Why Tech Startups Need a Financial Model?

By Lior Ronen | Founder, Finro Financial Consulting

Starting a tech startup is no small feat. There's a lot to manage between developing innovative products and navigating competitive markets.

One crucial element that often gets overlooked is financial planning. Without a solid financial model, a tech startup can quickly lose direction.

A financial model isn't just a collection of numbers in a spreadsheet. It's a tool that helps you understand where your business is headed and how to get there. A financial model is essential for seeking funding, planning your growth, or managing day-to-day operations.

This article will explain why tech startups need a financial model when to build one, and what key components to include. By the end, you'll clearly understand how a well-constructed financial model can set your startup on the path to success.

A solid financial model is crucial for tech startups to forecast, budget, attract investors, guide decisions, and manage risks. It should be built early, regularly updated, and include revenue streams, expenses, cash flow, profit and loss statements, balance sheets, and key metrics like burn rate and customer acquisition cost. Specialized consultants like Finro provide the expertise needed to create precise, investor-aligned models, positioning startups for sustainable growth and long-term success.

Understanding the Importance of a Financial Model

A startup financial model is a structured representation of a company’s financial performance and future projections. It includes estimates of revenues, expenses, cash flow, and other key financial metrics. For tech startups, having a solid financial model is vital for several reasons.

First, it plays a crucial role in forecasting and budgeting. A financial model helps predict future revenues, expenses, and cash flow, providing a clear picture of the company’s financial health. This allows startups to set realistic goals, allocate resources effectively, and prepare for future growth.

Second, a financial model is essential for attracting investors. Potential investors need to see a transparent and credible financial plan demonstrating the startup's profitability and growth potential. A well-crafted financial model provides the clarity and confidence investors look for, making it easier to secure funding.

Third, it aids in decision-making. By analyzing financial data and projections, startups can make informed strategic decisions. Whether scaling operations, entering new markets, or launching new products, a financial model offers valuable insights that guide these critical choices.

Lastly, a financial model is key for risk management. It helps identify potential financial risks and provides strategies to mitigate them. This proactive approach allows startups to navigate challenges and uncertainties more effectively, ensuring long-term sustainability.

In summary, a financial model is more than just a financial tool; it’s a comprehensive guide that supports forecasting, investor relations, strategic decision-making, and risk management for tech startups.

When to Build a Financial Model?

As we discussed earlier, a financial model is essential for tech startups. However, understanding when to build and update this model is just as important as knowing its benefits.

