Cash Flow Modeling 101: Understanding the Basics

By Lior Ronen | Founder, Finro Financial Consulting

When it comes to running a business, understanding your cash flow is fundamental.

It's about more than just tracking the money coming in and going out; it's about getting a clear picture of your financial health and ensuring your business can operate smoothly on a day-to-day basis.

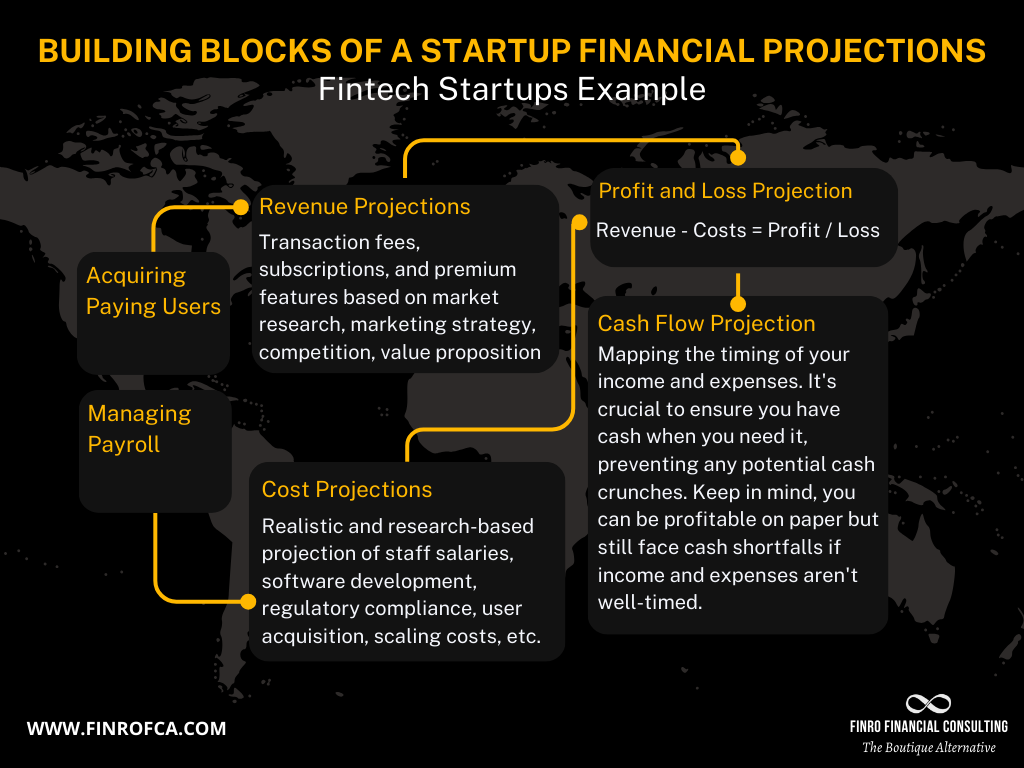

In this guide, we'll take a closer look at what cash flow means in the context of business. We'll explain the cash flow statement and how it differs from an income statement, also known as a Profit and Loss (P&L) statement.

We'll discuss why cash flow and profitability aren't the same thing, delve into the three main types of cash flow, and introduce the basics of cash flow modeling.

It's not just about staying solvent; it's about strategic planning for your business's future.

Let's explore how to understand and manage cash flow effectively.

Navigating business finance requires a deep understanding of cash flow, the distinct roles of cash flow and income statements, and the crucial differences between cash flow and profitability. Effective cash flow modeling is essential for forecasting and managing a company's financial health, enabling businesses to anticipate future needs and adjust strategies accordingly.

By incorporating historical data, expected changes, and market trends, companies can create dynamic financial models that support strategic decision-making. Regular updates to these models ensure they remain accurate and relevant, providing a solid foundation for growth and stability in the competitive business landscape.

- What is Business Cash Flow?

- What is a Cash Flow Statement?

- Cash Flow Statement vs. Income Statement (P&L)

- Differences Between Cash Flow and Profitability

- What is Cash Flow Modeling?

- How to Create a Cash Flow Model?

- Benefits of Choosing Finro As Your Financial Modeling Consultant To Build Your Cash Flow Model

- Conclusion

What is Business Cash Flow?

Business cash flow is essentially the movement of money in and out of your business. It's a snapshot of your financial activity, showing how much money is coming into your business through sales or investments and how much is going out as expenses, like rent, salaries, or purchasing supplies.

Think of it as the business's heartbeat, with cash inflows pumping in like oxygen and cash outflows like the essential nutrients being circulated to keep everything running.

