Revenue Multiples: A Beginner's Guide

By Lior Ronen | Founder, Finro Financial Consulting

Have you ever wondered how investors decide the value of a startup, especially when it's yet to make significant profits or even sales? It's not magic, but rather a clever use of financial metrics.

Among the various financial tools at our disposal, the concept of the 'revenue multiple' stands out for its simplicity and effectiveness. But what exactly is a revenue multiple, and why is it so important in the startup ecosystem?

The revenue multiple is one of the valuation multiples used to value businesses by comparing them to similar companies. The two most common multiples are the EBITDA multiple, used to value companies based on their value-to-EBITDA ratio, and the second one is the revenue multiplier.

At its core, a revenue multiple is a way of gauging a company's value relative to its revenue. This metric, calculated by dividing a company's overall value by its annual revenue, offers a quick snapshot of its market position and growth potential.

It's like measuring the worth of a tree not just by its current height but by considering how fast it's growing and the richness of the soil it's rooted in.

This metric becomes particularly pivotal in the startup world.

Startups, unlike established businesses, often don't have long histories of profitability or extensive assets, making traditional valuation methods less applicable.

Revenue multiples step in here, providing a lens through which investors and founders can assess value, compare different-sized companies, and make strategic decisions.

In this article, we'll dive into the simplicity and nuance of revenue multiples. We'll explore how they are used, their benefits and limitations, and the various factors that influence them.

Revenue multiples are a vital financial metric for valuing companies, particularly useful for startups. They are calculated as company value divided by annual revenue and are instrumental in assessing a company's worth, especially in cases where traditional profit-based metrics fall short. While offering simplicity and comparability across different industries, revenue multiples can also oversimplify complex business dynamics and vary significantly across sectors.

Their interpretation is influenced by factors like projected growth, industry trends, and market conditions. A balanced approach, combining revenue multiples with other financial analyses, is essential for a more accurate and comprehensive evaluation of a company's market value.

Understanding Revenue Multiples

To really grasp the essence of revenue multiples, let's start with a simple definition.

A revenue multiple, or the EV Revenue multiple, is a financial metric used to determine how a company is valued in relation to its sales or revenue.

In other words, it tells us how many times over the market values a company's sales.

Now, how is this metric calculated? The formula is straightforward:

Revenue Multiple = Company’s Enterprise Value / Annual Revenue

This equation seems simple, yet it reveals a lot about a company. A higher multiple could indicate that the market expects significant growth or that the company holds a strong competitive position. On the other hand, a lower multiple might suggest a more conservative view of the company’s growth prospects.

Let's break this down with an example. Imagine a startup, 'Tech Innovate', has annual revenues of $2 million. Investors are excited about its potential and value the company at $10 million. Using our formula, the revenue multiple for Tech Innovate would be:

Revenue Multiple = $10 million / $2 million = 5

This means the market values Tech Innovate at five times its current annual revenue. It's a quick way to see how the market perceives the company compared to its actual sales performance.

Understanding this concept is key, especially in the startup world where future potential often outweighs current financial performance. Revenue multiples provide a snapshot, allowing us to compare and contrast startups at different stages and in various sectors, even when they aren't profitable yet.

In addition to theoretical understanding, real-life scenarios can vividly illustrate the impact of these factors. Take the tech industry, for example, which has experienced a significant recalibration in recent years:

From Boom to Adjustment: A Case Study on SaaS and Cloud Stocks

In the not-so-distant past, the software as a service (SaaS) and cloud computing sectors were hailed as the vanguards of the tech industry, commanding towering revenue multiples that reflected this sentiment. In 2021, the fervor was palpable, with revenue multiples reaching an astounding 18x. This figure wasn't just a number—it was a testament to the unbridled optimism surrounding tech startups' growth potential.

Fast forward to December 2023, and the landscape has dramatically shifted. Those same revenue multiples have plummeted to a mere 6.6x. This precipitous decline prompts the question: what's behind such a stark realignment?

The answer lies in understanding the revenue multiple itself—a ratio of Company Value to Annual Revenue. This seemingly simple metric is a barometer for market expectations, capturing the zeitgeist of investor confidence and speculation about future growth.

