What is a SAFE Agreement?

Securing funding is a perpetual challenge for startups. Traditional financing methods, while effective, often bring significant complexities and high legal costs.

Enter SAFEs—Simple Agreements for Future Equity. Introduced by Y Combinator in 2013, SAFEs have quickly become a favorite among early-stage startups and investors alike.

They offer a streamlined, cost-effective alternative to traditional equity financing, making the funding process quicker and less burdensome.

This article explores what SAFEs are, when they’re used, their key terms, and their impact on your cap table, along with the benefits they bring to the table.

SAFEs (Simple Agreements for Future Equity) offer a streamlined, cost-effective financing tool for startups, allowing rapid capital raising without the complexities of traditional equity rounds. Introduced by Y Combinator in 2013, SAFEs provide flexible terms, such as valuation caps and discount rates, that convert into equity in future funding events.

They positively impact the cap table by deferring dilution until specific triggers occur and align incentives between founders and investors. Used by successful startups like Dropbox, Airbnb, and Reddit, SAFEs are favored for their simplicity, reduced legal costs, and ability to attract early-stage investment, making them an attractive option in the startup ecosystem.

What is a SAFE?

A SAFE (Simple Agreement for Future Equity) is a financing contract between an investor and a startup that grants the investor the right to obtain equity in the company at a later date, subject to specific conditions. Unlike convertible notes, SAFEs do not accrue interest or have a maturity date, making them simpler and more founder-friendly.

SAFEs were introduced by Y Combinator in 2013 to address the need for a straightforward, flexible, and cost-effective financing instrument. They are designed to provide startups with a quick way to raise capital without the complexities and costs associated with traditional equity financing rounds.

In essence, a SAFE investor provides capital to the startup and, in return, receives the right to convert that investment into equity at a future financing round, typically at a discount or at a pre-agreed valuation cap. This arrangement allows startups to secure necessary funds while deferring the valuation discussion until a more mature financing round.

SAFEs are typically used during the seed or early stages of a startup’s lifecycle when rapid capital infusion is critical for growth and development. Common scenarios include:

Pre-seed and Seed Rounds: Early funding rounds where startups are building their product or service and need initial capital to get off the ground.

Bridge Financing: Interim funding between larger financing rounds to maintain momentum and operations.

Accelerator Programs: Many accelerators, including Y Combinator, use SAFEs to invest in their cohort companies quickly and efficiently.

When compared to other financing options, SAFEs offer distinct advantages:

Convertible Notes: Similar to SAFEs, however, convertible notes accrue interest and have a maturity date, adding complexity. SAFEs are simpler and avoid these complications.

Equity Rounds: Involve selling shares directly to investors, requiring a detailed valuation and often significant legal and administrative work. SAFEs defer the valuation and streamline the process, making them faster and more cost-effective than equity rounds.

Overall, SAFEs provide a flexible solution that aligns the interests of both founders and investors, making them a popular choice in the startup ecosystem.

