What are Valuation Caps in Convertible Notes?

By Lior Ronen | Founder, Finro Financial Consulting

Convertible notes are a popular startup financing instrument typically used in the early stages of the startup’s life. They offer a blend of debt and equity characteristics that appeal to both founders and investors.

At the heart of this mechanism lies a crucial component known as the "valuation cap," a term that often surfaces in discussions about early-stage investments but can be shrouded in complexity.

Convertible notes are short-term debt instruments that convert into equity, typically at the time of a future financing round. They offer startups a way to raise funds without immediately setting a valuation, which can be particularly advantageous in the early stages when valuing a company is challenging and subjective.

The valuation cap is a key feature in this equation.

It serves as a protective measure for investors, ensuring they receive a fair share of the company in return for their early backing, regardless of the startup's future success and valuation. Essentially, it sets a maximum valuation at which the invested funds will convert into equity, benefitting investors in scenarios where the company's value increases significantly.

In this article we will explore the significance of the valuation caps, how they function, and the impact they have on both investors and startup founders.

By breaking down this concept, we aim to provide a comprehensive understanding that is crucial for navigating the intricacies of early-stage funding.

Convertible notes are a key financial instrument in early-stage startup financing, blending debt and equity characteristics. They enable startups to raise funds without immediate valuation, with valuation caps serving as a safeguard for investors against excessive dilution.

The article discusses the determination of valuation caps, their advantages and challenges for both investors and startups, and the negotiation process involved. It also explores alternatives to valuation caps, such as discount rates, highlighting their distinct functions and impacts in startup investment scenarios. This information is essential for understanding the strategic use of convertible notes in the startup ecosystem.

Understanding Convertible Notes

Convertible notes are a cornerstone in startup financing, particularly in the early stages of a company's growth. They are essentially debt instruments that provide a unique flexibility: the ability to convert into equity at a later stage, typically during a subsequent funding round. This hybrid nature makes them a preferred choice for startups and investors navigating the uncertainties of early business valuation.

At its core, a convertible note is a loan. Like any loan, it accrues interest over time. However, instead of being repaid in cash, the principal and the accrued interest are converted into equity - shares in the company - under predetermined conditions set at the time of the investment.

Advantages for Startups and Investors

For startups, the appeal of convertible notes lies in their simplicity and efficiency. They allow founders to avoid the complex and often contentious process of valuing their company too early in its lifecycle. This is crucial, as early-stage startups often lack the steady revenue streams, customer base, or market presence required for an accurate valuation.

From an investor's perspective, convertible notes offer a strategic entry point. They provide a way to support a startup with a potentially lower risk than direct equity investment. The conversion feature - especially when combined with valuation caps and discount rates - offers investors a chance to participate in the company's upside potential, aligning their interests with the startup's growth trajectory.

| Aspect | Convertible Note | Equity Investment |

|---|---|---|

| Nature | Debt, later equity | Direct ownership |

| Valuation | Deferred | Immediate |

| Complexity & Speed | Simpler, faster | More complex |

| Investor Rights | Creditor, then equity | Immediate equity |

| Risk | Lower, potential upside | Higher, direct tie |

| Cost | Interest, converts | No interest, dilutes |

| Control & Dilution | Less, until conversion | Immediate, may grant control |

| Maturity | Has maturity date | No maturity |

| Financial Impact | Debt on balance sheet | Equity addition |

| Preferred Stage | Early-stage, uncertain value | Mature, clear value |

Conversion into Equity

The conversion of these notes into equity is typically triggered by a specific event, most commonly a subsequent financing round. This event is known as the "qualified financing round," where the startup raises a certain minimum amount of capital, usually at a higher valuation.

The conversion rate - how much equity the notes convert into - is determined by a variety of factors, including the valuation cap, discount rate, and the amount raised in the qualified financing round. This conversion mechanism is what makes convertible notes an attractive tool for early-stage investing, balancing the interests of both the startups seeking funding and the investors seeking opportunities.

Interest Rates and Convertible Notes Trends

The interest rate applied to convertible notes is a critical aspect that both startups and investors must consider.

Unlike traditional loans, where interest accrual is a key focus, in convertible notes, the interest rate adds to the total amount that will eventually convert into equity.

