Top 5 Elements To Boost Your Startup Financial Model

By Lior Ronen (@Lior_Ronen) | Founder, Finro Financial Consulting

There's a great variety in the quality of financial models that startups send potential investors.

When analyzing a startup for a potential investment, we see all kinds of financial projections.

I've seen models that were so complex that it took me days to understand, and even the founders could not explain.

Other models were so simplistic that they included a few hardcoded numbers in a simple table in Excel.

The right model is probably somewhere in the middle, but the great question is how to get there.

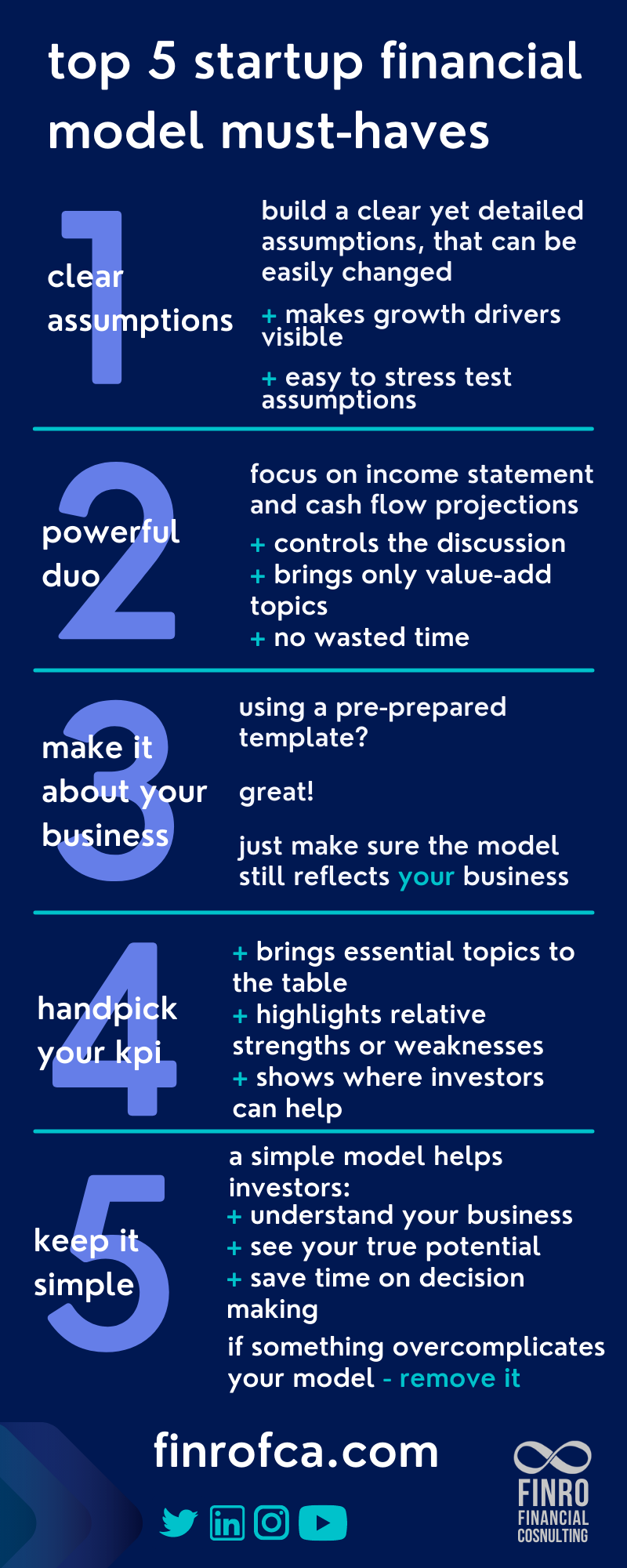

While there are many financial modeling tactics, there are 5 key elements that could help every startup showcase its business and help investors understand its potential.

But before that, let's look at the three general financial model types that I usually receive from startups when I perform due diligence on behalf of an investor.

The three types below are not categorized by the model's complexity, instead of their general quality.

How do I measure a financial model's quality?

There are a few characteristics that make a startup financial model good:

Simple and easy to follow: a financial model should not include dozens of tabs and drill down to the cent of every expense or revenue item. Instead, it should focus on the things that matter the most to the business. If it's an early-stage startup, it should focus on the top-line revenues projection and competitor analysis. A late-stage should probably focus on revenue growth and profitability.

Describes the business model specifically: some financial models highlight a different model than they will actually adopt since the founder re-used someone else's model. In other cases, a startup's business model in one niche is forced on another niche, just because this is the template the founder had. Using a pre-prepared model is not bad, but just make sure it reflects your business and not another company the model was built for.

Easy to update and play with the assumptions: this simple element could help you stress test different scenarios in seconds. It could also help investors understand how your model works.

Focuses the discussion and adds-value: the primary goal of financial forecasting is to share the founders' estimates and expectations for the business' growth and potential. Showing too much information (or too little) can harm this goal. Don't add information to the model just because you think it's needed. For example, in most cases, an early-stage SaaS startup's balance sheet doesn't add value to investors, and a cash flow or income statement could be enough. Try to focus the discussions and avoid items that could hijack it to other directions.

As I mentioned above, these are the three types of financial models that I usually receive from startups when doing due diligence on behalf of a potential investor:

Type 1: Poor

These models use a one-size-fits-all, pre-prepared financial model template that is not showcasing the business's unique business drivers or specific niche.

By their nature, this template tries to accommodate as many industries and niches as possible, and lose their edge in the process.

Not all businesses are the same, even in the same industry and even in the same niche.

So, suppose a financial model shows elements that might not be relevant for the business. In that case, it not only misses the whole point of the financial model and could really hurt the chances that an investor will understand the true potential of your business.

These models require many adjustments to make them useable and ready to analyze and drive conclusions.

Type 2: Okay

In this category, financial models were built for a business in the same segment or niche as your business. These models showcase a similar business model as your company but lack a few elements to make them great.

An okay model might use the right jargon but might emphasize different elements than the company highlights and uses other terms as the pitch deck and business plan.

Calculations and the general flow of these models might be okay and close to what investors are looking for but still require adjustments. However, fewer adjustments are needed to make them useable than type 1 above.

Type 3: Top Notch

Financial models in this category have the best mix of accuracy, business fit, and relevancy.

These are custom-made models built to describe this company's specific business model and do that accurately. In this group, financial models capture the costs and revenue growth correctly, provide additional insights through detailed and adjustable assumptions, and showcase relevant KPI metrics that add value.

Naturally, you want your tech startup financial model to fall into the Type 3 category. Including the five must-haves will get you started in the journey to up-level your financial model from okay to excellent.

Your startup financial model doesn't have to be mediocre.

Even if you don't have the budget to hire a consultant, you can elevate your startup financial model from okay to excellent by implementing the 5 simple elements outlined in the infographic below or in this video.

Finro Financial Consulting: Top 5 Must-Haves For Every Startup Financial Model