Annual Contract Value (ACV) vs. Annual Recurring Revenue (ARR)

By Lior Ronen | Founder, Finro Financial Consulting

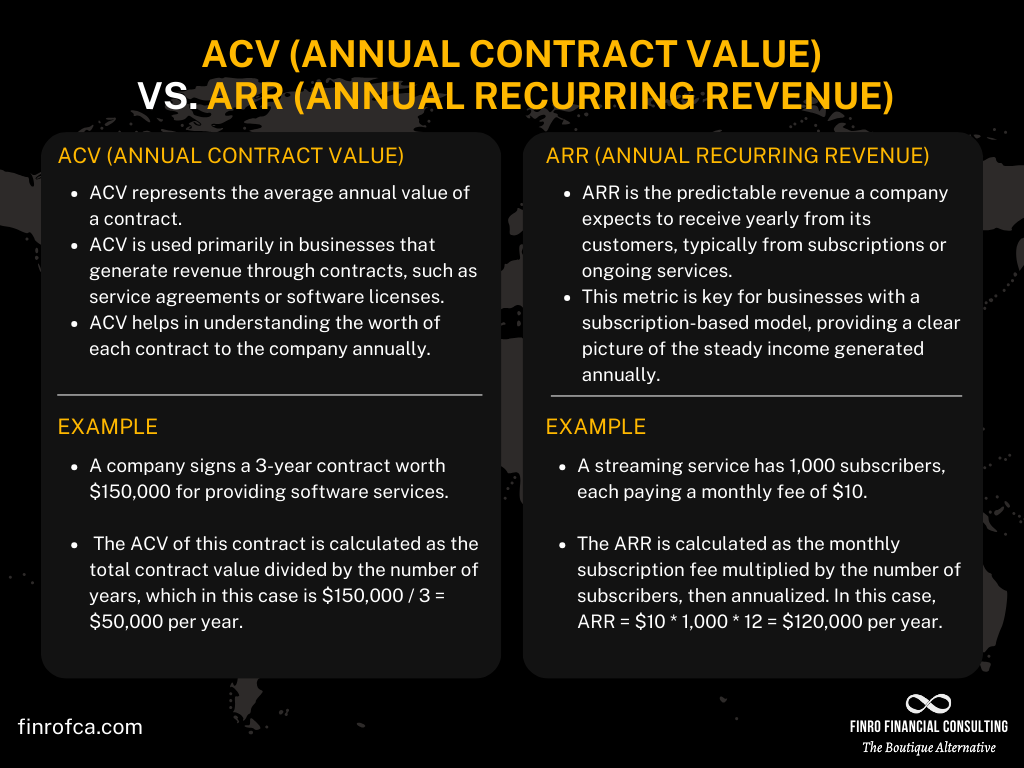

Understanding various financial metrics is key to evaluating a company's performance and potential for growth. Among these metrics, Annual Contract Value (ACV) and Annual Recurring Revenue (ARR) stand out as crucial indicators, especially in businesses relying on contracts and subscriptions. While they may sound similar, ACV and ARR serve different purposes and provide unique insights into a company's financial health.

ACV, or Annual Contract Value, primarily pertains to the average annualized value of a contract. It is especially relevant in businesses where contracts are the primary source of revenue, such as in service or software industries. ACV helps in understanding the value a single contract brings to the company over a year, aiding in effective resource allocation and forecasting.

On the other hand, ARR, or Annual Recurring Revenue, is a metric more suited to businesses with subscription-based models. It represents the predictable and recurring revenue components, such as subscriptions or maintenance fees, that a company expects to receive every year. ARR is a key metric for assessing the steady income of a business and is crucial for long-term financial planning.