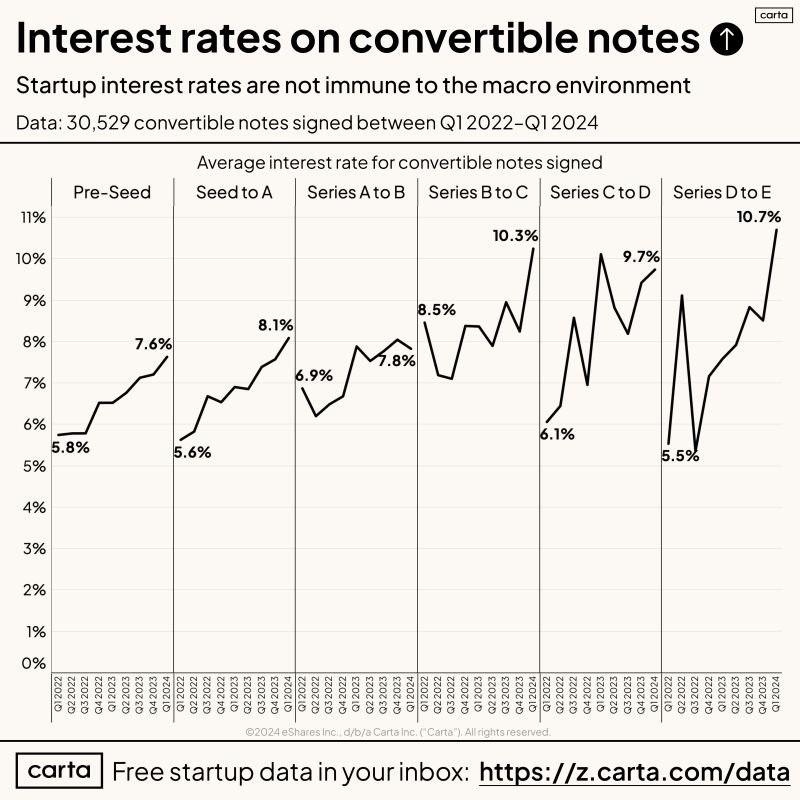

Recent data from Carta, encompassing over 30,000 convertible notes signed between Q1 2022 and Q1 2024, reveals insightful trends in the interest rates associated with these financial instruments across different funding stages.

This period, reflective of a challenging macro environment, has seen interest rates on convertible notes fluctuate significantly, emphasizing the influence of broader economic conditions on startup financing.

Pre-Seed to Seed Stages: At the very nascent stages, interest rates have shown a moderate increase, from 5.8% to 7.6%. This uptick suggests a growing caution among investors when engaging with the earliest stage startups, compensating for the higher perceived risk with a slightly higher interest rate.

Seed to Series A: Transitioning from seed to Series A, interest rates have been observed to rise, peaking at 8.1%. The trend indicates a sharpened investor focus on balancing risk with the potential for higher returns as the company progresses towards more substantial funding rounds.

Series A to B and Beyond: As startups move into later stages, Series A to B, B to C, and so forth, the data shows more volatility in interest rates. Notably, Series B to C rounds faced the highest recorded interest rate at 10.3%, potentially reflecting a period of heightened market instability or investor sentiment at that time. However, interest rates appear to converge towards a higher mean, with Series D to E rounds stabilizing at 10.7%.

These interest rate trends on convertible notes underline the importance of economic conditions in startup financing. They serve as a reminder for founders and investors alike to stay attuned to market shifts, using instruments like convertible notes to navigate the financing landscape strategically.

As startups consider convertible notes as a financing option, understanding these interest rate trends can aid in anticipating the total cost of capital and preparing for how it may affect the conversion terms and equity dilution in future rounds. For investors, the data underscores the need to calibrate the interest rate against the startup's growth stage and overall market health to optimize investment outcomes.

The Role of Valuation Caps

A valuation cap is a pivotal term in convertible notes, playing a central role in how these financial instruments convert into equity. Essentially, a valuation cap sets an upper limit on the company valuation at which the note will convert into equity.

This means that no matter how high the company's valuation climbs at the next funding round, the convertible note will convert into equity at this pre-determined, capped valuation.

In the context of convertible notes, the valuation cap is designed to benefit early investors. It ensures that their investment converts into equity at a more favorable rate if the company's valuation at the next funding round exceeds the cap.

Without a cap, early investors might find their investments diluted significantly in the case of a high valuation during a future funding round.

Startup valuation is the process of determining the worth of a startup company, often a complex and subjective exercise, especially in the early stages of the company's life. Unlike established companies with steady revenue streams and predictable growth trajectories, startups often lack historical financial data, making traditional valuation methods challenging to apply.

