API-as-a-Service Startup Valuation: How to Value API-Driven Companies

By Lior Ronen | Founder, Finro Financial Consulting

API-as-a-Service startups are transforming the way software and applications interact, providing the backbone for modern digital ecosystems.

These companies enable businesses to quickly integrate essential features like communication, payments, and data management through ready-made APIs. With this shift, API-as-a-Service startups have gained tremendous traction, attracting both customers and investors alike.

Valuing these startups requires a deep understanding of their unique revenue models, growth potential, and the broader market they serve. Whether through usage-based pricing or subscription models, API businesses have unlocked scalable solutions for industries ranging from financial services to AI.

In this article, we'll explore how to approach valuation for API-as-a-Service startups, focusing on essential pricing models, the top niches in the market, and proven valuation methods such as revenue multiples, EBITDA multiples, and the discounted cash flow (DCF) method.

API-as-a-Service startups are valued based on their scalability, recurring revenue models, and growth potential, but they face challenges such as revenue volatility, customer churn, and intense competition. Key metrics like ARR, MRR, CAC, CLV, and gross margins are essential for evaluating their financial health, while valuation methods such as revenue multiples, EBITDA multiples, and discounted cash flow (DCF) are applied depending on the startup's stage. These businesses operate across various niches, including communications, payments, and AI, making their pricing models—usage-based and subscription-based—vital considerations for investors seeking long-term profitability.

- What is an API?

- What is API-as-a-Service?

- Key Pricing Models in API-as-a-Service

- Overview of the Top Niches in the API-as-a-Service Market

- Valuation Methods for API-as-a-Service Startups

- Challenges in Valuing API-as-a-Service Startups

- Key Metrics Investors Look For in API-as-a-Service Startups

- Conclusion

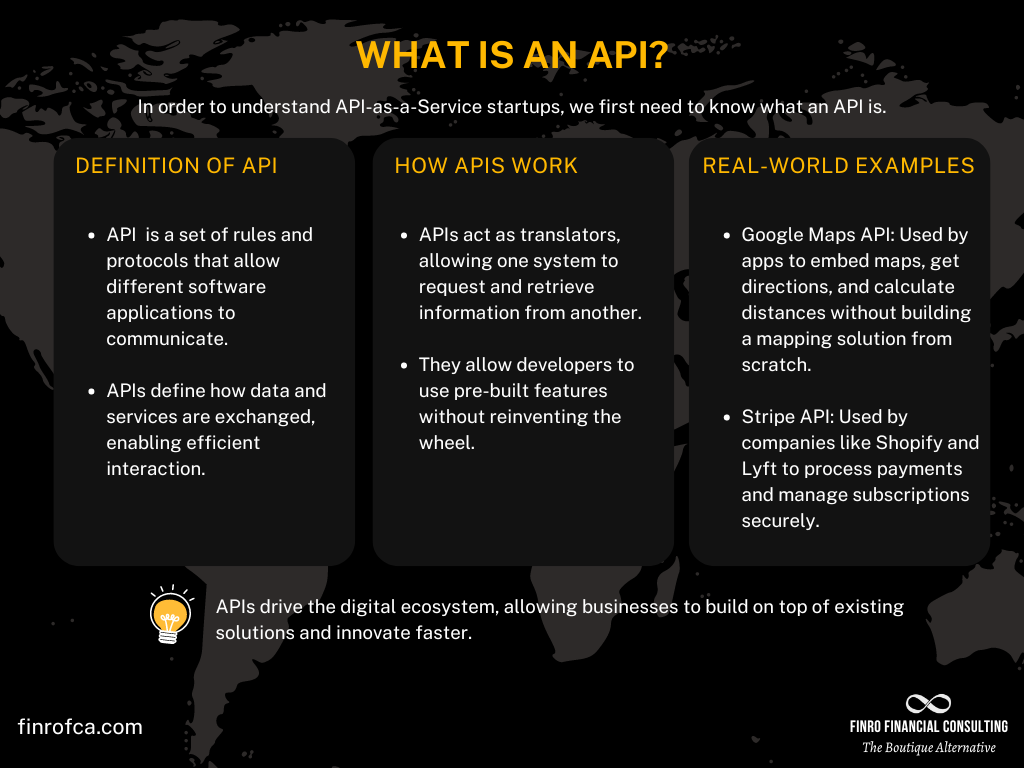

What is an API?

In order to discuss API-as-a-Service startups, we need to start by understanding what an API is.

An API (Application Programming Interface) is a set of rules and protocols that allow one software program to interact with another. APIs define how requests for data and services are made between systems, enabling different software applications to communicate efficiently and seamlessly.

Think of an API as a translator between two systems, allowing them to exchange information in a structured way without knowing the internal workings of each other.

