Startup Valuation: 409A vs. Fundraising Valuations

By Lior Ronen | Founder, Finro Financial Consulting

When you're running or investing in a startup, knowing how much the company is worth is crucial. But there are 2 totally different ways to answer the question of how much the business is worth.

In this article, we discuss two ways to determine a startup's value: 409A Valuations and Fundraising Valuations.

These two types of valuations are used for different reasons.

A 409A Valuation is needed for tax reasons and helps decide the price of stock options for employees. It follows specific rules set by the U.S. tax laws.

On the other hand, a fundraising valuation is used when a startup is getting an investment.

It helps decide how much money investors will give and how much of the company they will own.

Understanding these valuations is very important for anyone involved in a startup. It helps make better choices about money and business plans and ensures the company follows the law.

In this article, we'll explain each type of valuation, how they are different, and why they are important. This information will be helpful whether you are starting a company, working at one, or investing in one.

It will give you a clearer picture of how startup value is calculated and managed.

In the startup world, two key types of valuations play pivotal roles: 409A Valuations and Fundraising Valuations. 409A Valuations are essential for determining the strike price of employee stock options, ensuring compliance with tax laws and offering fair compensation to employees. On the other hand, Fundraising Valuations are crucial during investment rounds, setting the company's value in the eyes of investors and influencing how much equity is exchanged for funding.

While 409A Valuations are characterized by their adherence to regulatory standards and conservative approach, Fundraising Valuations are more dynamic, driven by market conditions, investor interest, and the company’s growth potential. Both valuations, with their distinct methodologies and impacts, are integral to a startup's financial strategy, influencing everything from employee motivation to the company's ability to secure vital capital for growth.

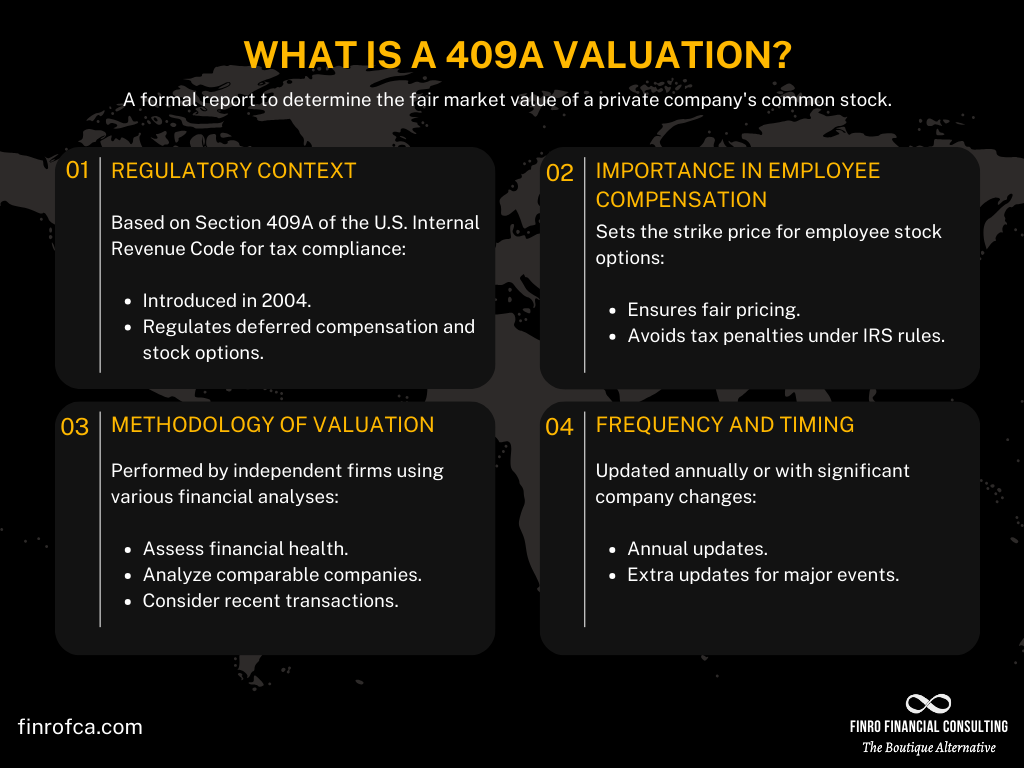

What is a 409A Valuation?

A 409A Valuation is a formal report that determines the fair market value of a private company's common stock.

