Building a Startup Financial Model: Why Simplicity Wins

By Lior Ronen | Founder, Finro Financial Consulting

Creating a financial model for a startup often feels like a daunting task. With so many moving parts and variables, it’s easy to get overwhelmed. But here’s the truth: a financial model doesn't need to be complicated to be effective.

Instead of focusing on intricate details and complex calculations, the real power of a financial model lies in its ability to clearly communicate your business idea.

Investors aren't looking for endless spreadsheets—they want to understand how your company generates revenue, spends money, and plans to grow. A model that’s cluttered with unnecessary complexity only makes that harder to grasp.

In this article, we’ll explore why simplicity is not only essential but also more effective when presenting your financial forecast. Whether you’re seeking investment or refining your internal strategy, a clear and straightforward model is the key to helping others understand your business.

Creating a financial model for a startup requires a focus on clarity and simplicity, avoiding unnecessary complexity that can confuse investors and obscure the core aspects of the business. By emphasizing key metrics such as customer acquisition, revenue growth, expenses, and cash flow, founders can build a model that effectively communicates their business’s potential.

Simplified models are not only easier to explain and adapt but also help build trust with investors through transparency. Ultimately, a clear and focused financial model leads to better conversations, more confident projections, and a stronger overall pitch.

Starting Point: Clarity Over Complexity

When building a startup financial model, many founders believe that adding layers of detail will make the forecast more accurate or impressive. In reality, it’s the opposite—over-complication can obscure your business’s core strengths and confuse your audience.

The purpose of a financial model is to present your business’s story in a way that’s easy to understand. This means focusing on clarity, not complexity. At its heart, a financial model should give a clear picture of how your business generates revenue, how it spends money, and how it plans to grow.

By prioritizing clarity, you're helping potential investors or buyers quickly grasp the fundamentals of your business without getting bogged down in unnecessary details. The last thing you want is for your audience to spend more time deciphering your model than understanding the business itself.

Before adding a new calculation or variable to your model, ask yourself: does this element make the overall picture clearer? If not, it’s likely an unnecessary detail that only distracts from the main message. Keep your focus on the numbers and assumptions that truly matter to your business’s growth and success.

The Pitfalls of Over-Complexity

While it’s tempting to think that a more detailed financial model will impress investors, adding unnecessary complexity can work against you. A model that’s packed with too many variables and intricate calculations often misses the bigger picture—and that’s when problems arise.

Complexity Confuses, Not Impresses

Complex financial models can derail your pitch. Instead of focusing on your business’s potential, you might find yourself explaining every calculation and assumption.

This diverts attention away from what matters most: how your company makes money and how it will grow. When investors have to spend too much time decoding the model, they lose sight of the business itself.

A good financial model should guide the conversation, not dominate it. Simplicity helps keep the focus where it belongs—on your vision, strategy, and potential for growth. If your model is hard to follow, even the best business ideas can get lost in translation.

Difficult to Update and Maintain

Another issue with complex models is that they are hard to maintain. As your business evolves, you’ll need to tweak your forecasts. If your model is overloaded with complex relationships and unnecessary detail, making those updates becomes a headache.

You might end up adding more layers of complexity to an already bloated model, creating a chain reaction that makes it even harder to manage.

Moreover, complexity increases the likelihood of errors. A single mistake in a complex model can throw off the entire forecast, leading to confusion and possibly even costly misunderstandings when discussing projections with investors.

By keeping your model simple, you will make it easier to present and update and refine as your business grows.

Get your expert support now!