Though both ACV and ARR are integral in assessing a company's financial status, they cater to different aspects and interpretations of a business's revenue stream. This article aims to demystify these two important financial metrics, outlining their definitions, differences, and their respective roles in shaping business strategies

Annual Contract Value (ACV) and Annual Recurring Revenue (ARR) are crucial financial metrics in business, each serving a distinct purpose. ACV is used to evaluate the average annual value of individual contracts, particularly in businesses with long-term agreements, aiding in strategic decision-making and resource allocation.

In contrast, ARR measures predictable, consistent revenue from recurring sources, such as subscriptions, playing a vital role in businesses focused on sustained income streams. Understanding these metrics is essential for accurate financial forecasting, growth strategies, and investor relations, as they offer valuable insights into a company's financial health and potential for growth.

What is ACV (Annual Contract Value)?

Annual Contract Value (ACV) is a financial metric used to measure the value of a customer contract on an annual basis. It represents the average annual revenue a single contract generates over its lifetime.

ACV is particularly significant in businesses where customer contracts are the primary source of revenue, such as in software-as-a-service (SaaS) or any service-based industry.

The calculation of ACV can vary slightly depending on the business model, but it typically involves dividing the total value of a contract by the number of years it covers. For instance, if a company signs a contract worth $300,000 that spans over 3 years, the ACV would be $300,000 / 3 = $100,000.

This calculation can become more complex with additional factors like one-time fees, discounts, or variable pricing structures.

ACV plays a crucial role in helping tech companies across different niches understand the value of their contracts, aiding in financial planning, resource allocation, and strategic decision-making tailored to their specific market and customer base.

Here are few common examples:

Cybersecurity Solutions: A cybersecurity firm provides tailored solutions to businesses. A medium-sized business agrees to a 5-year contract for a comprehensive security package totaling $500,000. The ACV, in this case, is $100,000, highlighting the long-term value of securing extended contracts in the cybersecurity niche.

EdTech (Educational Technology): An EdTech company offers a learning management system (LMS) to a university on a 3-year contract for $150,000. The ACV of $50,000 helps the company strategize its focus on large educational institutions versus individual educators or smaller schools.

E-commerce Platforms: An e-commerce platform provides a comprehensive suite of services to a retail chain on a 2-year deal worth $300,000. The ACV of $150,000 aids in comparing the value of large retail contracts against numerous smaller vendor contracts.

In conclusion, ACV is not just a simple calculation but a vital tool for strategic decision-making in contract-based businesses. It helps in understanding the profitability of contracts and guiding the overall direction of the company's growth strategies.

Annual Contract Value (ACV) and Average Revenue Per Contract (ARPC) are distinct metrics used in business analysis. ACV measures the average annual value of a contract over its lifespan, ideal for long-term financial planning and commonly used in industries with multi-year contracts. In contrast, ARPC calculates the average revenue generated from each contract during a specific period, regardless of its duration.

This makes ARPC useful for assessing the immediate effectiveness of sales and pricing strategies. While ACV is key for strategic planning in scenarios with extended contract durations, ARPC provides insights into overall revenue efficiency per contract, making it relevant for short-term operational decisions.

What is ARR (Annual Recurring Revenue)?

Annual Recurring Revenue (ARR) is a key financial metric used by businesses to measure the predictable and consistent revenue they can expect to receive each year, primarily from recurring sources.

This metric is most relevant in subscription-based business models, such as software-as-a-service (SaaS), where customers pay regularly for continued access to a product or service. ARR provides a clear picture of the financial health and stability of a company by reflecting its steady income stream.

The calculation of ARR is straightforward: it's the sum of all recurring revenue on an annual basis. This includes monthly or quarterly subscriptions, annual contracts, and any other consistent, recurring charges.

For instance, if a company has 100 customers each paying a monthly subscription fee of $100, the ARR would be 100 customers x $100 x 12 months = $120,000. The simplicity of this calculation makes it a particularly powerful tool for financial analysis and forecasting.

ARR is crucial for businesses with recurring revenue models for several reasons:

Predictability: It offers a predictable revenue stream, which is essential for long-term planning and stability. Businesses can rely on this consistent income for making informed decisions about investments, expansions, and resource allocations.