It's named after Section 409A of the U.S. Internal Revenue Code, which requires companies to ensure their stock options are issued at a price that is at least equal to the stock's fair market value. This valuation is critical to avoid tax penalties for both the company and its employees.

The legal and regulatory context of a 409A Valuation is deeply rooted in tax compliance. Introduced in 2004, Section 409A was a response to corporate scandals and aimed to regulate the deferred compensation paid to employees, including stock options.

The law's intention is to ensure that companies cannot issue stock options at artificially low prices to benefit employees without facing tax consequences.

In the context of stock options and employee compensation, a 409A Valuation holds immense importance. When a company issues stock options to employees, the 409A Valuation sets the "strike price" — the price at which employees can buy the stock in the future. If the strike price is lower than the fair market value, employees might face significant taxes under the IRS rules.

The key elements and methodology of a 409A Valuation typically involve an assessment of the company’s financial health, an analysis of comparable companies, and a consideration of recent transactions.

An independent valuation firm often performs this analysis to ensure objectivity and compliance. They may use various methods, like the cost, market, or income approaches, to determine the fair market value.

The frequency and timing of 409A Valuations are also crucial. Generally, a 409A Valuation is updated annually.

However, if there are significant events that could affect the company's value — such as a new funding round, a major change in business model, or considerable market shifts — a new valuation may be required to reflect these changes accurately.

In summary, a 409A Valuation is an essential tool for private companies, ensuring compliance with tax laws and fairness in employee compensation through stock options. Its role in aligning stock option pricing with fair market value not only adheres to legal standards but also instills confidence in the company’s financial practices.

What is a Fundraising Valuation?

A Fundraising Valuation is a process used by startups and growth companies to determine their value during investment rounds.

Unlike 409A Valuation, which focuses on tax compliance and internal stock options, Fundraising Valuation is about setting a value for the company in the eyes of external investors. It's a key element in equity financing, as it influences how much money investors will give and how much of the company they will own in return.

Fundraisingvaluation plays a central role in investment rounds. It's the basis for negotiations between a startup and potential investors.

The outcome of this valuation affects how much equity a company needs to give up to secure funding. It's essential for startups seeking capital through selling shares to investors, whether in early seed rounds or later-stage funding.

Factors Influencing Fundraising Valuation Several factors influence this type of valuation:

Market Demand: Investor interest and market trends heavily impact valuation.

Company Performance: Revenue, growth potential, and profitability are key.

Competitive Landscape: The company's position relative to competitors.

Industry Trends: Overall health and trends in the industry sector.

The methodology for Fundraising Valuation is often more flexible and subjective compared to 409A Valuation. It involves negotiation and market dynamics.

Common approaches include comparing similar companies (comparables), projecting future cash flows (discounted cash flow analysis), and considering recent investments made in the company at a specific valuation (post-money valuation).

Unlike the annual or event-driven frequency of 409A Valuations, Fundraising Valuations are conducted during each investment round. The timing can be less predictable and is often driven by the company's need for new capital or a strategic opportunity in the market.

In conclusion, Fundraising Valuation is a critical process for startups seeking investment. It’s a negotiation-driven and market-influenced assessment that determines how much of the company's equity is exchanged for crucial funding.

Understanding the nuances of this valuation is vital for entrepreneurs and investors alike, as it shapes the financial structure and ownership of a growing company.

Comparing 409A Valuation and Fundraising Valuation

While both 409A valuation and fundraising Valuation are crucial for startups, they serve different purposes and follow distinct methodologies.

Understanding these differences is key for startup founders and investors:

| Aspect | 409A Valuation | Fundraising Valuation |

|---|---|---|

| Purpose | Set stock option prices | Determine investor equity value |

| Methodology | Independent, considers finances | Subjective, market-driven |

| Use | Fair stock value for options | Share pricing for funding |

| Frequency | Annual or major changes | Each funding round |

Purpose

409A Valuation: Primarily used for internal purposes, specifically to set the price for employee stock options. This valuation ensures compliance with IRS regulations and helps companies avoid tax penalties.

Fundraising Valuation: Focuses on external factors, primarily used for determining the company’s value in the eyes of investors. This valuation is crucial during funding rounds as it dictates the amount of money investors will give and the share of the company they receive.

Methodology:

409A Valuation: Conducted by an independent party, it often involves a thorough analysis of the company’s financial health, market comparables, and business projections. This method aims for an objective assessment of fair market value.

Fundraising Valuation: Tends to be more subjective and influenced by market conditions, investor interest, and negotiation skills. It reflects what investors are willing to pay based on potential future growth and the competitive landscape.

