Breaking Down The TAM-SAM-SOM Model

By Lior Ronen | Founder, Finro Financial Consulting

Are you launching a product or service and wondering how large your market could be? Understanding the potential market size is crucial, and the TAM-SAM-SOM model provides the tools to do just that.

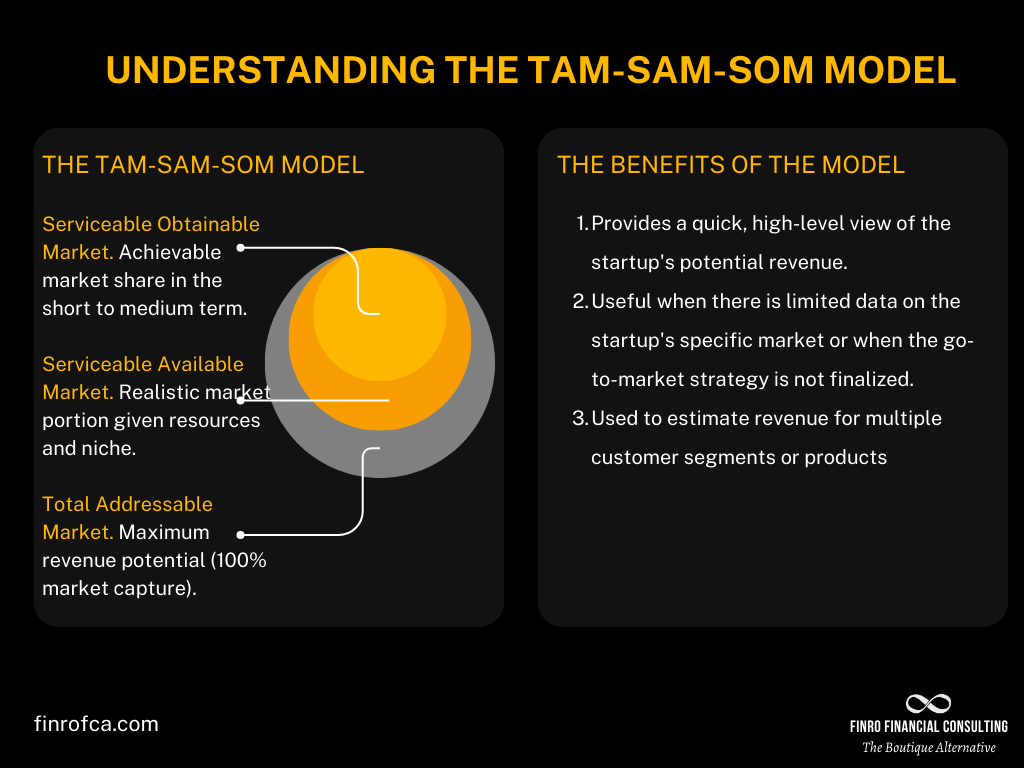

These acronyms stand for Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) — far from mere buzzwords, they are essential for anyone in business.

From entrepreneurs to strategists, these metrics help quantify market opportunities in a clear and focused manner. In this article, we'll break down TAM, SAM, and SOM in simple English.

Understanding these terms is critical for making informed decisions related to product development, marketing strategies, and investment planning.

For instance, consider how a tech startup used TAM to identify a $50 billion opportunity, then narrowed it down using SAM and SOM to strategically capture a $10 billion segment poised for rapid growth. Join us as we clarify these concepts further.

We'll explore how businesses use TAM, SAM, and SOM to measure their market potential and make smart, strategic decisions. It's your guide to understanding and leveraging key market analysis metrics for your advantage.

Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) are pivotal concepts in business strategy for understanding and quantifying market potential. TAM represents the entire market demand for a product or service, offering a view of the maximum potential market. SAM narrows this down to the portion of TAM accessible given a company's specific products, services, and geographic reach.

SOM further refines this to the segment of SAM that a business can realistically expect to capture, taking into account current market competition and constraints. These metrics are essential for businesses in strategic planning, enabling them to set realistic goals, allocate resources effectively, and identify the most lucrative market segments for targeted growth and success.

- What is TAM (Total Addressable Market)?

