What is Monthly Recurring Revenue (MRR)?

By Lior Ronen | Founder, Finro Financial Consulting

When we talk about the success of a business, especially those that offer subscription services like streaming platforms or software companies, one important term often comes up: Monthly Recurring Revenue, or MRR.

In simple words, MRR is the total amount of money a business can reliably expect to receive every month from its customers who pay for its services or products on a recurring basis.

MRR isn't just a number; it's a powerful business planning tool. It helps them understand how much stable and predictable income they generate, which is essential for making informed decisions about the future and facilitating steady growth.

Unlike businesses that rely heavily on one-time sales, companies focused on MRR can forecast their income more reliably and take a longer-term approach to planning.

In this article, we will explore what exactly MRR is, how it's calculated, and why it's so vital for certain types of businesses to understand, especially those with subscription-based models.

Monthly recurring revenue (MRR) refers to the reliable, predictable income a business can expect from ongoing customer subscriptions and renewals month-to-month. Calculating and monitoring MRR is crucial for companies with subscription models as it directly impacts their financial planning and provides insight into satisfaction and churn risks. Changes in expansion vs contraction MRR signify business health and growth trends.

While valuable for any business with regular customer payments, MRR is an essential metric in subscription-centric industries like SaaS and media streaming. Tracking MRR gives decision makers the pulse on revenue stability, which ultimately impacts budgets, resourcing and long-term profitability. Business leaders in 2023 need to have a solid grasp of what MRR entails and why it serves as an important health barometer for modern online service companies.

Understanding MRR

Monthly Recurring Revenue (MRR) refers to the predictable revenue that a business generates each month from ongoing customer subscriptions or other recurring payment plans.

In simpler terms, MRR represents the amount of money that a company can reliably expect to receive from these recurring revenue streams monthly.

For many businesses, especially subscription-based companies like SaaS or media streaming platforms, understanding and tracking MRR is vital. MRR helps businesses predict how much stable and recurring income they can count on each month. This aids in budgeting, cost projections and other financial planning.

Monitoring MRR over time provides insight into customer loyalty, churn rates, and whether the business is growing sustainably.

MRR is often a key performance indicator (KPI) for businesses with subscription models, assessing the overall health of the business.

When it comes to MRR, there are a few categories to be aware of:

Gross MRR - The total amount of recurring revenue from all customers before accounting for discounts, failed payments, refunds etc.

Net MRR - The actual recurring revenue the business can expect to receive each month after factoring in discounts, churn, failed transactions etc. This represents the true reliable recurring income.

Expansion MRR - Refers to the MRR added when existing customers purchase higher tiers of service, additional features or new product packages. This is key for sustainable business growth.

Contraction MRR - The opposite of expansion MRR, this is the MRR lost when customers downgrade or cancel part of their subscription. Businesses aim to minimize contraction MRR by limiting churn.

Analyzing these different MRR categories provides fuller insight into the financial health and growth velocity of a subscription business.

| Type of MRR | Definition | Significance in Business | Calculation Method |

|---|---|---|---|

| New MRR | Revenue from new customers acquired in the month. | Indicates the business's success in attracting new customers. | Sum of the monthly fees from new subscribers. |

| Expansion MRR | Additional revenue from existing customers, usually from upgrades or additional services. | Reflects customer satisfaction and loyalty, as it shows existing customers are willing to spend more. | Total increase in MRR due to existing customers upgrading or purchasing more services. |

| Churned MRR | Revenue lost due to customers canceling or downgrading their subscriptions. | Crucial for understanding retention challenges and customer satisfaction issues. | Total decrease in MRR from customers who cancel or downgrade their subscriptions. |

| Net New MRR | The actual growth in MRR, considering new, expansion, and churned MRR. | Provides a clear picture of the overall business growth or contraction. | New MRR + Expansion MRR - Churned MRR. |

| Reactivation MRR | Revenue from customers who re-subscribe after having previously canceled. | Indicates the effectiveness of re-engagement strategies and the ongoing appeal of the product or service. | Sum of the monthly fees from customers who have reactivated their subscriptions. |

How MRR is Calculated?

Calculating Monthly Recurring Revenue (MRR) is straightforward. At its core, MRR is calculated by multiplying the monthly subscription fee by the number of subscribers.

