprecedented pace.

From advancing autonomous vehicles to revolutionizing drug discovery, AI is the catalyst behind today’s most groundbreaking technologies.

As we move into 2025, the rapid evolution of AI technology is not only creating new business opportunities but also influencing how these businesses are valued.

Understanding this relationship is key to navigating the AI market, which we’ll explore through the lens of startup valuation in the next section.

Understanding Startup Valuation

In earlier sections, we explored how AI reshapes industries and drives innovation. Now, let’s turn to the fundamentals of startup valuation—a critical step for founders and investors looking to gauge a company’s worth in a competitive market.

This section focuses on the leading methods that Finro uses to value AI startups, bringing structure, credibility, and industry-specific insights to the process. Valuation is not just about assigning a number; it’s about telling the story of a startup’s potential, market position, and future trajectory.

Key Valuation Methods

Different methods suit startups at various stages of growth, and understanding when to apply each approach is vital. Below, we’ll cover three of the most widely used valuation methods that Finro employs: the EBITDA Multiple, Revenue Multiple, and Discounted Cash Flow (DCF).

1. EBITDA Multiple Method

The EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) method focuses on a startup’s operational profitability. By isolating earnings from external factors like taxes and interest, this method evaluates how efficiently a business operates at its core.

When to Use: Ideal for later-stage startups transitioning into stable revenue and profitability.

Strengths:

Highlights operational efficiency.

Removes external variables like tax structures or depreciation policies.

Works well for industries with high variability in capital expenditures, such as telecom or manufacturing.

2. Revenue Multiple Method

Revenue multiples are a go-to method for valuing early- and growth-stage startups. This approach values a company based on its revenue, providing insights into its ability to scale and capture market share.

When to Use: Suitable for startups in early stages that lack profitability but demonstrate strong revenue growth.

Strengths:

Simple and easy to calculate.

Reflects market demand and growth trends.

Well-suited for fast-growing industries like SaaS, fintech, or AI.

3. Discounted Cash Flow (DCF) Method

The DCF method values a startup based on its projected future cash flows, discounted back to their present value. This approach captures long-term potential while accounting for risk and time value.

When to Use: Ideal for growth-stage startups with well-defined financial projections.

Strengths:

Highly customizable to reflect specific risks and opportunities.

Focuses on future potential rather than immediate profitability.

Accounts for the uncertainties inherent in scaling operations.

Each of these methods provides a unique perspective on a startup’s value. For instance, early-stage startups in fast-moving industries like AI often lean toward revenue multiples, as profitability is still a long-term goal. Conversely, growth-stage startups or those in stable industries may find DCF models or EBITDA multiples more appropriate.

Understanding these approaches is crucial, as it allows founders to align their valuation narrative with their company’s stage and objectives. In the next section, we’ll zoom in on how these methods apply specifically to AI startups and the unique challenges they face in valuation.

Valuing AI Startups

Building on the valuation methods outlined earlier, it’s essential to recognize the unique challenges and opportunities AI startups face when determining their value.

AI companies operate in a fast-moving environment with dynamic innovation cycles, often making traditional valuation approaches less straightforward. Understanding these nuances is critical for founders, investors, and acquirers looking to make informed decisions.

Unique Challenges in AI Startup Valuation

AI startups often encounter hurdles that set them apart from other industries. For one, their reliance on cutting-edge technology and intellectual property can make it challenging to assess their future potential. Many AI companies also operate with high upfront development costs and delayed revenue realization, which adds complexity to forecasting profitability.

Additionally, competition in the AI space is fierce, with new players emerging rapidly and established companies pivoting to incorporate AI into their offerings. These factors introduce both risks and opportunities when valuing AI startups, as they can quickly gain market share—or lose it just as fast.

Opportunities in AI Startup Valuation

Despite the challenges, AI startups also benefit from distinct opportunities. Their innovative solutions often address critical pain points across industries, from automating tasks to unlocking new revenue streams.

This scalability, paired with the increasing adoption of AI technologies, positions these companies for significant growth. Moreover, AI’s ability to adapt and evolve creates a long-term value proposition that attracts investors.

