How Much Equity Should Startups Give Away?

By Lior Ronen | Founder, Finro Financial Consulting

Alright, let's tackle the big question that's buzzing in every startup founder's head:

'How much of my company should I give up to investors?'

You've probably lost some sleep over this one, right?

Trust me, you're not alone.

See, there's no cookie-cutter answer because it's like trying to hit a moving target—so many things can change the game.

People always throw around that 20% figure as if it's the secret password to the cool founders' club.

But hold on, is that really the magic number?

We're going to roll up our sleeves and dig deep into this 20% talk.

We’ll check out where this idea comes from, break down what it actually means to give away a piece of your business, and jump into some real-deal numbers to show you what's actually happening on the ground.

So, grab your favorite snack, and let's walk through this together. By the end, you'll have a clearer picture, not just a number someone shouted in a crowded room.

Equity allocation in startups is akin to slicing a pizza, where the size of each piece represents the share of ownership distributed among founders, investors, and key contributors. The prevailing wisdom of the 20% rule serves as a benchmark for Seed and Series A funding rounds, suggesting that founders might offer up this portion to investors. Yet, as businesses grow and progress through Series B, C, and D, the trend shows a decrease in the equity percentage offered.

This strategic preservation of equity ensures that founders maintain control and have the leverage for future growth. Balancing equity allocation is crucial, as it determines the distribution of profits, decision-making power, and the company's direction. The cap table acts as the record-keeper, detailing the division of equity and reflecting the company's valuation and the stakeholders' investment. Understanding and managing equity allocation is essential for the long-term success of a startup, enabling it to attract investment while safeguarding the founder's vision and the company's autonomy.

Understanding Equity in the Startup World

Before we dive into the nitty-gritty of percentages, let's talk about what it actually means to give equity to investors. Think of your startup as a pie. Every slice represents a piece of ownership.

When you give equity to investors, you're essentially giving them a slice of your pie—in other words, a share in your company. In return, they give you the funds you need to grow your business.

The bigger the slice, the more of your company they own, and the more say they might have in how things are done.

Now, where does this 20% figure come from? It's like an old tale passed down through generations of entrepreneurs.

The origins are a bit fuzzy, but it's believed that the 20% rule became popular because it strikes a balance—it's enough to entice investors with a significant stake, yet it allows founders to retain control and still have enough equity for future funding rounds.

Plus, it's a neat, round number, and let's be honest, that simplicity helps when you're juggling a gazillion startup challenges.

Venture capitalists, angel investors, accelerators, and even friends and family who invest in your dream are all part of this equity equation.

They're betting on your success, and their investment is like the fuel that powers your startup engine. But remember, once you slice the pie, you can't just smoosh it back together—so deciding on the size of the slice you give away is crucial.

Alright, so we've chewed over what giving away a slice of your business pie means and where this whole 20% idea comes from. It's all about finding that sweet spot between keeping control and getting enough dough to grow.

But hey, giving away equity is just one way to feed your startup's appetite. There are other recipes in the startup kitchen, like cooking up your own funds or borrowing a cup of sugar (I mean, cash) from the bank.

Let's lay it all out on the table, shall we? Up next, we've got a neat little table that breaks down these different ways of funding your dream – bootstrapping, raising equity, and taking on debt.

It's like a menu of choices, each with its own flavor, so you can pick what’s best for your startup feast.

| Comparison Aspect | Bootstrapping | Raising Equity | Raising Debt |

|---|---|---|---|

| Source of Funds | Self-funding by the founders | Funding in exchange for company shares | Funding through loans or bonds |

| Impact on Equity & Control | No equity given away; full control retained | Equity given away; potential loss of some control | No equity given away; control retained |

| Funding Limitations | Limited by the founder's personal capital | Potentially large amounts of money can be raised | Interest payments required; potential for large funding |

| Growth Strategy | Profit-driven, slow but stable growth | Focus on rapid growth and scaling | Obligation to repay debt, can be risky |

| Financial Obligation | No debt incurred | No debt incurred, but dilution of ownership | Debt must be repaid with interest |

The Birth of the 20% Benchmark

This benchmark likely emerged from the early days of Silicon Valley, where seasoned investors noticed a pattern.

Companies that gave away too much equity early on often struggled later, either because their founders lost motivation or because they had less equity to offer in subsequent funding rounds.

On the flip side, companies that gave away too little might have had trouble attracting the right investors or enough capital to make a real go of it.

So, 20% became the 'Goldilocks zone'—not too hot, not too cold, just right—for many startups.

It's been adopted as a starting point for negotiations, a baseline from which you can adjust depending on your company's specific needs, your industry's norms, and the interest level of investors.