The sharp downturn in SaaS and cloud stocks' multiples from 18x to 6.6x isn't just about market corrections; it encapsulates a broader reevaluation of growth potential within the startup ecosystem. It serves as a stark reminder that investor sentiments are ever-evolving, influenced by economic cycles, market trends, and, crucially, by the startups' performance and scalability prospects.

This case study isn't merely a cautionary tale; it's an essential signpost for entrepreneurs and investors navigating the dynamic and often unpredictable tech landscape. It underscores the importance of not only tracking revenue multiples but also understanding the underlying factors that drive them.

As we consider these shifts in investor perspectives, it's equally important to explore how revenue multiples are applied in various scenarios.

Use Cases and Applications of Revenue Multiple

As we've established, revenue multiples offer a snapshot of how startups are valued by the market, relative to their sales. This simple yet powerful tool, calculated as a ratio of company value to annual revenue, is particularly insightful for businesses in their early stages, where other financial metrics may not yet apply or be as telling.

We've seen through a case study how fluctuations in revenue multiples can reflect broader market sentiments and shifts in investor outlooks, especially in fast-evolving industries like SaaS and cloud computing.

Now, understanding the concept and its impact is one thing, but applying it is where the true value unfolds. Revenue multiples are not just theoretical constructs; they are actively used in various aspects of business and investment practices.

From gauging the worth of a fledgling enterprise to benchmarking against industry giants, revenue multiples serve as a common denominator in the complex equation of business valuation. They enable stakeholders to navigate the financial landscape with a clearer view of comparative worth and potential.

In this section, we'll explore the practicalities of revenue multiples — how they are leveraged for startup valuation, the nuances they bring to comparative analysis across different-sized businesses, their role in shaping investment decisions, and their utility in sector benchmarking.

This exploration is crucial, as it connects the foundational understanding of revenue multiples with real-world applications, illustrating how this metric is an indispensable part of the financial toolkit in the startup ecosystem.

Startup Valuation

When it comes to startups, traditional valuation methods often fall short due to the lack of historical financial data. Revenue multiples step into this void, offering a straightforward approach to valuation.

By comparing a startup's value with its annual revenue, investors can estimate a startup’s worth, even when profits are yet to materialize. It's a method that aligns closely with the forward-looking nature of startup finance, where potential often outshines present performance.

Startup valuation is the process of determining the worth of a startup company. This involves assessing its current financial standing, market potential, intellectual property, and the experience of its management team, among other factors. Since many startups have not yet turned a profit, or may even be pre-revenue, investors and founders typically use alternative methods to traditional valuation techniques, such as revenue multiples, to gauge their potential future success and decide on a fair market value. This process is crucial for making investment decisions, negotiating funding, and understanding the growth trajectory of the business.

Read more

Comparative Analysis

One of the most significant advantages of revenue multiples is the ability to compare apples to oranges — or, more accurately, startups of different sizes and development stages.

By using a common metric, investors can level the playing field, comparing fledgling tech companies to more established players to identify undervalued or overvalued ventures. It's a comparative tool that transcends the boundaries of scale and maturity, providing a standardized measure of value across the startup spectrum.

Investment Decisions

In the investment decision-making process, revenue multiples act as a beacon, guiding venture capitalists and angel investors through the fog of financial forecasts and market hype.

This metric helps to ground investment choices in a reality that’s often obfuscated by complex financial projections and speculative growth models. By evaluating the revenue multiple in the context of industry averages and growth forecasts, investors can make more informed and rational investment choices.

Sector Benchmarking

Every industry has its own rhythm and pace of growth, which is reflected in the typical revenue multiples within that sector. Startups can be benchmarked against these industry standards to gauge their performance and potential.

For instance, a SaaS company might be assessed differently than a hardware startup, simply because software companies typically scale more rapidly. By understanding these sector-specific benchmarks, startups can be more accurately valued and compared to their peers.

Get your expert support now!

Real Market Examples of Revenue Multiple Use

Exploring real-world data offers us a vivid picture of how revenue multiples vary across different business niches.