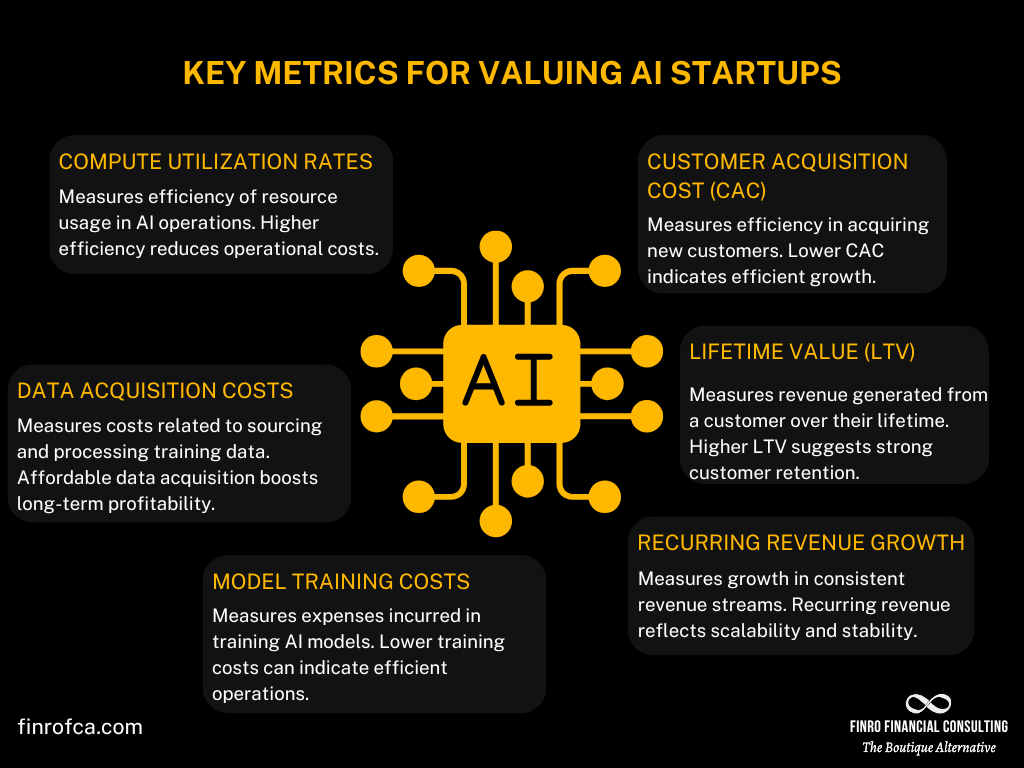

Key Metrics and Benchmarks for AI Companies

When evaluating AI startups, specific metrics and benchmarks are crucial for understanding their market position and growth potential:

Customer Acquisition Cost (CAC): How efficiently the company can acquire new customers.

Lifetime Value (LTV): The projected revenue a customer will generate over their relationship with the company.

Recurring Revenue Growth: Especially important for SaaS-based AI models.

AI-Specific Metrics: Such as model training costs, data acquisition expenses, and compute utilization rates.

These benchmarks provide insights into the startup’s scalability, efficiency, and ability to sustain growth over time.

Why Revenue Multiples Matter for AI Startups

Revenue multiples are often the preferred method for valuing AI startups, particularly in their early stages. Since many AI companies prioritize growth over immediate profitability, revenue serves as a tangible metric that reflects market traction and demand.

For example, an AI startup in the health tech space might command higher multiples due to the critical nature of its solutions, while a marketing tech AI company might show strong revenue growth due to the widespread applicability of its offerings.

Revenue multiples allow investors to compare these startups within their respective niches, making it easier to identify high-potential opportunities.

Revenue Multiples Across AI Niches

In the previous section, we discussed the unique challenges and metrics that shape the valuation of AI startups. Now, let’s dive deeper into the specifics—examining how revenue multiples vary across AI niches and different company types.

By understanding these trends, investors and founders can benchmark their valuations more effectively and identify opportunities within the AI landscape.

Detailed Breakdown of Niches

The AI ecosystem is incredibly diverse, encompassing 11 key niches that play distinct roles in the broader industry. Here’s a closer look at each niche and what makes them unique:

1.LLM Vendors

Companies specializing in large language models (LLMs) provide the foundation for generative AI applications, such as chatbots, content creation tools, and language translation. These vendors command solid multiples due to their widespread applicability and significant R&D investments.

2. Data Intelligence

Data intelligence firms focus on processing, analyzing, and deriving actionable insights from vast data sets. These companies drive enterprise decision-making, offering scalable solutions that serve industries ranging from finance to retail.

