Startup Valuation Services

Maximize Value. Minimize Guesswork.

Unlock your startup's potential with Finro's specialized valuations. Tailored to reflect your unique business, our services support critical, timely decisions.Embrace valuations that empower strategic growth, guided by our dedicated consultants.

Schedule a Call

Recent Success Stories

| " | " | "

| Finro were one of the very few companies that had a correct view of the leap in technology, which is now slowly unfolding. Technology always gets overvalued in the short-term, and undervalued in the long term. And Finro helped us navigate that future like few others can. |

With full command of all relevant financial aspects and demonstrated financial analysis capability, combined with equal expertise, understanding and knowledge of the global tech startup sector; Lior has an impressive understanding of early stage venture finance. |

Lior's foresight in identifying pivotal trends and disruptions within the sector has delivered real value. His adeptness and synthesis of large data sets into actionable intelligence based on key comps has also been instrumental in refining our investment strategy. |

Sven Van de Perre Sven Van de PerreCo-Founder, Tropos AR  Capt. Michael Sperling Capt. Michael SperlingCo-Founder and CEO, Spaceling General Partner, Princap |

Top Advantages of Partnering with Finro

|

|

|

| Personalized Valuation Tailored to reflect your startup’s unique aspects, ensuring accurate and meaningful valuations. |

Swift and Efficient Service Rapid valuations to accelerate investor negotiations and strategic decisions. |

Flexible and Adaptive Our services evolve with your startup, staying relevant through all growth stages. |

|

|

|

| Dedicated Attention Benefit from our deep understanding of your business for insightful, accurate valuations. |

Cost-Effective Solutions High-quality valuations without excessive costs, focusing your resources on growth. |

Strategic Partnership Beyond numbers, we capture your startup’s essence, offering valuations as dynamic and unique as your vision. |

Contact Us To Learn More

How Do We Estimate The Value of a Startup?

Many different startup valuation methods fit startups in various stages.

Angel investors may use the Berkus method or the scorecard valuation method to get a qualitative startup assessment. Outside of that universe, the quantitative valuation of pre-revenue or seed-stage companies will lean towards their revenue forecast and use comparable revenue multiples. In contrast, valuation in later stages will count towards future cash flows and use the discounted cash flow (DCF) or EBITDA multiples.

Comparables Valuation

The comparables valuation is a relative valuation method that takes a market approach to business valuation. What does it mean?

With this valuation method, we can calculate the value of a company by looking at similar businesses' EBITDA and revenue multiples.

Discounted Cash Flow (DCF)

DCF, or discounted cash flow method, is an income valuation method that evaluates the company based on the present value of the expected cash flows.

The discounted cash flow analysis model calculates the value of a business by discounting its projected free cash flows to the present.