APIs are everywhere in modern technology. They power everything from logging into websites using third-party credentials, like Google or Facebook, to retrieving live data from stock exchanges and integrating payment systems into eCommerce platforms. For example, when you order a ride through an app, the app uses APIs to connect to the GPS on your phone, the payment processor, and the driver’s interface, all in real-time. Each of these services works independently, but through APIs, they communicate smoothly to deliver the complete experience.

Real-World API Usage Examples

Google Maps API: Many apps, from food delivery to fitness tracking, use the Google Maps API to display location data. Developers can embed maps, get directions, calculate distances, and more without having to build a mapping solution from scratch. This integration allows businesses to offer location-based services to their users effortlessly.

Stripe API: Stripe offers a powerful API for payment processing that’s used by companies like Shopify, Lyft, and Postmates. It allows businesses to accept payments online, manage subscriptions, and even handle complex international transactions with just a few lines of code, making payments easier for both developers and customers.

APIs aren’t limited to web applications or mobile apps—they play a central role in cloud computing, IoT (Internet of Things) devices, and even enterprise software. Whether it’s a chatbot fetching data from an internal database or a healthcare app retrieving patient records, APIs allow software to interact more efficiently and extend its functionality without rebuilding core components from scratch.

For businesses, APIs have become essential in achieving scalability, flexibility, and innovation. By exposing key services and data through APIs, companies enable developers to integrate those services into new applications quickly, fostering an ecosystem of interconnected products. This reusability and modularity make APIs invaluable in today's digital landscape, where interoperability and rapid deployment are critical for staying competitive.

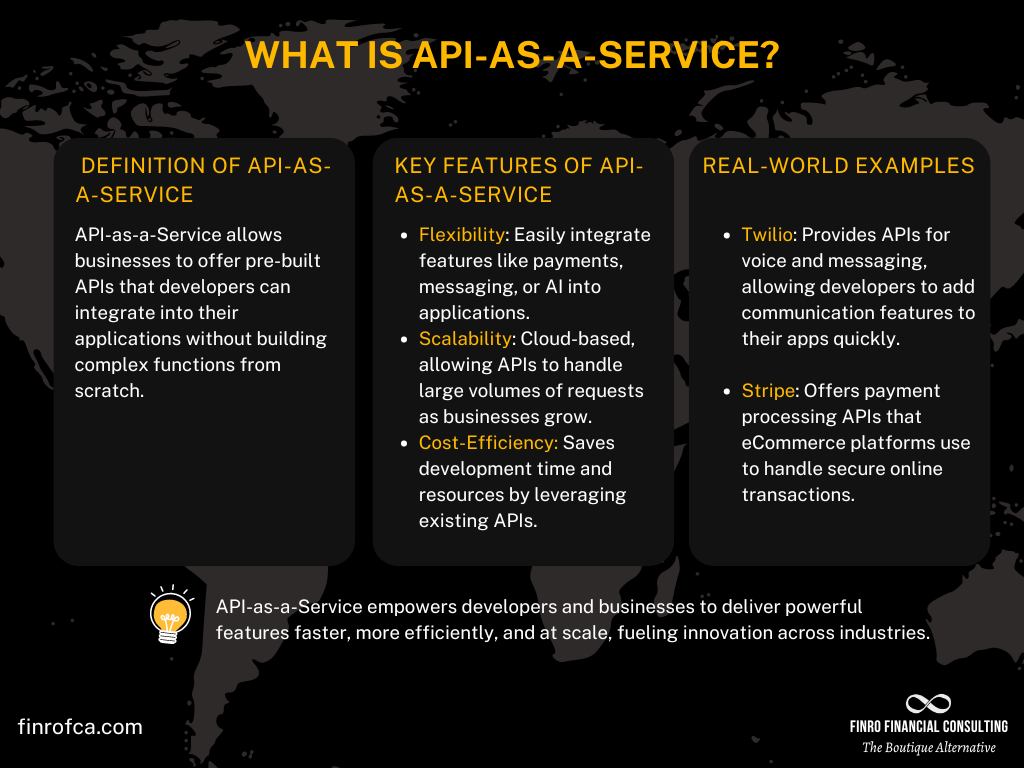

What is API-as-a-Service?

API-as-a-Service refers to a business model where companies offer pre-built APIs as a product, allowing other businesses and developers to integrate these APIs into their applications easily.

Rather than building complex functionality from scratch, API-as-a-Service allows developers to leverage ready-made solutions to extend the capabilities of their own software. This model enables businesses to save time, reduce development costs, and focus on their core offerings while still providing advanced features to their users.

API-as-a-Service operates much like traditional Software-as-a-Service (SaaS), but instead of providing full software solutions, it delivers specific functions that can be accessed via APIs.

