What is Customer Lifetime Value (LTV)?

By Lior Ronen | Founder, Finro Financial Consulting

Customer Lifetime Value (CLTV or LTV) is a pivotal metric for businesses, particularly startups. It represents the total net profit a business can expect from an average customer throughout their relationship.

This metric provides a comprehensive understanding of a customer's value, going beyond individual transactions to encompass the entire customer lifecycle.

For instance, if a customer spends $20 a month for 36 months on a service, their LTV is $720. This calculation demonstrates how long-term customer loyalty can significantly impact a company's bottom line.

Understanding and maximizing Customer Lifetime Value (LTV) is crucial for sustainable business growth. LTV represents the total revenue expected from a customer over their relationship with a company.

Key to this is balancing the Lifetime Value with Customer Acquisition Cost (CAC), ensuring that the cost of acquiring new customers is justified by their long-term value. Factors like customer retention, purchase frequency, and average purchase value play significant roles in influencing LTV.

A healthy LTV to CAC ratio indicates efficient investment in customer acquisition. The focus on customer satisfaction and loyalty, alongside adapting strategies to specific industry contexts and evolving market dynamics, is essential for enhancing LTV and driving long-term profitability.

Increasing LTV indicates that customers are not only maintaining their subscriptions but also upgrading to higher-priced plans or products. This growth signals a strong customer relationship and the potential for even greater profitability in the future.

When combined with the customer acquisition cost (CAC), LTV forms a crucial ratio to evaluate whether a customer's revenue justifies their acquisition cost.

Generally, an LTV should be at least three times the CAC, or else the investment might not be worthwhile. This ratio helps businesses make informed decisions about their customer acquisition strategies.

Understanding and optimizing CLTV is essential for businesses of all sizes seeking to achieve sustainable growth and long-term success. The next section of this article will delve into the methodologies and considerations for calculating LTV, empowering businesses to measure and manage this crucial metric effectively.

Customer Acquisition Cost (CAC) is a key business metric that represents the total cost associated with acquiring a new customer. This includes all marketing and sales expenses – such as advertising, promotional activities, salaries of marketing and sales teams, and costs of marketing and sales tools – over a specific period.

CAC is crucial for evaluating the effectiveness and efficiency of a company's marketing strategies, understanding the investment required to expand the customer base, and assessing overall profitability. It's particularly important for businesses to compare CAC with other metrics like Lifetime Value of a Customer (LTV) to ensure that the cost of acquiring a customer does not exceed the revenue they are expected to generate, thereby maintaining a sustainable business model.

How to Calculate the LTV?