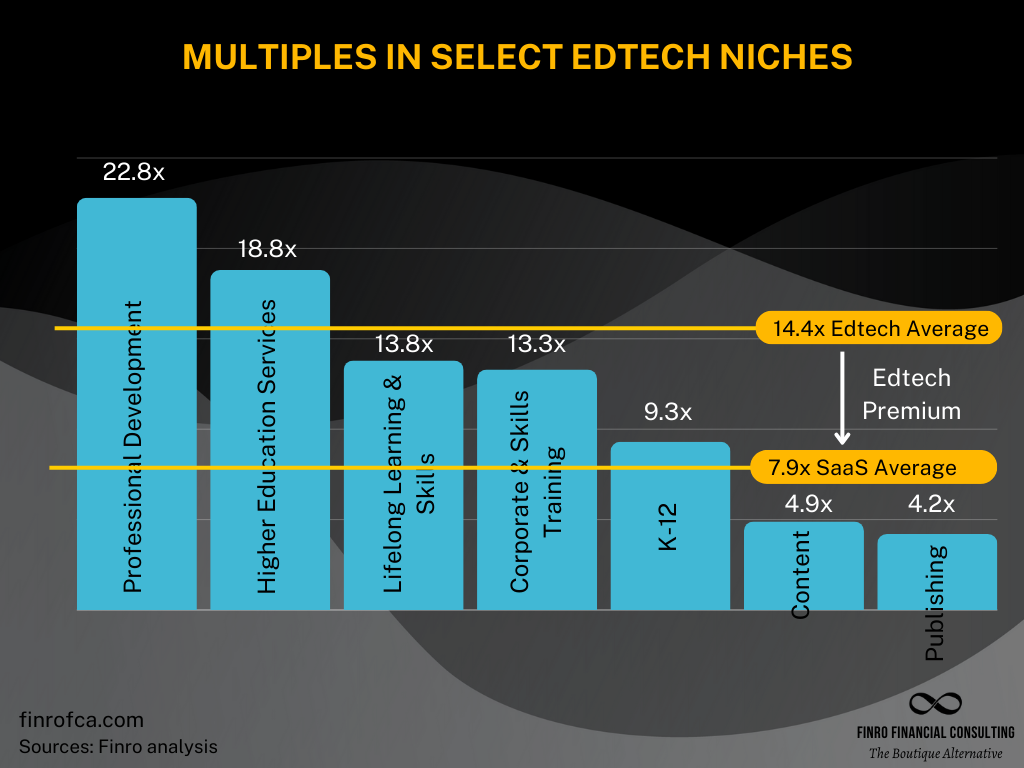

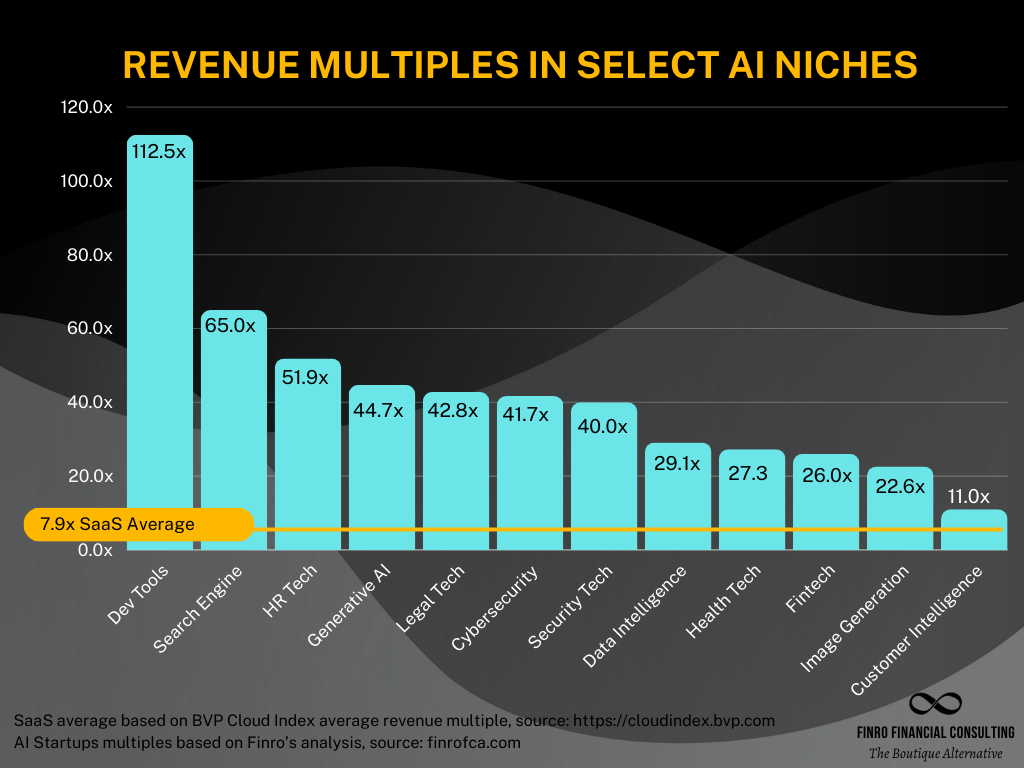

Finro Analysis of Valuation Multiples in Select Tech Niches

|

|  |

|

| Edtech Multiples 2024 |

AI Multiples 2024 |

Cybersecurity Multiples 2024 |

Payments Multiples 2024 |

|

|

|

|

| Proptech Multiples 2024 | Insurtech Multiples 2024 | HR Tech Multiples 2024 | SaaS Multiples 2024 |

Who Are Our Clients?