These functions can range from payment processing and communication tools to AI-driven services and data management. The "as-a-service" nature of this model means that APIs are hosted in the cloud, maintained by the provider, and accessible through subscriptions or usage-based pricing.

For example, companies like Twilio offer APIs for integrating voice and messaging features into apps, while Stripe provides payment processing APIs that can be embedded into eCommerce platforms.

These services remove the need for developers to build these systems from the ground up, allowing them to focus on enhancing their applications without worrying about infrastructure or maintenance.

The flexibility, scalability, and modularity of API-as-a-Service are some of the reasons it has become a cornerstone of modern software development. As more businesses move towards microservices and cloud-native architectures, the demand for APIs that deliver specific functions continues to grow.

Key Pricing Models in API-as-a-Service

API-as-a-Service companies typically operate using two primary pricing models: usage-based pricing and subscription-based pricing. These models offer flexibility to businesses, allowing them to choose pricing structures that align with their product needs, scale, and usage patterns.

Usage-Based Pricing

Usage-based pricing, often referred to as "pay-as-you-go," charges customers based on the volume of API calls or the amount of data they consume. This model allows businesses to scale their costs according to how much they actually use the API. It’s highly flexible and ideal for companies that experience fluctuating demand or require elastic scaling without paying for unused services.

For example, a business integrating a payment gateway like Stripe will pay based on the number of transactions processed through the API. Similarly, a startup using the Google Maps API to display maps or calculate routes will be charged according to the number of requests made to the service.

Advantages:

Scalability: Costs adjust dynamically based on usage, making it suitable for businesses with unpredictable or seasonal demand.

Cost Control: Companies only pay for what they use, minimizing waste and enabling tighter budget control.

Challenges:

Cost Unpredictability: If usage spikes unexpectedly, costs may exceed projections, which can be a concern for startups with limited budgets.

Subscription-Based Pricing

Subscription-based pricing offers customers a fixed monthly or yearly fee for a defined level of access to an API. This model often comes in tiers, with different levels of service based on the customer’s needs. Each tier includes a set number of API requests, and companies can move to higher tiers if they exceed their usage limits.

For instance, Twilio offers various subscription plans for its communication APIs, allowing businesses to pay a monthly fee based on their messaging volume and features required. Similarly, Mailchimp’s API offers different subscription plans based on the number of emails a business wants to send each month.

Advantages:

Predictable Costs: Startups benefit from consistent, predictable monthly or annual fees, making financial planning easier.

Flexible Plans: Subscription tiers allow businesses to scale up or down based on their growth and needs.

Challenges:

Overpayment Risk: If a business does not fully utilize its plan, it could end up paying more for services it doesn’t use.

Hybrid Models

Some API-as-a-Service providers combine usage-based and subscription-based pricing, offering a hybrid model. In this model, customers pay a base subscription fee for a certain number of API calls, with additional fees for exceeding the included usage. This model provides both predictability and flexibility, allowing businesses to pay a lower fixed cost but scale when needed.

For example, AWS (Amazon Web Services) uses a hybrid pricing model for its APIs, where customers pay for a base level of service but are charged extra for exceeding resource usage or API call limits.

Advantages:

Balanced Flexibility: Offers the predictability of subscriptions while retaining the scalability of usage-based pricing.

Customizable: Ideal for companies with varying usage levels, allowing them to scale efficiently without major cost jumps.

Challenges:

Complexity: The hybrid model may introduce complexity in understanding and managing costs, especially for smaller startups.

| Pricing Model | Description | Advantages | Challenges |

|---|---|---|---|

| Usage-Based Pricing | Pay-as-you-go, charged based on the number of API calls or data usage. | Highly scalable, only pay for what is used. | Cost unpredictability, unexpected spikes may lead to higher costs. |

| Subscription-Based Pricing | Fixed monthly or annual fee for a set level of API access. | Predictable costs, flexible tiers for different needs. | Overpayment risk if service is underutilized. |

| Hybrid Model | Combination of a base subscription fee with additional charges for overage usage. | Offers both cost predictability and scalability. | More complex to manage and understand costs. |

Overview of the Top Niches in the API-as-a-Service Market

API-as-a-Service startups cater to a broad range of industries and use cases. To understand the landscape, it's crucial to identify the top niches where API-as-a-Service companies thrive. Each niche delivers specific functionalities and solves unique challenges for developers and businesses. Below is an overview of the top niches, with examples of companies operating within each.

1. Communications

APIs in this niche provide voice, messaging, and video functionalities, enabling businesses to integrate communication features seamlessly into their apps. Whether it’s SMS notifications, video calls, or real-time chat, communication APIs are vital for creating interactive and user-friendly applications.