Growth Measurement: ARR is a vital metric for measuring growth, particularly in the early stages of a company. A steadily increasing ARR is a sign of a healthy, growing business.

Valuation and Investment: For startups and companies seeking investment, ARR is often a key metric that investors look at. A high ARR can indicate a successful business model and can be instrumental in securing funding.

Customer Loyalty and Retention: Regular monitoring of ARR helps businesses understand customer loyalty and retention. A stable or increasing ARR suggests high customer satisfaction, whereas a declining ARR might indicate issues with customer churn.

Operational Efficiency: Understanding ARR allows businesses to assess the efficiency of their operations and marketing strategies. It helps in aligning expenses with predictable revenue, ensuring long-term operational sustainability.

In summary, ARR is not just an indicator of current financial status but a crucial metric for strategic planning, growth measurement, and investor relations in businesses with recurring revenue models.

It provides a comprehensive view of how revenue is being generated and sustained, which is vital for the ongoing success of the company.

Why ACV and ARR Matter?

In the complex game of business, understanding the right numbers is your key to success. Two crucial metrics stand out like shining beacons: Annual Contract Value (ACV) and Annual Recurring Revenue (ARR). While they might sound similar, they tell vastly different stories.

ACV: Landing the Prize Whales

Think of ACV as the weight of your biggest catch. It's the average yearly value of your individual contracts, revealing the worth of each deal you reel in. For companies like consulting firms or custom software developers, landing a high-value contract with a major player can send their ACV soaring. This tells them where to focus their sales efforts, directing resources towards attracting and servicing these prized whales.

ARR: The Steady Stream of Coins

Imagine a constant trickle of coins filling your coffers. That's ARR in action. It's the predictable income you generate year after year through subscriptions, maintenance fees, or other recurring revenue sources. For SaaS companies or membership-based businesses, a healthy ARR provides stability and long-term financial security. It allows them to plan for the future, invest in growth, and weather economic storms with confidence.

Why Both Matter: Navigating the Business Sea

Understanding both ACV and ARR is like having a double map. They guide you in crucial decisions across the business landscape:

Target the Right Customers: Do you chase big, infrequent contracts or prioritize a loyal customer base? ACV and ARR show you the potential value in each path, helping you target the right type of clients for your business model.

Forecast with Confidence: Planning for the future becomes easier when you know what to expect. ACV helps you predict income from new contracts, while ARR provides a reliable baseline for ongoing revenue.

Allocate Resources Wisely: Every dollar spent needs to count. ACV and ARR guide your resource allocation,ensuring you invest in the right areas, whether it's personalized support for high-value clients or product improvements to keep your subscription base happy.

Measure and Grow: Tracking your progress is essential for any captain. ACV and ARR become your performance metrics, showing you if your strategies are paying off and how much you're growing.

Attract Investors and Stakeholders: Strong ACV and ARR figures are music to the ears of investors and stakeholders. They prove the viability and stability of your business, making it easier to secure funding and build trust.

Whether you're a small startup or a seasoned enterprise, mastering the language of ACV and ARR is key to navigating the dynamic waters of business. These metrics aren't just numbers; they're powerful tools that unlock hidden potential, chart a clear course, and ultimately, propel you towards success.

| Aspect | ACV (Annual Contract Value) |

ARR (Annual Recurring Revenue) |

|---|---|---|

| Definition | The average annual value of a single contract over its term. | The predictable and consistent revenue expected annually from recurring sources. |

| Calculation | Total contract value divided by the number of years. | Sum of regular recurring revenue, annualized (e.g., monthly or quarterly subscriptions). |

| Focus | Value of individual contracts. | Overall recurring revenue streams. |

| Relevance | More relevant in businesses with varied contract lengths and high-value agreements. | More relevant in subscription-based models or businesses with steady, recurring income. |

| Usage | Used for evaluating the profitability of specific contracts, resource allocation, and strategic planning. | Used for long-term financial stability, forecasting, customer retention analysis, and operational efficiency. |

| Key for | Assessing individual contract value and guiding sales strategies. | Understanding steady income and customer loyalty. |

| Ideal for Industries | Contract-based industries like enterprise software, bespoke services. | Subscription models like SaaS, streaming services, membership platforms. |

