What Is a Startup Valuation?

By Lior Ronen | Founder, Finro Financial Consulting

Ever wonder how much your startup is worth? Or how do investors come up with those big numbers? If so, you're not alone! Valuation is a crucial concept that impacts both entrepreneurs and investors.

Startup valuation is the process of estimating the fair market value of a young, privately held company. It's like figuring out the price tag of your awesome new idea, and it plays a big role in securing funding, attracting talent, and driving growth.

Unlike established businesses with years of financial history, valuing startups is a bit different. Traditional methods based on past profits and sales don't always work, as many startups are just starting out and haven't reached profitability yet.

This is where specialized tech startup valuation methods come in, considering factors like market potential, user growth, innovative technology, and a strong founding team.

By understanding the basics, you can navigate the startup world with confidence and turn your dream into a reality.

Startup valuation is the process of estimating the fair market value of a young, privately held company. A formal valuation, though not always mandatory, is beneficial as it enhances negotiation strength, boosts investor confidence, and sets a benchmark for future planning. In the competitive startup arena, effective use of valuation can mean the difference between acquiring necessary resources or lagging behind.

Founders should view valuation as a key tool to ascertain their startup's real value, attract suitable investors, and mold their venture's future. Success involves careful planning, strategic decision-making, and a profound grasp of the financial landscape, allowing entrepreneurs to confidently navigate the funding environment and realize their business aspirations.

- Investors: Why Should You Care About Startup Valuation?

- Founders: Why Should You Care About Startup Valuation?

- The Berkus Method & the Payne Scorecard Method

- The Revenue Multiple Valuation Method

- The EBITDA Multiple Valuation Method

- The Discounted Cash Flow (DCF) Method

- Previous Transactions Method

- Cost-To-Duplicate Method

- VC Method

- Choosing the Right Valuation Method

- Different Financing Alternatives

- The Benefits Of Choosing Finro As Your Valuation Consultant

- Conclusion

Investors: Why Should You Care About Startup Valuation?

Startup valuation is more than just a number. It is an important tool for investors to understand new, fast-growing companies. By looking at different parts of the valuation, investors can make smart decisions that give them the best chance of success. Understanding valuation helps investors navigate the complicated world of startups.

It allows them to compare companies and choose ones that fit their investment goals. With knowledge of valuations, investors can put their money into startups that have the potential for big returns in the future. Valuation gives insights that turn investments from gambles into calculated risks.

Making Informed Investment Decisions

Every investor wants to put their money to work in ventures with the potential for significant returns. Analyzing market size and traction helps investors assess the addressable market for the startup's product or service and its ability to capture a significant share.

This provides valuable insights into the potential revenue and profitability of the venture, allowing investors to determine if it aligns with their risk-return profile.

Comparing Different Opportunities

The startup landscape is filled with diverse businesses across various industries. Comparing valuation multiples, such as revenue or EBITDA multiples, allows investors to compare different startups on a standardized basis.

This helps identify undervalued opportunities that might be overlooked due to less established brand recognition or industry hype, potentially leading to higher returns on investment.

Protecting Investments

While the potential for high returns is lucrative, investors also need to protect their capital from potential losses. Assessing the exit strategy and potential for liquidity is crucial. This involves understanding how investors can eventually sell their shares in the company and realize their profits.

Analyzing the potential for an acquisition, initial public offering (IPO), or other exit scenarios helps investors mitigate risk and ensure they can recover their investment in a reasonable timeframe.

Setting Clear Expectations

Aligned expectations are key to a successful partnership between investors and founders. By clearly communicating their return on investment expectations to founders, investors can ensure that everyone is working towards the same goals. This fosters transparency and trust, minimizing the risk of future conflicts or disagreements about the value of the company.

Understanding Valuation Methods

The world of startup valuation is complex, with various valuation methods used to estimate a company's worth. Understanding the strengths and limitations of each method, such as the Discounted Cash Flow (DCF) or market multiples approach, allows investors to take better investment decisions based on a comprehensive analysis of the startup's risks and uncertainties. This reduces the potential for overpaying or undervaluing a company, leading to better investment decisions.

| Benefit | Specific Aspect of Valuation |

|---|---|

| Make informed investment decisions | Analyzing market size and traction to assess future growth potential |

| Compare different investment opportunities | Comparing valuation multiples across different startups and industries |

| Protect your investment | Assessing the exit strategy and potential for liquidity |

| Set clear expectations for return on investment | Communicating expectations effectively to founders |

| Understand the different valuation methods and their limitations | Analyzing the risks and uncertainties associated with startup investments |

Founders: Why Should You Care About Startup Valuation?