Understanding cash flow is critical for several reasons.

First, it helps ensure that your business has enough cash on hand to cover its immediate and short-term obligations. This is crucial for day-to-day operations because, without sufficient cash, a business may struggle to pay its bills on time, purchase inventory, or even meet payroll.

In essence, good cash flow management means you're not constantly playing catch-up with your expenses; instead, you're staying ahead, ensuring your business operates smoothly without unnecessary financial stress.

Moreover, cash flow is a vital indicator of your business's financial health. It's possible for a business to be profitable on paper, according to its income statement, yet still face cash flow challenges.

This discrepancy can arise from the timing difference between making sales and actually receiving cash, or when expenses are incurred versus when they are paid. Therefore, keeping an eye on cash flow can provide early warning signs of financial issues, allowing you to take corrective action before they become more significant problems.

In sum, business cash flow isn't just about tracking money; it's about managing your business's lifeline.

Ensuring you have a steady and positive cash flow allows your business to thrive, invest in growth opportunities, and navigate the ups and downs of market conditions with confidence.

What is a Cash Flow Statement?

Before we dive into the nuts and bolts of cash flow modeling, it's crucial to lay the groundwork by understanding the cash flow statement. Think of this statement as a detailed map that tracks every penny entering and exiting your business over a specific period. It's akin to a financial diary, offering a snapshot of how your business's operations impact its cash position.

The cash flow statement is a key player in financial reporting. It complements the income statement by providing insights into the business's liquidity and financial health, beyond mere profitability. For investors, creditors, and business owners alike, it clarifies whether the business generates enough cash to meet its obligations and support growth. In essence, it's the foundation upon which cash flow modeling is built, allowing for a deeper analysis of financial strategy and operational effectiveness.

This statement is categorized into three main sections, each shedding light on different facets of your business's cash flow:

Operating Activities:

This section reflects the cash flow from the company's core business operations, essentially showing the cash version of your income statement. It includes examples like:

Cash received from customers, evidencing sales revenue.

Cash paid to suppliers and employees, representing the day-to-day running costs.

Interest paid or received, showing the cost or income from cash management activities.

Investing Activities

This area details the cash used for and received from long-term investments, indicating the company's growth and asset management strategies. Examples include:

Purchasing equipment or property, which indicates investment in the business's operational capacity.

Proceeds from the sale of assets, such as selling an old delivery van or a piece of machinery, which brings cash back into the business.

Money spent on acquiring other businesses or financial investments, showcasing expansion or diversification efforts.

Financing Activities

Here, the focus is on the exchange of cash between the company and its financiers or shareholders. Examples of financing activities are:

Issuing new shares or returning capital to investors, which can provide the business with fresh funds or adjust its capital structure.

Borrowing from a bank or repaying loan principal, impacting the company's debt levels.

Paying dividends to shareholders, indicating a return on their investment.

By dissecting these sections, we gain insights into the operational efficiency, investment decisions, and financing strategies of the business. This tripartite breakdown not only illuminates how cash moves through the company but also sets the stage for effective cash flow modeling. With this foundational knowledge, we can now delve into the intricacies of forecasting and managing cash flow to secure the financial health and growth of the business.

Cash Flow Statement vs. Income Statement (P&L)

Now that we've unpacked the cash flow statement, let's juxtapose it with another key financial document – the income statement, often referred to as the Profit and Loss (P&L) statement.

Understanding the distinction between these two is like knowing the difference between having cash in your wallet versus expecting a paycheck; both are essential, but they serve different purposes.

What is an Income Statement?

The income statement is a financial report that shows a company's revenues, expenses, and profits over a specific period. It's all about the company's performance, focusing on how much money was made (revenue) and spent (expenses), culminating in the net profit or loss. Think of it as the scorecard of the business's operational effectiveness, highlighting whether the business operations have resulted in a financial gain or loss.

The Key Differences

While both the cash flow and income statements offer insights into the financial health of a business, they do so from different angles:

Timing of Cash Movements vs. Recognition of Revenues and Expenses: The cash flow statement records cash activities when they actually occur – when cash physically enters or leaves the business. It’s a real-time look at the company's liquidity. For instance, if you sell a product today but the customer pays you 30 days later, the cash flow statement reflects this transaction only when the cash is received.

On the other hand, the income statement operates on the accrual basis of accounting, recognizing revenues when they are earned and expenses when they are incurred, regardless of when the cash transaction happens. Using the same example, the sale would be recorded on the income statement at the time of the sale, not when the payment is received. This method gives a more consistent measure of the business's operating performance over time but doesn’t show the cash movement.

