Rule of 40 in SaaS Valuation

By Lior Ronen | Founder, Finro Financial Consulting

The valuation of SaaS (Software as a Service) businesses can be quite intricate due to their unique operational and revenue structures.

One metric that has gained significant traction in recent years is the Rule of 40. This metric offers a straightforward yet powerful way to gauge a company's performance by balancing growth and profitability.

For investors and business leaders alike, understanding the Rule of 40 can provide critical insights into the health and potential of a SaaS company. Let's explore what the Rule of 40 is, why it matters, and how it can be applied effectively in SaaS valuation.

The Rule of 40 is a crucial metric for evaluating SaaS companies, balancing revenue growth rate and profit margin to assess overall performance. By combining these two metrics, the Rule of 40 helps ensure that neither growth nor profitability is overlooked, providing a comprehensive view of a company’s health. It guides strategic decision-making, highlights areas needing improvement, sets benchmarks, and facilitates performance monitoring.

Investors use it to identify promising opportunities, while company leaders employ it to drive sustainable growth and profitability. Understanding and applying the Rule of 40 can significantly enhance a SaaS company's valuation and strategic direction, making it a key tool for long-term success.

What is the Rule of 40?

The Rule of 40 is a guiding principle for evaluating SaaS (Software as a Service) companies, emphasizing the balance between growth and profitability.

According to this rule, a SaaS company's combined revenue growth rate and profit margin should equal or exceed 40%.

This metric is particularly valuable because it acknowledges that high-growth SaaS businesses often operate with slim profit margins or even losses in their early stages. Conversely, more mature SaaS companies might see slower growth but higher profitability.

To break it down:

Revenue Growth Rate: This measures how quickly a company's sales increase over a specific period.

Profit Margin: This reflects the percentage of revenue after all expenses are deducted, showcasing the company's efficiency in managing its costs.

The Rule of 40 allows investors and company leaders to assess whether a SaaS company is on a sustainable path. If a company is growing rapidly but has low profitability, or vice versa, the Rule of 40 helps ensure that these factors are balanced to support long-term success.

The Rule of 40 provides a comprehensive view of a SaaS company's performance and explores both aspects of potential.

How to Calculate the Rule of 40?

Calculating the Rule of 40 involves adding two key metrics: the revenue growth rate and the profit margin. Here’s a step-by-step guide to help you understand the process:

1. Calculating the Revenue Growth Rate

Identify the Period: Choose the time frame for which you want to measure growth, typically year-over-year.

Calculate Revenue for Each Period: Determine the company's total revenue at the beginning and end of the chosen period.

Apply the Growth Formula: Use the formula ((Revenue at the end of Period−Revenue at the beginning of Period) / Revenue at the beginning of Period) × 100. This will give you the percentage growth rate.

Example: If a company’s revenue grew from $10 million to $15 million over a year, the revenue growth rate would be ((15−10) / 10) × 100 = 50%

2. Calculating the Profit Margin

Determine Net Income: Find the net income, which is the profit after all expenses, including taxes and interest, have been deducted.

Calculate Total Revenue: Ensure you have the total revenue figure for the same period used in the revenue growth calculation.

Apply the Profit Margin Formula: To find the profit margin, use the formula (Net Income / Total Revenue) × 100.

Example: If the net income is $2 million on revenue of $15 million, the profit margin would be (2/15) × 100 ≈ 13.3%.

3. Combining the Metrics

Add the revenue growth rate and the profit margin together. The sum should ideally be 40% or higher.

Example: With a revenue growth rate of 50% and a profit margin of 13.3%, the Rule of 40 score would be 50 + 13.3 = 63.3%, indicating strong performance.

Following these steps, you can calculate the Rule of 40 and assess whether a SaaS company maintains a healthy balance between growth and profitability.

This simple yet powerful formula helps investors and executives make more informed decisions regarding the company’s financial health and strategic direction.

Why the Rule of 40 Matters in SaaS Valuation?

The Rule of 40 has become an essential benchmark for evaluating the health and sustainability of SaaS (Software as a Service) companies. Here’s why this metric is so significant:

1. Balancing Growth and Profitability The Rule of 40 strikes a balance between two critical aspects of a SaaS business: growth and profitability. While rapid growth is often a priority for SaaS companies, especially in their early stages, profitability is equally important for long-term sustainability. By combining these two metrics, the Rule of 40 ensures that neither is overlooked, providing a more holistic view of a company's performance.

2. Investor Decision-Making Investors use the Rule of 40 to assess the attractiveness of potential investments. A company that meets or exceeds the Rule of 40 is seen as managing its growth and profitability effectively, making it a safer and more promising investment. This metric helps investors identify companies that are not just growing quickly but are also on a path to sustainable profitability.

3. Benchmark for Success The Rule of 40 serves as a benchmark for SaaS companies to measure their performance against industry standards. Companies that consistently achieve a Rule of 40 score of 40% or higher are often viewed as high-performing and capable of delivering value to their stakeholders. This benchmark can also be a valuable tool for internal assessment and goal setting.