Early-Stage Development

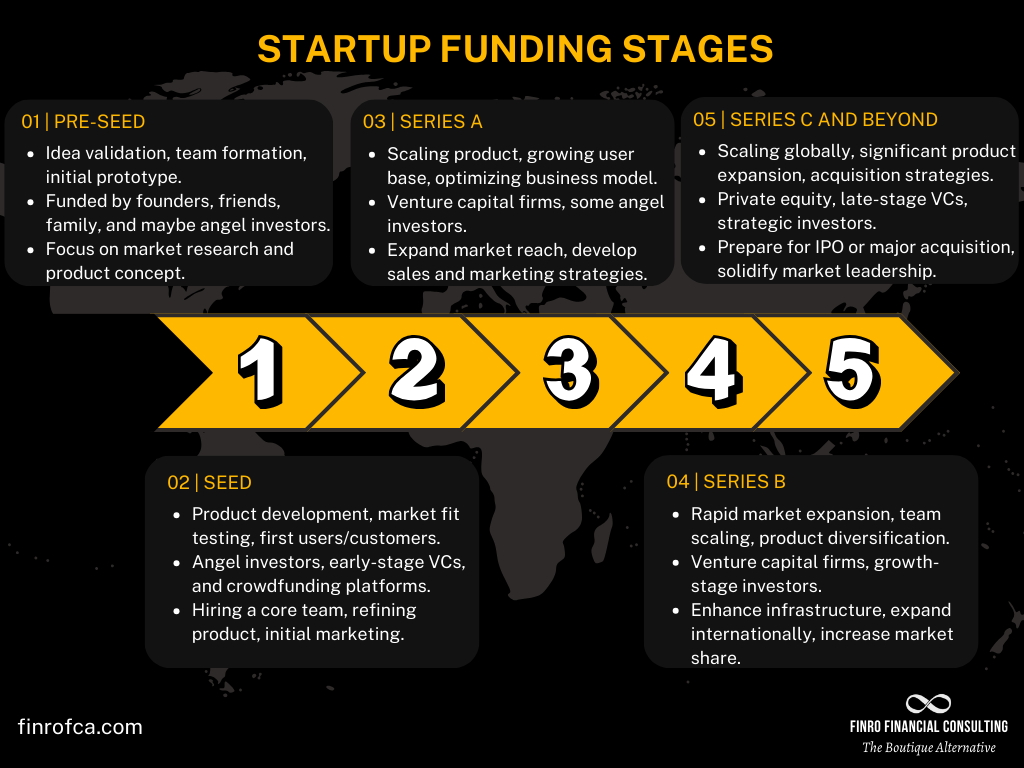

An initial financial model is essential during the pre-seed and seed stages. At this point, the model helps you pitch your business to potential investors. It demonstrates that you clearly understand your financial needs and the potential return on the investment.

Even if your revenue streams and costs are mostly projections, having a well-thought-out financial model can make your startup more attractive to investors.

As you move into the product development phase, your financial model should evolve along with your product. Adjust the model to reflect changes in development costs, projected sales, and market conditions. This ensures that your financial planning remains aligned with the actual progress of your startup.

Growth Stage

When your startup begins scaling operations, the financial model becomes a tool for managing growth and expansion. At this stage, it helps plan for increased production, hire new employees, and enter new markets. The financial model should provide detailed forecasts that guide your decisions and ensure that growth is sustainable and well-managed.

As you reach Series A and beyond, refining your financial model becomes crucial for subsequent funding rounds. Investors at this level will scrutinize your financial projections more closely, so your model needs to be robust and precise. It should clearly show how additional funding will drive further growth and achieve profitability.

Ongoing Maintenance

A financial model is not a one-time task; it requires regular updates. Continuously updating your model to reflect actual performance and market changes is vital. This ongoing maintenance helps you stay on top of your financial health, adapt to new challenges, and seize emerging opportunities. Regular updates ensure that your financial model remains a reliable guide for making strategic decisions.

In summary, building and maintaining a financial model is an ongoing process that evolves with your tech startup. Starting early, refining it through different stages of growth, and keeping it updated are key to leveraging the full benefits of a financial model.

Key Components of a Tech Startup Financial Model

Building on the importance and timing of creating a financial model for your tech startup, it's crucial to understand the key components that make up a comprehensive financial model.

Each component plays a vital role in providing a clear financial picture and guiding your strategic decisions.