- What is SAM (Serviceable Available Market)?

- What is SOM (Serviceable Obtainable Market)?

- The Interplay of TAM, SAM, and SOM in Business Strategy

- Biotech Example: Calculating TAM, SAM, and SOM for a Biotech Company

- Enterprise SaaS Example: Applying TAM, SAM, and SOM in Enterprise Software

- Successful Applications of the TAM-SAM-SOM Model

- Conclusion

What is TAM (Total Addressable Market)?

Total Addressable Market (TAM) refers to the total market demand for a product or service. It is the entire revenue opportunity available if a product or service were to be adopted by every potential customer in the market. TAM helps businesses and investors quantify the largest market size and available revenue opportunity.

How to calculate TAM?

To effectively calculate TAM, examining the total population that could feasibly become customers is crucial. This includes not just the current user base but also potential customers across all market segments.

The market is sized by determining the total number of potential buyers and multiplying it by the average expected spend per customer. This process involves making educated assumptions about customer needs, price points, and accessibility to accurately size the market.

For example, if a company manufactures smartwatches, the TAM calculation would consider everyone who could potentially use a smartwatch. This includes current watch users, fitness enthusiasts, and those interested in health monitoring.

With an estimated 200 million potential customers globally and an average price of $200 per smartwatch, the TAM would be 200 million times $200, totaling $40 billion. This figure represents the ultimate revenue potential in the smartwatch market.

The Significance of TAM in Business Strategy

A large, well-quantified TAM is particularly attractive to investors as it indicates significant growth potential for the business. It also aids in strategic planning, setting realistic goals for market penetration, and assessing the overall potential of new ventures. However, it’s important to remain grounded in reality.

An overly optimistic TAM can misrepresent the actual market potential. Accurate TAM calculations require a careful analysis of competition, market dynamics, regulatory factors, and buyer willingness to pay.

Understanding TAM is not just about envisioning the maximum market opportunity; it’s about laying the groundwork for strategic decision-making, providing a clear picture of what’s attainable, and guiding businesses toward sustainable growth.

What is SAM (Serviceable Available Market)?

While Total Addressable Market (TAM) gives a broad view of the market potential, the concept of Serviceable Available Market (SAM) brings a more focused perspective.

SAM refers to the TAM segment that is within the reach of your product or service. Given your current business model, geographic constraints, and resource limitations, this is the part of the market you can truly service.

SAM is about focusing your resources where they can be most effective. Understanding your SAM helps you to:

Target Marketing Efforts: By knowing the market segment you can realistically serve, you can tailor your marketing strategies more effectively.

Resource Allocation: It guides where to allocate your resources, like staff and budget, for the most impact.

Realistic Sales Forecasting: SAM provides a more attainable sales target, helping to set realistic revenue goals.

How to calculate SAM?

Let's consider a company that develops educational software. While the TAM includes all educational institutions globally, the SAM would be more specific.

If the company's software is only in English and complies with U.S. educational standards, the SAM would include only those educational institutions in the U.S. that are seeking English language-based software solutions.

Suppose there are 120,000 such institutions in the U.S., and the average contract value per institution is $10,000. The SAM for this educational software company would then be 120,000 multiplied by $10,000, equating to $1.2 billion.

This figure represents the revenue potential within the company’s serviceable market – a more realistic and attainable target compared to the broader TAM.

What is SOM (Serviceable Obtainable Market)?

After identifying the Total Addressable Market (TAM) and narrowing it down to the Serviceable Available Market (SAM), the next crucial step is understanding the Serviceable Obtainable Market (SOM).

SOM is essentially the portion of SAM that your business can realistically expect to capture. It's not just about the market you can reach, but the market you can actually obtain given your current competitive position, brand strength, and market dynamics.

SOM is integral to business strategy for several reasons:

Realistic Goal Setting: It provides a more realistic target for sales and revenue, considering the competition and your market share.

Focused Efforts: Knowing your SOM helps concentrate efforts on the most achievable market segments.

Resource Optimization: It ensures that resources are not spread too thin over unattainable market areas.

How to calculate SOM?