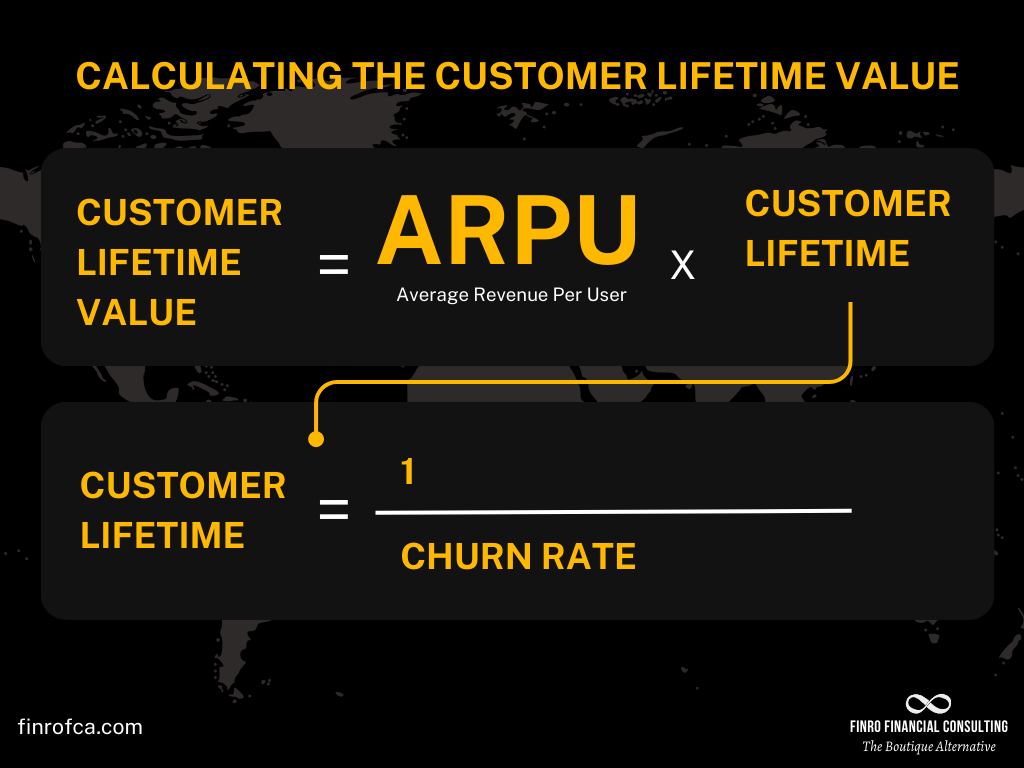

To accurately calculate the Lifetime Value (LTV) of a customer, start by determining the Average Revenue Per User (ARPU).

ARPU is the average revenue generated from each customer over a specific time period, such as monthly or annually. It's essential to maintain consistent time units throughout the calculation. For instance, if using a monthly ARPU, ensure that the customer lifespan is also calculated in months.

Consider a business with a monthly ARPU of $20. If the average customer lifespan is four years, the LTV is calculated by multiplying the monthly ARPU by the total number of months in the lifespan: $20/month × 48 months = $960.

This figure represents the total revenue expected from an average customer over their relationship with the company.

Average Revenue Per User (ARPU) is a financial metric used by businesses, particularly in the telecommunications, media, and technology sectors, to measure the average revenue generated from each user or customer over a specific period, typically monthly or annually. ARPU is calculated by dividing the total revenue generated in a given period by the number of users or customers during that period.

ARPU is essential for evaluating a company's revenue generation efficiency and is often used to assess the financial health and growth potential of subscription-based and service-oriented businesses. By tracking ARPU, companies can identify trends, make informed decisions about pricing strategies, marketing, and customer service improvements, and gauge the overall value derived from their customer base.

In situations where the customer lifespan isn't directly known, it can be estimated using industry benchmarks or calculated from the churn rate.

The churn rate indicates the proportion of customers that discontinue using the service annually.

For example, with a churn rate of 20% per year, the estimated customer lifespan is 1 divided by the churn rate: 1 / 20% = 5 years, or 60 months. Therefore, with a monthly ARPU of $20, the LTV becomes $20/month × 60 months = $1,200.

It's crucial to note that higher churn rates typically lead to lower LTVs. This underscores the importance of effective customer retention strategies, particularly in industries like SaaS and e-commerce, where acquiring new customers can be costly. By reducing the churn rate, a business can significantly increase the lifetime value of its customers, enhancing overall profitability and sustainability.

The Dynamics of Customer Lifetime Value (LTV): Factors That Impact The Metric

Understanding and enhancing Customer Lifetime Value (LTV) is essential for businesses aiming to solidify their market position and ensure long-term profitability. LTV isn't just a static figure; it's a dynamic metric influenced by a spectrum of factors, ranging from customer behavior to operational efficiency.

Recognizing these factors is the first step in developing strategies that not only boost LTV but also align with your overall business objectives. By delving into the nuances of each component, businesses can identify areas for improvement, adapt their strategies accordingly, and effectively increase the value derived from each customer relationship.

This exploration is not just about identifying what boosts LTV, but also understanding the intricate balance between customer satisfaction, spending habits, and business operations.

Prioritizing Customer Retention: The longer you retain a customer, the higher their LTV. Implementing effective retention strategies, like personalized communication and loyalty programs, directly reduces churn rates and boosts LTV.