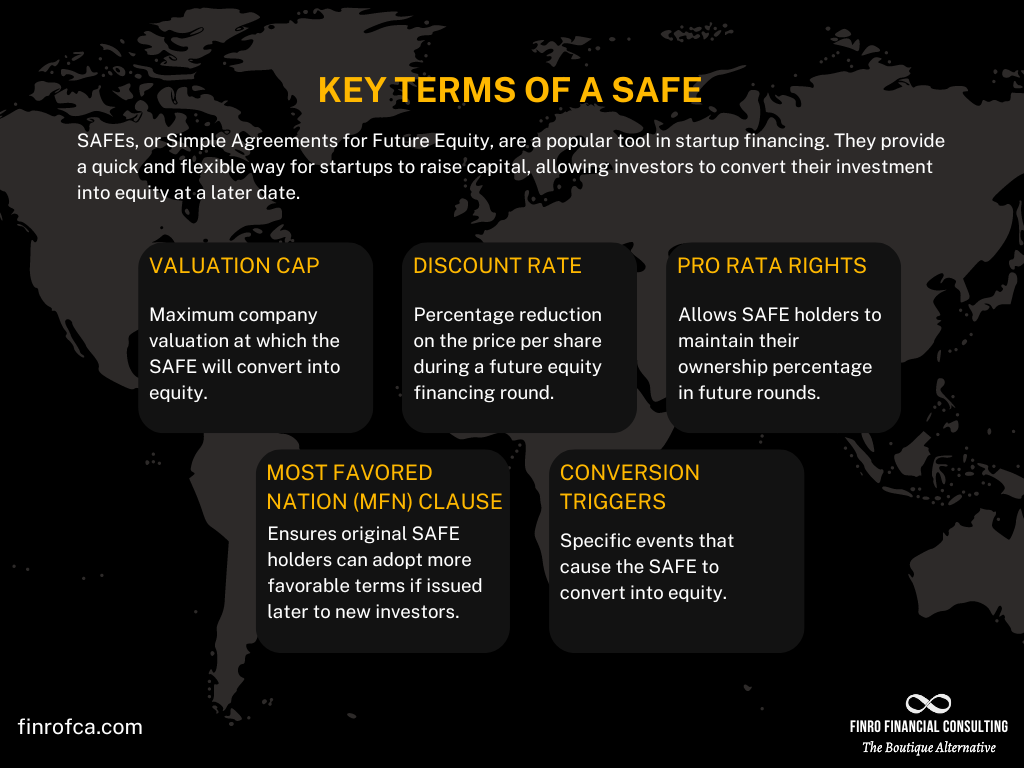

Key Terms of a SAFE

Understanding the key terms of a SAFE (Simple Agreement for Future Equity) is crucial for both founders and investors.

These terms define how SAFE operates and how it will convert into equity in the future.

Here are the primary terms to be aware of:

1. Valuation Cap

The valuation cap sets the maximum company valuation at which the SAFE will convert into equity. It protects the investor by ensuring they receive a fair equity stake even if the company’s valuation skyrockets in future funding rounds.

For example, if the valuation cap is set at $10 million and the company later raises at a $20 million valuation, the SAFE will convert as if the valuation were $10 million.

2. Discount Rate

The discount rate provides a percentage reduction on the price per share during a future equity financing round. This rewards early investors for their risk by allowing them to purchase shares at a lower price.

For instance, if the discount rate is 20% and the future round’s share price is $1.00, the SAFE converts at $0.80 per share.

3. Pro Rata Rights

Pro rata rights give SAFE holders the opportunity to maintain their ownership percentage in future financing rounds. This means they can invest additional funds to purchase new shares in proportion to their existing ownership, helping them avoid dilution as the company grows.

4. Most Favored Nation (MFN) Clause

The MFN clause ensures that if the company issues another SAFE with more favorable terms to a subsequent investor, the original SAFE holders can opt to adopt those better terms.

This clause protects early investors by ensuring they benefit from any more advantageous terms offered later.

5. Conversion Triggers

Conversion triggers are specific events that cause the SAFE to convert into equity. Common triggers include:

Equity Financing: When the company raises a priced equity round.

Liquidity Event: Such as an acquisition or IPO, where the SAFE converts into shares or cash.

Dissolution: If the company winds down, the SAFE holders may receive a payout before common shareholders, although this is often minimal.

These key terms define the structure and benefits of a SAFE, ensuring both founders and investors have clear expectations and protections in place. Understanding these terms is essential for leveraging SAFEs effectively in startup financing.

Impact on the Cap Table

Understanding how SAFEs impact the cap table is crucial for founders and investors.

When a SAFE converts into equity, it increases the total number of shares outstanding, which can lead to dilution of existing shareholders' ownership percentages.

Here’s how it works:

Pre and Post-SAFE Cap Table Scenarios

Pre-SAFE: Before issuing a SAFE, the cap table includes the founders, any existing investors, and employee stock options. The ownership percentages are based on the total shares issued at this stage.

Post-SAFE: When the SAFE converts, new shares are issued to the SAFE holders based on the agreed valuation cap or discount rate. This increases the total number of shares and dilutes the ownership percentages of existing shareholders.

Example

Imagine a startup with the following pre-SAFE cap table:

Founders: 70%

Early Investors: 20%

Employee Stock Options: 10%

If a SAFE investor injects $1 million with a valuation cap of $10 million, and the company later raises a Series A round at a $15 million valuation, the SAFE will convert as if the valuation were $10 million.

This means the SAFE holder gets more shares than they would have at the $15 million valuation, leading to dilution.

The new cap table might look like this:

Founders: 60%

Early Investors: 17%

Employee Stock Options: 8.5%

SAFE Investors: 14.5%

Potential Dilution

Dilution can be significant, especially if multiple SAFEs are issued. Founders need to understand this and communicate transparently with existing shareholders about the potential impact.

Planning for Dilution

To manage dilution, founders should:

Model different scenarios to understand the potential impact of SAFEs on the cap table.

