Financial Due Diligence Services

Uncover Risk. Drive Growth.

Enhance investment confidence with Finro's thorough Financial Due Diligence. Our in-depth analysis assesses financial health, revealing risks and opportunities.Private equity funds, VCs, family offices, and angels trust our detailed evaluation for informed decisions.

Schedule a Call

Recent Success Stories

| " | " | "

| I was impressed and very pleased with how much Lior was able to glean in a short amount of time about the operations and future strategy of the company from nothing more than its financial statements, pitch deck, and pro formas. |

One of the solutions that help guide me is Lior and Finro. I think without Lior's guidance, the success that we have achieved would have been much more difficult. The firm has incredible customer service and guidance and I recommend the service for anyone in the space. |

Lior's foresight in identifying pivotal trends and disruptions within the sector has delivered real value. His adeptness and synthesis of large data sets into actionable intelligence based on key comps has also been instrumental in refining our investment strategy. |

Dave Mao Dave MaoManaging Director, Come Up Capital  Joseph Baldassarra Joseph BaldassarraManaging Partner, Broad Street Global Fund General Partner, Princap |

Top Advantages of Partnering with Finro

|

|

|

| Data Analysis Mastery Deep dive into financial health with unmatched data scrutiny. |

Valuation Expertise Crafting precise valuation models to pinpoint your company's worth. |

Risk Identification Unveiling potential pitfalls to safeguard your tech investment. |

|

|

|

| Scenario Simulation Exploring financial futures to prepare for any outcome. |

Tech Sector Insight Leveraging deep tech knowledge for tailored financial strategies. |

Impartial Perspective Offering unbiased views to enhance your strategic decision-making. |

Working With Finro

When investing in private tech companies, expertise in data analysis and critical questioning is crucial. A specialized tech financial consultant should examine the company's financial model for viability. You need a professional who can construct a robust valuation model, identify potential risks, simulate various scenarios, and offer an impartial external perspective on the deal.Generalist consultants won't suffice for analyzing private tech companies. Financial experts with a comprehensive understanding of the tech sector are essential. You require a tech financial consultant with experience in working with private equity funds, venture capitalists, and family offices, skilled in evaluating and modeling private market transactions.

It's vital to have an expert scrutinize a potential investment to ensure all aspects function as expected. A tech financial consultant must verify that the financial forecast aligns with its assumptions and business model. You need a professional who can pose the challenging questions, alleviating your need to do so. At Finro, we specialize in the financial due diligence of private tech companies.

|

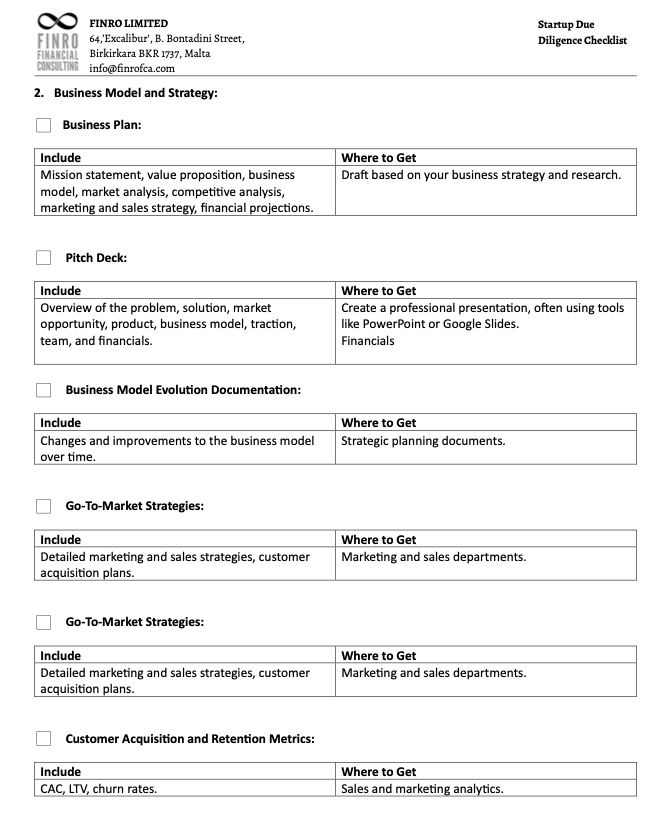

Click to Recieve The Full Checklist Now: Finro Startup Due Diligence Checklist |