Breakeven Point Demystified

By Lior_Ronen | Founder, Finro Financial Consulting

Have you ever wondered when your SaaS business will start making a profit? Or maybe you've heard the term "breakeven point" and thought it sounded important but didn't quite know what it meant or when you'd reach it. Fear not, my friend! You've come to the right place.

In this easy-to-understand guide, we'll focus on the timing of the breakeven point for SaaS businesses, explaining what it is, why it matters, and how to calculate it.

By the end of this article, you'll be able to chat about breakeven, and who knows, you might even find yourself using it to make some smart business decisions!

So, grab a cup of coffee, sit back, and start this exciting journey together.

The Basics of Breakeven Point for SaaS Businesses

Alright, let's start by talking about what breakeven timing is. In the world of SaaS (Software as a Service), breakeven timing is when your cumulative revenue covers all your cumulative costs, fixed and variable. At this point, you're not making any profit but also not losing any money.

Understanding breakeven timing is important because it gives you a clear goal to work towards and helps you make informed decisions about growth, spending, and pricing.

Now, let's talk about the costs involved in a SaaS business. We have two main types: fixed costs and variable costs. Fixed costs are expenses that don't change, no matter how many customers you have. These might include office rent, salaries, and software licenses.

Variable costs, on the other hand, are the expenses that change based on the number of customers you have. In a SaaS business, this includes server costs and customer support expenses.

Understanding the difference between fixed and variable costs is super important because it helps you determine how to make your business more profitable. For example, you might decide to optimize your software to reduce server costs or find a more efficient way to provide customer support.

By keeping an eye on these costs and knowing your breakeven timing, you'll be in a better position to make smart decisions for your business. Stay tuned for the next section, where we'll introduce a method to calculate that all-important breakeven timing.