As we gear up to question the current standing of this golden rule, keep in mind that these aren't just numbers on a page. They're reflections of dreams, risks, and the high-stakes world of startups.

Now, let's step into the real picture and see if the 20% rule holds its ground in today's fast-paced entrepreneurial landscape.

Does the 20% Golden Rule Still Stand?

When you're starting your own business and looking for cash to get the ball rolling, you're probably asking yourself: "How much of my company should I give away to investors?"

This is a big question, and honestly, there isn't a one-size-fits-all answer because every business is different.

A lot of folks might tell you that 20% is the magic number to stick to when you're just starting. But what's really happening out there in the startup world? Is everybody really sticking to this 20% thing?

We've got our hands on some fresh numbers from Carta Inc.—they're the go-to guys for this kind of info—and it turns out that 20% is a pretty common number, but it's not the whole story.

So, here's the scoop based on the latest data from the startup scene, covering early 2023 all the way up to the fall. For the youngest companies, the ones just planting their feet with a Seed round of funding, they usually go with giving away about 20.6% of their company.

That's like saying, "Here, Mr. Investor, you can have a bit more than a fifth of my pie."

And for Series A, where companies are a bit more grown-up but still young, they're also handing out a slice that's just over 20%.

But as companies grow and climb up the ladder to Series B, C, and D rounds, they're not as generous with their pie. It's not because they're stingy, but because their pie is getting bigger and they've got more to offer. By Series D, they're only giving away about 12%, which is like a little more than a tenth of their pie.

And hey, not everyone's giving away the same size slice. Some companies are super confident and only give away a tiny sliver, like 5% or even less, especially when they're more established.

Others might need a big chunk of money to make their dreams happen, so they go ahead and give away a bigger piece, sometimes even more than 30%.

What all these numbers are really saying is that there's no hard rule about that 20%. It's a good starting point to think about, but when it comes to your own business, you've got to play it by ear.

Think about how much your business is worth, how fast you're growing, and what you need the money for.

So, if you're sitting there scratching your head about how much of your company to offer up, take these numbers as a friendly bit of advice. Remember, it's your business, and you make the call.

The 20% rule is more like a friendly suggestion than a must-do. Use it to kick off the conversation, but in the end, choose the number that feels right for you and your business goals.

The Dilution Dilemma

So, we've chewed over whether the 20% rule is the golden ticket for startup funding. But let's pause and ponder what it really means when you hand over a slice of your company to investors.

Giving equity is a bit like sharing your favorite pizza – it means less for you, but more hands to help it grow.

When investors come aboard, they're not just bringing their wallets. They're buying a piece of your dream, a share of your hard work. In exchange for their cash, they get a chunk of your company's ownership.