Boosting Average Purchase Value: Encourage customers to spend more per transaction. Tactics like upselling, cross-selling, and offering bundle deals can significantly elevate the average purchase value, enhancing LTV.

Increasing Purchase Frequency: Regular customer engagement through marketing initiatives and excellent service encourages repeat purchases, raising purchase frequency and, consequently, LTV.

Optimizing Profit Margins: High profit margins contribute to a higher LTV. Strategies like cost reduction, value-based pricing, and offering premium services can improve margins.

Leveraging Customer Segmentation: Differentiate your strategies for various customer segments. Focus on nurturing high-value segments to maximize revenue generation and LTV.

Efficient Cost Management: Streamlining operations and controlling production costs can improve profit margins, positively influencing LTV.

Adapting to Market Conditions: Stay agile in response to external factors like competition and economic changes. An adaptable approach ensures resilience and sustained LTV growth.

LTV to CAC Ratio: A Key Indicator of Business Health

The LTV to CAC ratio is a critical metric that illustrates the relationship between the Lifetime Value of a customer (LTV) and the Cost of Acquiring that customer (CAC). LTV, as we know, represents the total revenue a business can expect from a single customer account over their relationship with the company.

It takes into account the revenue value from a customer and contrasts it with the company's anticipated customer lifespan, highlighting profitable customer segments.

Conversely, CAC measures the total expenses incurred to acquire a new customer, encompassing all marketing and sales efforts. The LTV to CAC ratio, obtained by dividing LTV by CAC, is a vital indicator of return on investment (ROI) in customer acquisition. It answers a crucial question: Is the cost to acquire a customer justified by the revenue they generate over their lifetime with the company?

A healthy LTV to CAC ratio is typically around 3:1, meaning the customer's value is three times the cost of acquiring them. This ratio signals a balanced and efficient customer acquisition and profitability model.

A 1:1 ratio, where the cost equals the revenue, suggests a breakeven point, while anything below 1:1 is concerning, indicating that acquisition costs outweigh customer revenue. Conversely, a very high ratio, significantly above 3:1, might indicate underinvestment in growth and potential missed opportunities for business expansion.

For instance, if a company spends $250 to acquire a customer whose LTV is $960, the LTV to CAC ratio would be 3.84 (960 ÷ 250), exceeding the optimal 3:1 benchmark.

This suggests that for every dollar spent on acquiring a customer, the company earns back $3.84 over the customer's lifecycle, a sign of efficient customer acquisition strategy and promising business sustainability.

Conclusion

Mastering Customer Lifetime Value (LTV) is essential for the sustained success and growth of any business. LTV isn't merely a reflection of customer expenditure; it's a comprehensive measure of their engagement duration and overall profitability to your company. This metric serves as a guiding light for refining marketing, sales, and customer retention strategies, ensuring that each customer's potential value is fully realized.

It's important to understand that LTV extends beyond monetary transactions; it embodies the quality of relationships you build with your customers, the value they derive from your products or services, and the overall experiences they encounter. By focusing on enhancing customer satisfaction and loyalty, you can significantly increase the LTV, driving long-term business growth.

The LTV to Customer Acquisition Cost (CAC) ratio also plays a pivotal role, highlighting the importance of balancing the cost of acquiring new customers with the value they bring over their lifetime. A strategic approach to this ratio ensures that your growth is not just rapid but also sustainable.

Remember, the ideal LTV varies across industries and business models. It requires a contextual understanding of your specific market and customer base. Regular analysis and adaptation of your LTV strategies are crucial, as customer behaviors and market conditions evolve continuously. Leveraging data analytics can provide deeper insights into LTV, enabling more precise and effective strategies.

In conclusion, a robust understanding and application of LTV principles can steer your business towards greater profitability and success. By continuously adapting to changing market dynamics and customer preferences, you can ensure that your LTV strategies remain effective, driving your business forward in an ever-evolving landscape.