Examples: Twilio, Zoom, MessageBird

2. Payments

Payments APIs facilitate payment processing, subscription management, and financial transactions for a variety of businesses. These APIs handle everything from secure transactions to recurring billing, enabling eCommerce platforms, marketplaces, and fintech companies to streamline payments.

Examples: Stripe, Paystack, Braintree

3. Email & Messaging

This niche focuses on email services and messaging APIs that allow businesses to manage email communication, handle transactional emails, and integrate user authentication features such as password resets or sign-up confirmations.

Examples: SendGrid, Nylas, Clerk

4. Financial Services

APIs in the financial services niche provide access to financial data, banking services, and fintech functionalities. These APIs are essential for building applications that handle payments, credit scoring, account verification, and more.

Examples: Plaid, ClearBank, Mambu

5. API Development & Management

This niche covers tools and platforms that help developers build, manage, and scale their own APIs. These APIs help businesses integrate microservices, secure their infrastructure, and monitor their API performance, making it easier for developers to focus on application logic.

Examples: Postman, Kong, MuleSoft

6. Search & Data Enrichment

Search and data enrichment APIs allow businesses to embed powerful search functionalities into their apps or enhance existing customer data with additional information. These services improve the user experience by delivering fast, relevant search results or enriching CRM data with missing details.

Examples: Algolia, Clearbit

7. File & Content Management

APIs in this niche enable businesses to manage files, documents, and digital content. Whether it’s storing, sharing, or delivering content, these APIs streamline the process and ensure secure management of digital assets.

Examples: Dropbox, Airtable, Contentful

8. Design & Collaboration

This category covers APIs that facilitate real-time collaboration and design features, helping businesses create, share, and collaborate on projects. Design tools like Figma offer APIs to enable integrations with other applications for seamless workflows.

Examples: Figma, Notion

9. AI & Machine Learning

APIs that deliver AI-driven functionalities, such as natural language processing, machine learning models, and predictive analytics, fall into this niche. These APIs empower businesses to integrate AI solutions without building their own machine learning infrastructure.

Examples: OpenAI, Algomo, Hume AI

10. Infrastructure & Serverless

This niche focuses on APIs that support cloud infrastructure and serverless computing. These APIs provide resources for hosting, scaling, and maintaining applications without the need for developers to manage physical servers.

Examples: New Relic, Supabase, Shippo

| Niche | Description | Examples |

|---|---|---|

| Communications | Voice, messaging, and video features | Twilio, Zoom, MessageBird |

| Payments | Payment processing and financial transactions | Stripe, Paystack, Braintree |

| Email & Messaging | Email communication and user authentication | SendGrid, Nylas, Clerk |

| Financial Services | Financial data and banking services | Plaid, ClearBank, Mambu |

| API Development & Management | Tools for building and managing APIs | Postman, Kong, MuleSoft |

| Search & Data Enrichment | Search functionalities and data enrichment | Algolia, Clearbit |

| File & Content Management | Managing files and digital content | Dropbox, Airtable, Contentful |

| Design & Collaboration | Real-time collaboration and design tools | Figma, Notion |

| AI & Machine Learning | AI-driven functionalities | OpenAI, Algomo, Hume AI |

| Infrastructure & Serverless | Cloud infrastructure and serverless computing | New Relic, Supabase, Shippo |