Avoiding the Common Traps

Let's face it, navigating the financial world can be tricky, especially when it comes to deciphering cryptic acronyms like ACV and ARR. While these metrics are powerful tools, they're not without their fair share of confusion and potential pitfalls.

So, before you get swept away by the tide of numbers, let's set the record straight and equip you with the knowledge to avoid some common snafus.

First things first, ditch the misconception that ACV and total contract value are twins. ACV is all about the average annual worth, the steady drip of revenue over time, not the one-time lump sum.

Similarly, ARR isn't about instant gratification. It's a futuristic promise, a glimpse into the expected, annual income you'll enjoy from reliable sources like subscriptions or maintenance fees.

Now, don't be tempted to treat ACV and ARR like interchangeable buddies. They're each playing a different game on the financial field. ACV shines in the realm of high-value contracts, highlighting the average yearly treasure each deal brings.

ARR, on the other hand, thrives on the predictability of recurring revenue streams, painting a picture of your financial stability for the long haul. And remember, even though ARR loves subscription models, it doesn't limit its dance moves. Any reliable, recurring revenue source, like those sweet annual maintenance fees, can join the party!

But here's where things can get tricky. Don't let the short-term allure of ACV blind you to building lasting relationships. Chasing big-ticket contracts is one thing, but neglecting sustainable growth and nurturing loyal customers can leave you empty-handed in the long run.

And when calculating ACV, don't forget to factor in the contract's full duration. Skipping this step is like presenting a lopsided picture, giving you a false sense of the yearly bounty.

Now, relying solely on ARR to gauge your business health is like checking the weather report for a single day. Don't ignore issues like customer churn or market saturation, even if your ARR seems like a steady sunbeam. And remember, seasonal changes and market trends can make ARR fluctuate, so don't jump to conclusions without considering the bigger picture.

Finally, keep in mind that ACV and ARR, although powerful, can have blind spots. Don't let them neglect non-recurring revenue or costs, especially if they play a significant role in your business model. Remember, a comprehensive financial analysis needs all the pieces of the puzzle.

So, there you have it, dear reader, a map to navigate the sometimes-murky waters of ACV and ARR. By understanding their nuances and avoiding these common pitfalls, you can turn these metrics from potential traps into powerful tools, steering your business towards a bright, financially secure future.

Conclusion

In the complex landscape of business finance, the metrics of Annual Contract Value (ACV) and Annual Recurring Revenue (ARR) stand as critical tools for insightful revenue analysis and strategic decision-making. While they serve different purposes, both ACV and ARR provide invaluable perspectives on a company's financial health and potential for growth.

ACV, with its focus on the annual value of individual contracts, is particularly vital for businesses engaged in high-value, multi-year agreements. It aids in understanding the worth of each contract, guiding resource allocation and strategic planning.

On the other hand, ARR offers a snapshot of the predictable, steady income generated from recurring revenue sources, making it a cornerstone metric for businesses with subscription models or regular service agreements.

The key to leveraging these metrics effectively lies in understanding their distinct roles and applications. Misinterpreting or interchanging them can lead to flawed business strategies and misjudged financial health.

As we've seen, each metric has its own set of nuances and considerations, which are essential to grasp for accurate financial analysis and forecasting.

By demystifying ACV and ARR, this article aims to empower business leaders, financial analysts, and investors with the knowledge to use these metrics judiciously.

Whether it's in negotiating contracts, planning future growth, or making investment decisions, a clear understanding of ACV and ARR can provide a robust foundation for sound business practices and sustained financial success.