Case Study: Over-Complicated SaaS Models

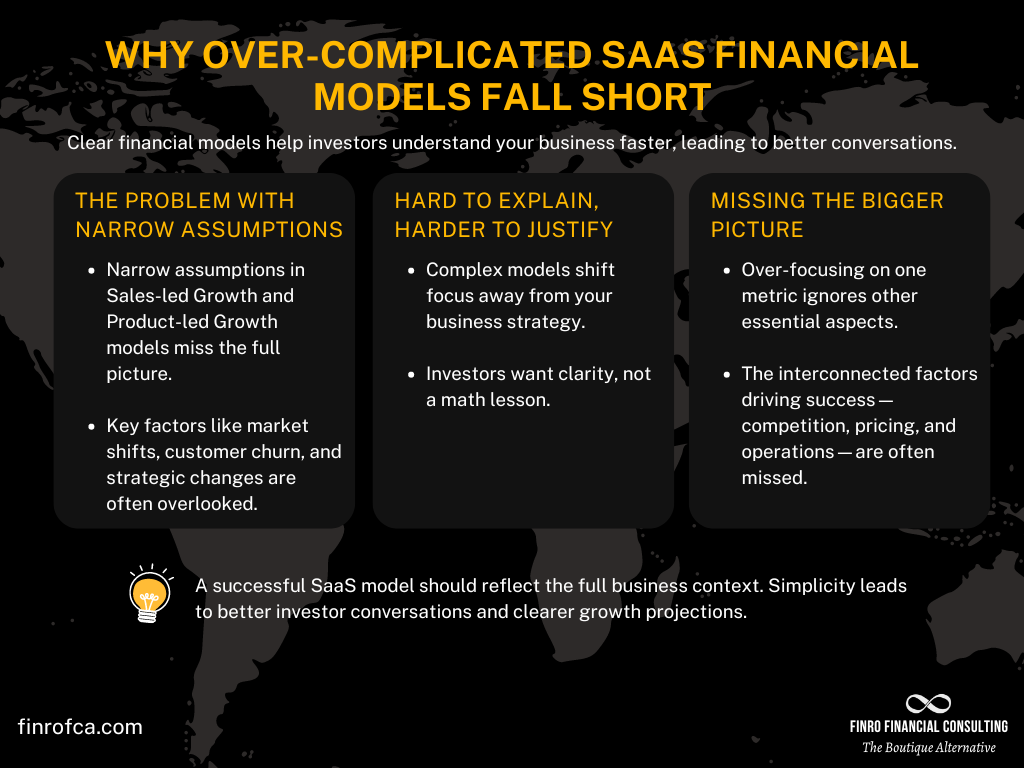

In the SaaS world, it's common to see startups over-complicating their financial models in an attempt to project growth.

Two popular approaches are Sales Led Growth and Product Led Growth, which rely on a set of assumptions to forecast revenue. While these models can look impressive on paper, they often end up doing more harm than good.

Narrow Assumptions, Misleading Results

These growth models tend to focus on a very narrow set of variables—like customer acquisition rates or product usage metrics—while ignoring other essential factors that influence a business’s performance.

As a result, the financial forecast becomes disconnected from the full reality of the company.

For instance, a Sales Led Growth model may assume a linear increase in revenue based on sales performance, without accounting for market fluctuations, customer churn, or changes in sales strategy.

Similarly, Product Led Growth models may overemphasize user acquisition without considering how those users convert into long-term customers. In both cases, the model offers an incomplete view of the business, making it harder for investors to get a true sense of the company’s potential.

Hard to Explain, Harder to Justify

Beyond these assumptions, the complexity of these models can make them counterproductive when presenting to investors.

Founders often find themselves in a position where they have to spend valuable time explaining how the model works instead of discussing the actual business strategy. When the conversation shifts from the fundamentals of the business to the inner workings of the forecast, it becomes clear that something is off.

A complicated model is a distraction. Investors want to understand your vision for growth, not navigate through a maze of projections. When a model becomes too hard to explain, it loses its value and weakens your pitch.

The Bigger Picture Is What Matters

Ultimately, a financial model should reflect the broader business context, not just a slice of it. SaaS businesses—and startups in general—are complex, with many interconnected factors driving success.

When a model narrows its focus too much, it can overlook critical aspects like competition, pricing strategies, and operational challenges. This kind of tunnel vision can prevent investors from seeing the full potential of your business.

Simplification: Focus on What Matters

The key to building a successful startup financial model is to focus on the elements that truly drive your business forward. Overcomplicating your model with endless calculations and variables will only dilute the message you want to convey to investors or buyers. Instead, concentrate on the core aspects of your business that matter most.

Customer Acquisition: The Heart of Growth

Start by thinking about how you’ll acquire customers. Whether you plan to invest in paid advertising, leverage organic traffic, or use other growth channels, these assumptions should be front and center in your financial model. By focusing on these acquisition methods, you're showing investors how you plan to generate revenue and scale the business.

For example, you could highlight metrics such as:

Paid Advertising: How much do you plan to spend? What’s your expected customer acquisition cost (CAC)?

Organic Growth: What growth rates do you anticipate from content marketing or SEO strategies?

Conversion Rates: How many leads do you expect to convert into paying customers?

Churn Rates: How quickly do you expect to lose customers, and what strategies are in place to retain them?

Core Business Metrics

Simplicity also means focusing on the business metrics that drive long-term success. Avoid getting bogged down in minor details that don’t impact your overall performance. Instead, ensure your model clearly demonstrates:

Revenue Projections: How will your business grow revenue over time, and what assumptions are behind those projections?

Expenses: What are your key operating expenses, and how do they scale as your company grows?

Cash Flow: Investors want to see how well you manage cash, particularly in the early stages of growth. Make sure to include cash flow forecasts that reflect your ability to sustain operations.