Imagine a startup that has developed a new fitness app. While the SAM for this app includes all smartphone users interested in fitness in the United States, the SOM is narrower. If the startup has strong competition from established fitness apps and a limited marketing budget, its SOM might be a smaller segment of the SAM.

Let’s say the SAM is estimated at 50 million users, but considering the startup’s current capacity and competitive landscape, it realistically expects to capture about 5% of this market in the first two years.

Therefore, the SOM for the fitness app would be 5% of 50 million, which equals 2.5 million users. This number represents a more achievable target for the startup, guiding its marketing strategies and resource allocation.

Biotech Example: Calculating TAM, SAM, and SOM for a Biotech Company

The biotech industry plays a pivotal role in the healthcare sector, encompassing a wide range of products and technologies to improve human health.

For the purpose of this example, let's consider a biotech company developing a new therapeutic drug for diabetes.

Defining the TAM for Biotech

Total Addressable Market (TAM) for our hypothetical biotech company involves estimating the global demand for diabetes treatments.

To calculate TAM, we start by identifying the total number of diabetes patients worldwide, which, according to recent data, is approximately 463 million.

Assuming an annual treatment cost per patient is $500, the TAM would be 463 million multiplied by $500, totaling approximately $231.5 billion. This figure represents the ultimate revenue potential for diabetes treatments globally.

Narrowing Down to SAM

The Serviceable Available Market (SAM) narrows our focus to the segment of TAM that the biotech company can realistically target. Considering our company's drug is compliant with both U.S. and European regulations, SAM would be limited to these regions.

Assuming there are 60 million diabetes patients in the U.S. and Europe and maintaining the same treatment cost, the SAM would be 60 million times $500, equating to $30 billion. This market segment is accessible given the company’s regulatory capabilities and geographic focus.

Determining the SOM

Serviceable Obtainable Market (SOM) is the segment of SAM that our biotech company is likely to capture. For this, we consider factors such as market competition, the effectiveness of the drug compared to existing treatments, and market entry strategies.

If the company expects to capture 10% of the SAM in the initial years due to competitive advantages like superior efficacy or fewer side effects, the SOM would be 10% of $30 billion, which is $3 billion.

This figure represents a realistic sales target for the company, considering current market dynamics and competitive landscape.

Strategic Implications

Understanding the TAM, SAM, and SOM allows the biotech company to make informed decisions regarding product development, marketing strategies, and resource allocation.

For example, knowing the SOM helps prioritize investment in clinical trials and marketing in the U.S. and European markets. It also guides the company in setting achievable revenue targets, managing investor expectations, and strategically positioning the product in the market.

By applying the TAM, SAM, and SOM framework, biotech companies can strategically navigate the complex healthcare market, focusing their efforts where they are most likely to succeed and ensuring optimal use of resources to maximize market penetration and profitability.

Enterprise SaaS Example: Applying TAM, SAM, and SOM in Enterprise Software

The enterprise Software as a Service (SaaS) market has transformed how companies deploy and manage software applications.

For this example, consider a company specializing in Customer Relationship Management (CRM) software designed for medium to large businesses.

Establishing TAM for Enterprise SaaS

To determine the Total Addressable Market (TAM) for our CRM software, we first consider the global number of medium and large enterprises that could benefit from advanced CRM systems.

With over 200,000 such businesses worldwide and assuming each business spends an average of $50,000 on CRM systems annually, the TAM would be 200,000 enterprises multiplied by $50,000, resulting in a TAM of $10 billion.

This figure represents the total global market potential for CRM software, assuming every potential customer is reached and converted.

Identifying the SAM

The Serviceable Available Market (SAM) is more specific and considers only those markets where the company can realistically sell its CRM software.

Assuming the company's CRM software is tailored to English-speaking markets with compliance to data protection regulations such as GDPR in Europe and similar standards in North America, the SAM would include enterprises in these regions.

If there are 50,000 such enterprises, the SAM calculation would be 50,000 enterprises multiplied by $50,000, totaling $2.5 billion. This narrowed focus helps the company understand where to direct its marketing and sales efforts.

Calculating the SOM

The Serviceable Obtainable Market (SOM) is even more refined and represents the portion of the SAM that the company realistically expects to capture in the near term.