4. Comparison with Other Metrics While other metrics like EV/Revenue and EV/EBITDA are commonly used in SaaS valuation, the Rule of 40 offers a unique advantage by integrating both growth and profitability. EV/Revenue focuses solely on revenue without considering profitability, and EV/EBITDA emphasizes earnings but may not fully capture growth potential. The Rule of 40 provides a balanced perspective that complements these other metrics.

5. Strategic Guidance For SaaS companies, the Rule of 40 can guide strategic decisions. It can highlight areas needing improvement, whether it’s boosting growth rates or improving profit margins. By aiming to meet the Rule of 40, companies can align their strategies to achieve a healthier balance between expanding their market presence and maintaining financial health.

Conclusion The Rule of 40 is more than just a metric; it’s a strategic tool that provides a comprehensive view of a SaaS company’s performance. By balancing growth and profitability, it helps investors make informed decisions, offers a benchmark for success, and guides companies towards sustainable growth. Understanding and applying the Rule of 40 can significantly enhance the valuation and strategic direction of a SaaS business.

Get your expert support now!

Interpreting the Rule of 40

Understanding how to interpret the Rule of 40 is crucial for making informed decisions about a SaaS company’s performance and potential.

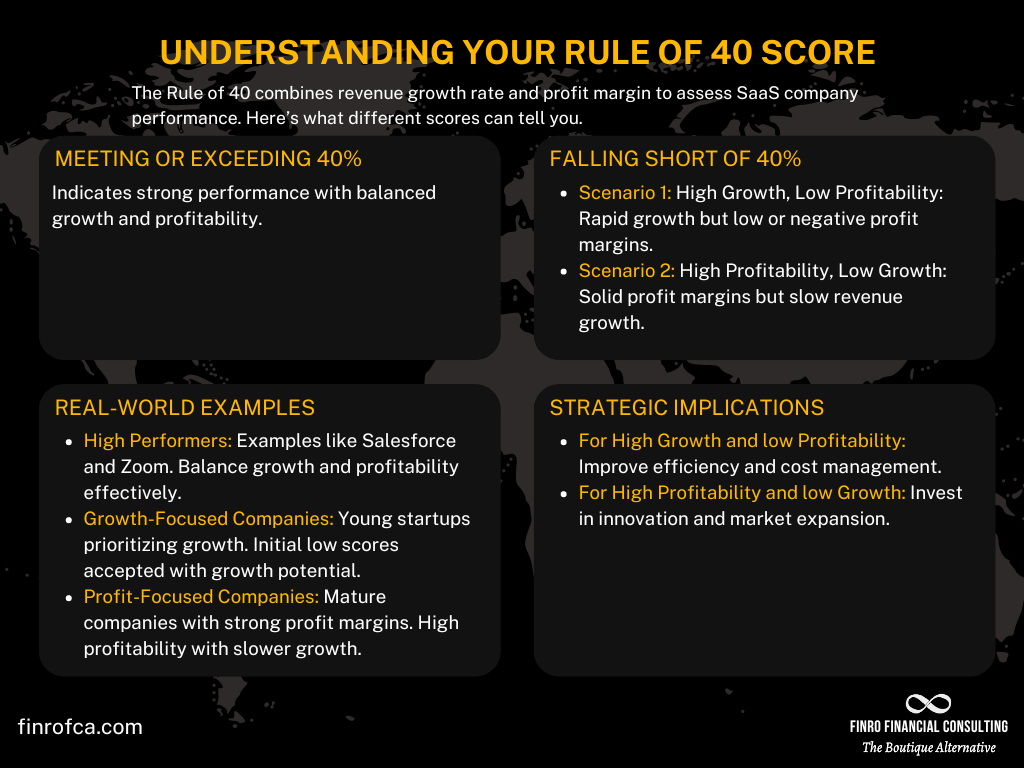

Here’s what different Rule of 40 scores can tell you:

1. Meeting or Exceeding the Rule of 40 When a company’s combined revenue growth rate and profit margin meet or exceed 40%, it indicates a strong performance. This balance suggests that the company is managing to grow quickly while also maintaining profitability, which is a positive sign for investors and stakeholders. Companies that consistently achieve high Rule of 40 scores are often seen as well-managed and capable of sustaining their growth over the long term.

2. Falling Short of the Rule of 40 If a company’s Rule of 40 score falls below 40%, it can signal potential issues that need addressing. There are two common scenarios:

High Growth, Low Profitability: A company might be growing rapidly but struggling to turn a profit. This could be due to high operating costs, aggressive market expansion, or inefficiencies. While growth is promising, the lack of profitability may pose risks if the company cannot eventually convert growth into sustainable profits.