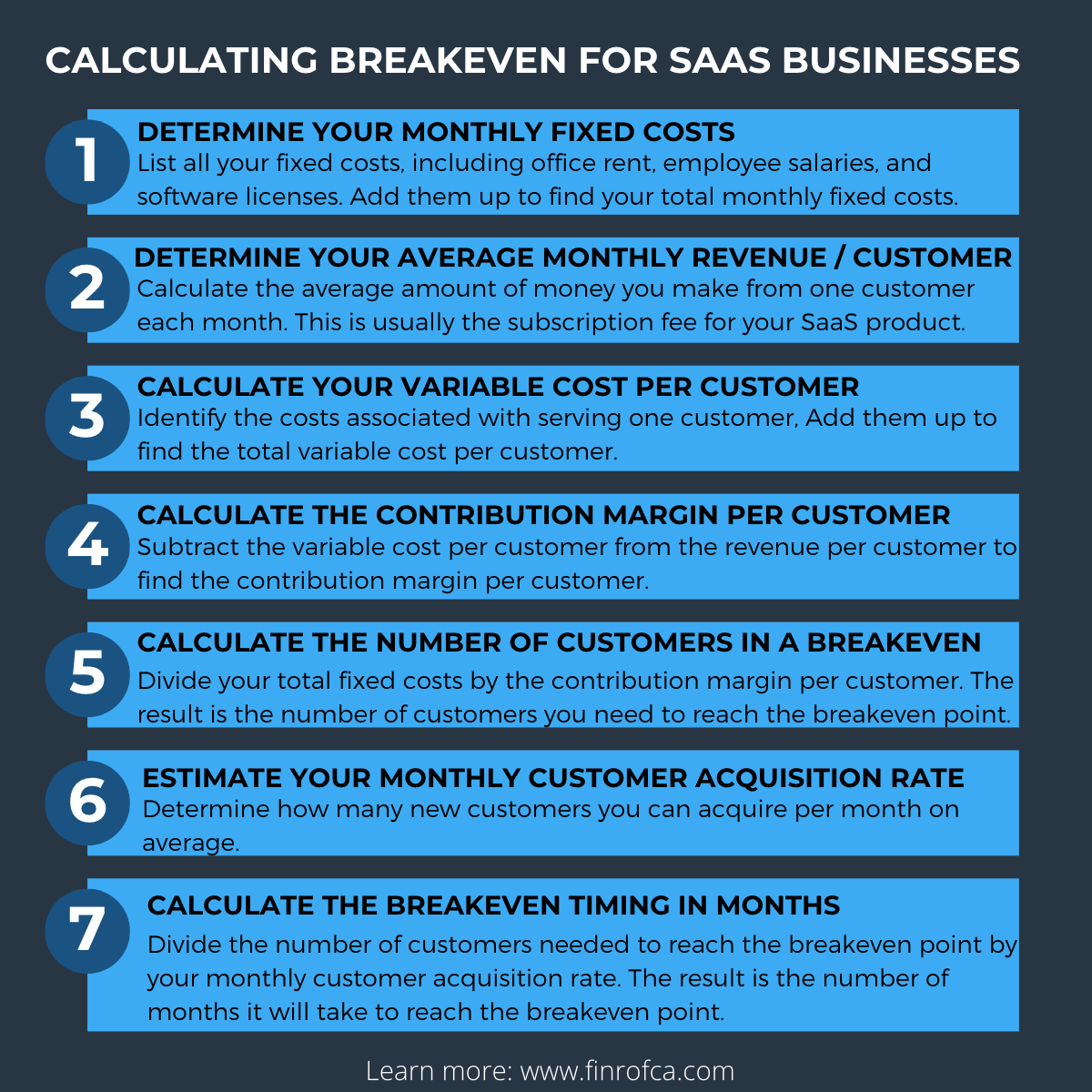

Calculating Breakeven for SaaS Businesses

Now that we've discussed the basics and importance of the breakeven point let's walk through a step-by-step guide on calculating the breakeven timing for your SaaS business. By following these steps, you can determine when your business will cover its costs and generate profit.

Step 1: Determine your monthly fixed costs. List all your fixed costs, including office rent, employee salaries, and software licenses. Add them up to find your total monthly fixed costs.

Step 2: Determine your average monthly revenue per customer. Calculate the average amount of money you make from one customer each month. This is usually the subscription fee for your SaaS product.

Step 3: Calculate your variable cost per customer. Identify the costs associated with serving one customer, such as server costs and customer support expenses. Add them up to find the total variable cost per customer.

Step 4: Calculate the contribution margin per customer. Subtract the variable cost per customer from the revenue per customer to find the contribution margin per customer.

Step 5: Calculate the number of customers needed to reach the breakeven point. Divide your total fixed costs by the contribution margin per customer. The result is the number of customers you need to reach the breakeven point.

Step 6: Estimate your monthly customer acquisition rate. Determine how many new customers you can acquire per month on average.

Step 7: Calculate the breakeven timing in months. Divide the number of customers needed to reach the breakeven point by your monthly customer acquisition rate. The result is the number of months it will take to reach the breakeven point.

Following these seven steps, you can calculate the breakeven timing for your SaaS business. This will help you set realistic goals, make informed decisions, and track your progress toward profitability. Remember to update your calculations regularly, as your costs and revenue may change over time. Happy calculating!

How to Calculate the Breakeven Point

Let's work through an example to help you understand the breakeven timing calculation for a SaaS business:

Imagine you have a SaaS company called "SuperApp" that offers a project management tool. Here's a breakdown of the company's costs and revenue:

Step 1: Determine your monthly fixed costs

Office rent: $3,000

Salaries: $15,000

Software licenses: $1,500 Total monthly fixed costs for SuperApp: $19,500

Step 2: Determine your average monthly revenue per customer

The subscription fee for SuperApp: $100

Step 3: Calculate your variable cost per customer

Server costs per customer: $10

Customer support expenses per customer: $5 Total variable cost per customer for SuperApp: $15

Step 4: Calculate the contribution margin per customer

Contribution Margin per Customer = Revenue per Customer - Variable Cost per Customer

Contribution Margin per Customer for SuperApp = $100 - $15

Contribution Margin per Customer for SuperApp = $85

Step 5: Calculate the number of customers needed to reach the breakeven point

Number of Customers Needed to Breakeven = Total Fixed Costs / Contribution Margin per Customer

Number of Customers Needed to Breakeven for SuperApp = $19,500 / $85

Number of Customers Needed to Breakeven for SuperApp ≈ 229 customers

Step 6: Estimate your monthly customer acquisition rate

Monthly customer acquisition rate for SuperApp: 50 new customers per month

Step 7: Calculate the breakeven timing in months

Breakeven Timing (in months) = Number of Customers Needed to Breakeven / Monthly Customer Acquisition Rate

Breakeven Timing (in months) for SuperApp = 229 customers / 50 customers per month

Breakeven Timing (in months) for SuperApp ≈ 4.58 months

By following these seven steps and incorporating the SuperApp example, we can see that it will take approximately 4.58 months for SuperApp to reach the breakeven point and start generating profit, given its current costs, revenue, and customer acquisition rate.