For founders, understanding startup valuation is not just about securing funding; it's about empowering them to make informed decisions that drive their company's success. By understanding the different aspects of valuation, founders can navigate crucial stages like fundraising, talent acquisition, and strategic planning with greater confidence.

Negotiating Fair Deals with Investors

Every founder wants to secure the capital needed to grow their business while retaining control and ownership. Understanding dilution, the process by which ownership is distributed as new investors come in, allows founders to negotiate fair terms and ensure they are not giving away too much of their company for the funding they receive. This protects their long-term vision and ensures they remain in control of their own destiny.

Attracting Top Talent

Building a strong team is critical for any startup's success. Top talent wants to be part of companies with a bright future and strong growth potential. Demonstrating strong growth through key metrics like user base and revenue, as well as a compelling valuation, helps founders attract the best people to join their team. This can significantly accelerate the company's growth and development.

Tracking Progress and Setting Milestones

Knowing your company's worth is essential for tracking progress and setting realistic goals. By monitoring key metrics like user base and revenue and key performance indicators (KPIs) like CAC, LTV, churn rate, etc. , founders can accurately assess their growth trajectory and identify areas for improvement.

A strong valuation also serves as a benchmark for measuring success and validating the company's potential. This allows founders to set realistic milestones and make informed decisions about resource allocation and future strategy.

Managing Expectations and Communicating Value

Setting clear expectations with investors and stakeholders is crucial for a startup's long-term success. By understanding the different stages of startup valuation and the typical valuations for each stage, founders can manage expectations and avoid unrealistic promises. This fosters trust and transparency in their relationships with investors and stakeholders, leading to a more collaborative and supportive environment.

Making Informed Fundraising Decisions

Understanding your company's valuation empowers you to make informed decisions about fundraising. Knowing the right time to raise capital and how much to raise is crucial for optimizing your company's financial health and avoiding unnecessary dilution.

This allows you to secure the funding needed to fuel growth without jeopardizing your long-term vision and control.

| Benefit | Specific Aspect of Valuation |

|---|---|

| Negotiate fair deals with investors | Understanding dilution and how it affects ownership |

| Attract top talent | Demonstrating strong growth and financial projections |

| Track your progress | Monitoring key metrics like user base and revenue |

| Manage expectations | Understanding the different stages of startup valuation and the typical valuations for each stage |

| Make informed decisions about fundraising | Knowing when and how much capital to raise |

The Berkus Method & the Payne Scorecard Method

Qualitative methods stand out for their nuanced approach. These methods are particularly vital when assessing the worth of nascent startups, where quantitative data like revenue and profit are sparse or non-existent.

They rely on a more subjective analysis of a startup's potential, offering a unique perspective in the valuation landscape.

