What is the difference between bookings, billings, and revenue?

By Lior Ronen | Founder, Finro Financial Consulting

Understanding financial metrics is crucial for any business, especially in the SaaS industry where specific terms can be quite nuanced. Among these metrics, bookings, billings, and revenue stand out as essential yet often misunderstood terms.

Each plays a distinct role in financial reporting and has unique implications for business operations. This article aims to help you navigate these key SaaS financial terms, providing a clear understanding of how they fit into the broader financial picture.

By the end, you'll be better equipped to analyze SaaS financials and communicate effectively with stakeholders.

Bookings, billings, and revenue are key financial metrics in the SaaS industry, each serving a unique role in assessing a company's financial health. Bookings represent the total value of signed contracts, indicating future revenue potential and sales performance. Billings refer to the invoices sent to customers, reflecting amounts to be collected and impacting cash flow management.

Revenue is the actual income recognized from delivered goods or services, providing a measure of financial performance and profitability. Understanding these differences is crucial for making informed business decisions, managing cash flow, and evaluating the company's financial health and growth potential.

Understanding Bookings

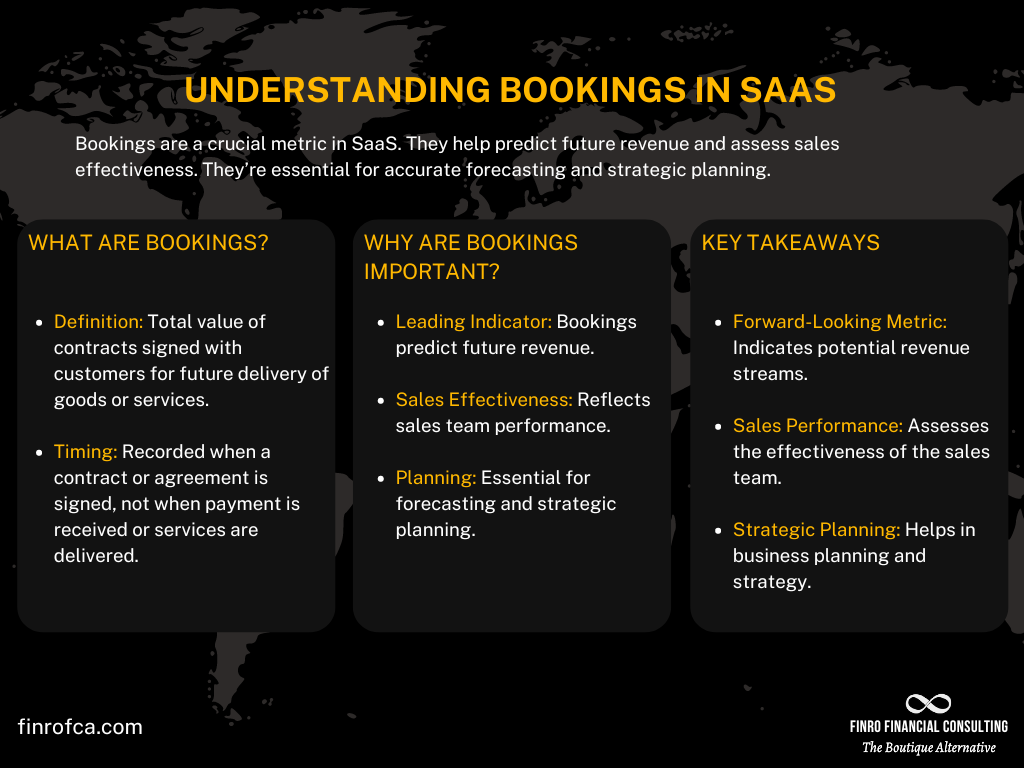

To grasp the distinctions between bookings, billings, and revenue, it’s crucial to start with bookings. Bookings represent the total value of contracts signed with customers for goods or services to be delivered in the future.

This figure reflects a commitment from the customer to make a purchase, often highlighting the effectiveness of the sales team and indicating potential future revenue.

Bookings are recorded when a customer signs a contract or agreement, not when payment is received or the service is delivered. This can include multi-year contracts, where the total value of the deal is considered rather than just the immediate cash flow.