Instead, startup valuation frequently relies on future potential, market opportunities, the uniqueness of the product or service, the strength of the management team, and investor demand. This valuation is crucial as it affects how much of the company founders have to give away in exchange for investment. It's a blend of art and science, balancing quantitative analysis with qualitative assessments, and often involves negotiation between the startup founders and potential investors.

Read more

The primary purpose of a valuation cap is to protect early investors from excessive dilution. When a startup grows in value significantly after an initial investment round, new investors may come in at a much higher valuation.

Without a valuation cap, the early investors' convertible notes would convert at this higher valuation, resulting in a smaller share of equity than anticipated. The cap ensures they receive a larger portion of equity, reflecting their early support and the higher risks they took.

Illustrative Example

For instance, imagine an investor puts $100,000 into a startup using a convertible note with a valuation cap of $5 million. If the startup's next funding round values the company at $10 million, without a valuation cap, the investor's note would convert at this higher valuation, resulting in fewer shares.

However, with the valuation cap, the conversion happens as if the company is valued at only $5 million. This means the investor's $100,000 converts to a larger percentage of the company, rewarding them for their early investment and the associated risks.

Benefits and Drawbacks of Valuation Caps

In the world of startup financing, valuation caps on convertible notes are a critical element that can significantly influence the outcome for both investors and startups. Understanding the benefits and drawbacks of valuation caps is essential for both parties to make informed decisions.

While they offer distinct advantages, such as protecting investors from dilution and aiding startups in capital acquisition, they also come with challenges. These include complexities in cap level setting and potential impacts on future funding. This section explores these aspects in detail, presenting a balanced view from the perspectives of both investors and startup founders.

| Stakeholder | Benefits | Drawbacks |

|---|---|---|

| Investors |

|

|

| Startups |

|

|

The negotiation and implementation of valuation caps in convertible notes is a delicate balance. For investors, it’s about securing a fair return and minimizing risks, while for startups, it’s about maintaining control and ensuring sustainable growth. Both parties must approach valuation caps with a clear understanding of their potential impacts.

Effective negotiation requires a harmonious balance that aligns the interests of investors with the strategic goals of the startup, ensuring a mutually beneficial relationship. As the startup ecosystem continues to evolve, so too will the dynamics of valuation caps, underscoring the need for adaptability and foresight in startup financing strategies.

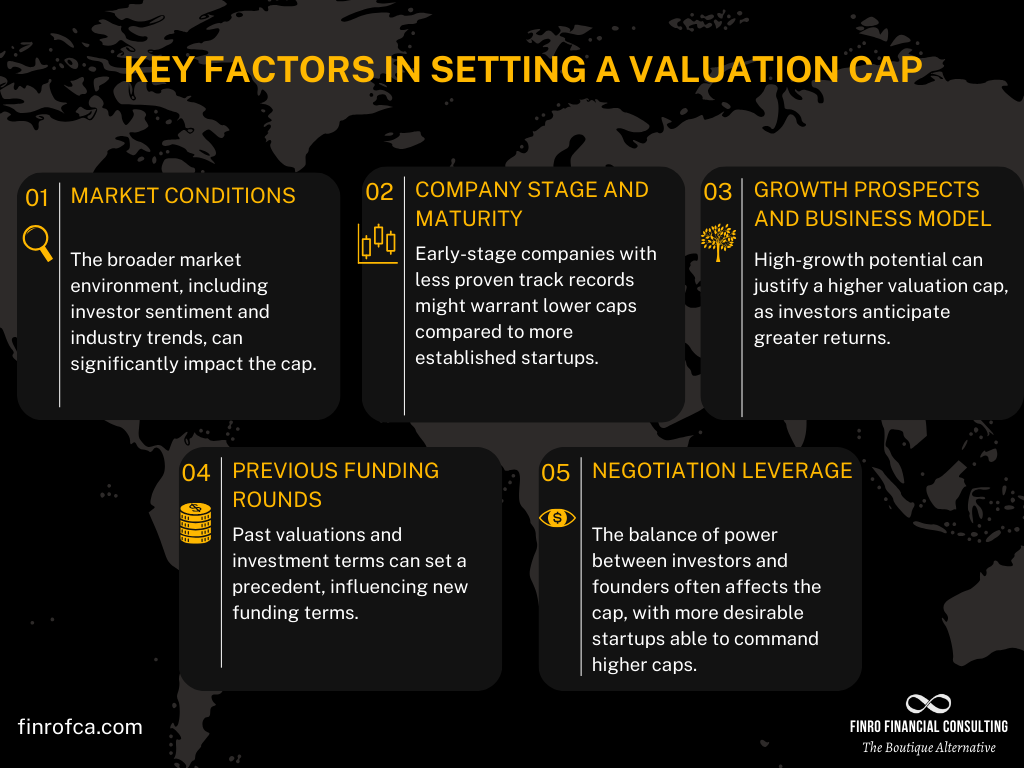

Setting the Valuation Cap

Determining the valuation cap in a convertible note agreement is a critical and nuanced process, pivotal to the interests of both investors and startups. The valuation cap isn't just a number; it's a reflection of the company's potential, the risk appetite of the investors, and the current market dynamics.