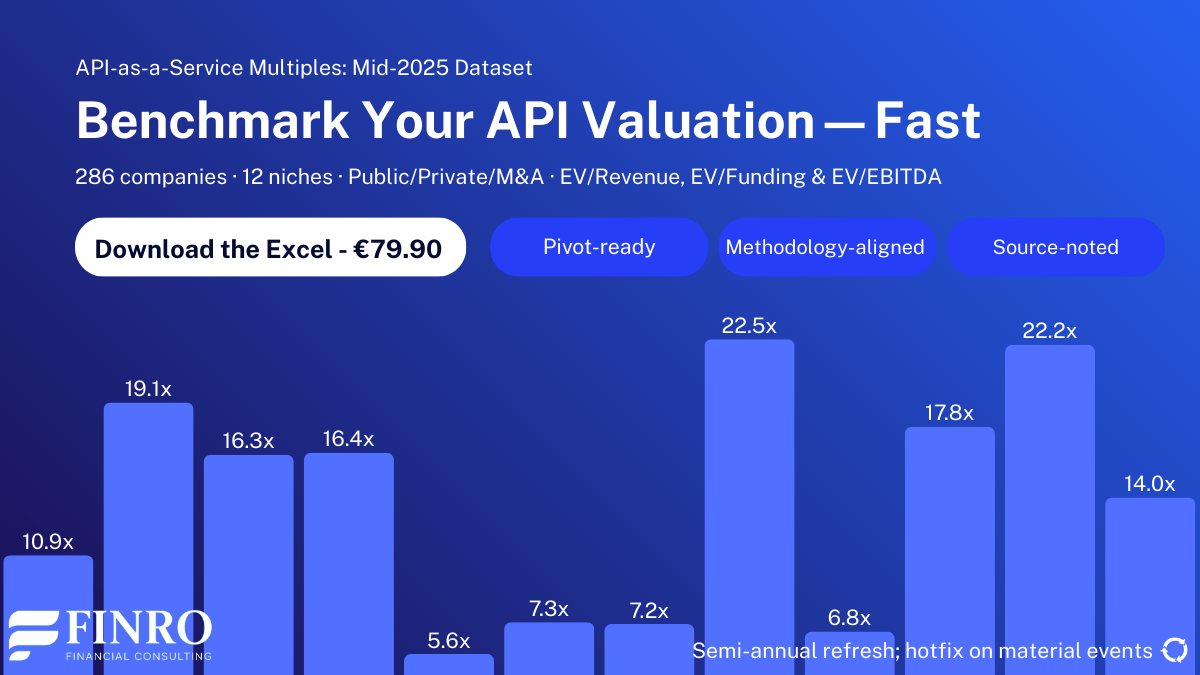

Valuation Methods for API-as-a-Service Startups

Valuing an API-as-a-Service startup can be challenging, as it involves analyzing both the financial metrics and the growth potential of the company.

Three common valuation methods are typically used: revenue multiple, EBITDA multiple, and Discounted Cash Flow (DCF). Each method has its strengths and is applied based on the startup's stage, profitability, and market potential.

Revenue Multiple Valuation

The revenue multiple method is one of the most commonly used valuation techniques, especially for early-stage API startups.

This approach values the company based on its annual or monthly recurring revenue (ARR or MRR) by applying a multiple to that revenue figure. The multiple typically varies depending on factors such as growth rate, industry trends, and the startup's competitive position.

For API-as-a-Service companies, investors often look at the growth of subscription revenues or the number of API calls, as these metrics indicate strong demand for the product. A higher growth rate generally results in a higher revenue multiple, which can significantly boost the startup's valuation.

Example:

If a startup has $10 million in annual recurring revenue (ARR) and the industry-standard multiple is 8x, the company would be valued at $80 million using the revenue multiple methods.

EBITDA Multiple Valuation

The EBITDA multiple method is typically used for more mature API startups that have established profitability. EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) reflects the company’s core profitability, and this method involves applying a multiple to the company's EBITDA to estimate its value.

For API startups, this method is more relevant in later stages when the company is generating consistent earnings. Investors will assess the company's profitability alongside growth potential to determine the appropriate multiple.

Example:

If an API company has an EBITDA of $5 million and the industry multiple is 10x, the company would be valued at $50 million based on the EBITDA multiple.

Discounted Cash Flow (DCF) Valuation

The Discounted Cash Flow (DCF) method values a company based on the present value of its projected future cash flows. This method is ideal for companies with a long-term view of profitability and a stable cash flow projection. However, for early-stage API startups, projecting reliable future cash flows can be difficult due to volatility in revenue growth, customer churn, and market changes.

The DCF method involves estimating future free cash flows and discounting them back to their present value using a discount rate. This approach is more suitable for later-stage API-as-a-Service companies that have more predictable financial performance.

Example:

If a startup projects $20 million in free cash flow over the next 5 years and uses a discount rate of 10%, the present value of those cash flows can be calculated to estimate the company’s value today.