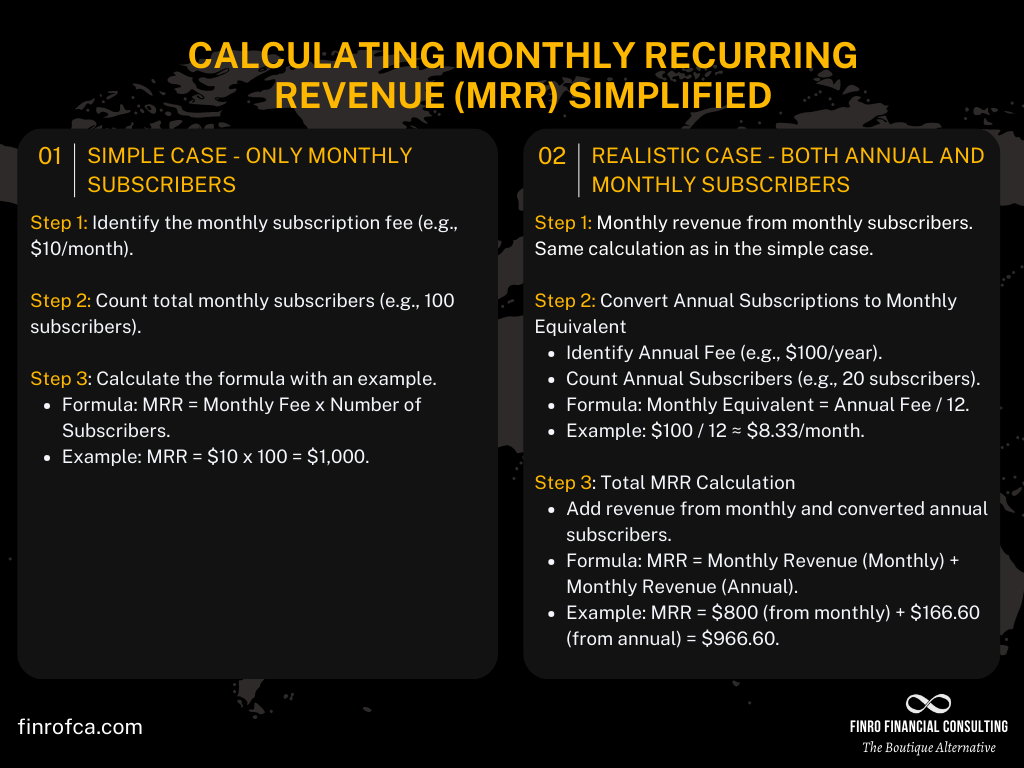

In this section we will break the MRR calculation into 2 different cases: the simple case, where the company has only monthly subscribers, and the realistic case, where the company has both annual and monthly subscribers.

Simple Case: Only Monthly Subscribers

In the simplest scenario, where all subscribers are billed monthly, calculating MRR is straightforward. Here's how you do it:

Step 1: Identify the Monthly Subscription Fee: Determine each subscriber's monthly fee. Let's say it's $10 per month.

Step 2: Count the Total Number of Monthly Subscribers: Count how many subscribers are paying the monthly fee. Suppose there are 100 subscribers.

Step 3: Calculate MRR: Multiply the monthly fee by the total number of subscribers.

MRR = Monthly Subscription Fee x Number of Subscribers

So, in this case:

MRR = $10 x 100 = $1,000. The MRR in this simple case would be $1,000.

Realistic Case: Monthly and Annual Subscribers

In a more realistic scenario, a company might have a mix of annual and monthly subscribers. To calculate MRR in this situation, you need to first convert the annual subscriptions to their monthly equivalent before adding them to the monthly subscriptions.

Step 1: Calculate Monthly Revenue from Monthly Subscribers: This is done as in the simple case. Suppose you have 80 monthly subscribers each paying $10.

Monthly Revenue from Monthly Subscribers = $10 x 80 = $800

Step 2: Calculate Monthly Equivalent of Annual Subscriptions:

Identify the Annual Subscription Fee: Assume it's $100 per year.

Count the Total Number of Annual Subscribers: Let's say there are 20 annual subscribers.