3. Cybersecurity

AI-driven cybersecurity companies are critical for detecting and preventing threats in real time. Their recurring revenue models, strong enterprise adoption, and relevance in a digital-first world often position them for robust valuations.

4. Infrastructure

Infrastructure providers—those offering AI chips, GPUs, and data storage solutions—are essential for enabling AI systems. With high demand for compute power, these companies often see the highest revenue multiples across the ecosystem.

5. HR Tech

AI-powered HR solutions streamline recruitment, employee engagement, and workforce analytics. While still a smaller niche, it is growing rapidly as companies increasingly prioritize data-driven human capital management.

6. Health Tech

Startups leveraging AI in healthcare focus on diagnostics, drug discovery, and patient care automation. Their solutions address critical societal needs, making this niche attractive for both investors and strategic acquirers.

7.Marketing Tech

Marketing technology companies utilize AI to optimize ad targeting, campaign performance, and customer personalization. This niche benefits from scalability and direct ROI for businesses, resulting in steady valuation multiples.

8. Legal Tech

AI-powered legal technology simplifies document analysis, contract review, and compliance tracking. This niche has gained traction for its ability to reduce time and costs in traditionally labor-intensive legal workflows.

9. Fintech

Fintech startups use AI for applications like fraud detection, credit scoring, and personalized financial services. With consistent revenue growth and broad market adoption, this niche remains a strong player in AI valuations.

10. Search Engines

Companies developing AI-driven search engines or recommendation algorithms create value by improving user experience and relevance. While dominated by a few players, niche search providers still show growth opportunities.

11. Computer Vision

Computer vision companies specialize in image and video recognition, powering applications in autonomous vehicles, facial recognition, and industrial automation. While the technology is maturing, this niche remains essential for innovation.

Comparisons Across Company Types

Revenue multiples can vary significantly depending on whether a company is public, private, or involved in an M&A deal. Here’s how these differences typically manifest:

Public Companies

Public AI companies generally exhibit the most stable revenue multiples, as they benefit from investor confidence and broader market dynamics.

Example: Infrastructure companies often lead with higher multiples, reflecting their critical role in supporting AI development.

Private Startups

Private companies tend to have more variable multiples, driven by growth potential and market perception.

Example: Early-stage Health Tech startups may command lower multiples compared to their public counterparts but have greater room for growth.

M&A Deals

M&A valuations often include strategic premiums, particularly for companies with unique IP or market-leading positions.

Example: Cybersecurity AI firms frequently attract higher multiples in acquisitions due to their ability to integrate seamlessly with acquirers’ existing offerings.

Key Trends in 2025 Revenue Multiples

The data reveals interesting trends:

Infrastructure companies lead with the highest revenue multiples, driven by demand for compute power.

Computer Vision and LLM Vendors, while still high, show more tempered multiples compared to previous years as the market matures.

Health Tech and Cybersecurity maintain solid performance due to consistent enterprise adoption.

By breaking down revenue multiples by niche and company type, we can see how the AI market’s diversity influences valuation dynamics. In the next section, we’ll analyze these trends over time, highlighting how revenue multiples have evolved across cycles and what this means for the future of AI valuation.

Cycle-Over-Cycle Comparison

Having examined revenue multiples across niches and company types, it’s time to analyze how these multiples have shifted over the past valuation cycles: 2024, mid-2024, and 2025.

This cycle-over-cycle comparison reveals key trends shaping the AI market and offers insights into what’s driving these changes.

Significant Trends in Multiples Across Niches

A closer look at the data highlights several notable trends:

Infrastructure’s Dominance

Infrastructure companies consistently lead with the highest multiples across all cycles. From 61.8x in 2024 to 47.7x in 2025, this niche saw a decline, though it remains the most valuable. The slight drop reflects maturing demand for foundational AI tools like GPUs and cloud services.

Steady Growth in Health Tech and Cybersecurity

Health Tech and Cybersecurity maintained steady growth in their multiples. Health Tech rose from 6.5x in 2024 to 7.3x in 2025, driven by increasing enterprise adoption of AI-powered diagnostics and care management solutions. Similarly, Cybersecurity increased from 15.5x to 21.3x, reflecting heightened demand for threat detection tools.

Cooling Off in LLM Vendors and Computer Vision

While still high, multiples for LLM Vendors and Computer Vision have tempered. LLM Vendors dropped from 51.3x in 2024 to 22.6x in 2025, reflecting market adjustments as competition intensified. Computer Vision showed a similar trend, declining from 9.6x to 6.5x as the technology matured.