Consider the timing and terms of SAFE issuances carefully.

Communicate with existing investors about how SAFEs will affect their ownership.

By understanding and planning for the impact of SAFEs on the cap table, founders can make informed decisions that balance the need for capital intending to maintain reasonable ownership percentages for all stakeholders.

Benefits of Using a SAFE

SAFEs offer numerous advantages for both startups and investors, making them an increasingly popular choice in early-stage financing.

Here are some of the key benefits:

Speed and Simplicity

SAFEs are designed to be quick and easy to execute. Unlike traditional equity rounds that require extensive negotiations and legal documentation, SAFEs are straightforward contracts. This simplicity allows startups to raise funds rapidly, which is crucial in the early stages when time and resources are limited.

Reduced Legal Costs

The streamlined nature of SAFEs significantly reduces legal fees. Traditional equity financing involves drafting complex agreements and conducting thorough due diligence, all of which can be costly. In contrast, SAFEs have a standardized structure, minimizing the need for extensive legal work and thus lowering costs.

Flexibility

SAFEs provide flexibility for both startups and investors. For startups, they offer a way to raise capital without having to set a precise valuation too early. This is particularly beneficial when the company’s future prospects are still uncertain. For investors, SAFEs offer the potential for favorable conversion terms, such as valuation caps and discounts, which can enhance their returns if the startup succeeds.

Aligns Incentives

SAFEs align the incentives of founders and investors by deferring the valuation discussion until a later, more mature financing round. This helps ensure that both parties are working towards the same goal of increasing the company’s value. Additionally, the conversion terms in SAFEs are designed to protect early investors by offering them better terms compared to later investors.

Reduced Dilution Concerns

Since SAFEs convert into equity only when specific conditions are met (such as a future financing round), they help startups manage dilution more effectively. Founders can focus on growing the company without immediate concerns about diluting their ownership stake, knowing that the conversion will happen under predefined terms.

By leveraging the benefits of SAFEs, startups can secure the funding they need to grow while maintaining a flexible and founder-friendly financing structure. Investors, in turn, gain a stake in promising companies with the potential for attractive returns, making SAFEs a win-win solution in the startup ecosystem.

Get your expert support now!

Famous Examples of Startups Using SAFEs

Several high-profile startups have successfully utilized SAFEs to fuel their early growth.

These examples highlight the versatility and effectiveness of SAFEs in helping startups secure essential funding while avoiding the complexities of traditional equity rounds.

Dropbox

Dropbox, the cloud storage giant, used SAFEs in its early fundraising efforts. This allowed the company to quickly raise capital from investors who believed in its vision, providing the necessary resources to scale its infrastructure and user base without the immediate need for a formal equity round.

Airbnb

Airbnb, the world-renowned home-sharing platform, also benefited from SAFEs during its early stages. The simplicity and speed of issuing SAFEs enabled Airbnb to secure critical funding, which was instrumental in expanding its platform and establishing a strong market presence.

Reddit, the popular social news aggregation and discussion website, utilized SAFEs to attract early investment. The flexible and founder-friendly nature of SAFEs made it easier for Reddit to bring on board influential investors who supported its growth trajectory, helping it become one of the most visited websites globally.

Instacart

Instacart, the grocery delivery service, leveraged SAFEs to raise capital quickly. This rapid infusion of funds allowed Instacart to build out its delivery network and technology platform, positioning it as a leader in the on-demand grocery delivery market.

Ginkgo Bioworks

Ginkgo Bioworks, a biotechnology company specializing in synthetic biology, used SAFEs to secure early investment. The funds raised through SAFEs enabled Ginkgo to invest in research and development, leading to significant advancements in its technology and capabilities.

These examples demonstrate how SAFEs have been pivotal in the growth stories of some of the most successful startups. By providing a quick, flexible, and cost-effective way to raise capital, SAFEs have helped these companies overcome early financial hurdles and achieve substantial growth.

| Startup | Industry | Key Benefit from SAFEs | Impact |

|---|---|---|---|

| Dropbox | Cloud Storage | Quickly raised capital for infrastructure and user base growth | Enabled rapid scaling and market establishment |

| Airbnb | Home-sharing Platform | Secured critical funding for platform expansion | Established strong market presence |

| Social News Aggregation | Attracted influential early investors | Became one of the most visited websites globally | |

| Instacart | Grocery Delivery Service | Raised capital quickly to build delivery network and technology | Positioned as a leader in the on-demand grocery delivery market |

| Ginkgo Bioworks | Biotechnology | Secured early investment for R&D | Achieved significant advancements in synthetic biology |

Current State of the SAFEs Market in US Early Stage Rounds

SAFEs have become a dominant force in the early-stage fundraising landscape, expanding their reach from pre-seed to seed stages. Understanding the current state of the SAFEs market is crucial for startup founders looking to raise venture capital or even those considering angel investments before relying on revenue funding.