Since 2014, we've worked with more than 200 clients from the US, UK, Europe, and the Middle East. We work with buyers and sellers in the tech sector on different aspects of the fundraising process and M&A transactions.

Bootstrapped Startups

Finro works with bootstrapped startups looking to raise for the first time, sell their business entirely, or for internal financial analysis purposes.

These clients typically need a company valuation to share with potential investors or acquirers during the M&A or fundraising processes.

VC-Backed Startups

Finro works with early-stage startups between pre-seed and Series B looking to raise funds, preparing to raise funds, or for internal financial analysis purposes.

Whether they have generated revenues or are still pre-revenue startups, we work with them to estimate their startup's value based on a combination of methods as mentioned above.

Tech Investors

Finro works with private equity funds, family offices, and venture capital firms looking to invest or acquire tech companies.

We work with tech investors to estimate a company's pre-money valuation, analyze key financial metrics, test the startup's value under different scenarios, and challenge revenue growth potential.

Frequently Asked Questions (FAQ): Startup Valuation

What is Startup Valuation?

Startup valuation estimates a young company's value, boosting negotiation power, investor confidence, and future planning. It's crucial for attracting investors, strategic decision-making, and navigating the funding landscape to achieve business goals.

Learn moreHow Startup Valuation Is Calculated?

Startup valuation is calculated using market comparables, discounted cash flows, cost duplication, venture capital returns forecasts, and qualitative attributes, considering market potential, business model, team, revenues, and competition.

Learn moreWhat is Pre-Money Valuation?

Pre-money valuation assesses a startup's worth before new investments, considering market potential, team experience, product stage, and competition, using methods like Comparable Company Analysis and Discounted Cash Flow Analysis to guide financial strategy and attract investors.

Learn moreHow To Value A Pre-Revenue Startup?

To value a pre-revenue startup, assess the team, product, traction, market potential, and investor interest using qualitative and quantitative methods like Berkus, Comparables, and Discounted Cash Flow to project future growth and potential returns.

Learn moreFinro Valuation Services: The Boutique Advantage

Finro Financial Consulting offers a unique approach to valuation services, specifically designed for the distinct needs of early-stage startups. Here are our top advantages:

- Tailored Valuation Services: We provide customized valuations that delve into your business model, growth trajectory, and industry nuances, ensuring a reflection of your startup's distinctiveness.

- Rapid Turnaround Times: Understanding the startup world's pace, we deliver swift, efficient valuations to facilitate your investor negotiations and strategic planning without delay.

- Flexibility and Adaptability: Our services are dynamic, adapting to your startup's changing needs and schedules, ensuring relevance and effectiveness at every stage.

- Personalized Client Experience: With Finro, you receive dedicated attention from a consultant who deeply understands your business, ensuring insightful valuations and smoother interactions.

- Cost-Effective Solutions: We offer competitive pricing, providing high-quality valuations without the excessive costs typical of larger firms, so you can focus your resources on growing your business.

Read more

Our Detailed Valuation Work Process

Step 1: Discovery Call.

This is the preliminary and most fundamental step of our work, where we discuss the company's business model with the founder and explain how we will break it down in our forecast. In this stage, we typically inquire about different aspects of the business and request additional documents that might help.

Step 2: Financial Analysis.

To begin, we will examine the company's financial history, which can provide valuable insight into the business. This will include reviewing past financial statements, management accounts, accounting system reports, user and client data, and more.

This step aims to understand the company's annual and monthly trends, current clients, revenue, headcount, and cash flow status. This information will help us build a structure and assumptions for our analysis. If you're starting up and have no previous financials, that's ok! We'll jump straight to step 3.