A Model That Reflects Your Strategy

A well-crafted financial model isn't just a set of numbers—it's a reflection of your business strategy. When you simplify your model to focus on customer acquisition, revenue growth, and core expenses, you’re not only making the model easier to follow, but you're also aligning it with your broader business goals.

Investors are less interested in a forecast that covers every possible scenario. What they want is a clear understanding of how your business plans to succeed. By streamlining your model and focusing on what matters, you create a more compelling narrative that resonates with your audience.

Why Simplicity Works Better

Simplicity is not just about making your financial model easier to read—it’s about creating a model that drives better conversations with investors and makes your business more adaptable. There are several key reasons why a simplified financial model works better, especially for startups.

1. Clear Communication

A clear, straightforward model helps investors understand your business quickly. When they can easily grasp the basics—like how you acquire customers, what your key expenses are, and how you plan to grow—they can spend more time discussing your vision and asking insightful questions. This creates a more productive dialogue, allowing you to demonstrate your expertise and align your goals with their interests.

On the other hand, a complex model that requires constant explanation only slows down the conversation. Instead of focusing on growth opportunities, you may find yourself trying to justify every calculation. A simple model avoids these distractions and keeps the conversation focused where it belongs—on the future of your business.

2. Flexibility for Future Adjustments

Your business will evolve, and so should your financial model. A simplified model is much easier to update and adjust as new information becomes available or your business strategy shifts. Whether it’s changes in customer acquisition strategies, new product lines, or shifts in market conditions, a simple model allows you to incorporate these updates seamlessly.

Overly complex models, with multiple layers of interconnected variables, are harder to adjust without causing disruptions. Each new change may require recalibrating numerous sections of the model, leading to frustration and delays. A simpler model, with fewer moving parts, gives you the flexibility to adapt without losing sight of your business fundamentals.

3. Transparency for Investors

Investors value transparency. They want to know exactly how you arrived at your projections, what assumptions you’re making, and how realistic those assumptions are. A simple model gives them a clear view of your business, without forcing them to sift through unnecessary complexity.

When your model is transparent, it builds trust. Investors are more likely to believe in your forecasts if they can see the logic behind them. This not only increases their confidence in your business but also enhances your credibility as a founder.

4. Fewer Mistakes

One of the most significant risks with complex models is the increased likelihood of errors. More variables and assumptions mean more opportunities for something to go wrong—whether it’s a miscalculation, a formula error, or an incorrect input.

By keeping your model simple, you reduce the chances of mistakes slipping through. This helps you maintain accuracy in your forecasts, which is critical when presenting to investors or making important business decisions. Fewer mistakes also mean less time spent troubleshooting and more time focusing on growth.

| Key Benefit | Description |

|---|---|

| Clear Communication | A simplified model helps investors quickly grasp key aspects of your business, leading to better discussions. Avoids time spent explaining complex details. |

| Flexibility for Adjustments | A simple model is easier to update as your business evolves. Changes can be integrated without disrupting the overall structure. |

| Transparency for Investors | Investors appreciate a clear and transparent model, which builds trust and credibility. Easy-to-follow logic boosts confidence in your forecasts. |

| Fewer Mistakes | Simpler models reduce the chances of errors, ensuring accuracy in your projections and saving time on troubleshooting. |

Conclusion

The goal of a startup financial model is not to impress investors with complexity but to clearly communicate your business’s potential. A well-constructed model provides a roadmap for how your company plans to grow, what key drivers will fuel that growth, and how you intend to manage resources along the way.

By focusing on clarity and simplicity, you make it easier for investors to understand your business. This leads to more productive conversations, greater confidence in your projections, and a stronger overall pitch.

Remember, your financial model should be a tool that guides discussions and highlights the key metrics that matter most—not a maze of calculations that distracts from the big picture. Whether you're presenting your model to investors, refining it internally, or using it to guide strategic decisions, simplicity will always work in your favor.

Keep your focus on the core elements—customer acquisition, revenue, expenses, and cash flow—and build a model that reflects the reality of your business. This approach will not only make your financial forecasting easier but also ensure that your message is clear, compelling, and impactful.

Key Takeaways

Start Simple: Begin your financial model with clarity, focusing on how to communicate your business effectively.

Avoid Complexity: Over-complicated models confuse investors and shift focus away from your core business strategy.

Focus on Key Metrics: Emphasize customer acquisition, revenue, expenses, and cash flow for a model that reflects real business performance.

Maintain Flexibility: Simpler models are easier to update, adapt, and align with evolving business strategies.

Build Trust Through Transparency: A clear, transparent model builds investor confidence, making your projections more believable and your pitch more credible.