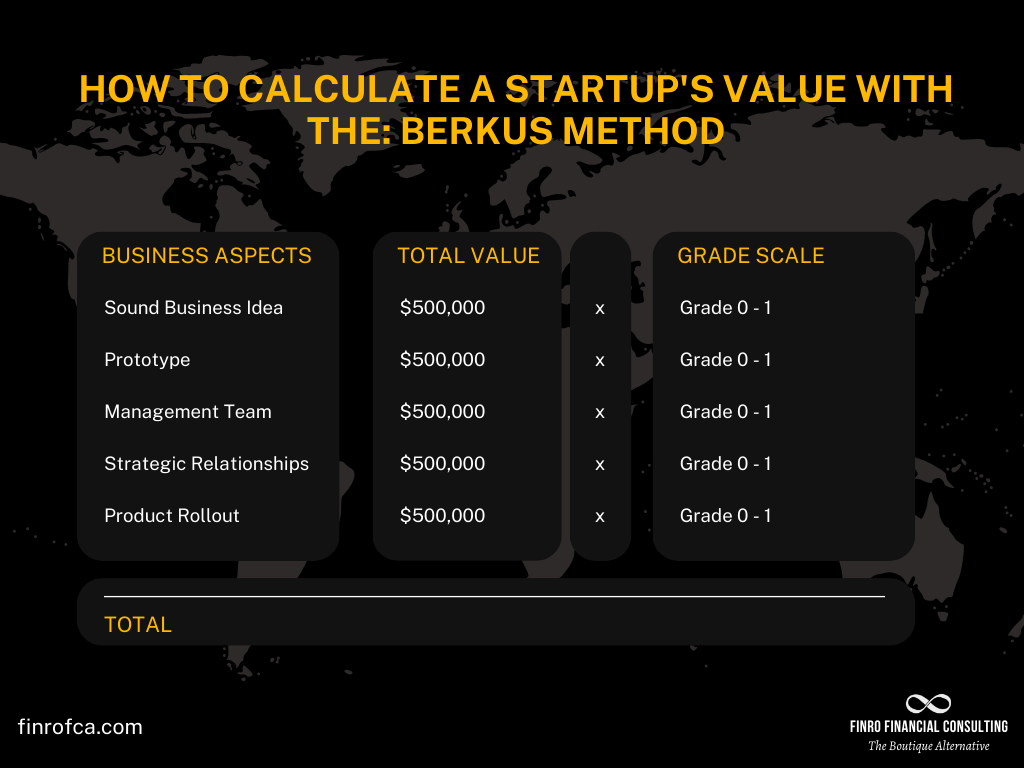

First, let’s look at the Berkus Method. Renowned angel investor Dave Berkus developed it, and the Berkus Method emerged as a pioneering approach to value early-stage startups.

Recognizing the limitations of traditional financial metrics in the embryonic stages of a company, Berkus sought a method that could quantify the intangible yet critical aspects of a startup's potential.

This method revolves around five core elements: soundness of the idea, prototype development, the strength of the management team, strategic relationships, and the sales and marketing plan.

Berkus assigns a monetary value, typically up to $500,000, to each of these components.

If a startup shows exceptional promise in a particular area, it's awarded the full value, leading to a potential maximum pre-money valuation of $2.5 million.

The Berkus Method is a balancing act between optimism in a startup’s potential and the pragmatic reality of business challenges.

Now, after we learned about the Berkus Method, let’s dive into the Payne Scorecard Method.

Bill Payne, an accomplished angel investor, developed the Payne Scorecard Method to provide a more structured and detailed approach to startup valuation.

This method was born from the need to systematically evaluate the multiple facets that contribute to a startup's future success.

The Payne Scorecard Method assesses a startup across several dimensions: management team, size of the opportunity, product or technology distinctiveness, competitive environment, marketing/sales channels, need for future investment, and the potential for a profitable exit.

Each category is scored and then weighted according to its perceived importance. The total score is then used to adjust the average valuation of comparable startups, providing a more tailored valuation figure.

This method demands a thorough understanding of the market and the startup's place within it, making it an in-depth analytical tool for valuation.

Both the Berkus Method and the Payne Scorecard Method excel in the context of early-stage startups. They shine where traditional financial metrics are insufficient, offering a lens to view a startup's potential through its inherent strengths and market opportunities.

When to Use Berkus vs Payne Scorecard?

Choosing between the Bthankerkus and Payne Scorecard Methods depends on the depth of analysis required and the nature of the startup.

The Berkus Method, with its straightforward and somewhat broad approach, is ideal for investors who prefer a rapid assessment focusing on key startup attributes.

In contrast, the Payne Scorecard Method suits scenarios where a detailed, multifaceted analysis is necessary, taking into account the startup’s broader market environment and internal dynamics. The choice of method hinges on the investor's preference for breadth versus depth in the valuation process.

| Criteria | Berkus Method | Payne Scorecard Method |

|---|---|---|

| Focus and Scope | Broad, evaluating key areas like idea, prototype, team, relationships, and sales plan. | Detailed, scoring various factors including team, market, product, competition, etc. |

| Complexity and Detail | Simpler and straightforward, with less granular analysis. | More complex, involving scoring, weighting, and detailed market analysis. |

| Valuation Approach | Subjective, focuses on potential success factors. | Analytical and data-driven, adjusts valuation based on scored factors. |

| Best Use Case | Ideal for quick assessments in very early stages with limited data. | Suited for detailed analysis, offering a comprehensive market and industry view. |

The Revenue Multiple Valuation Method

The Revenue Multiple Valuation Method is a popular approach in startup valuation and it's highly useful for estimating a startup value in the pre-revenue stage.

The revenue multiple method, also known as the EV/revenue multiple, is one of the two leading valuation multiples that measures a company's value by comparing it to similar companies: the revenue multiple and the EBITDA multiple.