Revenue Model

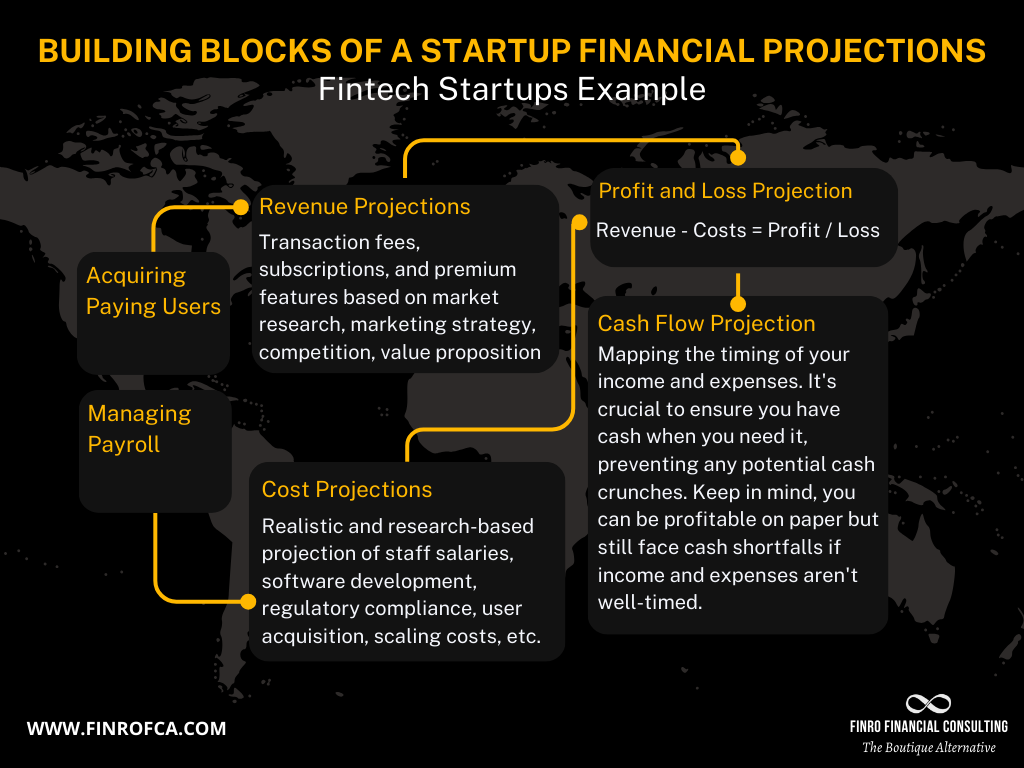

The revenue model is the foundation of your financial projections, outlining how your startup plans to generate income.

Revenue Streams: Identify and categorize different sources of income. For tech startups, this could include subscription fees, licensing, advertising, and product sales. Understanding and diversifying revenue streams can help stabilize cash flow and reduce risk.

Sales Forecast: Projecting sales volume and growth rates is essential. This involves estimating how much of your product or service you expect to sell over a given period, considering factors like market demand, competition, and marketing efforts.

Expense Model

Your expense model should detail all costs associated with running your startup. This helps you budget and ensure that you have enough resources to cover your expenses.

Fixed Costs: These are overhead expenses that do not vary with production or sales volume, such as salaries, rent, and utilities. Accurately estimating fixed costs is crucial for financial planning.

Variable Costs: These costs change in proportion to your production or sales volume. For tech startups, this might include manufacturing, distribution, and customer support costs.

Research and Development: R&D expenses are significant for tech startups, as ongoing innovation is often required. This includes costs related to developing new products, improving existing ones, and maintaining technological competitiveness.

Cash Flow Projections

Cash flow projections help you understand how money moves in and out of your business, ensuring you have enough liquidity to sustain operations.

Cash Inflows: Include all expected cash receipts from operations, investments, and financing. This helps you anticipate the funds available to run your business.

Cash Outflows: Detail all expected cash payments for operations, investments, and financing. Understanding outflows is crucial for managing expenditures and avoiding cash shortages.

Net Cash Flow: Calculate the difference between cash inflows and outflows. Positive net cash flow indicates that your business is generating more cash than it is spending, which is essential for growth and stability.

Profit and Loss Statement (P&L)

The P&L statement provides a summary of your revenues, costs, and expenses over a specific period, highlighting your startup’s profitability.

Revenue: Total income generated from your revenue streams.

Cost of Goods Sold (COGS): Direct costs attributable to the production of goods sold, such as raw materials and labor.

Gross Margin: Revenue minus COGS = gross margin. This metric shows the profitability of your core business activities.

Operating Expenses: Costs required to run your business that are not directly tied to production, including administrative, marketing, and R&D expenses.

Net Profit: The bottom line profitability, calculated as revenue minus all expenses. This figure indicates the overall financial health of your startup.

Balance Sheet

The balance sheet provides a snapshot of your startup’s financial position at a specific point in time, detailing assets, liabilities, and equity.