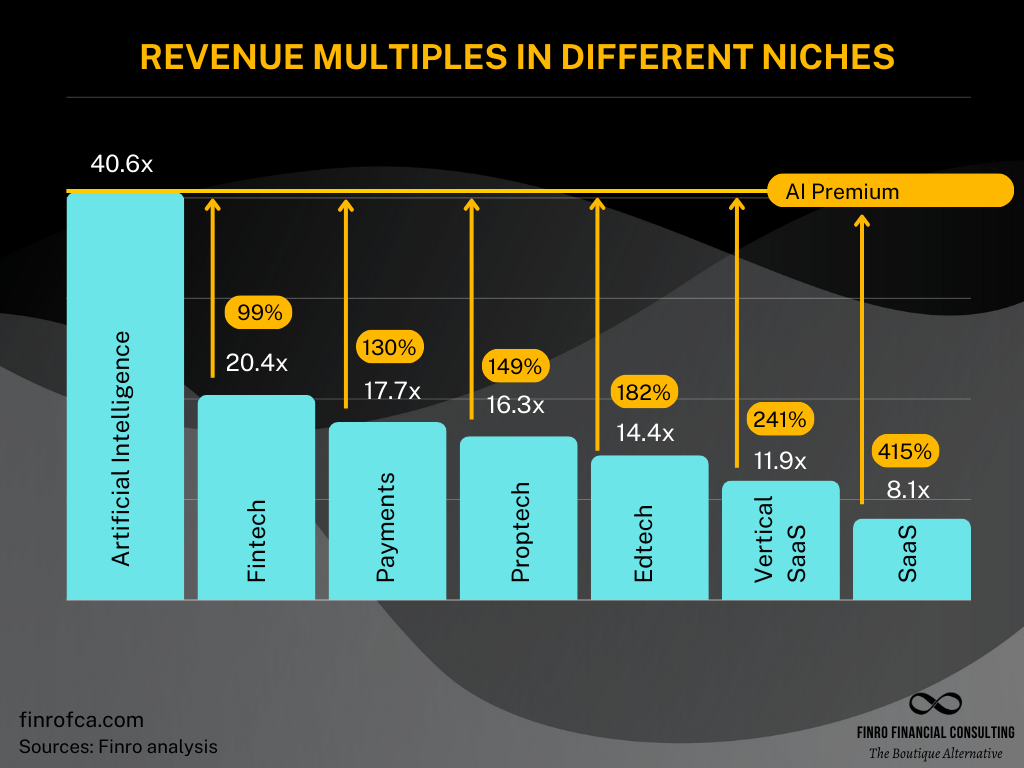

Our research at Finro has provided a detailed comparison of revenue multiples in seven distinct sectors: SaaS at 8.1x, vertical SaaS at 11.9x, Edtech at 14.4x, Proptech at 16.3x, Fintech at 17.7x, Payments at 20.4x, and AI at an impressive 40.6x.

These numbers, reflecting both public and private companies, reveal much more than just figures; they uncover the unique market positions and growth expectations within each niche.

Particularly striking is the premium placed on AI, with a revenue multiple far exceeding those of other sectors.

This 'AI premium' is not just a number—it's a testament to the groundbreaking potential that investors see in AI technologies. Compared to AI's 40.6x, other sectors like Payments and Fintech, despite their high multiples, highlight a significant gap in valuation.

This gap, or premium, is essentially the market's vote of confidence in AI's power to transform businesses and society at large.

The AI premium can be quantified by comparing its revenue multiple to those of other niches, revealing the extra value the market assigns to AI.

For example, when we say AI's multiple is 40.6x—more than double that of some sectors—it illustrates the high expectations for AI's role in driving future innovations.

This comparison is crucial, as it goes beyond mere numbers to highlight the belief in AI's unique capabilities to enhance efficiency, creativity, and growth across all industries.

This analysis allows us to appreciate the utility of revenue multiples not just as a measure of current value, but as a lens through which we view the future potential and strategic importance of different sectors.

By showcasing the variations in revenue multiples and the remarkable AI premium, we offer a concrete way to understand how different sectors are valued. It provides a clear, numeric expression of the market's anticipation for what AI can achieve, setting it apart from other areas of tech and industry.

Furthermore, this exploration into revenue multiples and the AI premium emphasizes the nuanced landscape of startup valuation. It highlights how these numbers enable a comparison across sectors with vastly different characteristics, from their size to their market reach. This comparison is not just about who's leading the race today but about who is poised to redefine the playing field tomorrow.