This method involves using a multiplier - the revenue multiple - applied to a company's revenue to estimate its value. This multiple is derived from the valuation of similar companies in the same industry or sector.

The simplicity of this method lies in its focus on revenue, making it particularly appealing for businesses at various stages of development.

The greatest advantage of the revenue multiple method is in it's versatility across stages. It's highly useful for mature, profitable companies, but could be as useful for pre-revenue companies.

When used for a pre-revenue companies, the method relies solely on revenue projeciton, while in mature businesses, it's a mix of both historcial and projected revenues.

For growth-stage companies, it offers a way to value potential and market positioning. However, the key is adjusting the multiple to reflect the specific stage and risk profile of the business.

To provide a clearer understanding of the Revenue Multiple Valuation Method, let's examine its strengths and drawbacks in a structured manner. The following table concisely summarizes the key advantages and limitations of this method, offering a balanced view of its applicability in different business scenarios.

| Aspect | Advantages | Limitations |

|---|---|---|

| Simplicity | Straightforward and easy to understand. | May oversimplify valuation by ignoring other factors. |

| Comparability | Allows for direct industry comparisons. | Heavily reliant on market conditions and benchmarks. |

| Flexibility | Adjustable to different business stages. | - |

| Focus | Emphasizes revenue, useful for growth projection. | Focuses solely on revenue, not profitability, which can be misleading for businesses with high revenues but low or negative profits. |

| Market Relevance | Reflects current industry standards and trends. | Susceptible to market volatility and changes. |

Real-Life Cases for Revenue Multiples

To further illuminate the Revenue Multiple Valuation Method and its practical applications, examining real-life cases provides tangible insights. The method's flexibility across different sectors and stages of company growth is exemplified in these examples, showcasing the variability and practicality of revenue multiples.

Below is a snapshot of revenue multiples across select tech niches, reflecting industry-specific valuations:

Artificial Intelligence: Topping the list, AI companies command a whopping 40.6x revenue multiple, indicative of high growth expectations and the transformative potential of AI technology.

Fintech: Financial technology firms follow closely with a 20.4x revenue multiple, underscoring the disruptive innovation reshaping the financial services landscape.

Payments: Within fintech, the payments sector shows a 17.7x multiple, emphasizing the lucrative nature of digital transaction services.

Proptech: Property technology, at a 16.3x multiple, reveals the burgeoning interest in real estate innovation.

Edtech: The education technology niche stands at a 14.4x multiple, highlighting the increasing investment in digital learning platforms.

Vertical SaaS: With a 11.9x multiple, this segment represents specialized software services catering to specific industry verticals.

HR Tech: Human resources technology companies have a multiple of 11.7x, indicating the critical role of digital tools in managing workforce solutions.

Insurtech: Insurance technology firms, at a 9.7x multiple, show a moderate but significant expectation of growth within the insurance industry.

SaaS: The broader software as a service sector shows a 7.1x multiple, reflecting its mature status yet continuing relevance in the tech ecosystem.

The above figures provide a contemporary landscape of how different tech sectors are valued in terms of revenue multiples.

They highlight not only the diversity of the tech industry but also the varying levels of investor confidence and market expectations tied to each niche.

Understanding these nuances is crucial for entrepreneurs, investors, and analysts alike in gauging the valuation and potential of startups within these sectors.

The EBITDA Multiple Valuation Method

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It's a measure used to evaluate a company's operational performance without the impact of financial and accounting decisions.

In the context of valuation, EBITDA is crucial as it provides a clearer picture of a company's profitability from its core business operations, making it a popular metric among investors and analysts.

The EBITDA Multiple is calculated by dividing the value of a company (either in terms of market value or enterprise value) by its EBITDA.

This multiple provides a relative measure of a company's valuation compared to its earnings before accounting deductions. Interpreting these multiples involves comparing them to those of similar companies in the same industry or sector.

A higher EBITDA Multiple may suggest that a company is overvalued, or it could indicate that investors expect higher growth and profitability in the future. Conversely, a lower multiple might signal undervaluation or potentially lower growth prospects.

The EBITDA Multiple is particularly useful in scenarios where companies have significant investments in fixed assets or where depreciation and amortization policies vary significantly.

This makes it a favored method in industries like manufacturing, telecommunications, and utilities. It's also suitable for comparing companies within the same sector, as it neutralizes the effects of different capital structures and tax rates.