Impact:

409A Valuation: Directly impacts the employees as it sets the strike price for stock options. A fair and accurate 409A Valuation protects employees from potential tax issues.

Fundraising Valuation: Has a significant impact on the ownership and financial structure of the company. A higher valuation in fundraising means less equity given up for the same amount of capital.

Frequency:

409A Valuation: Typically updated annually, or when significant events affect the company’s value. This consistency helps maintain compliance and reflects changes in the company’s financial status.

Fundraising Valuation: Conducted with each round of funding or investment negotiation, making it more sporadic and aligned with the company's capital needs.

In summary, while both 409A and fundraising valuations assess a company's value, they do so for different stakeholders and purposes.

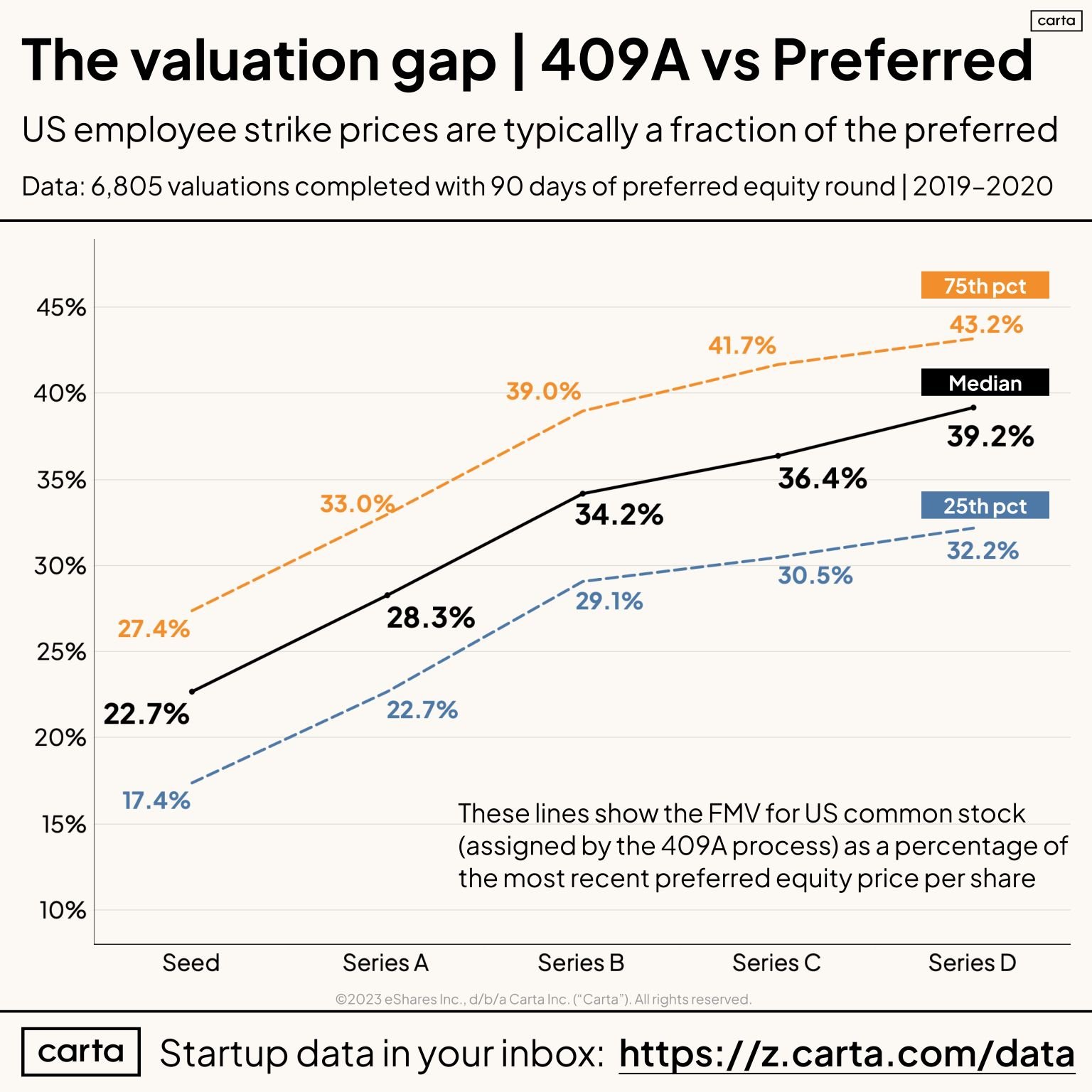

As a rule of thumb, the 409A valuation will always be lower than your funding round valuation. The funding round valuation is a market-driven process that establishes the company's worth in the eyes of investors, while the 409A Valuation is a regulatory requirement focused on internal fairness.

