Balancing Risk and Reward: Understanding Anti-Dilution Mechanisms

By Lior Ronen | Founder, Finro Financial Consulting

Venture capital plays a pivotal role in the growth of innovative startups, providing not just financial backing but also strategic guidance to help young companies scale.

One critical aspect of venture capital investment is the protection of an investor's ownership stake. As companies evolve and seek additional funding rounds, original investors face the risk of their shares being diluted.

This dilution can significantly decrease the value of their initial investment unless measures are taken to prevent it.

Anti-dilution mechanisms are contractual safeguards within investment agreements that serve to protect investors from the potential devaluation of their equity stakes during subsequent financing rounds.

These provisions are vital for ensuring that the ownership percentage of early investors does not diminish disproportionately when new shares are issued.

This article explores the nuances of dilution, the importance of anti-dilution provisions, and the different types of mechanisms available to investors.

We will also discuss how various factors such as the stage of the company and industry trends influence the choice of anti-dilution protections.

Whether you're an investor or part of a startup, understanding these mechanisms is key to navigating venture capital financing effectively.

Venture capital investments are safeguarded by anti-dilution provisions, crucial for protecting investors from equity dilution during new funding rounds. The choice between Full Ratchet and Weighted Average mechanisms depends on factors such as the company's stage, industry sector, and investment size.

These provisions need careful consideration to balance protection with the company's ability to attract future investments. Flexibility in modifying these clauses is vital as market conditions and company needs evolve, ensuring that both new and existing investors' interests are aligned, facilitating company growth and successful fundraising efforts.

Understanding Dilution

Dilution occurs when the ownership percentage of a company's existing shareholders decreases due to the issuance of new shares.

This is a common scenario in venture capital financing, where startups raise additional capital to fuel growth, develop new products, or expand into new markets.

Dilution can also arise through other channels such as the exercise of employee stock options, the conversion of convertible bonds or preferred shares, and even through mergers and acquisitions where new shares are issued.

What Leads to Dilution?

Equity Financing: Startups often issue new shares to raise capital. Each new share issued can reduce the ownership percentage of existing shareholders unless protected by anti-dilution provisions.

Convertible Instruments: Instruments like convertible bonds or convertible preferred shares can be converted into common stock, increasing the total number of shares and diluting existing shareholders.

Employee Stock Options: As part of compensation packages, employees may receive stock options. When these options are exercised, new shares are created, which dilutes the ownership of existing shareholders.

Mergers and Acquisitions: M&A activities can lead to dilution if the acquiring company issues new shares as part of the transaction to purchase another company.

How Does Dilution Affect Shareholders?

The effects of dilution can be significant:

Ownership Percentage: Shareholders find their percentage of ownership reduced, which can affect their control and influence within the company.

Economic Value: The value of each share may decrease if the increase in total number of shares outpaces the growth in the company’s overall value.

Voting Power: With a reduced percentage of ownership, a shareholder’s voting power diminishes, which can impact their ability to influence company decisions.

Dividend Rights: If dividends are paid, a smaller ownership percentage results in smaller dividend payouts to the shareholders.

Understanding the mechanics of dilution is crucial for both investors and company founders. For investors, it’s about safeguarding the value of their investments.

For founders, it’s essential to recognize how dilution impacts their shareholders and to manage investor relations carefully, especially during subsequent rounds of financing.

The next sections will dive into the specific anti-dilution mechanisms designed to protect investors from these risks.