Focus and Purpose: The cash flow statement’s primary focus is on managing and forecasting cash needs, crucial for day-to-day operations. The income statement, however, aims to provide an overview of the business's profitability, which is vital for assessing its financial performance and making strategic decisions.

This distinction is vital for anyone involved in managing or analyzing a business's finances. While profitability (income statement) is crucial for the long-term success of a business, cash flow (cash flow statement) is essential for its survival and day-to-day operations. A business can be profitable according to the income statement but still face cash flow problems if its cash is tied up in inventory or if customers are slow to pay.

Understanding both financial statements allows business owners and stakeholders to make informed decisions, ensuring not only the profitability but also the liquidity and operational continuity of the company.

| Feature | Cash Flow Statement | Income Statement |

|---|---|---|

| Focus | Cash movements | Profitability |

| Timing | Actual cash flow | Earned or incurred |

| Purpose | Liquidity tracking | Performance measure |

| Basis | Cash basis | Accrual basis |

| Key Components | Operating, Investing, Financing | Revenue, Expenses, Profit |

Differences Between Cash Flow and Profitability

It's a common misconception that profitability directly equates to having a healthy cash flow. However, a business can be profitable on paper yet still find itself grappling with cash flow challenges. Let's break down how this paradox occurs and underline why managing cash flow is critical, regardless of profitability.

Profitable Yet Cash-Strapped?

Profitability, as depicted by the income statement, measures the revenues exceeding expenses over a certain period - essentially, whether the business is making more money than it spends. But here’s the catch: it doesn't account for the timing of when cash actually enters or leaves the business.

Consider this scenario: a company makes a significant sale, recognized instantly as revenue and thus profit. However, if the customer is given a 90-day payment term, the company won't see that cash for three months. During this time, the business might need to pay its suppliers, cover payroll, or make loan payments, leading to potential cash flow problems despite the healthy profit margin.

The Crucial Role of Cash Flow Management

This discrepancy highlights why cash flow management is indispensable, even for businesses that appear profitable on their income statements. Effective cash flow management ensures that a business has enough liquid assets to meet its short-term obligations. Without it, companies may not be able to handle day-to-day expenses or unexpected downturns, regardless of their profitability.

Here are key reasons why cash flow management is crucial:

Liquidity: Having cash on hand is vital for covering operational costs, such as rent, utilities, inventory purchases, and employee salaries.

Flexibility: A healthy cash flow allows a business to make investments or pivot its strategy quickly in response to market changes.

Creditworthiness: Businesses with solid cash management practices are often seen as more creditworthy, making it easier to obtain financing on favorable terms.

In essence, cash flow management acts as the steering wheel for navigating the financial health of a business. It enables business owners to anticipate cash shortfalls, plan for future growth, and maintain operational stability, irrespective of the profitability figures.

Understanding the distinction between cash flow and profitability is crucial for anyone involved in running a business. While profitability indicates the business's potential for growth and sustainability, cash flow represents its immediate financial health and operational viability. Both are critical, but they serve different roles in the financial story of a company.

| Aspect | Cash Flow | Profitability |

|---|---|---|

| Definition | Cash in and out of the business | Revenues exceed expenses |

| Focus | Liquidity and immediate financial health | Long-term financial health |

| Timing | Real-time cash movements | Earnings over a specific period |

| Importance | Essential for daily operations | Indicates growth and sustainability |

| Measurement | Actual cash transactions | Accrued revenues and expenses |

What is Cash Flow Modeling?

Cash flow modeling is like having a financial crystal ball for your business. It's a forecasting tool that helps you predict the flow of cash in and out of your company over a future period.

By using historical financial data, assumptions about the future, and analysis of upcoming income and expenses, cash flow modeling gives you a detailed projection of your company's financial health.

The Power of Cash Flow Forecasting

Imagine being able to anticipate financial tight spots before they happen or identifying opportunities to invest surplus cash wisely.

That's the power of cash flow modeling. It allows business owners and financial managers to make informed decisions based on projected cash positions, ensuring that the business can meet its obligations, like paying suppliers or servicing debt, without unnecessary stress.

Why Cash Flow Modeling is Crucial

Cash flow modeling is not just about avoiding financial pitfalls; it's a strategic tool for planning the future growth and stability of your business. Here's why it's indispensable:

Risk Management: By foreseeing potential cash shortages or surpluses, businesses can strategize to mitigate risks before they become problematic. This might involve arranging additional financing in advance or identifying cost savings to improve liquidity.