In the first half of 2021, SAFEs were primarily used in rounds under $1 million. Startups raising less than this amount typically opted for SAFEs, while those seeking more substantial funds turned to priced equity. This unwritten rule made fundraising simpler and more predictable, with SAFEs accounting for a significant portion of early-stage investments but within defined limits.

Fast forward to today, and the landscape has dramatically shifted. SAFEs now dominate not just pre-seed but also seed-stage rounds, as illustrated by the attached data. In the first half of 2021, SAFEs constituted a significant share of rounds up to $4 million. By the first half of 2024, this trend has only intensified, with SAFEs making up a larger proportion of even higher funding rounds.

Several factors contribute to this shift:

Investor Comfort: Investors have grown more comfortable with SAFEs at larger amounts, likely due to the increasing use of side letters in deals, which provide additional protections and terms.

Multiple SAFE Rounds: Startups often raise multiple SAFE rounds, granting investors anti-dilutive benefits from post-money SAFEs.

Geographic Trends: Venture hubs outside Silicon Valley are increasingly adopting SAFEs, mirroring trends from the heart of the tech industry.

While the growing use of SAFEs offers clear benefits, such as reduced legal costs and simplified fundraising for smaller rounds (typically $2 million or less), the trend of raising multiple rounds on SAFEs raises some concerns. Priced equity, despite being more complex and costly, remains a valuable tool for setting clear valuations and avoiding potential dilution issues.

In conclusion, SAFEs have reshaped the early-stage funding landscape, offering a flexible and cost-effective solution for many startups. However, as their use expands into larger and multiple rounds, founders and investors alike must carefully consider the implications to ensure they strike the right balance between simplicity and strategic equity management.

Conclusion

SAFEs have become an essential tool in the startup financing landscape, providing a streamlined and flexible alternative to traditional equity financing.

By understanding what SAFEs are, when they are used, their key terms, and their impact on the cap table, founders and investors can make informed decisions that benefit both parties.

The speed and simplicity of SAFEs make them particularly attractive for early-stage startups needing quick capital infusion without the burden of complex legal arrangements.

The reduced legal costs and flexibility in terms ensure that startups can focus more on growth and less on administrative hurdles.

Moreover, the alignment of incentives between founders and investors through SAFEs fosters a collaborative approach to building the company’s value.

This has been evidenced by the success stories of high-profile startups like Dropbox, Airbnb, Reddit, Instacart, and Ginkgo Bioworks, all of which leveraged SAFEs to fuel their early growth.

In summary, SAFEs offer a practical and effective financing option that supports the dynamic needs of startups.

Whether you are a founder looking to raise capital quickly or an investor seeking to support promising ventures, SAFEs provide a viable path to achieving your goals in the competitive startup ecosystem.

Key Takeaways

What is a SAFE? - A flexible financing tool for startups that converts investment into future equity.

Key Terms - Includes valuation cap, discount rate, pro rata rights, MFN clause, and conversion triggers.

Impact on Cap Table - SAFEs affect ownership percentages, leading to potential dilution upon conversion.

Benefits - Speed, simplicity, reduced legal costs, flexibility, and aligned incentives.

Famous Examples - Dropbox, Airbnb, Reddit, Instacart, and Ginkgo Bioworks successfully used SAFEs for early-stage funding.

Answers to The Most Asked Questions

-

SAFE stands for Simple Agreement for Future Equity. It is a financing tool that allows startups to raise capital by providing investors with the right to obtain equity at a later date, subject to specific conditions.

-

In investing, a SAFE is a contract between an investor and a startup that grants the investor the right to convert their investment into equity in the company at a future financing round or other triggering event, typically at a discount or valuation cap.

-

A SAFE investment stock is not an actual stock but a financial instrument that promises the investor future equity in the startup. The investor's investment converts into shares when certain conditions are met, such as a subsequent financing round.

-

SAFEs are neither debt nor equity at the time of issuance. They do not accrue interest or have a maturity date like debt, and they do not represent ownership in the company like equity until they convert upon a triggering event. They are a form of convertible security.