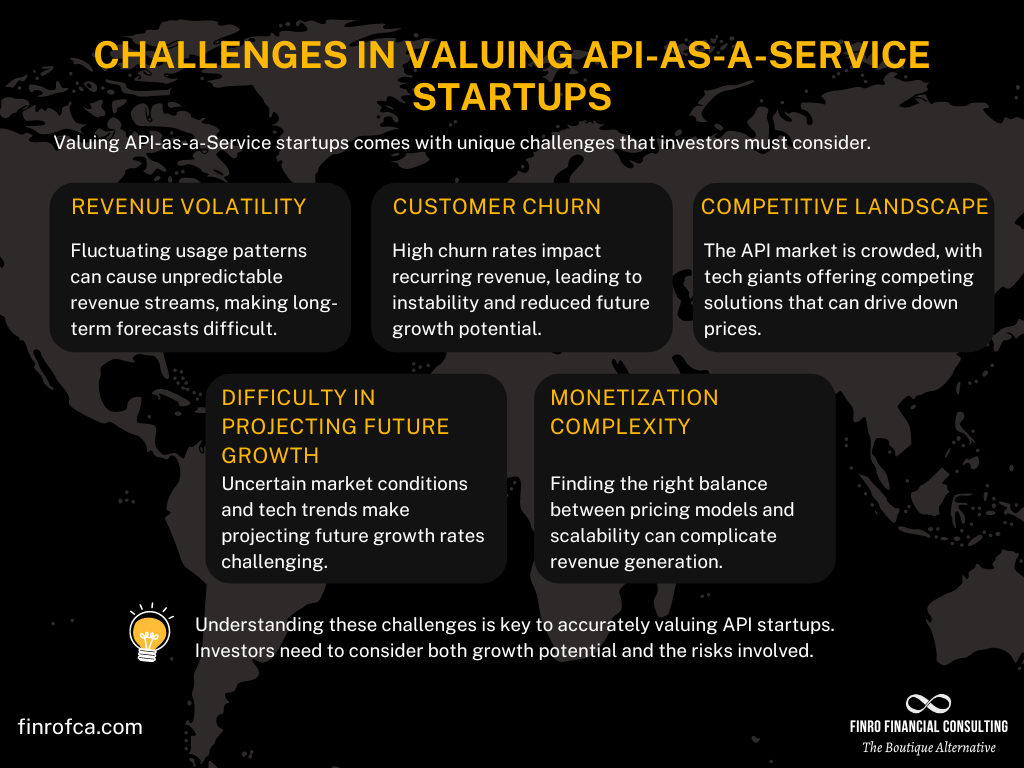

Challenges in Valuing API-as-a-Service Startups

Valuing API-as-a-Service startups presents its own set of challenges due to the unique nature of their business models and the complexities of predicting future growth.

Below are some key challenges investors and analysts face when trying to assess the value of these companies accurately.

1. Revenue Volatility

API-as-a-Service companies often experience unpredictable revenue fluctuations, especially those operating on a usage-based pricing model. While this model offers flexibility to customers, it introduces revenue volatility, making it challenging to forecast long-term financial performance. For example, if a customer’s usage spikes during a high-demand period but drops off sharply afterward, it can lead to significant variations in revenue from month to month.

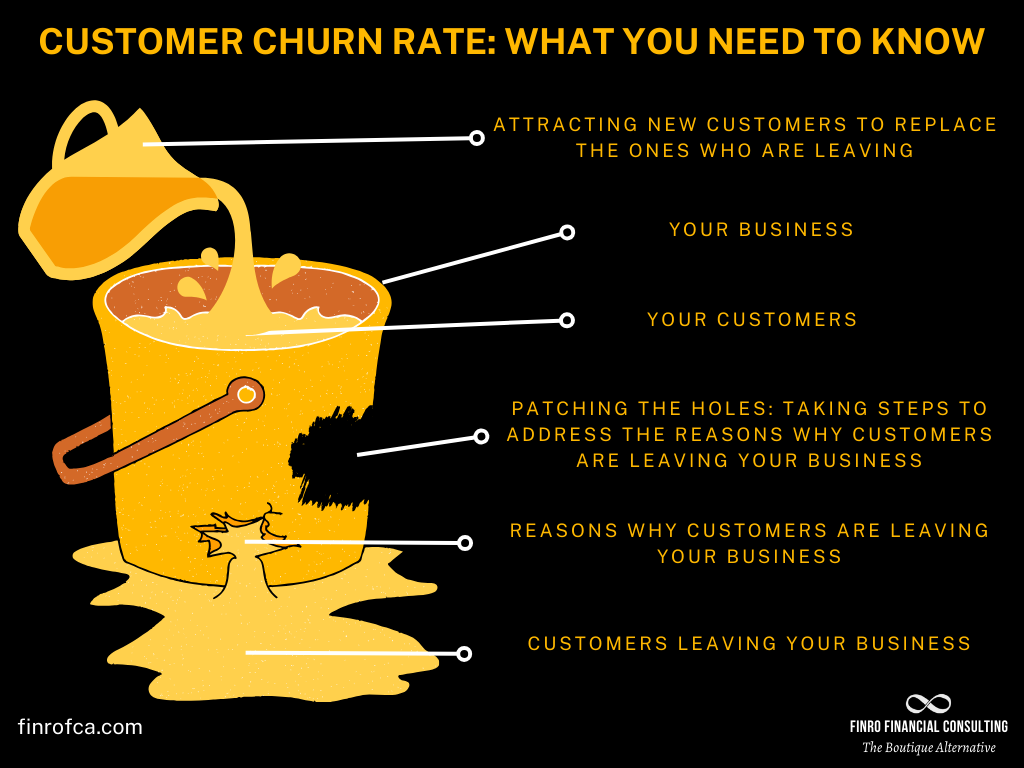

2. Customer Churn

Customer churn is another critical factor in valuing API startups. API-as-a-Service companies rely on recurring revenue streams from customers who integrate their APIs into their applications. However, if customers leave or switch to a competitor, the company loses both revenue and potential future growth.