Convert the Annual Fee to a Monthly Equivalent:

Monthly Equivalent = Annual Subscription Fee / 12

So, for each annual subscriber: Monthly Equivalent = $100 / 12 ≈ $8.33

Calculate the Total Monthly Revenue from Annual Subscribers:

Monthly Revenue from Annual Subscribers = Monthly Equivalent x Number of Annual Subscribers

Which is: Monthly Revenue from Annual Subscribers = $8.33 x 20 ≈ $166.60

Step 3: Calculate Total MRR: Add the monthly revenue from both monthly and annual subscribers.

MRR = Monthly Revenue from Monthly Subscribers + Monthly Revenue from Annual Subscribers.

Thus:

MRR = $800 + $166.60 = $966.60

Therefore, for a business with both monthly and annual subscription plans, you must account for revenue from both streams when calculating total MRR.

Importance of MRR in Business

Understanding Monthly Recurring Revenue (MRR) is crucial for businesses, especially those with subscription-based models.

MRR isn't just about tracking income; it's a key indicator of a company's health and future prospects. Here's why it's so important:

Predictable Revenue Stream:

Consistency: MRR provides a steady and predictable stream of income. Unlike one-time sales, which can fluctuate significantly, MRR comes from ongoing customer subscriptions. This consistency allows businesses to know how much revenue they can expect each month.

Reliability: With this predictable income, companies can make informed decisions about investing in new projects, hiring staff, or expanding operations. It reduces the uncertainty that often comes with variable income streams.

Role in Budgeting and Forecasting:

Financial Planning: MRR is a powerful tool for financial planning. It helps in creating more accurate budgets because businesses have a clearer idea of the revenue they will receive each month.

Future Projections: MRR also aids in forecasting future revenue. By analyzing trends in MRR, companies can predict growth and make strategic decisions about where to allocate resources for maximum impact.

Measuring Business Growth and Stability:

Growth Indicator: An increasing MRR is a sign of business growth. It means more customers are subscribing or existing ones are upgrading their plans.

Stability Metric: Conversely, a stable or only slightly fluctuating MRR indicates a stable customer base, which is equally important. It shows that the business isn’t losing customers at a high rate, a key factor in long-term sustainability.

Health Check: Regularly monitoring MRR can also act as a 'health check'. It can alert businesses to potential problems, like a high churn rate, giving them a chance to address these issues before they escalate.

MRR offers a comprehensive snapshot of a company's financial health.

It’s not just a revenue metric; it's a lens through which businesses can view their past, manage their present, and plan for their future. For subscription-based businesses, mastering MRR is a stepping stone towards achieving long-term success and stability.

| Aspect of MRR | Importance in Business | Key Points |

|---|---|---|

| Predictable Revenue Stream | Ensures steady income and reduces uncertainty. |

|

| Role in Budgeting and Forecasting | Aids in financial planning and future revenue projections. |

|

| Measuring Business Growth and Stability | Indicates company growth and highlights potential problems early. |

|

A Real-Life Example

In this example, we will calculate the monthly recurring revenue (MRR) for a subscription business with multiple plan types and billing cycles. However, we will first start by determining the average revenue per user (ARPU).

Calculating ARPU is an important intermediate step because it allows us to quantify the average monthly revenue generated per customer. Some customers may pay monthly while others pay annually, so calculating a blended ARPU helps normalize this before multiplying by total subscribers to derive MRR.

Additionally, breaking out ARPU by plan provides insight into the revenue profile of each offering. Therefore, ARPU gives a helpful cross-sectional revenue view before aggregating to the overall MRR figure.

We'll start by calculating the monthly Average Revenue Per User (ARPU).

Part 1: Monthly plans:

Plan #1: 51 subscribers. Each one pays $65 per month.

Plan #2: 50 subscribers. Each one pays $95 per month.

Plan #3: 10 subscribers. Each one pays $125 per month.

Plan #4: 4 subscribers. Each one pays $95 per month.

ARPU for the monthly plan is a weighted average of the monthly prices, with the number of customers (or paying subscribers) as the weight:

[(51 * $65) + (50 * $95) + (10 * $125) + (4 * $95)] / 115 = $87.09

Part 2: Annual plans:

To calculate the monthly ARPU of the annual plan subscribers, we'll divide the yearly price by 12:

Plan #5: 150 subscribers. Each one pays $702 per year, equivalent to $59 per month.

Plan #6: 120 subscribers. Each one pays $1,026 per year, equal to $86 per month.

Plan #7: 35 subscribers. Each one pays $1,350 per year, equivalent to $113 per month.