Sector-Specific Dilution Trends in Venture Capital Funding

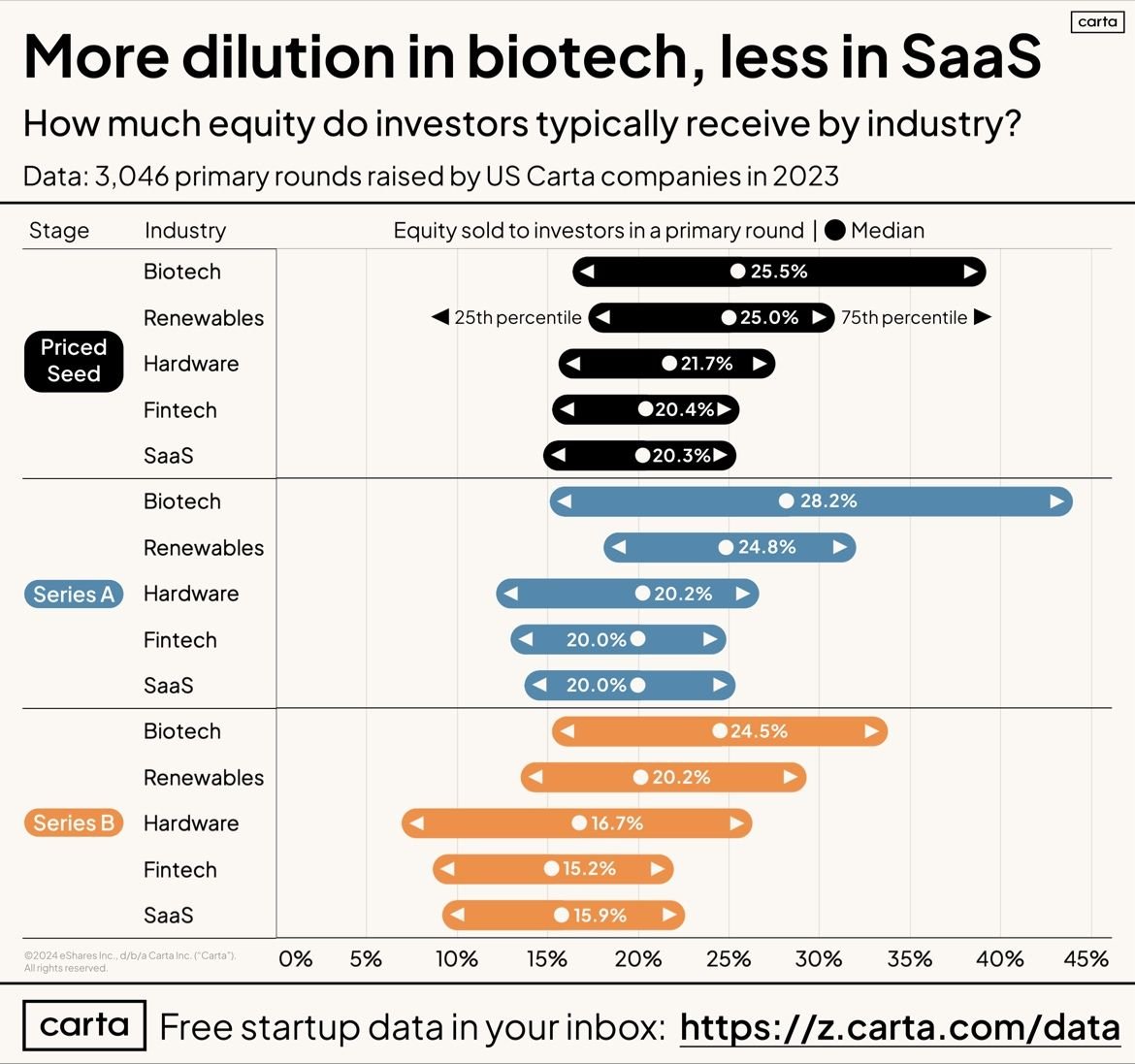

This section offers a detailed look at how equity dilution varies across different tech sectors and funding stages, breaking down the percentage of equity typically required by investors at the Priced Seed, Series A, and Series B stages for industries including Biotech, Renewables, Hardware, Fintech, and SaaS.

Analysis of Dilution Across Stages and Sectors

Priced Seed Stage:

Biotech shows a median equity stake given to investors around 25.5%, reflecting high dilution. This is indicative of the high-risk, high-investment needs typical of early-stage biotech firms.

SaaS companies, on the other hand, show a lower median at 20.3%. This suggests that SaaS startups might be perceived as less risky or perhaps more capital efficient at this stage.

Series A Stage:

In the Biotech sector, dilution remains high with a median of 28.2%, emphasizing continuous high capital demands and prolonged development cycles.

SaaS maintains a steadier dilution rate, with a median of 20.0%. The relatively stable equity demand suggests confidence in scaling operations without excessively diluting existing stakes.

Series B Stage:

Dilution in Biotech slightly decreases to a median of 24.5%, possibly due to earlier investments helping to establish some foundational value.

SaaS sees a further reduction in median dilution to 15.9%. This trend might indicate that SaaS companies generally reach more sustainable revenue models or valuations by this stage, reducing the need for large equity shares in funding rounds.

Implications and Trends

The data clearly shows that Biotech consistently requires higher equity from investors across all stages compared to other sectors. This is likely due to the substantial upfront capital required for R&D and regulatory approvals, coupled with a longer timeline to market and revenue generation. Investors in Biotech are exposed to higher risks and therefore might require more substantial equity to justify their investments.