The EBITDA Multiple Method vs. Revenue Multiple Method

To better understand the distinctions between the EBITDA Multiple Method and the Revenue Multiple Method, let's compare them side by side. The following table highlights the fundamental differences in their approaches, suitability, and insights they offer in company valuation.

This comparison will aid in determining the most appropriate method for specific business scenarios.

| Aspect | EBITDA Multiple Method | Revenue Multiple Method |

|---|---|---|

| Primary Focus | Profitability of core operations (earnings before interest, taxes, depreciation, and amortization). | Total revenue generated by a company. |

| Suitability | Suitable for industries with significant fixed assets or varying depreciation policies (e.g., manufacturing, telecommunications). | Applicable across various industries, especially for startups and growth companies. |

| Valuation Insight | Provides a view of operational efficiency and profitability. | Focuses on top-line growth and market potential. |

| Consideration of Costs | Takes into account operational costs excluding financing and accounting decisions. | Does not consider operational costs or profitability. |

| Market Comparison | Useful for comparing companies with similar capital structures within an industry. | Useful for industry-wide comparisons, regardless of capital structure. |

| Application Scenario | Often used for mature companies with stable earnings. | Commonly used for early-stage or fast-growing companies. |

The Discounted Cash Flow (DCF) Method

The Discounted Cash Flow (DCF) method is a powerful valuation tool used to estimate the value of an investment based on its expected future cash flows.

This approach involves forecasting the cash flows a company will generate in the future and then discounting them back to their present value using a discount rate.

The discount rate typically reflects the risk associated with the investment. The fundamental principle behind DCF is the concept that money has a time value – a dollar today is worth more than a dollar in the future due to its potential earning capacity.

Calculation

The discounted cash flow method involves forecasting the future cash flows that an asset or business is expected to generate over a discrete period. These projected free cash flows are then discounted back to the present value using a discount rate aligned with the risk of achieving the estimates. The summation of these risk-adjusted present values provides the net present value, which equates to fundamental asset value.

Key inputs into DCF models include:

Free cash flow projections – most critical estimates

Discount rate assumptions – typically a weighted average cost of capital

Forecast period time frame – e.g. 5 or 10 years

Adjustments for Startups and Growth Companies

For startups and growth companies, tailoring the Discounted Cash Flow (DCF) model is essential due to their distinct financial and operational traits. This often involves incorporating higher discount rates to account for greater risk, adopting more conservative projections of cash flows, and extending the forecast period to fully capture their potential for growth.

Central to DCF analysis is the Weighted Average Cost of Capital (WACC), which signifies the minimum return a company must generate to meet its investors' expectations. Adjusting the WACC is particularly vital for private companies, considering several key factors:

Lack of Market Data: Private companies lack publicly traded equity or debt, so market values for equity and debt are often estimated using alternative methods like book values or industry averages.

Higher Risk Profile: They typically face higher risks due to factors like smaller size and limited market access, requiring a higher cost of equity in the WACC calculation.

Beta Calculation Challenges: Without market data, beta (a measure of volatility) for private companies is estimated using public company proxies, which can be less accurate.

Diverse Capital Structures: Private companies often have more complex capital structures, making the allocation of weights in WACC more challenging.

Incorporating these adjustments ensures that the WACC used in DCF analysis reflects the unique financial and operational realities of private companies, leading to more accurate valuations.

For a more comprehensive understanding of the Discounted Cash Flow model, including a detailed step-by-step guide to its application, I highly recommend visiting this link.

This resource offers in-depth insights and practical examples, making it an invaluable tool for anyone looking to deepen their knowledge of DCF analysis and its nuances.

Previous Transactions Method

The Previous Transactions Method of startup valuation is based on analyzing the sale prices of similar companies in recent transactions.

This method operates on the principle that the value of a startup can be gauged by looking at how much investors were willing to pay for comparable companies.

It's particularly useful in providing a market-based perspective on valuation, reflecting what buyers are actually paying in the market.

How to Leverage Market Data and Comparable Sales

Leveraging market data and comparable sales involves a few key steps:

Identifying Comparable Companies: Select companies that are similar in size, industry, growth stage, and market conditions.

Analyzing Transaction Details: Look at recent transactions involving these companies. Key details include sale price, financial metrics at the time of sale, and terms of the deal.

Adjusting for Differences: Since no two companies are identical, adjustments may be needed for differences in growth prospects, market conditions, financial health, etc.

Applying Insights to Startup Valuation: Use the data from these transactions to estimate a valuation range for the startup in question, based on where it aligns with these comparables.