Strategic Planning: With a clear view of future cash flow, businesses can make strategic decisions about investments, expansions, or divestitures. Knowing when you'll have the cash to support these moves makes planning far more effective.

Operational Efficiency: Cash flow modeling helps identify periods when the business might have excess cash that can be put to work, perhaps by investing in short-term interest-bearing accounts or making early payments on debt to reduce interest expenses.

Stakeholder Confidence: For investors, lenders, and other stakeholders, a well-thought-out cash flow model demonstrates that the business is being managed with foresight and financial acumen. This can enhance confidence in the business's leadership and its financial stability.

In essence, cash flow modeling is a critical component of financial planning that supports the sustainable growth and operational effectiveness of a business. It's about preparing for the future, navigating challenges with confidence, and seizing opportunities with the assurance that your financial position is secure.

How to Create a Cash Flow Model?

Crafting a cash flow model is akin to drawing a map for a journey — it outlines the path your business's finances are expected to take, helping you navigate through future periods with greater certainty and strategic foresight.

Step 1: Gather Financial Data

Start with the basics: collect all your historical financial information. This includes income statements, balance sheets, and cash flow statements from previous periods. These documents offer a comprehensive look at your business's financial history, showing trends in revenue, expenses, and net cash flow. The more detailed your data, the more accurate your model will be. Look for patterns in your past financials, as these will be invaluable in forecasting future cash flow.

Step 2: Project Future Sales, Expenses, and Cash Flow

Using the historical data you've gathered, begin to project your future sales, expenses, and overall cash flow. This step requires a careful analysis of past trends and may involve a bit of educated guessing. For sales projections, consider factors like market growth, customer demand, and your business's capacity to meet that demand. For expenses, factor in fixed costs (like rent and salaries) and variable costs (like materials and utilities). The goal here is to create a realistic picture of how cash will move in and out of your business.

Step 3: Incorporate Planned or Expected Changes

No business operates in a vacuum. Changes, both internal and external, can significantly impact your cash flow. Maybe you're planning to launch a new product, or perhaps there's an upcoming expansion into new markets. Incorporating these planned changes into your cash flow model helps ensure it remains relevant and accurate. Consider the financial impact of these changes, including the cost of product development, marketing expenses, and the expected increase in sales revenue.

Step 4: Adjust for Seasonal Variations or Market Trends

Many businesses experience seasonal fluctuations in sales and expenses. Retail businesses, for example, might see a spike in sales during the holiday season.

Understanding these patterns and incorporating them into your cash flow model can prevent unexpected shortfalls. Similarly, staying informed about broader market trends and economic forecasts can help you adjust your projections to be more in line with expected conditions.

Step 5: Regularly Update the Model as Actual Data Comes In

A cash flow model is not a set-it-and-forget-it tool; it's a living document that needs regular updates to remain useful. As actual financial data comes in, compare it against your projections to see where you were spot on and where you missed the mark.

Use this information to refine your model, making it an ever more accurate tool for financial planning. This iterative process helps you stay ahead of potential cash flow issues and keeps your business on solid financial footing.

Creating a cash flow model may seem daunting at first, but it's an invaluable exercise for any business. By taking it step by step, you can develop a model that not only guides your financial strategy but also supports dynamic decision-making and long-term business growth.

Benefits of Choosing Finro As Your Financial Modeling Consultant To Build Your Cash Flow Model

Embarking on a tech startup journey without a solid financial model is akin to navigating an unfamiliar city without a map.

While the analogy might seem dramatic, it perfectly encapsulates the vital role of financial modeling in the tech startup ecosystem.

It's more than just having numbers in a spreadsheet; it's about visualizing your business's potential trajectory.

Why Finro? The Specialized Financial Modeling Advantage

Deep Tech Industry Focus: Finro specializes in the tech industry's unique challenges and opportunities, offering insights that generic financial modelers might miss.

Dual Purpose Modeling: Our models serve not just for internal strategy but also make your startup stand out in funding rounds and M&A discussions, impressing potential investors and partners.

Tailored to Tech Startups: Understanding the fast-paced, innovation-driven tech environment allows us to create models that reflect your unique business dynamics accurately.

Strategic Planning and External Engagement: Finro's models are indispensable tools for both guiding your internal financial strategy and showcasing your startup's potential to external stakeholders.

Finro stands out with a structured, meticulous approach that leaves no stone unturned, covering every facet of your tech startup.

Our deep dive into the tech sector's dynamics ensures our models are precisely tailored, accurately reflecting your unique business nuances and resonating with the fast-paced tech environment.