SaaS, contrastingly, exhibits less dilution across stages, reflecting the sector's lower capital requirements and faster path to scaling and profitability. This pattern suggests that SaaS startups can maintain more of their equity while still raising enough capital to grow, which is an attractive proposition for founders looking to retain control and for investors confident in quicker returns.

Conclusion

The data illustrates significant differences in the equity dilution expectations among industries, largely influenced by the inherent risks, capital needs, and growth trajectories associated with each sector.

Understanding these trends is crucial for investors and entrepreneurs alike, as they navigate the complexities of funding and scaling in the technology landscape.

Types of Anti-Dilution Mechanisms

Investors in venture capital often safeguard their investments against dilution through specific contractual provisions. Two primary anti-dilution mechanisms are prevalent in the industry: Full Ratchet and Weighted Average. Each method offers different levels of protection and is suited to varying investment scenarios.

Full Ratchet Anti-Dilution

Mechanism: The Full Ratchet provision offers the most substantial protection against dilution for investors. It adjusts the conversion price of preferred stock to the price at which new shares are sold in any future financing round, regardless of the amount of capital raised or the number of shares issued. Essentially, if new shares are issued at a lower price than what the investor previously paid, their conversion price is adjusted downwards to match this new price.

Implications: This mechanism ensures that the original investor maintains a percentage of ownership that does not get diluted by subsequent rounds of funding, provided the shares are issued at a lower price than the initial investment. It is particularly protective and can sometimes be seen as aggressive because it does not take into account the quantity of new shares issued.

Typical Scenarios: Full Ratchet is often applied in early-stage investments where the risk is higher, and future valuations are more uncertain. Investors might insist on this provision when they perceive the investment to be particularly risky, or when they want to hedge against significant valuation drops in subsequent funding rounds.

Example: Suppose Investor A purchases 1 million shares at $1 per share in a startup. If a subsequent round issues 500,000 shares at $0.50 per share, under Full Ratchet, Investor A’s conversion price would also drop to $0.50. Thus, the shares initially bought for $1 million would now represent a larger portion of the company, maintaining the investor's original equity percentage despite the lower valuation at the new funding round.

Weighted Average Anti-Dilution

Mechanism: The Weighted Average method offers a more balanced approach to anti-dilution. It adjusts the conversion price based on the weighted average of the prices before and after the new shares are issued. This method takes into account both the price and the number of new shares issued, making it less aggressive than Full Ratchet.

Benefits over Full Ratchet: Weighted Average is generally fairer to both existing and new investors. It dilutes the original investors’ stakes less severely than Full Ratchet, especially in scenarios where a significant amount of new capital is raised. It supports a more equitable distribution of dilution impact among all shareholders.

When It’s Preferable: This mechanism is suitable for later-stage companies or those with more stable valuations where massive down-rounds are less likely. It is also preferred in situations where maintaining positive relations with a broader group of investors is crucial, as it does not overly penalize new investors.

Example: Using the same initial investment by Investor A (1 million shares at $1 each), if the company later issues 1 million new shares at $0.50 per share, the Weighted Average price might be calculated as follows:

Weighted Average Pric e= ((1,000,000×$1) + (1,000,000×$0.50))/ (1,000,000+1,000,000) = $0.75

Investor A’s new conversion price would be adjusted to $0.75 instead of $0.50, reflecting a more moderate adjustment in their ownership stake compared to the Full Ratchet scenario.

Conclusion

Choosing the right anti-dilution mechanism depends on the specific conditions of each investment, including the company’s stage, its valuation trajectory, and the investor's risk appetite.

Both Full Ratchet and Weighted Average serve to protect investors but do so in markedly different ways, balancing investor protection with fairness and relationship management across the capitalization table.

| Feature | Full Ratchet | Weighted Average |

|---|---|---|

| Mechanism | Adjusts conversion price to match the price of new shares issued in future rounds. | Adjusts conversion price using a formula that accounts for both the price and number of new shares issued. |

| Protection Level | Offers the highest level of protection for investors, ensuring no dilution if shares are issued at a lower price. | Provides protection that balances the interests of new and existing investors. |

| Implications for New Investors | Can be perceived as aggressive; potentially discouraging new investments due to unfavorable terms. | More attractive to new investors as it allows fairer terms and less punitive dilution. |

| Best Suited For | Early-stage investments with high risks and uncertain future valuations. | Later-stage investments where the company has more stable valuations and massive down-rounds are less likely. |

| Impact on Existing Investors | Maintains a static ownership percentage despite share price reductions in new rounds. | Results in some dilution but less severe than without any protection; dilution is spread more equitably. |

| Example Scenario | If new shares are issued at a lower price, the conversion price for previous investors drops to this new lower price. | The new conversion price is calculated based on a weighted average, considering both the amount of money raised and the price of new shares. |