In essence, this section underscores the importance of looking beyond the present, using revenue multiples as a tool to gauge future potential.

For investors, entrepreneurs, and industry watchers, understanding the significance of these multiples, especially the standout value attributed to AI, provides invaluable insights.

It guides strategic decisions, investments, and the broader conversation on technological progress and market dynamics.

Pros and Cons of Using Revenue Multiple Valuation Method

As we've explored the various applications and practical uses of revenue multiples in the startup landscape, it becomes clear that this metric is a vital tool in business and investment analysis.

However, like any analytical tool, revenue multiples come with their own set of strengths and weaknesses. Understanding these pros and cons is essential for a well-rounded comprehension of the revenue multiple concept.

Pros of Using Revenue Multiple Valuation Method

One of the most appealing aspects of revenue multiples is their simplicity and ease of use. They provide a straightforward and quick way to estimate a company's market value, especially useful in scenarios where other financial data may be limited or not fully indicative of the company's potential, such as with high-growth startups.

This simplicity makes revenue multiples an accessible tool for a wide range of users, from seasoned investors to budding entrepreneurs.

Furthermore, revenue multiples have a particular utility in high-growth companies. Traditional valuation metrics often fall short in capturing the essence of startups that are rapidly scaling but may not yet be profitable. Revenue multiples fill this gap by focusing on sales, thus reflecting the growth potential and market enthusiasm around these companies.

Another significant advantage is the comparability revenue multiples offer. They provide a common denominator to evaluate companies across a range of industries and sizes. This feature is particularly beneficial when assessing startups that operate in diverse sectors, enabling a standardized approach to valuation.

Cons of Using Revenue Multiple Valuation Method

Despite their advantages, revenue multiples are not without drawbacks. Their simplicity can sometimes lead to an oversimplification of business complexities. By focusing solely on sales, this method may overlook other crucial aspects of a business, such as its operational efficiency, debt levels, or profitability prospects.

There's also a risk of misinterpretation when applying revenue multiples across different industries. Each industry has its own dynamics and standard multiples, and applying a uniform multiple can lead to misleading valuations. For example, the tech sector often has higher multiples due to its growth potential, which might not be applicable to more traditional industries.

Additionally, revenue multiples can lead to the neglect of other important financial factors and metrics. While sales are important, they are just one part of a company's financial health. Over-reliance on revenue multiples might result in underestimating the importance of earnings, cash flow, and debt, which are critical for a comprehensive evaluation of a company's value.

| Aspect | Pros | Cons |

|---|---|---|

| Simplicity | Easy to calculate and understand. | May oversimplify complex business dynamics. |

| Applicability | Useful for high-growth, non-profitable companies. | Inappropriate for industries with different standards. |

| Comparability | Enables comparison across diverse businesses. | Can lead to misinterpretation across industries. |

| Financial Comprehension | - | Ignores other key financial metrics like earnings. |

Factors Influencing The Revenue Multiple

As we've navigated through the intricacies of revenue multiples, from their definition and calculation to their practical applications and the advantages and limitations they present, a nuanced understanding of this valuation tool emerges.

We've seen how revenue multiples can simplify startup valuation and offer a comparative measure across industries and businesses. However, it's important to recognize that these multiples don't exist in a vacuum. They are influenced by a range of factors, which can significantly alter their interpretation and application.

This section breaks down the various factors that influence revenue multiples, highlighting the importance of considering these elements when using this metric. Understanding these factors is crucial not only for accurate valuation but also for comprehending the broader economic and industry-specific contexts in which these businesses operate.

By examining the impact of projected growth, industry trends, market conditions, and company-specific characteristics, we can gain a deeper insight into what drives the numbers behind the multiples. This understanding is vital for investors, entrepreneurs, and analysts alike, as it provides a more holistic view of a startup's value and potential.

Growth Potential. The projected growth of a startup is perhaps the most influential factor. High growth potential can lead to higher revenue multiples, as investors are willing to pay more for the anticipated future expansion. Startups in rapidly growing industries or those with innovative products or services often command higher multiples due to their potential to scale and capture significant market share.