Considering competitive factors, the company’s current market presence, and marketing strategies, let's say the company aims to secure 10% of the SAM over the next three years. Therefore, the SOM would be 10% of $2.5 billion, which equals $250 million.

This figure provides a realistic target for the company's sales team and informs resource allocation to maximize ROI.

Business Strategy Insights

With a clear understanding of TAM, SAM, and SOM, the enterprise SaaS company can align its product development and marketing strategies to the most lucrative market segments.

For instance, knowing the SOM helps in tailoring CRM features to meet the specific needs and compliance requirements of English-speaking markets in Europe and North America. It also aids in focusing customer service and support resources where they can make the most significant impact.

This framework of TAM, SAM, and SOM not only directs where to compete but also highlights where the company should innovate and differentiate its offerings to capture and grow its market share effectively.

This strategic approach ensures that the enterprise SaaS company invests in the most promising opportunities, aiming for sustainable growth and profitability in the competitive SaaS landscape.

The Interplay of TAM, SAM, and SOM in Business Strategy

Understanding the relationship between Total Addressable Market (TAM), Serviceable Available Market (SAM), and Serviceable Obtainable Market (SOM) is crucial for any business aiming to make informed and strategic decisions.

These three metrics are interconnected, and each plays a unique role in guiding business strategy:

TAM provides the broadest view of the market potential for a product or service. It is the total demand in an ideal scenario without considering market constraints.

SAM narrows this view down to the portion of the market that is realistically accessible to your business, considering factors like geographical reach and product/service applicability.

SOM is the most refined metric, representing the portion of SAM that your business can realistically capture or expect to achieve in the near term, given the competitive environment and current market dynamics.

This strategic tiering from TAM to SAM to SOM enables businesses to not only dream big but also plan realistically.

It's a progression from understanding the market in its entirety (TAM), to recognizing the part of the market you can actually serve (SAM), and finally, to focusing on the market segment where you can realistically compete and win (SOM).

Applying TAM, SAM, and SOM in Business Strategy

Market Entry and Expansion: When entering a new market or planning to expand, these metrics provide a roadmap. TAM gives the ultimate potential, SAM guides where to expand, and SOM pinpoints where efforts should be concentrated.

Resource Allocation: Each metric informs how resources like capital, human resources, and marketing efforts should be allocated. For instance, resources should be focused more on the SOM segment for immediate returns while keeping an eye on the broader SAM and TAM for future expansion.

Investment and Funding: These metrics are critical for attracting investors. A clear understanding of TAM, SAM, and SOM demonstrates a business's potential growth, realistic market capture, and strategic foresight, making it an attractive investment opportunity.

Successful Applications of the TAM-SAM-SOM Model

1. Tech Giant in the Smartphone Industry

TAM: Global market for smartphones.

SAM: Smartphones compatible with high-speed internet services in developed markets.

SOM: Young adults in urban areas with a preference for high-end smartphones.

Application: This tech giant initially focused on high-end markets (SOM) before gradually expanding. Their strategy included creating products tailored for their SOM, which helped them establish a strong brand presence and then expand into broader markets.

2. Online Education Platform

TAM: Global market for online education.

SAM: English-speaking regions with reliable internet access.

SOM: Professionals seeking career advancement in the United States.

Application: By focusing its marketing and course development on career-oriented professionals in the U.S. (SOM), the platform could establish a strong foothold in a niche market. This targeted approach allowed for tailored marketing strategies and course offerings, leading to significant market penetration.

3. Sustainable Clothing Start-up

TAM: Worldwide apparel and fashion industry.

SAM: Environmentally-conscious consumers in Europe and North America.

SOM: Young adults in urban areas interested in sustainable fashion.

Application: The start-up focused its initial efforts on fashion-forward, environmentally-conscious young adults in specific urban centers. By targeting this SOM with specialized marketing campaigns and eco-friendly product lines, the company successfully built brand loyalty and gradually expanded its reach.