For example, a three-year subscription worth $300,000 is recorded in full at the time of signing, even though the cash will be received over the course of the contract.

Bookings are significant because they are a leading indicator of a company's future revenue. They offer valuable insights into the sales pipeline and the potential growth trajectory of the business.

For SaaS companies, keeping track of bookings is essential for accurate forecasting and strategic planning, as it helps to understand customer demand and evaluate sales performance.

To illustrate, consider these examples:

New Customer Contracts: If a SaaS company signs a new customer for a three-year subscription worth $300,000, the entire amount is considered a booking at the time of signing.

Renewals and Upgrades: Existing customers renewing their contracts or upgrading their plans also contribute to bookings. For instance, if a customer upgrades from a $10,000 annual plan to a $15,000 annual plan, the $5,000 increase is recorded as a booking.

Understanding bookings helps assess the effectiveness of the sales team and the company's future financial health. It's a forward-looking metric that indicates potential revenue streams, allowing businesses to plan and strategize accordingly.

Understanding Billings

To fully understand the financial dynamics of a SaaS business, it's essential to grasp the concept of billings alongside bookings. Billings refer to the invoices sent to customers for goods or services delivered.

This is the amount the company charges its customers at specific intervals, reflecting the cash inflow that supports the company's operational needs.

Billings are recorded when an invoice is issued, not necessarily when the payment is received. This timing is crucial for managing cash flow, as it directly impacts the company's liquidity. For instance, a company might deliver a service in January but send the invoice in February, recording the billing at that time.

The significance of billings lies in their direct impact on cash flow management. Unlike bookings, which indicate future revenue potential, billings show the actual amounts the company expects to collect in the short term. This metric helps businesses understand their immediate financial health and ensures they have the necessary cash to fund operations and growth.

For example, if a SaaS company delivers a software solution to a client in January and sends an invoice for $10,000, this amount is recorded as a billing. Another example could be a monthly subscription service where the company bills customers $1,000 each month. Each of these monthly invoices represents a billing.

Understanding billings is critical for assessing a company's cash flow and operational efficiency. It provides a realistic view of the funds that will be available in the near term, allowing businesses to plan for expenses, investments, and growth strategies effectively.

Understanding Revenue

To complete the understanding of financial metrics in a SaaS business, it's important to delve into the concept of revenue. Revenue represents the actual income recognized from the delivery of goods or services, in accordance with accounting standards. This is the figure that appears on the company's income statement and is crucial for assessing the company’s financial performance.

Revenue is recorded when the service is delivered or the product is provided, not necessarily when the payment is received. This is based on the accrual accounting principle, which recognizes revenue when it is earned. For instance, if a SaaS company provides a service in January but receives payment in February, the revenue is recorded in January when the service was delivered.

The significance of revenue lies in its role as a definitive measure of a company’s financial health and performance. It directly impacts profitability and is a key indicator for investors, stakeholders, and analysts when evaluating the company’s market position and future prospects. Unlike bookings and billings, revenue clearly and accurately reflects the company’s earned income over a specific period.

Consider the following examples to illustrate revenue recognition:

Monthly Subscription Service: If a SaaS company charges $1,000 per month for a service, each month the service is provided, $1,000 is recognized as revenue.

Annual Subscription Paid Upfront: If a customer pays $12,000 upfront for an annual subscription, the SaaS company would recognize $1,000 as revenue each month as the service is delivered.

Understanding revenue is essential for accurately assessing a company’s profitability and financial performance. It provides a realistic view of the income earned from the company's operations, allowing businesses to evaluate their financial health and make informed strategic decisions.

Get your expert support now!

Key Differences Between Bookings, Billings, and Revenue

Understanding the distinctions between bookings, billings, and revenue is crucial for accurately interpreting a SaaS company's financial health and performance.

While these terms are interconnected, they represent different stages of the sales and accounting process.

Bookings vs. Billings vs. Revenue

Bookings: Bookings represent the total value of contracts signed with customers for future delivery of goods or services. This figure reflects the commitments made by customers and indicates potential future revenue.