This method has its unique strengths and weaknesses:

| Aspect | Strengths | Weaknesses |

|---|---|---|

| Market Relevance | Reflects actual market conditions and what investors are currently paying. | Market conditions can change rapidly, making past transactions less relevant. |

| Comparative Analysis | Provides a direct comparison with similar companies. | Finding truly comparable companies can be challenging. |

| Simplicity | Relatively straightforward if comparable transaction data is available. | Oversimplifies valuation by not accounting for unique startup qualities. |

| Data Accessibility | Based on real-world transaction data. | Access to detailed and relevant transaction data can be limited. |

| Objectivity | Offers a market-based, objective perspective. | May overlook subjective factors like management quality or brand value. |

Cost-To-Duplicate Method

The cost-to-duplicate method is one approach that can be used to value intellectual property (IP) assets and technology of a company.

This method seeks to estimate the cost that would be incurred to recreate or redevelop the unique intangible assets or technology being valued.

Explanation and Calculation of Cost-To-Duplicate

The cost-to-duplicate method calculates the value of IP or technology by estimating the costs involved with duplicating or reproducing it from scratch. This includes the costs of research and development, engineering, testing, materials, labor, licensing fees for any third-party IP, and other expenses that would be necessary to develop the asset independently. The total cost estimate provides the valuation.

There are several ways to estimate the various cost components. Common approaches include using historical accounting records, conducting engineering cost analyses, benchmarking industry research and development costs, or consulting technical experts. Companies may analyze either 1) the actual historical costs already incurred or 2) the prospective costs to recreate the technology for a third party.

Applicability to Tech Startups and IP-Intensive Companies

The cost-to-duplicate method is best suited for valuing the IP and technology of tech startups and IP-intensive companies. For such companies, IP and technology innovation is vital to competitive advantage and value creation. Their most valuable assets are often the proprietary inventions, algorithms, software, etc. that make their products or services possible. The cost-to-duplicate framework allows quantifying these innovation assets.

The method is especially relevant for tech and R&D-heavy verticals like software, hardware, life sciences tools, semiconductors, and clean technology. It provides these IP-rich companies a logical way to benchmark and place a value on intangible technology assets.

Limitations and Considerations

While useful in some contexts, the cost-to-duplicate method does have limitations. Key constraints include:

• It focuses narrowly on costs, not profit potential or competitive advantage enabled by the technology. The revenue generation ability or ecosystem synergies of a technology are ignored.

• Fast changing technology can result in rapid obsolescence of IP and R&D assets, making cost benchmarks less relevant over time. Short product cycles require frequent re-valuation.

• Estimating all the precise cost components accurately is often difficult and subjective assumptions may creep into analysis, reducing reliability.

Overall the cost-to-duplicate method does provide some helpful indicative guidance on technology valuation, but prudent analysts use it cautiously given considerable limitations.

The VC Method

The venture capital method (or VC method) is a specialized approach used by venture capital firms and private equity investors to value and evaluate potential investments in early-stage, high-growth companies. This methodology emerged from these professional investor communities.

The VC method was developed by venture capitalists to value the highly risky, unproven private companies that represent most of their investment opportunities.

With limited current revenues and a lack of comparable businesses, such nascent startups cannot be valued accurately through traditional approaches like discounted cash flow models. The VC technique provides an alternative analytical framework.

The VC method determines a startup's valuation across multiple investment rounds by following several key steps:

1. Project future business milestones like customers, revenues or costs

2. Estimate terminal value of business at a future liquidity date

3. Calculate required returns at each round based on risk and time to exit

4. Determine valuation by dividing forecasts by target returns

By iterating this analysis through different funding rounds, VCs can value both current and future equity stakes.

VC investors use their experience to thoroughly assess technology, market and execution risks when projecting startup returns. Common VC return targets range from 20-35%+ for early-stage deals, driven by elevated failure likelihood. These high targets anchor VC method valuations.

VC Method in Early-Stage Investment Decisions

In nascent, privately-held startups with little current revenue, the traditional valuation tools fall short. The forward-looking VC method provides experienced technology investors with a practical framework to assess investment potential and negotiate appropriate equity stakes. The method is integral to VC early-stage investment decisions.

Pre-money valuation refers to the valuation of a company prior to a new investment round. It is calculated by multiplying the price per share from the previous funding round by the fully diluted shares outstanding before receiving new funding. This gives investors an idea of how much the company is worth before putting in more money.