Emerging Opportunities in Marketing Tech and HR Tech

Marketing Tech and HR Tech have seen notable growth. Marketing Tech climbed from 7.8x to 8.5x, driven by businesses’ increasing reliance on AI for personalization and analytics. HR Tech rose from 6.5x to 7.1x as more organizations adopted AI-powered workforce solutions.

Key Drivers Behind Valuation Changes

Market Maturity

Niches like LLM Vendors and Computer Vision experienced declining multiples as their markets matured. Increased competition and growing adoption led to more realistic valuations.

Rising Demand in Critical Sectors

Health Tech and Cybersecurity continue to attract strong investor interest due to the essential nature of their solutions. As regulatory and enterprise focus grows, these sectors are expected to sustain their upward trajectory.

Macroeconomic Adjustments

Valuations for Infrastructure companies cooled slightly as macroeconomic conditions led to more cautious spending on foundational tools, despite their long-term importance.

Shifting Investor Priorities

Investors are increasingly drawn to niches with clear, scalable revenue models, such as Marketing Tech and HR Tech, as opposed to those requiring significant R&D investment.

This cycle-over-cycle analysis underscores how dynamic the AI market is, with niches evolving at different paces. Understanding these shifts is essential for benchmarking valuations and making informed investment or business decisions.

Next, we’ll explore how these trends intersect with broader market forces, providing actionable insights for stakeholders navigating the AI landscape.

Top-Performing Niches in 2025

As we analyze the 2025 data, certain AI niches stand out for their exceptional performance in revenue multiples.

These top-performing niches not only command high valuations but also reflect the evolving priorities of investors and market demand. Let’s explore the leading niches and the key factors driving their growth.

Infrastructure

2025 Revenue Multiple: 47.7x

Why It’s Leading: Infrastructure companies remain essential to the AI ecosystem, providing the compute power, storage, and hardware necessary for AI innovation. Their role as the backbone of AI operations ensures consistent demand, even amid slight valuation adjustments.

Growth Drivers:

Rising adoption of cloud-based AI solutions.

Increased demand for AI-specific chips and GPUs.

Enterprise reliance on scalable infrastructure for AI deployment.

Cybersecurity

2025 Revenue Multiple: 21.3x

Why It’s Leading: As organizations increasingly digitize, the need for robust AI-powered cybersecurity solutions has grown. Companies in this niche provide critical tools for threat detection, response automation, and risk mitigation, making them indispensable.

Growth Drivers:

Growing cyber threats and regulatory compliance requirements.

Enterprise-level adoption of AI to enhance security operations.

Increasing frequency of high-profile cyberattacks, driving demand.

Data Intelligence

2025 Revenue Multiple: 25.6x

Why It’s Leading: Data intelligence companies enable organizations to process and analyze vast datasets, extracting actionable insights. Their scalable solutions are pivotal for decision-making across industries.

Growth Drivers:

Expansion of big data analytics in enterprise applications.

Need for real-time insights in sectors like finance and retail.

Rising importance of data-driven decision-making for competitiveness.

Health Tech

2025 Revenue Multiple: 28.8x

Why It’s Leading: Health Tech startups are revolutionizing healthcare through AI-powered diagnostics, patient monitoring, and drug discovery. Their solutions address critical societal challenges, ensuring sustained investor interest. With a 2025 revenue multiple of 28.8x, Health Tech surpasses the overall AI average of 23.4x, reflecting strong market confidence in this sector.

Growth Drivers:

Increased adoption of AI in clinical settings.

Focus on cost reduction and efficiency in healthcare delivery.

Regulatory support for AI-driven innovations in healthcare.

Why These Niches Are Leading

These top-performing niches reflect the broader trends driving the AI market. They are not just meeting immediate market demands but also positioning themselves for long-term growth.

Infrastructure and Cybersecurity address foundational needs, while Data Intelligence and Health Tech are expanding into critical, high-growth sectors. Each of these niches benefits from unique growth drivers that align with both enterprise and societal priorities.

As we look at these high-performing niches, it’s clear that they set the tone for AI valuations in 2025. In the next section, we’ll explore how you can leverage these insights to understand valuation dynamics across the broader AI market.

AI Valuation Database: Your Go-To Resource for 2025 Insights

As we’ve explored, AI valuation multiples vary significantly across niches, company types, and cycles. To help investors, founders, and analysts dive deeper into these trends, we’ve compiled a comprehensive database covering 180+ AI companies across public, private, and M&A categories.