Where and How to Use the Breakeven Point

Understanding your breakeven point isn't just a fun exercise; it's an essential tool that helps you make smarter decisions and grow your SaaS business. By knowing your breakeven point, you can use it in various aspects of your business to your advantage.

One key area where the breakeven point can be helpful is in setting the right pricing strategy. If you find out that your current pricing won't allow you to reach the breakeven point within a reasonable time, you might consider increasing the subscription fee or offering additional features at a premium price to boost revenue.

The breakeven point also helps you manage costs effectively. When you understand what it takes to break even, you can identify areas where you can cut costs or optimize your operations. For example, if your variable costs are high, you might explore options to reduce server expenses or streamline customer support. Reducing costs will lower the breakeven point, allowing you to reach profitability faster.

Additionally, the breakeven point serves as an important milestone for your business. It gives you a clear goal to work towards and helps you track your progress. By monitoring your customer acquisition and keeping an eye on your costs, you can make adjustments as needed to ensure you stay on track to reach your breakeven point.

When you're seeking external funding, knowing your breakeven point can be a powerful tool to show potential investors that you have a clear plan for profitability. It demonstrates that you've done your homework and understand the financial aspects of your business, making you a more attractive investment opportunity.

Finally, once you've reached your breakeven point and your business is profitable, you might start thinking about expanding. Knowing the breakeven point for your current operations will help you estimate the additional costs and revenue associated with expansion, allowing you to make informed decisions about when and how to grow your business.

In summary, the breakeven point is more than just a cool piece of trivia—it's a valuable tool that can help you make better decisions and guide your SaaS business towards success. By understanding your breakeven point and using it to inform your strategies, you'll be well on your way to building a thriving, profitable business. Cheers to that!

Limitations and Considerations

Before we wrap up, it's essential to understand that while the breakeven point is a handy tool for your SaaS business, it also has a few limitations and considerations. Let's take a look at some factors you should keep in mind while using the breakeven point:

Changes in Costs: Your fixed and variable costs might change over time, impacting your breakeven point. For example, rent might increase, or you might need to hire more employees as your business grows. Ensure you regularly update your breakeven calculations to account for these changes so you always have an accurate picture of your financial situation.

Customer Churn: In the SaaS world, customer churn (the rate at which customers cancel their subscriptions) is an essential factor to consider. Churn can impact your breakeven point, as you'll need to replace those lost customers to maintain your revenue levels. Be sure to factor in churn when calculating your breakeven point and setting customer acquisition goals.

Seasonality: Some businesses experience seasonal fluctuations in customer demand, which can affect their breakeven point. If your SaaS business experiences these fluctuations, consider calculating your breakeven point for different periods to understand better how seasonality impacts your financials.

Growth and Scaling: As your SaaS business grows, you may experience economies of scale, which means your variable costs might decrease as you add more customers. This can lower your breakeven point, making it easier to reach profitability. However, it's essential to monitor these changes and adjust your breakeven calculations accordingly.

Simplification: The breakeven point is a simplified representation of your business's financial health. It doesn't consider factors like taxes, interest, or depreciation, which can impact your profitability. Use the breakeven point as a starting point for understanding your financials, but don't rely on it as the sole indicator of your business's success.

In conclusion, while the breakeven point is a valuable tool for SaaS businesses, it's important to consider its limitations and use it in conjunction with other financial metrics and insights. By doing so, you'll be able to make more informed decisions and build a stronger, more profitable business. Happy calculating!

Conclusion

In the world of SaaS businesses, understanding your breakeven point is crucial for success. It's a powerful tool that helps you determine when you'll start making a profit and guides you in making informed decisions regarding pricing, cost management, goal setting, investment, and expansion planning. By keeping your breakeven point in mind and using it to inform your strategies, you'll be better equipped to navigate the challenges of running a SaaS business and steer it toward profitability and growth.

Remember that the breakeven point has limitations and should be used with other financial metrics and insights. Make sure to regularly update your calculations to account for costs, revenue, and customer churn changes. This way, you'll always have an accurate picture of your business's financial health and be able to make the best decisions for your company's future.

So, go ahead and calculate your breakeven point, embrace it as a valuable resource, and use it to guide your SaaS business toward a successful and profitable future. Happy calculating, and best of luck in your entrepreneurial journey!