Industry Trends. Different sectors exhibit varying standard revenue multiples, influenced by the industry's overall growth trajectory and stability. For instance, tech startups might have higher multiples compared to manufacturing firms, reflecting the faster growth rate and scalability commonly seen in the tech sector. Understanding these industry-specific trends is vital for benchmarking a startup's multiple against its peers.

Market Conditions. The broader economic environment and market trends can also impact revenue multiples. In a bullish market, where investor confidence is high, multiples tend to increase as investors are more optimistic about future growth and willing to pay a premium. Conversely, in a bearish market, multiples might decrease due to increased risk aversion and a more cautious investment approach.

Company-Specific Factors. Lastly, company-specific factors play a critical role. These include the startup's business model, its customer base, market share, and even the strength of its management team. A startup with a robust and scalable business model, a growing customer base, and a significant market share is likely to have a higher revenue multiple. The reputation and track record of the management team can also influence investor perception and, consequently, the revenue multiple.

Conclusion

Throughout this article, we've journeyed through the complex yet fascinating world of revenue multiples, a critical tool in the valuation of startups. We began by defining this metric and explaining how it is calculated, showcasing its simplicity and accessibility. We then dived into its various applications, from startup valuation to comparative analysis, investment decision-making, and sector benchmarking, demonstrating its versatility in different business contexts.

However, we also acknowledged the limitations of revenue multiples, noting their tendency to oversimplify and the risks of misinterpretation, especially when applied across different industries or without considering other financial factors. The discussion on the various elements that influence revenue multiples further underscored the dynamic nature of this metric, influenced by factors like growth potential, industry trends, market conditions, and company-specific characteristics.

Understanding revenue multiples is more than just about grasping a financial formula; it's about recognizing the pulse of the market, the aspirations of startups, and the cautious optimism of investors. In the rapidly evolving startup ecosystem, revenue multiples serve as a crucial navigational tool, but they should not be the sole compass.

As we conclude, the key takeaway is the importance of a balanced approach in startup evaluation. Revenue multiples, while invaluable, should be used in conjunction with other financial analyses and metrics. This holistic approach ensures a more comprehensive and realistic assessment of a startup's value, potential, and position in the market.

For investors, entrepreneurs, and financial analysts alike, such a balanced view is instrumental in making informed, prudent decisions in the vibrant world of startups.

Key Takeaways

Revenue Multiples for Valuation: Essential for startup valuation, calculated as company value divided by annual revenue, reflecting growth potential.

Startup Significance: Crucial for startups lacking profit history, offering a comparative snapshot for market assessment and strategic decisions.

Dynamic Nature: Influenced by projected growth, industry trends, and market conditions, emphasizing the importance of a balanced approach.

Real Market Impact: Illustrated by fluctuations in sectors like SaaS, indicating investor sentiment shifts and sector-specific valuation trends.

Pros and Cons: Simplicity and comparability are strengths, but oversimplification and industry variations pose limitations, demanding nuanced interpretation.

Answers to The Most Asked Questions

-

Generally, a higher revenue multiple indicates that investors are willing to pay more for each unit of revenue generated by a company, suggesting optimism about its growth potential.

-

In M&A, revenue multiples are often used as a valuation metric to assess the attractiveness of a target company relative to its revenue. They help buyers determine the fair price to pay for acquiring the target company.

-

The revenue multiple of a stock refers to how many times over the market values a company's sales. It's calculated by dividing the company's enterprise value by its annual revenue.

-

A 5x revenue valuation means that a company's market capitalization is five times its annual revenue. It indicates that investors are willing to pay five times the company's revenue for ownership of its shares.

-

Revenue multiple provides insights into how investors perceive a company's value relative to its revenue. A higher multiple may suggest optimism about future growth prospects, while a lower multiple may indicate skepticism or concerns about the company's performance.

-

Whether a higher or lower multiple is better depends on the context. A higher multiple could signify growth potential, but it might also imply higher expectations and risk. Conversely, a lower multiple might suggest undervaluation but could also indicate concerns about the company's prospects.

-

The revenue multiple, also known as the price-to-sales ratio or the ev-to-sales ratio, is a financial metric used to gauge how the market values a company's sales or revenue. It's calculated by dividing the company's market capitalization or enterprise value by its annual revenue.