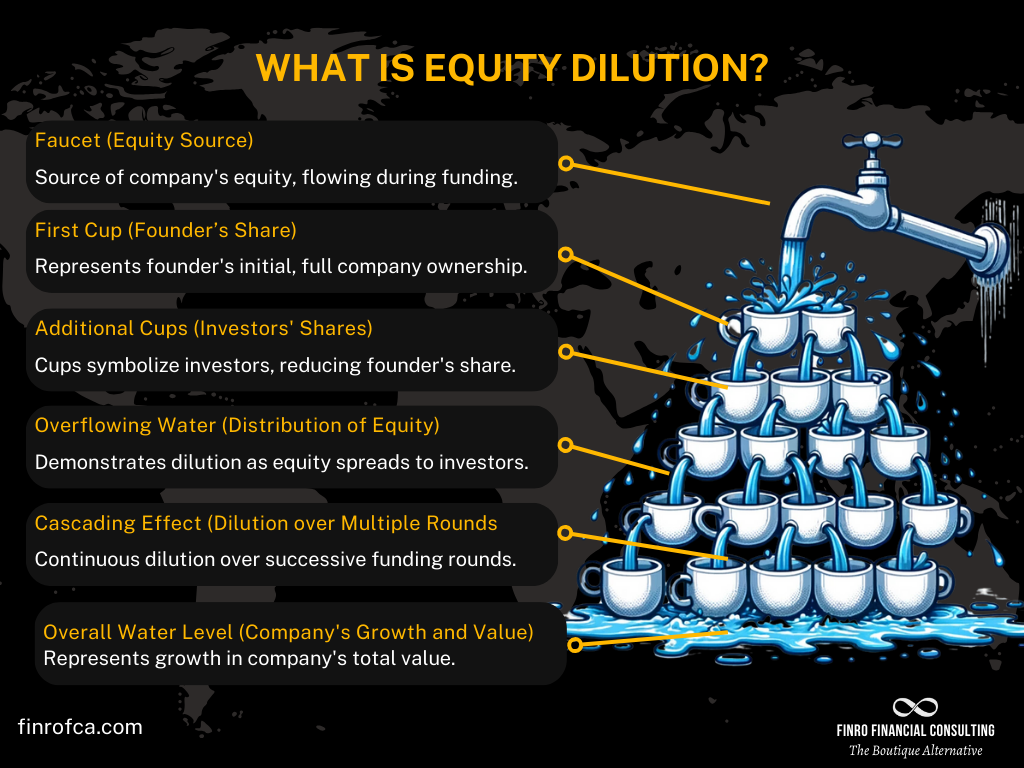

This is where the term 'dilution' struts onto the stage. It's not about watering down your drinks; it's about your ownership percentage getting smaller.

Every time you give out equity, your own slice of the pizza gets a bit thinner. You’re not losing pieces of your pie, but the size of your slice in relation to the whole pie is shrinking.

That's dilution.

It's an essential part of the startup game if you need the funds to fuel your growth, but it's a delicate dance. Give away too much, and you could end up with a sliver of a company that you've poured your heart into.

Think of it this way: if your company is a pizza with eight slices and you give one away, you've got seven left. But if your company grows and that pizza becomes a 16-slice mega pie, and you give away four more slices, you still have a bigger pizza, but you own a smaller piece of it.

The key is to strike a balance. You want to bring on investors who add not just capital but value to your company, helping your pizza grow so big that even with a smaller percentage, you’ve got a more valuable slice.

That's the smart way to approach dilution – not as a loss, but as an investment in your company's future, where a smaller piece of a bigger pie can be worth a whole lot more than a larger piece of a small pie.

Slicing the Pie: The Art of Equity Allocation

So, we've been gabbing about this 20% rule and how it plays out in real life. But there's another piece of the startup puzzle that's super important – equity allocation. It's like deciding how to cut the pie at your party, making sure everyone gets a piece that keeps them smiling.

Equity allocation is all about figuring out who gets what slice of your company. It's not just about investors; it also involves you, your co-founders, maybe some early employees, and anyone else who's putting their sweat and smarts into making your dream a reality.

Think of it as your way of saying, "Thanks for believing in this crazy ride. Here's a piece of the future we're building."

How does this tie back to our main story, the 20% rule? Well, when you're handing out equity to investors, it's not just about how much cash they're bringing to the table.

It's also about keeping enough pieces of the pie in your corner so you can reward the hardworking crew who are in the trenches with you. Plus, you’ve got to think ahead. Future funding rounds, new team members, maybe even some strategic partners down the line – they'll all want a piece of the pie, too.

Balancing this act is like being a DJ at a party. Play the right tunes, and you keep everyone grooving. Mess up the mix, and the party's a dud. If you give away too much too soon, you might not have enough left to motivate and attract talent.

On the flip side, being too stingy can turn off investors and leave you short on the cash you need to hit the big time.

So, as you navigate this wild world of startups, remember that equity allocation is a key move in your strategy dance. It's about making smart, forward-thinking decisions that keep everyone invested - literally and figuratively - in your startup's success.

With that in mind, let's roll into our conclusion. We've talked numbers, rules, and slicing pies. Now, it's time to wrap it all up and put a bow on top. Stay tuned!

Wrapping It Up: The Final Slice of the Startup Equity Pie

Well, folks, we've journeyed through the maze of startup equity, from questioning the mythical 20% rule to exploring alternative funding avenues, and even delving into the delicate art of equity allocation. It's been quite the adventure, hasn't it?

Here's the big takeaway: when it comes to giving away equity in your startup, there's no magic spell or secret sauce.

The 20% rule is a handy guideline, but it's not the gospel. Every startup's journey is unique, with its own twists, turns, and bumps in the road. Your decision on equity should be as unique as your business idea.

Remember, it's not just about the percentages or the money. It's about building a dream and bringing together a team that believes in that dream. Whether you're bootstrapping with your savings, sharing your pie with investors, or taking on some debt, the goal is the same – to see your startup soar.

So, wear your founder's hat with pride, and when you slice your equity pie, do it with a thoughtful mind and a clear vision of the future. And hey, don't forget to enjoy the ride!

After all, building something from scratch and watching it grow is what the startup thrill is all about.

Thanks for hanging with us through this equity exploration.

We hope you're walking away with a bit more insight and maybe, just maybe, feeling a bit more ready to tackle that big equity question with confidence.

Here's to your success, today, tomorrow, and beyond!