What is ROAS (Return On Ad Spend)?

By Lior Ronen | Founder, Finro Financial Consulting

Businesses live and die on the effectiveness of their marketing.

As competition for customer attention intensifies, companies need accurate metrics to measure marketing success and make smart spending decisions.

One such metric that has become indispensable is Return On Ad Spend (ROAS). ROAS measures the earnings generated per dollar invested in advertising campaigns.

Unlike vague brand awareness or reach metrics, ROAS offers hard ROI insights to inform budget and channel choices.

For direct response marketers specifically, optimizing for ROAS aligns perfectly with overall business profit aims. The higher the ROAS, the more profitable the ads. This makes ROAS an ideal optimization goal.

In this article, we will cover everything marketers need to know about ROAS, including:

The precise formula for calculating ROAS

Why it’s a crucial metric for direct response marketers

How to analyze ROAS data at campaign, channel, creative, and other granular levels

Strategies for improving ROAS through testing and targeting

How to combine ROAS with related metrics like CAC for decisions

Understanding and acting on ROAS is a vital capability for marketers in any industry pursuing growth through digital channels.

Whether just starting to use ROAS or looking to take their practice of it to the next level, this guide will help cement it as a core piece of marketing measurement.

The marketing metric Return on Ad Spend (ROAS) offers a uniquely effective lens into advertising performance by directly tying spend to bottom-line revenue and profit generation. By factoring total sales driven by paid campaigns and dividing that figure by the cost of those campaigns, ROAS reveals hard return multiples to inform budget decisions. Savvy marketers track granular ROAS rates across channels, geo-targets, creative concepts and more to determine optimal allocation for growth.

They set tiered performance goals based on margins, industry benchmarks and business objectives to balance ambition and realism. Testing new variables like audiences, messages and placements to incrementally improve ROAS facilitates continual optimization over years. When paired with cost efficiency metrics like CAC, focusing intensely on return on spend guides organizations to build truly scalable and profitable marketing machines.

Defining ROAS

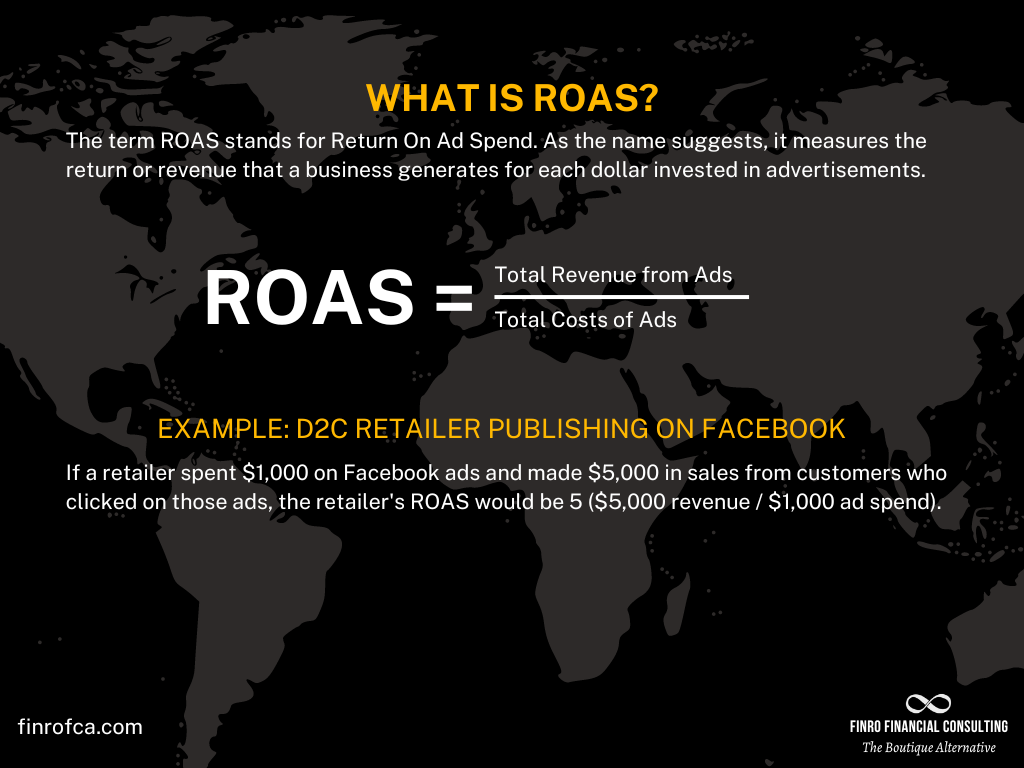

The term ROAS stands for Return On Ad Spend. As the name suggests, it measures the return or revenue that a business generates for each dollar invested into advertisements.