Assets: Resources owned by your startup, such as cash, equipment, and intellectual property. Assets are critical for operations and potential leverage for future financing.

Liabilities: Obligations owed to others, including loans and accounts payable. Managing liabilities is crucial to ensure they do not exceed assets.

Equity: The owner’s interest in the company, representing the residual value after liabilities are subtracted from assets.

Key Metrics and KPIs

Key performance indicators (KPIs) provide insights into your startup’s performance and help in making data-driven decisions.

Burn Rate: The rate at which your startup is spending its capital. Keeping an eye on the burn rate is crucial for maintaining sufficient runway.

Customer Acquisition Cost (CAC): The cost to acquire a new customer. This metric helps assess the efficiency of your marketing and sales efforts.

Lifetime Value (LTV): Total revenue expected from a customer over their lifetime. Comparing LTV with CAC can help determine the profitability of acquiring new customers.

Runway: The time remaining before your startup runs out of cash. Knowing your runway helps in planning funding rounds and managing expenditures.

In summary, a tech startup financial model should include detailed revenue and expense models, cash flow projections, a profit and loss statement, a balance sheet, and key metrics and KPIs. Each component provides critical insights that aid in decision-making, planning, and securing investments.

Why You Should Choose Finro As Your Startup Financial Model Consultant?

For startups, the options for creating a financial model include doing it yourself (DIY), hiring a generalist, or partnering with specialists. Given the specific challenges tech startups face, partnering with specialists is often the best choice.

Financial modeling for tech startups involves piecing together a complex puzzle that reflects unique business factors such as rapid technological changes, varying monetization strategies, and intense competition.

This is where Finro comes in.

We specialize in financial modeling for the tech industry, focusing on its specific challenges and opportunities. Our expertise ensures that your financial model is accurate and strategically aligned with your business goals and investor expectations.

A well-crafted financial model serves two vital purposes: guiding your internal strategy and impressing potential investors. Internally, it helps you set realistic targets, allocate resources efficiently, and identify potential financial risks.

Externally, it communicates your startup’s potential and strategy to investors, increasing their confidence in your business. Finro ensures that your financial model is precise and aligned with what investors want to see, which is crucial for securing funding and forming valuable partnerships.

Choosing Finro as your financial model consultant provides specialized knowledge of the tech landscape, a proven track record of success in the tech sector, and the ability to position your startup for sustainable growth and long-term success.

By partnering with Finro, you gain a trusted advisor who understands the intricacies of the tech industry and can help build a financial model that sets the foundation for your startup’s future growth and success.

Conclusion

Having a robust financial model is not just beneficial—it's essential. From our discussion, it’s clear that a financial model is a critical tool for forecasting, budgeting, decision-making, and risk management.

Building this model early and updating it regularly ensures that your startup remains agile and prepared for growth.

We also explored a tech startup's financial model's key components, including revenue streams, expense projections, cash flow, P&L statements, balance sheets, and essential KPIs. Each component provides a comprehensive view of your financial health and guides strategic decisions.

Choosing the right approach to building your financial model can significantly impact your startup's success. While DIY or hiring a generalist might seem cost-effective, partnering with specialists like Finro can provide the expertise and precision needed to navigate the tech industry's unique challenges.

Finro's specialized knowledge, proven track record, and alignment with investor expectations make them the ideal partner for any tech startup aiming to build a solid financial foundation.

A well-crafted financial model is indispensable for guiding your tech startup through internal planning and external engagements. By leveraging the expertise of a specialized partner like Finro, you can ensure that your financial model meets your current needs and positions your startup for long-term success and growth.

Investing in a robust financial model today can pave the way for a prosperous future in the ever-evolving tech landscape.

Key Takeaways

A solid financial model is essential for tech startups.

Build and update your financial model regularly.

Key components include revenue, expenses, cash flow, P&L, balance sheet, and KPIs.

DIY or generalist models are less effective.

Partnering with specialists like Finro ensures accuracy, investor alignment, and strategic growth.