Post-money valuation = Pre-money valuation + Investment amount

Pre-revenue valuation, on the other hand, refers more broadly to valuing a startup that has not yet made any revenue. This is common for companies still in the product development and market testing stages that have not yet commercialized their offering. Since there are no financials to use in the calculation, pre-revenue valuations are largely based on the perceived market potential, strength of the management team, competitive advantages, and other qualitative factors. It aims to estimate future revenues and profits.

So while a pre-money valuation provides a specific dollar figure at a point in time, a pre-revenue valuation is more subjective in assessing longer term potential.

Read more

Choosing the Right Valuation Method

Various valuation methodologies exist to determine the value of a private company, ranging from sophisticated discounted cash flow models to more back-of-the-envelope approaches. With methods like the Berkus method, VC method, revenue multiples, EBITDA multiples and more, entrepreneurs seeking to value their startups must identify the most fitting technique.

Suitability often depends on company maturity, data availability, importance of market versus investor perspectives, risk tolerance, and other dynamics. Mature companies with long operating histories warrant different valuation approaches than early-stage, pre-revenue startups. Here are key considerations when assessing valuation methods:

Company Maturity Level. Methods like discounted cash flow and EBITDA multiples work better for established companies with financial histories. Approaches such as the Berkus method, VC method, and valuations based on previous transactions are designed for early-stage startups. Maturity determines applicable options.

Existence of Revenues and Positive EBITDA. If no revenues yet, valuation multiples of revenue or EBITDA will not apply. In those cases, early-stage methods like the Berkus method, VC approach, and techniques relying on previous transaction rounds are more relevant. With revenues already, EBITDA or revenue multiples become suitable.

Data Availability and Reliability. Some methods demand detailed quantitative inputs like long-term cash flow projections or comparable public companies. If such rigorous data is lacking, more qualitative approaches may be preferred. The existence of previous round details also expands possible methodologies.

Importance of Market vs. Investor Perspectives. Techniques such as the VC approach quantify based on investor return models. Market-based multiples of EBITDA or revenue reflect valuation norms. Assessing the anchor perspective depends on the valuation purpose.

Risk Tolerance. Approaches like the VC methodology explicitly factor in risk levels and target returns. Market-derived multiples encapsulate implicit assumptions. Companies must align techniques to their position on acceptable risk.

Considering these dynamics helps startups find and apply the optimal valuation methodology for their particular business situation and objectives from the various options.

Different Financing Alternatives

Beyond choosing the right valuation method, your next critical decision lies in the path you choose to finance your startup's journey. Each path offers unique advantages and considerations:

Founders finance the startup themselves, maintaining complete ownership.

Limited access to capital restricts growth potential.

Founders shoulder the full financial risk.

Access capital without diluting ownership through loans.

Debt obligations create financial pressure and burden future profits.

3. Venture Capital:

Sell shares to external investors to fuel rapid growth.

Reduced financial burden for founders.

Diluted ownership and potential impact on strategic decision-making.

While analyzing your startup's value can be insightful in any funding scenario, a formal valuation is primarily required when pursuing the venture capital path.

Even within this path, the need for valuation depends on the specific investment instrument chosen:

Selling Equity:

When founders raise funds by selling shares of their company directly to investors, a formal valuation becomes essential. This process determines the price per share, ensuring both founders and investors understand the company's worth and the proportionate ownership transferred.

SAFE and Convertible Debt:

In cases where founders utilize SAFE (Simple Agreement for Future Equity) or convertible debt agreements, obtaining a formal valuation is not always mandatory. However, having a reliable valuation can still offer significant advantages:

Negotiating Favorable Terms: Understanding your startup's value empowers you to negotiate fair conversion rates for SAFE or convertible debt instruments, ensuring you retain a larger ownership stake.

Attracting Investor Confidence: A professional valuation demonstrates transparency and instills confidence in potential investors, potentially increasing the chances of securing funding.

Future Planning: Having a baseline valuation provides a valuable reference point for future fundraising efforts and strategic decision-making.

While not mandatory in every situation, obtaining a reliable valuation can provide several benefits and offer a significant strategic advantage for startups navigating the venture capital landscape.

| Feature | Bootstrapping | Debt | Venture Capital |

|---|---|---|---|

| Ownership Dilution | No | No | Yes |

| Financial Risk | High | Moderate | Low |

| Access to Capital | Limited | Moderate | High |

| Control | Full | High | Moderate |

| Growth Potential | Limited | Moderate | High |

| Investor Impact on Decision-Making | None | Low | High |

| Time Commitment to Fundraising | Low | Moderate | High |

| Valuation Required | No | Not always | Yes |

The Benefits Of Choosing Finro As Your Valuation Consultant

Navigating the valuation landscape is a critical step for startups looking to secure investment and chart a course for growth.