The Crucial Role of 409A Valuations in Setting Stock Option Strike Prices

As we've discussed, 409A valuations are essential in determining the strike price for stock options offered to employees and service providers. Let’s delve into why this is crucial for everyone involved.

The strike price is the cost at which employees can purchase company stock through their options. Getting this price correctly aligned with the fair market value—the real price of the stock—is vital for several reasons:

Compliance with Tax Regulations: Setting the strike price at or above the fair market value helps the company adhere to tax laws, thus avoiding potential penalties. This compliance is beneficial not just for the company but also for the recipients of the stock options.

Incentivizing Performance: When the strike price mirrors the fair market value, it serves as a motivational tool. Employees and service providers are incentivized to contribute to the company's growth, knowing that an increase in stock value can lead to personal financial gain.

Attracting and Retaining Talent: A robust stock option program, rooted in a reliable 409A valuation, is a powerful strategy for attracting and retaining skilled individuals. Fair and reflective strike prices make stock options more appealing, as they genuinely represent the company's value.

In essence, the 409A valuation is not just a compliance tool; it's a strategic element in employee compensation and motivation.

Beyond Compliance to Strategic Planning Understanding the importance of 409A valuation and its role in setting stock option prices is crucial for companies. It ensures that their stock compensation plans are not only legally compliant but also effective as a tool for talent management and motivation.

Differentiating from Fundraising Valuation It's important to remember that a 409A valuation differs from a fundraising round valuation. Each serves distinct purposes in the financial strategy of a company. Understanding these differences is key to making informed business decisions.

While 409A valuations are pivotal for internal compensation strategies, fundraising valuations play a major role in external investment activities. Mastering both is crucial for the holistic growth and operation of a company.

Why Fundraising Round Valuations Are Generally Higher Than 409A Valuations?

These two types of valuations, though serving different purposes, often yield different results, with fundraising valuations typically being higher.

Here's an exploration of why this disparity exists, but first, let’s recap the purpose of each type of valuation.

Fundraising valuation is focused on preferred shares, which come with additional rights and protections, making them more valuable than common shares.

409A valuations concentrate on common shares, which lack the extra benefits of preferred shares.

Liquidation Preferences and Risk Assessment: In scenarios like a company sale or liquidation, preferred shares often have 'liquidation preferences'. This means investors holding these shares are paid first, reducing their risk and thereby increasing the value of these shares during fundraising valuations.

Anti-Dilution Provisions: Preferred shares typically include anti-dilution provisions to protect investors from losing value if new shares are issued at lower prices in the future. This protective measure further elevates the value of preferred shares in fundraising rounds.

Growth Expectations and Market Potential: Fundraising valuations are heavily influenced by the company’s projected growth and market potential. Investors willing to bet on a company's future success often agree to higher valuations during fundraising rounds, factoring in the company's promising prospects.

Negotiations and Market Dynamics: The outcome of a fundraising valuation emerges from negotiations, considering market trends and competition. Investors' willingness to pay more for a share in a promising company often results in higher valuations.

Conservative Approach of 409A Valuations: Valuations In contrast, 409A valuations are typically more conservative. They aim to set fair stock option prices and ensure tax compliance. Independent appraisers strive for a fair market value that avoids tax complications, often leading to a lower valuation compared to fundraising rounds.

Therefore, it's not uncommon to see higher valuations in fundraising rounds compared to 409A valuations. However, it's important to recognize that each type of valuation serves its unique purpose, and the specific circumstances of a company can influence these outcomes.

Conclusion

In this article, we talked about two ways to figure out how much a startup is worth: 409A Valuations and Fundraising Valuations. Each type has its own job and helps the startup in different ways.

409A Valuations make sure the price of stock options for employees is fair and follows tax rules.

This keeps both the company and its workers safe from tax problems. Fundraising Valuations, on the other hand, are used when a startup wants to raise money. They help decide how much the company is worth to investors and how much money they should give for a part of the company.

Both of these valuations are important for a startup.

They help the company in different situations: one with its employees and taxes, and the other with getting money from investors.

Knowing about both is really helpful for anyone in a startup. It helps make good choices and keeps the company on the right track.

As startups keep growing and changing, it's important to understand these valuations. They guide companies in making smart decisions for their future.