These case studies demonstrate the practical application of the TAM-SAM-SOM model in various industries. By understanding and applying these concepts, companies were able to strategically enter the market, focus their efforts, and expand their business successfully.

| Aspect | TAM | SAM | SOM |

|---|---|---|---|

| Definition | Total potential revenue from everyone in the market. | Portion of TAM within your geographic and service reach. | Part of SAM realistically achievable given current constraints. |

| Focus | Broadest market view, disregarding constraints. | Focuses on reachable market segment. | Most attainable market segment, considering competition. |

| Use in Business | For long-term strategic planning and vision setting. | Guides targeted marketing and resource allocation. | Sets realistic sales targets and short-term goals. |

| Importance | Essential for understanding overall market opportunity. | Important for defining operational scope and strategy. | Critical for achievable forecasting and operational planning. |

| Example | EV maker considering global demand for all vehicles. | Same maker focusing on EV-friendly countries. | Targeting regions with strong network and brand recognition. |

Conclusion

Throughout this article, we've explored the TAM-SAM-SOM model, a fundamental framework for analyzing market potential in business strategy.

Starting with a broad perspective of Total Addressable Market (TAM), which illustrates the ultimate market opportunity for a product or service, we narrowed our focus to the Serviceable Available Market (SAM) and then to the most attainable segment, the Serviceable Obtainable Market (SOM).

Our journey through the model provided not only a theoretical understanding but also practical insights through detailed examples from the biotech and enterprise SaaS industries.

The biotech example demonstrated how a company can strategically navigate a complex and highly regulated market by accurately estimating the global demand for diabetes treatments and then honing in on realistically accessible and obtainable markets in the U.S. and Europe.

This approach helps in prioritizing research and marketing investments, guiding strategic decisions that align with regulatory and market realities.

Similarly, the enterprise SaaS example illustrated the application of the TAM-SAM-SOM model in the tech-driven business sector. By focusing on CRM software tailored for medium to large businesses in English-speaking, GDPR-compliant regions, the company could effectively align its product development and marketing strategies with the most lucrative market segments.

This targeted approach ensures that efforts and resources are concentrated where they have the highest potential for returns, enhancing the company's ability to compete and grow in the competitive SaaS landscape.

These practical applications show that whether in biotech, enterprise SaaS, or any other industry, the TAM-SAM-SOM model is instrumental in guiding companies through the complexities of market analysis.

It provides a structured method for businesses to visualize and strategize their market entry and expansion, helping them set realistic goals, allocate resources wisely, and maximize their market penetration.

In conclusion, mastering the TAM-SAM-SOM model is crucial for any business, from startups to established enterprises, looking to navigate their market landscapes effectively.

By understanding and applying this model, businesses can ensure that their strategic planning is not just based on ambitious market potential but is grounded in what is realistically achievable, paving the way for sustained growth and success.

Key Takeaways

Understanding Market Potential: TAM-SAM-SOM provides a structured approach to assessing total, accessible, and obtainable market opportunities.

Strategic Planning Tool: These metrics guide businesses in setting realistic goals, focusing resources, and planning market entry and expansion.

Resource Allocation: SAM and SOM help companies pinpoint where to concentrate marketing and development efforts for maximum impact.

Investor Attraction: Clearly defined TAM, SAM, and SOM can demonstrate growth potential and operational strategy to prospective investors.

Industry Applications: The model is versatile, aiding strategic decisions across various industries like biotech and enterprise SaaS.

Answers to The Most Asked Questions

-

SOM (Serviceable Obtainable Market) is smaller than SAM (Serviceable Available Market) because SOM represents the portion of SAM that a company can realistically expect to capture, taking into account factors like competition, market share, and current market dynamics.

-

TAM (Total Addressable Market): This is the total market demand for a product or service, representing the entire revenue opportunity if a product or service were adopted by every potential customer in the market.

SAM (Serviceable Available Market): This is the portion of TAM that is realistically accessible to a company, considering factors like geographic reach and product/service applicability.

SOM (Serviceable Obtainable Market): This is the segment of SAM that a company can realistically expect to capture in the near term, considering competitive dynamics and current market share.

-

No, SAM cannot be larger than TAM. SAM is a subset of TAM, representing only the part of the total addressable market that is accessible to a company based on its current capabilities and market reach. Thus, by definition, SAM is always equal to or smaller than TAM.