High churn rates can negatively impact a startup’s valuation because it suggests that the business may struggle to maintain a stable revenue base. Managing and improving customer retention is crucial to keeping the company’s value intact.

3. Competitive Landscape

The API market is highly competitive, with new companies entering the space regularly. Established tech giants like Google, Amazon, and Microsoft also provide API solutions, making it difficult for smaller startups to stand out.

This intense competition can exert downward pressure on pricing, impacting revenue growth and profitability. Furthermore, the presence of free or low-cost alternatives from large players can make customer acquisition more difficult and expensive for smaller API startups.

4. Difficulty in Projecting Future Growth

API-as-a-Service startups, especially those in the early stages, often face uncertainty when projecting future growth. Factors such as market adoption, scalability, and competitive differentiation can vary significantly.

Additionally, shifts in technology trends or customer behavior can drastically alter a company’s growth trajectory, making long-term projections challenging. This unpredictability complicates the use of certain valuation methods, like the Discounted Cash Flow (DCF) method, which relies on stable and predictable future cash flows.

5. Monetization Complexity

API startups must carefully balance their pricing models to monetize effectively while remaining competitive. Choosing between usage-based, subscription-based, or hybrid pricing models can significantly impact the company’s financials. Monetizing the API offering while maintaining a user-friendly and scalable product can be challenging, especially when attempting to maximize value without alienating potential customers.

Key Metrics Investors Look For in API-as-a-Service Startups

When evaluating the potential of an API-as-a-Service startup, investors focus on several key metrics that reveal the company's financial health, growth trajectory, and operational efficiency. These metrics help investors assess the scalability, profitability, and long-term sustainability of the business.

1. Annual Recurring Revenue (ARR) / Monthly Recurring Revenue (MRR)

ARR and MRR are critical metrics for any subscription-based API-as-a-Service company. These metrics represent the predictable, recurring revenue generated from customers, often through subscription or usage fees. Consistent growth in ARR or MRR indicates strong customer acquisition and retention, which signals the startup’s ability to scale over time.

Why it matters: Investors use ARR/MRR to gauge the company’s revenue stability and growth potential. A high growth rate in ARR or MRR is a positive signal for future success.

| Aspect | ARR (Annual Recurring Revenue) |

MRR (Monthly Recurring Revenue) |

|---|---|---|

| Definition | Total revenue expected annually from subscriptions | Total revenue expected monthly from subscriptions |

| Time Frame | Yearly | Monthly |

| Usage | Long-term planning and strategic decision-making | Short-term trend analysis and immediate revenue tracking |

| Calculation | MRR multiplied by 12 | Sum of monthly subscription revenues |

| Financial Insight | Broader view of financial performance | Detailed, immediate view of revenue changes |