Choosing the Right Anti-Dilution Mechanism

Selecting the appropriate anti-dilution mechanism is a critical decision for both startups and their investors. This choice can significantly influence the company's future financial structure, investor relations, and overall success. Various factors must be considered to ensure that the chosen anti-dilution provision aligns with the specific needs and goals of both parties involved.

Factors Influencing the Choice of Anti-Dilution Mechanisms

Stage of the Company:

Early Stage: Companies at an early stage of development often face higher uncertainties regarding valuation and future financing rounds. Full Ratchet might be preferred by investors who are taking a larger risk by putting capital into unproven ventures.

Growth Stage: For more established companies with predictable growth and stable valuations, a Weighted Average provision could be more appropriate. This mechanism is less restrictive and can facilitate easier fundraising in subsequent rounds.

Industry Sector:

Different sectors experience varying levels of volatility and investment requirements. For instance, biotech firms generally require substantial capital over longer periods due to the nature of their R&D and regulatory approval processes. Investors in these companies might lean towards Full Ratchet to protect against substantial dilution during lengthy development phases.

In contrast, sectors like SaaS, as shown by industry-specific trends, typically encounter less dilution and may benefit from the more balanced approach of Weighted Average anti-dilution, reflecting their quicker path to revenue and lower capital intensity.

Investment Size:

The amount of capital being raised can also impact the choice of anti-dilution protection. Larger rounds that significantly alter the ownership structure might necessitate stronger protections like Full Ratchet to reassure early investors about maintaining their stake's value.

Smaller, incremental funding rounds might be better served by Weighted Average provisions, where the dilution effect is more evenly spread and less likely to deter new investors.

Strategic Considerations for Startups and Investors

Balancing Investor Attraction with Founder Interests: Startups need to balance the interests of protecting their early investors and attracting new capital. Overly aggressive anti-dilution terms might protect existing stakeholders but at the cost of making new financing rounds challenging.

Negotiation Leverage: The negotiation of anti-dilution terms often depends on the current market conditions, the startup's performance, and its bargaining power at the time of the investment. Startups in strong positions may negotiate less stringent terms, favoring Weighted Average to maintain a more founder-friendly capital structure.

Long-term Implications: Both startups and investors should consider the long-term implications of their chosen anti-dilution mechanism. The goal is to foster a funding environment that supports future growth and additional investment rounds without undue complication or conflict.

Impact of Industry-Specific Risks and Dilution Trends

Using data, such as from the provided dilution trends, can inform the decision-making process significantly. For instance, knowing that biotech generally sees higher dilution rates might make Full Ratchet more appealing in this sector, whereas the lower dilution rates in SaaS might support the use of Weighted Average. Understanding these trends helps tailor anti-dilution provisions to the specific risks and capital needs of the sector in which the startup operates.

Conclusion

Choosing the right anti-dilution mechanism is not merely a contractual detail but a strategic decision that impacts a startup's financial trajectory and its relationships with investors. By carefully considering the stage of growth, industry dynamics, and the size of investment rounds, startups and investors can establish terms that support mutual long-term success.

Get your expert support now!

Impact of Anti-Dilution Provisions on Future Financing

Anti-dilution provisions are critical in protecting investors from the loss of value in their equity stakes due to the issuance of new shares.

However, these provisions can also significantly influence a startup's ability to attract future investments.

Understanding this dynamic is essential for both entrepreneurs and their financial backers as they prepare for subsequent rounds of funding.

Effect on Future Investment Attractiveness

1. Investor Perception: Strong anti-dilution provisions, particularly the Full Ratchet type, can be seen as a red flag by potential new investors.

These mechanisms can indicate high risk or a lack of confidence in the company's future valuation, potentially deterring investment.

If new investors believe they might be unfairly penalized in future down-rounds due to aggressive anti-dilution protections granted to earlier investors, they may either demand similar terms or decide against investing.

2. Capital Raising Challenges: Startups with stringent anti-dilution clauses might find it challenging to raise new capital at a valuation that is acceptable to both new and existing investors.

New shares might need to be priced lower to attract investment, but doing so can trigger anti-dilution adjustments that significantly benefit prior investors at the expense of new ones.