This spreadsheet isn’t just a collection of numbers—it’s a powerful tool for understanding market trends, benchmarking valuations, and making informed decisions in the AI landscape. Here’s why it’s worth your attention:

What’s Inside the AI Valuation Database?

Extensive Coverage: 180+ AI companies, categorized by niche: LLM Vendors, Cybersecurity, Health Tech, Infrastructure, and more.

Revenue Multiples: Comprehensive data on revenue multiples for public companies, private startups, and M&A deals.

Cycle-by-Cycle Comparisons: Year-over-year insights, including trends from 2024, mid-2024, and 2025.

Key Metrics: Essential benchmarks like median multiples and valuation ranges to support your analysis.

Why Download This Database?

Deep Dive Into Niches: Get a clear view of how different AI categories are performing and evolving.

Identify Opportunities: Use the data to spot undervalued or high-potential segments.

Save Time: Our database consolidates hours of research into an easy-to-navigate format.

How to Access

The AI Valuation Database is available for just €29.90. Once downloaded, you’ll have immediate access to all the data you need to stay ahead in the AI market.

Click the link below to get your copy today!

By leveraging this database, you’ll not only stay informed but also position yourself to make smarter investment and strategic decisions. Ready to explore the full scope of AI valuation trends? Download now and unlock the insights you need!

In the next section, we’ll wrap up with a recap of key takeaways and a forward-looking perspective on AI valuation in the years to come.

Navigating the AI Valuation Landscape in 2025

The 2025 AI valuation trends highlight a market that is both dynamic and diverse. From the steady leadership of Infrastructure and the growing importance of Cybersecurity, to the scalability of Data Intelligence and the transformative potential of Health Tech, each niche presents unique opportunities and challenges.

Understanding these variations is essential for investors, founders, and analysts aiming to make informed decisions in this rapidly evolving space.

As the data has shown, revenue multiples reflect more than just numbers—they capture the essence of market demand, investor priorities, and technological advancements. The 23.4x average revenue multiple for AI companies underscores the market’s recognition of AI’s transformative potential across diverse niches

By analyzing these trends across public companies, private startups, and M&A deals, stakeholders can better identify where the opportunities lie and how to position themselves for success.

For those seeking deeper insights, our AI Valuation Database offers a comprehensive resource to explore trends across 180+ companies. It’s more than just a spreadsheet; it’s your guide to navigating the complex world of AI valuations.

Looking ahead, the AI market will undoubtedly continue to evolve, with new niches emerging and existing ones maturing. Staying updated on these trends will be key to capitalizing on opportunities and shaping the future of AI-driven innovation.

Ready to take the next step? Dive deeper with our database and stay ahead of the curve.

Key Takeaways

AI Valuation Trends in 2025: Infrastructure leads, with Cybersecurity and Health Tech showing significant growth due to rising demand.

Cycle-by-Cycle Insights: Revenue multiples reflect market maturity, increased adoption, and shifting investor priorities from 2024 to 2025.

Key Drivers of Change: Market maturity, demand growth, macroeconomic conditions, and investor focus shape valuation dynamics.

Top Niches to Watch: Infrastructure, Cybersecurity, Data Intelligence, and Health Tech dominate with high revenue multiples and growth potential.

Actionable Resource Available: The 2025 AI Valuation Database offers detailed insights into 180+ companies, including public, private, and M&A data.

Answers to The Most Asked Questions

-

Valuation multiples represent a financial metric used to assess a company’s value relative to a key performance indicator, such as revenue or EBITDA. They are often expressed as ratios (e.g., EV/Revenue) to help compare companies within the same industry or niche.

-

A 10x multiple indicates that a company’s valuation is 10 times its annual metric, such as revenue or EBITDA. For example, if a company generates $10 million in annual revenue and has a 10x revenue multiple, its valuation would be $100 million.

-

Finro’s analysis shows that the average revenue multiple for AI companies is 23.4x, reflecting strong investor interest and growth potential across the industry.

-

AI companies are typically valued using key methods like:

• Revenue multiples for early-stage and growth-stage startups prioritizing market traction.

• EBITDA multiples for later-stage companies with stable profitability.

• Discounted Cash Flow (DCF) models for companies with defined cash flow projections.

Specific metrics like Customer Acquisition Cost (CAC), Lifetime Value (LTV), and AI-specific factors (e.g., training costs) are also considered to refine valuations.