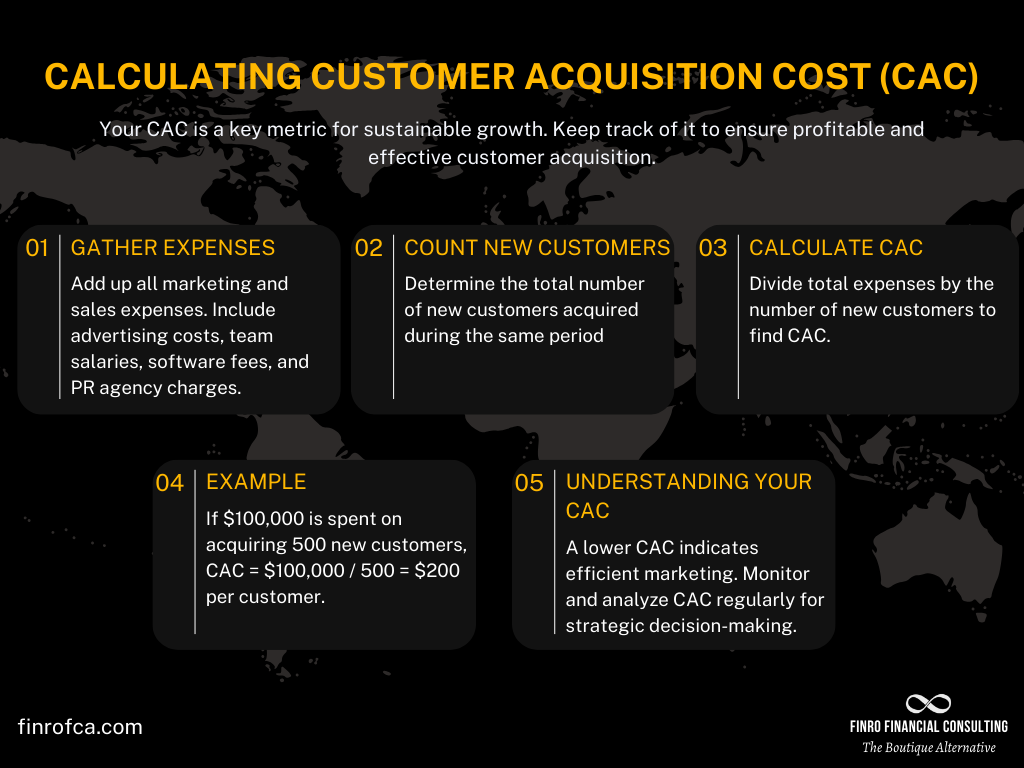

2. Customer Acquisition Cost (CAC)

CAC measures the cost incurred by the company to acquire a new customer. This includes marketing, sales, and any additional costs associated with onboarding. For API startups, a lower CAC indicates an efficient customer acquisition process, which is crucial for maintaining profitability as the business scales.

Why it matters: A high CAC can drain resources, while a low CAC relative to Customer Lifetime Value (CLV) signals efficient growth and scalability.

3. Customer Lifetime Value (CLV)

CLV (or LTV) represents the total revenue a company can expect from a customer over the entire relationship duration. This metric is especially important for API-as-a-Service startups because it indicates the long-term profitability of each customer. A high CLV relative to CAC is an indicator of sustainable business growth.

Why it matters: CLV shows how valuable each customer is over time, and when paired with CAC, it helps investors assess the company's profitability.

4. Customer Churn Rate

Churn rate measures the percentage of customers who cancel or stop using the service over a given period. For API-as-a-Service startups, churn is a vital metric because it directly impacts recurring revenue. A high churn rate can signal product dissatisfaction, intense competition, or pricing issues.

Why it matters: A low churn rate is a sign of customer satisfaction and revenue stability, while a high churn rate raises red flags about the business's ability to retain customers.

5. Gross Margins

Gross margin represents the percentage of revenue that remains after accounting for the direct costs of delivering the API service, such as server infrastructure and maintenance. High gross margins are typical for API companies because they usually have low variable costs after the initial product development.

Why it matters: High gross margins are a positive sign that the company can scale without dramatically increasing costs, which is important for profitability.

6. Net Revenue Retention (NRR)

Net Revenue Retention measures the percentage of revenue retained from existing customers over a certain period, including upgrades, downgrades, and churn. For API-as-a-Service startups, a high NRR indicates that customers are not only staying but are also expanding their usage of the product.

Why it matters: NRR above 100% is a strong indicator that the company is effectively growing its revenue from existing customers, which is a key metric for long-term growth.

7. API Call Volume

API call volume measures the total number of API requests made by customers. It is a valuable operational metric that indicates how much customers are using the product and how deeply integrated the API is into their operations. Consistent growth in API call volume suggests increasing engagement and reliance on the service.

Why it matters: High API call volume shows that the product is being actively used and integrated into customers' core business processes, signaling strong customer engagement and product stickiness.

Conclusion

Valuing API-as-a-Service startups requires a nuanced approach, as these companies operate within dynamic and often rapidly evolving markets.

Their potential for scalability, high margins, and recurring revenue models make them attractive to investors, but they also face unique challenges, such as revenue volatility, customer churn, and intense competition.

Investors need to look beyond basic financials and assess key metrics such as ARR/MRR, CAC, CLV, and gross margins to understand both the short-term performance and long-term potential of these businesses.

Valuation methods like revenue multiples and EBITDA multiples are commonly applied depending on the startup’s stage and profitability, while more advanced methods like DCF are used for mature companies with predictable cash flows.

As the API-as-a-Service market continues to grow and evolve, successful companies will be those that can retain customers, expand their offerings, and differentiate themselves in an increasingly competitive landscape.

Investors who take a comprehensive approach to valuation—considering both financial metrics and market dynamics—are best positioned to identify high-potential startups in this space.

Key Takeaways

Valuation Complexity: API-as-a-Service startups need tailored valuation methods due to growth potential, recurring revenue, and unique challenges.

Revenue Models:Usage-based and subscription-based pricing models are common, with revenue multiples often used for early-stage startups.

Key Metrics: ARR, MRR, CAC, CLV, and churn rate are critical for assessing the financial health and scalability of API startups.

Competitive Landscape: API startups face intense competition from large tech companies, making differentiation and customer retention crucial for success.

Challenges in Forecasting: Unpredictable revenue, customer churn, and market volatility make long-term growth projections difficult, complicating valuation efforts.