This scenario can lead to complex negotiations and possibly impede the fundraising process.

3. Company Valuation and Growth: While designed to protect investors, aggressive anti-dilution provisions can also constrain a company’s flexibility in managing its capital structure and growth strategy.

If a startup is locked into unfavorable terms, it might have to forego opportunities to raise capital at critical moments, which could stifle growth and adversely affect overall company valuation.

Negotiation and Modification of Anti-Dilution Clauses

1. Flexibility and Forethought: It is possible for startups and investors to negotiate the modification of existing anti-dilution provisions as part of new funding rounds. Such negotiations are typically driven by the current needs of the company, the interests of new investors, and the prevailing market conditions.

Both parties might find it advantageous to adjust terms to facilitate new investments and ensure the company’s continued growth.

2. Balancing Interests: During these negotiations, it's crucial to balance the interests of existing investors, who want to protect their investments, and new investors, who seek fair entry points.

One approach is transitioning from Full Ratchet to Weighted Average provisions, which are generally seen as less onerous by new investors. This modification can help align the interests of all parties more equitably.

3. Strategic Revisions: Revising anti-dilution clauses may also involve strategic considerations, such as changing the basis of the weighted average calculation or resetting the conversion prices based on new realities and valuations.

Such adjustments require careful legal and financial planning to ensure they meet regulatory standards and align with the company's long-term strategy.

Conclusion

The presence and nature of anti-dilution provisions can significantly impact a startup's ability to raise future funds.

While these clauses protect investors, they must be crafted thoughtfully to ensure they do not unduly hinder the company's ability to attract new capital.

Negotiating flexible terms that can be adapted as the company grows and market conditions change is crucial for maintaining a healthy balance between protecting existing interests and fostering future investment opportunities.

Conclusion

Anti-dilution provisions are crucial tools in venture capital, designed to protect investors from losing equity value as new shares are issued.

These mechanisms safeguard investments but also carry significant implications for a startup's ability to secure future financing and manage its growth effectively.

Choosing between Full Ratchet and Weighted Average anti-dilution provisions requires consideration of several factors, including the company's development stage, industry sector, and the size of investment rounds.

It's vital for startups and investors to carefully evaluate these aspects to choose the mechanism that best aligns with their long-term objectives and the current business climate.

Additionally, the negotiation and potential adjustment of these provisions underscore the need for adaptability and strategic planning. As startups grow and market conditions change, the ability to modify anti-dilution terms can be crucial in balancing the interests of existing and new investors.

This adaptability facilitates successful funding rounds and ensures the company's ongoing growth.

Ultimately, anti-dilution mechanisms are more than just legal stipulations; they are strategic choices that demand thoughtful consideration and foresight.

Both startups and investors should approach these provisions with a comprehensive understanding of their implications, equipped to negotiate terms that support sustainable business growth and foster mutually beneficial relationships.

This balanced strategy will help secure long-term success in the competitive field of venture capital financing.

Key Takeaways

Protection Importance: Anti-dilution provisions protect investors from equity dilution during subsequent funding rounds.

Mechanism Choice: Selection between Full Ratchet and Weighted Average depends on company stage, industry, and investment size.

Investor Attraction: Stringent anti-dilution terms can deter potential new investors, impacting future fundraising.

Negotiation Flexibility: Provisions may be renegotiated to align with evolving company needs and market conditions.

Strategic Balance: Careful structuring of anti-dilution mechanisms is crucial for maintaining investor relationships and supporting company growth.

Answers to The Most Asked Questions

-

Anti-dilution provisions adjust the conversion price of existing shares to mitigate the dilution impact of new share issuances.

-

Anti-diluted refers to maintaining the value of an investor's ownership stake by adjusting conversion prices in response to share issuance.

-

An example of an anti-dilution right is the ability of preferred shareholders to maintain their ownership percentage in a company by adjusting their conversion prices.

-

The difference between partial and full ratchet lies in the extent of adjustment to the conversion price. Partial ratchet adjusts the conversion price based on the difference between the new and old share prices, while full ratchet adjusts the conversion price to the lowest price of the new shares.

-

In private equity, a ratchet is a mechanism that adjusts the conversion price of convertible securities to protect investors from dilution when future financing occurs at a lower valuation.

-

The main difference between full ratchet and weighted average anti-dilution clauses is in how they adjust the conversion price. Full ratchet adjusts it to the lowest price of the new shares, while weighted average calculates an average price, taking into account both the old and new share prices.