Expressed as a formula, ROAS is calculated as:

ROAS = Total Revenue from Ads / Total Cost of Ads

For example, if a retailer spent $1,000 on Facebook ads and made $5,000 in sales from customers who clicked on those ads, the retailer's ROAS would be 5 ($5,000 revenue / $1,000 ad spend).

Typically, the revenue used in the formula is measured over a set period of time after the ad clicks occur, such as 30 or 60 days.

This allows time for the ad traffic to convert into actual sales through the purchase funnel.

So in simple terms, ROAS evaluates the profitability and efficacy of ad expenditures. The higher the ROAS multiple, the better, as it indicates your ads are contributing significant revenues compared to what they cost.

Because of this pure ROI angle, managing and optimizing for ROAS has become vital for direct response marketers focused on measurable sales or lead outcomes.

Comparing campaign or channel ROAS helps identify the best places to allocate ad budgets.

Over time, marketers can hone in on the most profitable demographics, placements, creatives, and more based on the performance data.

Why ROAS Matters?

ROAS is a uniquely valuable metric because it transcends misleading "vanity" marketing metrics like impressions, reach, clicks, or even website traffic alone. Those gauges do not necessarily correlate with business profitability.

ROAS directly ties ad performance to revenue and profit outcomes for a much more accurate assessment of ROI.

It reveals the hard return on investment rather than output proxies. As marketing budgets continue to rise across industries, decisively answering whether those dollars positively impact the bottom line becomes crucial.

Additionally, optimizing towards ROAS fits neatly with the broader financial objectives that all businesses share - maximum possible profitability.

Rather than vaguely driving "clicks" or "traffic", marketers can use granular ROAS benchmarks and trends to guide decisions with financial returns in clear sight.

If a campaign drives customers profitably, ROAS shows precisely by how much.

This data transparency empowers marketers to allocate budgets more effectively and shift investments rapidly into better-performing segments.

When you directly track which copy resonates best with customers or which channel offers the most profitable traffic, you can fine-tune marketing to maximize your ROAS over time. It gives control and adaptability to grow revenue efficiently.

In short, no serious direct response marketer measuring business impact can afford ignoring precise ROAS performance any longer.

It offers the clarity needed to engineer a truly ROI-first organization.

Get your expert financial analysis now!

Calculating ROAS

The first key step is using tracking and analytics tools to accurately capture revenue driven by your advertising campaigns.

Platforms like Google Analytics, Facebook Ads Manager, and LinkedIn Campaign Manager have robust attribution features to connect conversion data back to sources.

Tagging campaign landing pages and setting up goals and events ahead of time is vital for monitoring the full customer journey post-click.

Retargeting pixels also facilitate tracking across devices and websites. For direct sales, reporting e-commerce revenue by traffic source is essential.

SaaS tools like AppsFlyer and Adjust offer mobile measurement across multiple networks with dashboards to easily view ROAS performance.

This facilitates managing complex multi-channel efforts. Integrations with CRMs like Salesforce also help consolidate data.

The next consideration is choosing the conversion window - the time frame used to count revenue after someone clicks an ad.

Typical windows range from 24 hours to 90 days. Assess your sales cycle and common delays between initial click and eventual purchase. For short cycles, daily or weekly ROAS works. High consideration services may use 90 day windows.

More narrow time frames isolate the direct response, while longer periods account for longer lags and can improve accuracy.

Testing varying conversion windows can reveal ideal benchmarks for your business before setting final goals. The key is consistency in methodology.

ROAS Goal-Setting

When aiming to optimize ROAS, establishing realistic, informed goals is key. Blindly chasing maximum ROAS without context around industry benchmarks or business finances can lead to wasted effort or misleading data.

As a first step, research average ROAS metrics across your space.