Step 3: Financial Model Structure and Assumptions.

To properly value a business, a financial model must be created. This model serves as the basis for the valuation, and its structure and assumptions are crucial.

If a financial analysis has been conducted, that information can be used as a starting point for the model's structure and assumptions. If a financial analysis is not relevant or available, the information gathered during the discovery call can be used to create a preliminary draft of the model's structure and assumptions.

Any additional questions about the business model can be raised at this stage to help refine the model.

Step 4: Revenues Model.

Once we finalize the structure and initial assumptions, we'll start building the revenue model. This is an essential part of the model for most businesses, and we'll dedicate an entire step just for that.

In this step, we'll break down the entire client acquisition process, which includes a detailed client or user base forecast, subscribers, tiers, pricing, conversion, and more. In this step, we'll have the first review with the client to seek feedback on the work accomplished so far. Any input is incorporated into the model before step 5.

Step 5: Costs and Expenses.

After we finalized step 4, we moved on to add the costs and expenses layer, which includes: headcount forecast per role and function, payroll, operating expenses, customer support, COGS, and all relevant costs.

Once this part is done, we'll review the work together and seek additional feedback. Feedback is incorporated into the model before step 6.

Step 6: Income Statement Forecast.

Also known as the profit and loss (PnL) forecast. In this step, we put together the revenues forecast, costs, and expenses to produce an income statement summary forecast and a detailed summary forecast.

Step 7: Cash Flow Forecast.

Once we finalize the income statement part of the financial model, we will start building the cash flow part, which is highly dependent on the income statement we completed earlier. In this step, we will add cash flow-specific items such as debt, funds raised, depreciation, dividend payouts, etc.

Step 8: KPIs and Analysis Elements.

In this step, we add the final piece of the puzzle – the key performance indicators(KPIs) and analysis elements such as vertical analysis, horizontal analysis, charts, etc.

Step 9: Final Draft Of The Financial Model.

In this step, we'll wrap up the financial modeling part of the valuation process. In this step, we'll review the entire financial model together. We'll walk through every tab, section, table, and chart in the model to make sure they all make sense from a business and financial perspective and support the general theme.

In this step, we'll ask you again to with the financial model to see that you understand how to update it and how it works if you have any additional feedback after you review the model that we haven't covered before, we can cover it in this step.

Step 10: Comps Analysis.

In this step, we're adding the first layer of the valuation by building the comparable companies' analysis, or comps analysis. The comps analysis breaks down different financial aspects of significant comparable companies in the niche, whether privately held or publicly traded.

Is your business model not that straightforward, and you don't have too many (or any) comparable companies? No problem.

We'll synthetically break down your business model into different pieces, find comparables for them, and combine them to mimic your business model.

To these comparables, we'll add relevant information from previous transactions in the niche to build a comprehensive market analysis.

Step 11: Valuation.

In this step, we'll add the final piece of the puzzle – the valuation.

In this step, we combine everything to calculate the startup's valuation. We take the relevant pieces of the financial model, combine them with other components of the comps analysis, calculate some additional elements, and calculate the final valuation.

To increase accuracy and benefit from the strengths of the different valuation methods, we'll calculate the business' valuation with several valuation methods, such as the revenue multiple, EBITDA multiple, the Discounted Cash Flow (DCF) method, and any other methods that fit the case.

Why You Should Choose Finro Over A Big 4 Firm?

Navigating the world of early-stage startups can be exhilarating, challenging, and sometimes downright confusing. When it comes to valuations, choosing the right partner can make all the difference.

When you're choosing Finro Financial Consulting over a big-4 firm, you're saving time, money, and stress and investing in a more personalized and efficient experience that truly understands your unique business needs.

At Finro, our mission is to help early-stage startups like yours grow, succeed, and reach their full potential. So, before you dive headfirst into the world of big-4 valuations, give us a shout.

Let's work together to create a valuation experience that propels your startup forward instead of holding it back.