Finro emerges as a distinguished partner in this journey, offering a suite of tailored valuation services that resonate with the unique demands of early-stage startups.

Here's how Finro stands out as the valuation consultant of choice for forward-thinking entrepreneurs:

Customized Valuation Approach: Understanding that no two startups are alike, Finro delves into the specifics of your business model, growth trajectory, and market dynamics. This personalized approach ensures that the valuation accurately reflects the unique aspects and potential of your startup.

Swift and Efficient Process: Time is of the essence in the startup world. Finro is dedicated to providing rapid turnaround times for valuations, enabling you to proceed with investor negotiations and strategic decisions without delay.

Adaptability to Startup Needs: Startups operate in a fast-evolving environment, necessitating a flexible approach to valuation. Finro prides itself on its adaptability, customizing its processes and timelines to align with your startup's specific needs and pace.

Dedicated Personalized Service: Finro offers a one-on-one consultancy experience, assigning a dedicated consultant who engages deeply with your business. This direct line of communication ensures clarity, efficiency, and valuations that are both insightful and actionable.

Competitive Pricing: Finro provides its specialized services at competitive prices, recognizing the financial constraints faced by many startups. This affordability ensures that startups can access high-quality valuation services without compromising their budget, allowing more funds to be directed towards growth initiatives.

Comprehensive Support Beyond Valuation: Beyond mere numbers, Finro acts as a growth partner to startups. With a deep understanding of the startup ecosystem and financial modeling, Finro equips you with the insights and strategic advice needed to navigate the complexities of fundraising and business development successfully.

Choosing Finro as your valuation consultant means partnering with a team that's not just about assessing value but is genuinely invested in your success.

With Finro, you gain more than just accurate valuation figures; you access a suite of services designed to support your growth journey every step of the way.

Conclusion

Choosing the right funding path and navigating the complexities of valuation are crucial steps in any startup's journey. By understanding the unique advantages and considerations of each option, founders can make informed decisions that propel their ventures towards success.

While a formal valuation might not be mandatory in every scenario, its benefits are undeniable. It empowers negotiation, attracts investor confidence, and provides a valuable baseline for future planning.

In the competitive world of startups, leveraging the power of valuation can be the difference between securing the resources you need and falling behind.

Remember, the path to success is rarely linear. Embrace the valuation process as a valuable tool for understanding your startup's true worth, attracting the right investors, and shaping the future of your venture.

With careful planning, strategic decision-making, and a clear understanding of your financial landscape, you can confidently navigate the funding landscape and turn your entrepreneurial dreams into reality.

Key Takeaways

Art Over Science: Balances quantitative data and qualitative insights, reflecting startup's potential beyond financials for more nuanced, contextual valuations.

Diverse Methods: Tailors to startup's stage and context, using appropriate valuation techniques from qualitative assessments to quantitative models.

Growth and Potential: Focuses on future market disruption and growth prospects, emphasizing innovative business models and scalability over current financials.

Risk and Reward: Accounts for high startup risks with potential for outsized returns, driving investor interest in innovative, high-growth ventures.

Strategic Factors: Considers competitive advantages, IP, and team strength, crucial for attracting investment and strategic partnerships beyond financial metrics.

Answers to The Most Asked Questions

-

Startup valuation is estimating the fair market value of a young, privately held company, considering factors like market potential and innovative technology.

-

The DCF model forecasts future cash flows and discounts them to present value using a discount rate, reflecting investment risk.

-

The comparables method estimates value by comparing the startup to similar companies in the same industry, using metrics like revenue or EBITDA multiples.

-

Yes, DCF is used for startups, adjusted for higher risk with conservative cash flow projections and a tailored discount rate.

-

There's no single most accurate method; it depends on the startup's stage, data availability, and the purpose of the valuation.

-

WACC for startups is adjusted for lack of market data and higher risk, using alternative methods for estimating equity and debt values.

-

Pre-revenue startup valuation assesses value based on perceived market potential, management team strength, and other qualitative factors.

-

Value a pre-revenue startup by considering market potential, team strength, competitive advantages, and industry benchmarks.