We leverage our extensive experience with investors to craft models that directly address their concerns, highlighting scalability, viability, and leadership potential, factors crucial for securing investor confidence.

Unlike the risks associated with DIY or generalist approaches, which can lead to critical oversights and costly mistakes, Finro's specialized expertise guarantees accuracy and alignment with investor expectations.

Our proven track record, illustrated by our pivotal work with fintech startup Pangea.io, showcases our ability to deliver financial models that are not just precise but also instrumental in securing VC interest, underscoring our precision, thoroughness, and deep understanding of what startups need to succeed.

Choosing Finro: The Right Partner for Your Tech Startup

Selecting Finro means choosing a financial modeling consultant with a proven track record, deep tech sector expertise, and a commitment to aligning financial models with your startup's vision and goals. Our structured approach, combined with our insights into investor expectations, makes Finro the premier choice for tech startups seeking to navigate the complexities of financial planning and strategic growth.

In conclusion, as the tech industry evolves, the need for robust, insightful financial modeling becomes increasingly critical.

With Finro Financial Consulting, tech startups gain not just a model but a strategic tool that lays the foundation for success, ensuring readiness for internal planning and external engagements, and paving the way for future growth and investment.

Conclusion

In conclusion, navigating a business's financial currents requires more than intuition; it demands a thorough understanding of cash flow, the nuances of financial statements, and the strategic foresight provided by cash flow modeling.

From understanding the fundamentals of business cash flow and its distinction from profitability to delving into the intricacies of cash flow statements and their key differences from income statements, we've explored the financial management landscape that is particularly vital for startups in the dynamic tech sector.

The journey through the complexities of cash flow modeling has underscored its importance not just as a ledger of numbers but as a beacon guiding businesses towards financial health and operational stability.

With our practical, step-by-step guide to crafting a cash flow model, we've provided businesses with a tangible tool to predict and navigate their financial future. This includes preparing for both expected and unforeseen changes in the market, making it a crucial resource for any business.

Choosing Finro as your financial modeling partner is not just a strategic decision—it's aity to harness precision, expertise, and insight. This is especially beneficial for tech startups, as it can be a game-changer on the path to unique opportunity growth and innovation.

The benefits of specialized financial modeling cannot be overstated. It offers businesses a clear view of their financial landscape, enables informed decision-making, and ensures sustainability and success in a competitive market.

As we wrap up this exploration into cash flow and financial modeling, it's clear that these tools are indispensable.

They are not just mechanisms for financial planning but are integral to the strategic foundation of any business aiming for longevity and success in today's dynamic economic environment.

With the right approach to financial modeling, guided by expertise and strategic insight, businesses can turn financial foresight into strategic action, steering towards a future of growth and stability.

Key Takeaways

Understanding cash flow is crucial for daily operations and long-term financial health, distinguishing it from profitability.

Cash flow modeling forecasts financial health, aiding in strategic planning and risk management.

The cash flow statement offers a real-time view of liquidity, contrasting with the accrual-based income statement.

Effective cash flow management ensures operational stability and enables strategic investments.

Specialized financial modeling, like that offered by Finro, is vital for tech startups, enhancing strategic planning and investor appeal.

Answers to The Most Asked Questions

-

Cash flow modeling is a forecasting tool that predicts the flow of cash in and out of a company over a future period, using historical financial data, assumptions about the future, and analysis of upcoming income and expenses. It provides a detailed projection of a company's financial health, enabling business owners and financial managers to make informed decisions based on projected cash positions.

-

This process includes gathering financial data (like past income statements, balance sheets, and cash flow statements), projecting future sales, expenses, and overall cash flow based on historical trends and educated guessing, incorporating planned or expected changes, adjusting for seasonal variations or market trends, and regularly updating the model with actual data to refine its accuracy.

-

Such a model typically integrates three financial statements: the income statement, the balance sheet, and the cash flow statement. This integrated approach provides a comprehensive view of a company's financial health, enabling better forecasting and decision-making by showing how cash moves, profits are earned, and the overall financial position changes over time.

-

Cash flow modeling is used for several reasons, as highlighted in the text. It serves as a strategic tool for planning future growth and stability, enabling businesses to foresee potential cash shortages or surpluses and strategize accordingly.

It aids in risk management by identifying potential financial pitfalls before they occur, supports strategic planning by providing a clear view of future cash flow for making informed decisions about investments and expansions, improves operational efficiency by identifying periods of excess cash, and boosts stakeholder confidence by demonstrating that the business is managed with foresight and financial acumen.