High Profitability, Low Growth: Conversely, a company might have solid profit margins but is experiencing slow growth. This situation could indicate market saturation, lack of innovation, or competitive pressures. While profitability is strong, the slow growth could limit the company’s future potential and attractiveness to investors seeking high returns.

3. Case Studies and Real-World Examples Examining real-world examples can provide valuable insights into how the Rule of 40 applies in practice:

High Performers: Companies like Salesforce and Zoom have historically maintained strong Rule of 40 scores by balancing rapid growth with solid profitability. These companies often reinvest profits into growth initiatives while maintaining operational efficiency.

Growth-Focused Companies: Younger startups, such as those in their early stages of market entry, might prioritize growth over profitability. While their Rule of 40 scores might be lower initially, investors might accept this trade-off if there is a clear path to profitability as the company matures.

Profit-Focused Companies: Mature SaaS companies that dominate their markets, such as Adobe, might focus more on profitability with slower growth rates. These companies often have high profit margins and use their stable revenues to drive innovation and incremental growth.

4. Strategic Implications Interpreting the Rule of 40 helps SaaS companies make strategic decisions:

For High Growth, Low Profitability: Focus on improving operational efficiencies, cost management, and strategic pricing to boost profitability without compromising growth.

For High Profitability, Low Growth: Invest in innovation, market expansion, and customer acquisition strategies to reignite growth while maintaining profitability.

Conclusion The Rule of 40 is a powerful tool for interpreting the balance between growth and profitability in SaaS companies. By understanding what different scores indicate, companies can make informed strategic decisions to enhance their performance and appeal to investors. Real-world examples underscore the importance of this metric and its practical applications in guiding business strategies.

Practical Applications of the Rule of 40

Understanding the Rule of 40 is essential, but applying it effectively can drive significant improvements in a SaaS company’s strategic decisions. Here’s how to put this metric into practice:

1. Strategic Decision-Making The Rule of 40 helps SaaS companies make informed strategic decisions by highlighting the need for a balanced approach. If a company focuses solely on growth without regard to profitability, or vice versa, it risks long-term sustainability. By aiming to achieve or exceed a Rule of 40 score, companies can ensure they are not neglecting either aspect.

2. Identifying Areas for Improvement A detailed analysis of the Rule of 40 score can reveal specific areas needing attention. For instance:

Low Profit Margins: If a company has a high growth rate but low profit margins, it should investigate cost-saving measures, optimize operational efficiency, and evaluate pricing strategies.

Slow Growth: If the profit margin is high but growth is sluggish, the company might need to invest in marketing, explore new markets, or innovate its product offerings.

3. Setting Goals and Benchmarks Using the Rule of 40 as a benchmark, companies can set realistic and measurable goals. For example, a SaaS company might aim to increase its growth rate by 10% while maintaining its profit margin, thus improving its overall Rule of 40 score. This metric provides a clear target for executives and teams to align their efforts.

4. Performance Monitoring Regularly monitoring the Rule of 40 score allows companies to track their performance over time. By incorporating this metric into their regular financial reviews, SaaS companies can quickly identify trends, measure the impact of strategic initiatives, and make necessary adjustments.

5. Communicating with Stakeholders The Rule of 40 is a straightforward and compelling metric that can be effectively communicated to investors, board members, and other stakeholders. Demonstrating a strong Rule of 40 score can enhance investor confidence and support fundraising efforts. It also provides a clear narrative about the company’s balanced approach to growth and profitability.

Real-World Examples of Application:

Company A: Focused on rapid expansion, Company A achieved a 60% growth rate but struggled with profitability, resulting in a low Rule of 40 score. By optimizing operations and re-evaluating their pricing model, they improved their profit margin, raising their score above 40%.

Company B: Initially profitable but with slow growth, Company B invested in market research and expanded into new regions. This increased their growth rate and resulted in a higher Rule of 40 score, attracting more investors.

Conclusion Applying the Rule of 40 in a practical context involves more than just calculating a number. It’s about using this metric to drive strategic decisions, identify improvement areas, set goals, monitor performance, and communicate effectively with stakeholders. By focusing on both growth and profitability, SaaS companies can achieve sustainable success and deliver long-term value.

Conclusion

The Rule of 40 stands as a vital metric in the world of SaaS valuation, offering a balanced approach to assessing a company's health by integrating both growth and profitability. By understanding and applying this rule, SaaS companies can make more informed strategic decisions, ensuring they do not sacrifice one key aspect for another.

For investors, the Rule of 40 provides a clear and straightforward benchmark to identify promising opportunities and gauge the sustainability of their investments. For company leaders, it serves as a guide to optimize operations, set realistic goals, and communicate value effectively to stakeholders.

Whether you’re looking to improve operational efficiency, drive market expansion, or secure investor confidence, the Rule of 40 can help steer your SaaS business toward long-term success. By continually monitoring and striving to meet or exceed this benchmark, companies can not only enhance their performance but also solidify their position in the competitive SaaS landscape.