For example, SaaS companies tend to target higher ROAS levels due to recurring revenue models.

E-commerce ROAS varies based on margins - low margin retailers may set goals around 2-3X returns, while high-end brands target 5-10X multiplicative returns.

Tiered goal-setting based on product and service profitability also lends more granularity.

For example, a SaaS company may set the following tiered ROAS goals:

3X for free trial signups

5X for low-tier software subscriptions

10X for premium enterprise solutions

This accounts for the wider monetization differences across customer segmentation.

Basing goals on broader business revenue needs is also important.

Factoring in CAC, average deal sizes, sales cycles, and more helps balance ROAS against real-world objectives.

Being overly-ambitious with ROAS targets without actually driving sufficient profit can undermine growth.

Continuously adapting the goalposts based on wider indicators allows for both ambition and pragmatic progress tracking.

ROAS can be improved gradually through testing and optimization efforts.

As with any business metric, the context behind the numbers matters tremendously.

Measuring ROAS Performance

The real power of ROAS comes from drilling down into granular performance data to locate high-potential opportunities.

By splitting out ROAS by critical marketing attributes like campaigns, channels, target segments, and placements, you can divert budgets to the best-performing levers.

For example, an e-commerce retailer may find ROAS through Google Shopping ads outperforming Facebook ads 3X over.

Or an agency may discover ROAS from LinkedIn ads for senior titles significantly beats mid-level roles.

Geo-targeted campaigns in Western Europe could trounce other regions.

Platform reporting features and analytics dashboards enable this segmentation conveniently across digital campaigns.

Trend analysis over longer time periods also highlights the impact of optimization efforts - for example, whether repeatedly A/B testing ad creatives and messages can move the needle on ROAS.

Sharp changes demand further investigation as they may signal data tracking issues or external factor influence rather than tested improvements.

Gradual ROAS growth through refinement is ideal.

No matter your business model, drilling into the layers of data is vital - sheer aggregate ROAS at the account level obscures huge performance differences across segments.

Uncovering those outliers leads to smarter budget decisions and better practices across channels.

Improving Low ROAS

When faced with an underperforming campaign or low ROAS across segments, marketers have several potential remedies to test:

First, re-evaluating audience targeting to hone in on proven high-value demographics can boost ROAS. For example, narrowing geo-targets, fine-tuning interest or behavioral variables, or placing age and income filters on the addressable market.

The goal is to remove poor-fitting customers from spending budgets to focus on prime profiles.

Testing completely new creative concepts, ad copy, headlines, and visuals can also lift ROAS by better resonating with audiences.

Similarly, launching marketing for ancillary products or services that carry higher margins can improve returns without massively increased costs.

Finally, doubling down on placements, partnerships, influencers, and channels that over-index on ROAS already can capitalize on existing momentum.

For instance, spending more on Cost Per Click networks like the Google Display Network instead of social platforms if they drive stronger conversion rates.

Persistently optimizing through testing, learning and re-allocation drives ROAS advancement over quarters and years.

The key is to remain nimble and open to new targeting avenues, creatives, products, and channels based on the data signals.

ROAS reveals the customer and messaging nuances to guide better marketing.

Conclusion

In closing, fully grasping ROAS and its use cases can significantly empower marketers to make smarter decisions towards profitability. By moving beyond superficial vanity metrics to a pure profitability goal based on return, direct growth and impact can be achieved across the many channels now available.

While simple in principle, accurately tracking, attributing, isolating, and comparing ROAS performance reveals meaningful optimization opportunities to efficiently drive the business forward. Rather than general awareness or scale, savvy marketing teams will be fixated on exploiting segments and approaches delivering exceptional returns.

The name of the game is ultimately revenue growth and margin expansion. ROAS provides the focused analytical lens for sustainable gains on both fronts. It embodies marketing ROI in the clearest, most actionable form for driving outsized business success. Treat it as a vital sign to regularly monitor and improve.

By maintaining an intense focus on return across campaigns, companies can make tremendous progress in not just lead generation but converting those leads into positive profit outcomes campaign-by-campaign. In tandem with costs-focused metrics like CAC, ROAS provides the complete picture to scale marketing profit engines.

The fruits of these efforts - enhanced revenues at lower costs - make the ROAS-centric approach well worth embracing as a long-term capability.