Bookings are recorded at the time a contract is signed, regardless of when the payment or service delivery occurs. For example, a three-year subscription worth $300,000 is booked in full when the contract is signed.

Billings: Billings refer to the invoices sent to customers for goods or services delivered. This figure reflects the amounts the company charges its customers at specific intervals, impacting cash flow management. Billings are recorded when an invoice is issued, not necessarily when payment is received. For instance, if a service is delivered in January and an invoice is sent in February for $10,000, the billing is recorded in February.

Revenue: Revenue represents the actual income recognized from the delivery of goods or services, in accordance with accounting standards. This figure is recorded when the service is delivered or the product is provided, reflecting the company’s earned income. Revenue is a definitive measure of financial performance, impacting profitability and investor evaluations. For example, if a SaaS company charges $1,000 per month for a service, $1,000 is recognized as revenue each month as the service is delivered.

Impact on Financial Statements

Bookings are not directly reflected on the financial statements but are crucial for forecasting future revenue and assessing sales performance. Billings impact the accounts receivable and cash flow statements, providing insight into the company's liquidity and short-term financial health. Revenue appears on the income statement and is a key indicator of the company's financial performance and profitability.

| Metric | Definition | Timing | Financial Impact |

|---|---|---|---|

| Bookings | Total value of signed contracts | When contract is signed | Indicates future revenue potential |

| Billings | Invoices sent to customers | When invoice is issued | Direct impact on cash flow and liquidity |

| Revenue | Actual income from delivered goods/services | When service/product is delivered | Key measure of financial performance and profitability |

Why Understanding These Differences Matters

Grasping the differences between bookings, billings, and revenue is crucial for anyone involved in the financial aspects of a SaaS company. Though interconnected, these metrics offer unique insights vital for decision-making, performance evaluation, and investor relations.

Decision Making: Understanding the distinctions between these metrics allows for more informed business decisions. Bookings provide a forward-looking view, helping businesses forecast future revenue and plan their growth strategies.

Billings offers a snapshot of the company’s immediate cash flow situation, which is crucial for managing operational expenses and short-term financial planning. Revenue, being the actual earned income, is essential for assessing the company's profitability and overall financial health.

Performance Evaluation: Each metric plays a distinct role in evaluating business performance. Bookings indicate the effectiveness of the sales team and the potential for future growth. High bookings suggest strong sales efforts and growing customer interest.

Billings reflect the company's efficiency in invoicing and collecting payments, directly impacting cash flow management. Revenue is the ultimate measure of the company’s success in delivering value to its customers and generating income.

Investor Relations: Understanding these metrics is critical for investors and stakeholders. Bookings signal future revenue streams and potential growth opportunities, making them a key indicator of the company’s long-term prospects.

Billings provide insights into the company’s cash flow and liquidity, which are essential for assessing financial stability. Revenue offers a clear picture of the company’s financial performance, influencing investment decisions and shareholder confidence.

By understanding these differences, stakeholders can better analyze financial statements, assess business health, and make informed decisions. For SaaS companies, this knowledge is especially important as it helps in aligning business strategies with financial goals, ensuring sustainable growth and profitability.

| Aspect | Bookings | Billings | Revenue |

|---|---|---|---|

| Decision Making | Forecast future revenue, plan growth strategies | Manage operational expenses, short-term planning | Assess profitability, overall financial health |

| Performance Evaluation | Sales team effectiveness, future growth potential | Efficiency in invoicing, cash flow management | Success in delivering value, income generation |

| Investor Relations | Indicate future revenue streams, growth prospects | Insights into cash flow, financial stability | Clear picture of financial performance, investment decisions |

Common Misconceptions and Clarifications

Understanding bookings, billings, and revenue can be challenging due to common misconceptions. Clarifying these misunderstandings is crucial for accurate financial analysis and decision-making in a SaaS business.

Misconception 1: Bookings Equal Revenue One common misconception is that bookings are equivalent to revenue. While bookings indicate the total value of signed contracts and future revenue potential, they do not represent the actual income earned. Bookings are commitments from customers but are not yet realized as revenue. For example, if a company signs a contract for a three-year subscription worth $300,000, the entire amount is recorded as a booking at the time of signing. However, the revenue is recognized over the three years as the service is delivered.