Plan #8: 15 subscribers. Each one pays $1,890 per year, equal to $158 per month.

The ARPU for the annual plan subscribers is a weighted average of the monthly prices, with the number of subscribers as the weight:

[(150 * $59) + (120 * $86) + (35 * $113) + (15 * $158)] / 320 = $79.17

Now we have an insight into the ARPU of each plan and each subscriber category (annual vs. monthly).

If we want to look at the overall ARPU of the company, we need to calculate a weighted average of the ARPUs, with the number of subscribers as the weight:

[(115 * $87.09) + (320 * $79.17)] / 435 = $81.26

To get to the MRR, we need to multiply the ARPU by the number of subscribers.

So the monthly plan MRR is 115 * $87.09 = $10,015. The annual plan MRR is 320 * $79.17 = $25,335

The total MRR is 435 * $81.26 = $35,550

Therefore, by calculating blended ARPU across plans and subscriber types, determining total subscribers, and factoring appropriately, we can derive the total monthly recurring revenue the business can expect, which in this case is $35,550.

MRR Importance Across Niches

Software/SaaS

SaaS companies provide software solutions to customers via subscription licensing models rather than one-time sales. Since revenue relies entirely on recurring subscription payments, SaaS businesses use MRR to assess predictable income to cover ongoing R&D and operating expenses.

Analyzing expansion MRR shows satisfaction and upsell opportunities. ARR (annual recurring revenue) also matters for yearly budgeting, but has less importance for month-to-month sustainability.

Media Streaming

Streaming platforms offer on-demand video/audio content via paid subscription memberships. MRR helps quantify reliable income to license and produce new shows and movies.

Contraction MRR indicates churn risk, so minimizing this via retention features is essential. Closely related is Monthly Churn Rate, with lower churn meaning higher platform loyalty.

Cloud Services

Cloud computing providers offer paid access to hosted storage, compute resources, and other IT services. MRR provides insight into client budgets and platform usage trends. Sudden compute service MRR growth could signal a major new client product launch.

Average Revenue Per User (ARPU) is also useful but doesn’t account for client spend variability over time like MRR.

Ecommerce

Online retail stores generate recurring revenue through auto-renewal subscriptions for enhanced buyer benefits. Tracking this renewal MRR helps ecommerce players fund continuity marketing programs and new service development.

However, one-time sales still dominate revenue, so metrics like Conversion Rate and Lifetime Value are equally if not more important.

In summary, while universally important, companies in complimentary or entirely subscription-centered businesses rely especially heavily on monitoring MRR trends to gauge overall health, stability and growth velocity.

| Niche | Definition | MRR Use & Importance | Secondary KPI |

|---|---|---|---|

| Software/SaaS | Companies providing software solutions via subscription licensing models | Assess predictable income to cover expenses. Expansion MRR shows satisfaction and upsells. | ARR for yearly budgeting |

| Media Streaming | Platforms offering on-demand video/audio via paid subscriptions | Quantify reliable income to license and produce content. Minimize contraction MRR and churn. | Monthly Churn Rate |

| Cloud Services | Providers offering hosted storage, compute resources via subscription | Insight into client budgets and usage trends. Sudden MRR changes can indicate major launches. | ARPU, but doesn't show spend variability trends |

| Ecommerce | Online retail stores with auto-renewal subscriptions for buyer benefits | Funds continuity marketing programs and service development. But one-time sales still dominate. | Conversion Rate, Lifetime Value |

Conclusion

As we have explored, monthly recurring revenue (MRR) is a crucial metric, especially for subscription-based businesses. Calculating MRR by factoring in subscriber counts, billing cycles, and subscription fees provides visibility into the predictable income a company can rely on.

Monitoring a business's MRR is invaluable for financial planning, budgeting costs, and making smart resourcing decisions. Comparing expansion and contraction MRR indicates satisfaction levels and churn risks. For subscription models, expanding MRR sustainably is tied directly to the health of the business.

While MRR means something different across industries, it is universally valuable for businesses with recurring customer payments. SaaS, cloud services, media streaming and other subscription-centered companies rely heavily on MRR as a pulse on the stability of their revenue stream.

In today's world of online services, subscriptions and renewals, MRR has become a key performance indicator that all business leaders need to be fluent in. Understanding what goes into this metric and why it matters is essential for planning, decision making and ultimately for steering companies towards growth and profitability.