Valuation caps are typically set through a combination of financial projections, market analysis, and negotiation. Startups and investors often use various methods to estimate the company's current and future value.

These may include assessing similar companies in the industry (comparables), evaluating the startup's growth potential, and considering the current investment climate.

Negotiation Process

The negotiation over valuation caps is a delicate dance. It involves a series of discussions and compromises. Founders must balance their need to minimize dilution with the necessity of making the deal attractive to investors. Investors, on the other hand, seek to maximize their potential return on investment while minimizing risk.

Startups often begin with a higher proposed cap, while investors may counter with a lower figure. The final number is usually reached through back-and-forth negotiations, often influenced by the startup's bargaining power, which is a function of its performance metrics, team strength, market opportunity, and competitive interest from other investors.

Setting the valuation cap is a pivotal part of the convertible note agreement, requiring careful consideration and strategic negotiation. It requires a deep understanding of both the startup's intrinsic value and the external market forces at play.

A well-negotiated valuation cap can pave the way for a successful partnership between investors and startups, aligning long-term interests and expectations.

Alternatives to Valuation Caps

While valuation caps are a prevalent feature in convertible notes, there are other mechanisms that serve similar purposes, such as discount rates. Understanding these alternatives is crucial for both investors and startups to tailor their financing agreements to specific needs and situations.

A discount rate in a convertible note is a mechanism that gives investors the right to convert their debt into equity at a reduced price compared to later investors in a subsequent funding round. It's a way to reward early investors for their risk by offering them a percentage discount on the share price during the equity conversion.

| Feature | Valuation Cap | Discount Rate |

|---|---|---|

| Primary Function | Sets maximum company valuation for equity conversion. | Provides price discount on shares at conversion. |

| Investor Benefit | Protects against high future valuations. | Rewards early investment with lower share price. |

| Impact on Founders | Possible higher dilution at low cap in high valuations. | Typically less dilution, predictable dilution rate. |

| Predictability | Uncertain equity percentage until future valuation. | More predictable, as discount rate is predefined. |

| Best Suited For | High-growth startups with uncertain future valuation. | Startups with moderate growth expectations. |

| Complexity | More complex due to dependency on future valuation. | Simpler, based on predefined discount percentage. |

The choice between valuation caps and discount rates (or a combination of both) depends on various factors, including the startup's growth trajectory, market conditions, and negotiation dynamics between investors and founders.

A discount rate can be more straightforward and predictable, but it might not provide as much protection as a valuation cap in high-growth scenarios. Conversely, a valuation cap can offer more significant benefits in rapidly appreciating startups but involves more complexity and risk for both parties.

Conclusion

In the dynamic landscape of startup financing, convertible notes and valuation caps play a pivotal role. They offer a unique blend of flexibility and protection, catering to the needs of both startups in their nascent stages and investors looking for opportunities in new ventures.

As we've explored, convertible notes serve as an efficient tool for early-stage funding, with valuation caps providing a safeguard against excessive dilution for investors.

The intricacies of setting valuation caps reflect a balancing act between the optimistic aspirations of startup founders and the prudent foresight of investors. This article has shed light on the benefits and drawbacks of valuation caps, the factors influencing their determination, and the critical negotiation process that underpins these decisions. We've also delved into alternatives like discount rates, highlighting the diversity of options available in startup financing.

The key takeaway is the importance of understanding and negotiating these financial instruments with a clear perspective. For startups, it's about leveraging these tools to fuel growth while maintaining a fair share of ownership and control.

For investors, it's about finding the right balance between risk and reward, ensuring a fair return on investment while supporting the growth of innovative businesses.

As the startup ecosystem continues to evolve, the tools and strategies for financing will also adapt. Staying informed and adaptable is essential for both founders and investors. The journey of a startup is fraught with challenges, but with the right financial strategies in place, the path to success becomes clearer and more attainable.