Misconception 2: Billings Always Align with Revenue Another misconception is that billings always align with revenue. Billings refer to the invoices sent to customers, reflecting amounts the company expects to collect. However, these invoices do not necessarily coincide with the period when the revenue is recognized. Revenue is recorded based on the delivery of goods or services, adhering to the accrual accounting principle. For instance, a SaaS company might bill a customer for an annual subscription upfront, but it will recognize revenue monthly as the service is delivered.

Clarifications:

Booking Does Not Mean Immediate Cash Flow: Bookings show the total contract value but do not indicate when the cash will be received. This distinction is vital for understanding future revenue streams versus current cash flow.

Billing Is Not Revenue: Billings impact cash flow and liquidity but do not equate to earned revenue. Revenue recognition depends on when the service is provided, not when the invoice is issued.

Revenue Recognition Follows Service Delivery: Revenue is recognized in alignment with service delivery, regardless of when payment is received or the invoice is issued. This principle ensures that the company’s financial statements accurately reflect its earned income.

By dispelling these misconceptions and understanding the nuances of bookings, billings, and revenue, stakeholders can perform more precise financial analyses and make better-informed business decisions. This clarity is essential for maintaining accurate financial records, ensuring compliance with accounting standards, and effectively communicating financial health to investors and stakeholders.

Conclusion

Understanding the differences between bookings, billings, and revenue is essential for accurately interpreting the financial health and performance of a SaaS company. These metrics, while interconnected, serve distinct purposes and provide unique insights into various aspects of the business.

Bookings represent the total value of signed contracts, reflecting future revenue potential and the effectiveness of the sales team. Billings indicate the invoiced amounts, crucial for managing cash flow and operational expenses. Revenue, as the actual income earned from delivered goods or services, is a definitive measure of financial performance and profitability.

By comprehending these differences, stakeholders can make more informed decisions, evaluate business performance more effectively, and communicate financial health more clearly to investors and other stakeholders. This understanding is not just about technical accounting details but about gaining a comprehensive view of the company's financial dynamics, enabling better strategic planning and sustainable growth.

In summary, mastering the concepts of bookings, billings, and revenue empowers businesses to forecast future revenue accurately, manage cash flow efficiently, and assess profitability with confidence. This knowledge is crucial for driving informed decision-making and achieving long-term success in the SaaS industry.

Key Takeaways

Bookings indicate future revenue potential and sales effectiveness.

Billings reflect invoiced amounts and impact cash flow.

Revenue measures actual earned income and profitability.

Understanding these metrics aids in informed decision-making.

Clear distinctions improve financial analysis and planning.

Answers to The Most Asked Questions

-

Billings refer to the invoices sent to customers for goods or services delivered. This figure reflects the amounts the company charges its customers at specific intervals, impacting cash flow management.

-

SaaS billing involves issuing invoices to customers for the subscription services provided. It reflects the charges for the use of software over a specified billing period, typically monthly or annually.

-

Bookings represent the total value of signed contracts for future delivery of goods or services, indicating potential future revenue. Billings, on the other hand, are the actual invoices sent to customers, reflecting amounts to be collected and impacting cash flow.

-

Bookings represent the total value of signed contracts, regardless of the timeframe. ARR (Annual Recurring Revenue) measures the recurring revenue components of subscription agreements normalized to a yearly amount. ARR focuses on the recurring portion of revenue expected annually, while bookings can include one-time fees and multi-year contracts.

-

Bookings represent the total value of contracts signed, including all future revenue potential. MRR (Monthly Recurring Revenue) is the normalized monthly revenue from recurring subscriptions. While bookings provide a broad view of future revenue commitments, MRR focuses specifically on the monthly recurring income.

-

Bookings represent the total value of signed contracts for future delivery. Backlog refers to the portion of bookings that have been signed but not yet fulfilled or recognized as revenue. Backlog essentially tracks the amount of work that remains to be completed or delivered from the booked contracts.

-

Item description