Scaling Smart: TAM Strategies for B2B SaaS Startups

By Lior Ronen | Founder, Finro Financial Consulting

It’s common for B2B SaaS founders to underestimate their market’s true potential. Many times, this isn’t because the business lacks opportunity, but because the market size—specifically the Total Addressable Market (TAM)—is either misunderstood or overlooked.

A well-defined TAM can reveal just how much room there is to grow, guiding better business decisions and avoiding those frustrating moments when a promising lead goes cold or a valuable opportunity slips away.

In this article, we’ll explore why TAM is essential for any B2B SaaS startup that wants to make the most of its market. Whether you’re aiming to bring in investors or fine-tune your strategy, understanding your TAM is a practical step that gives you a clearer picture of your business’s growth potential.

And if your TAM seems small? That’s not necessarily a problem; with the right approach, even niche markets can provide big returns.

Let’s look at what a solid TAM strategy can do for your B2B SaaS, whether you’re scaling up or trying to secure that next round of investment.

Understanding Total Addressable Market (TAM) enables B2B SaaS founders to make strategic decisions, allocate resources effectively, and appeal to investors—even within niche markets. Accurate TAM calculations support realistic growth goals and customer-focused strategies that drive revenue and loyalty. In specialized markets, a small TAM can foster deep customer relationships, high retention, and valuable referrals. Regularly revisiting TAM keeps growth aligned with market shifts, maximizing long-term success.

Why Total Addressable Market (TAM) Matters in B2B SaaS?

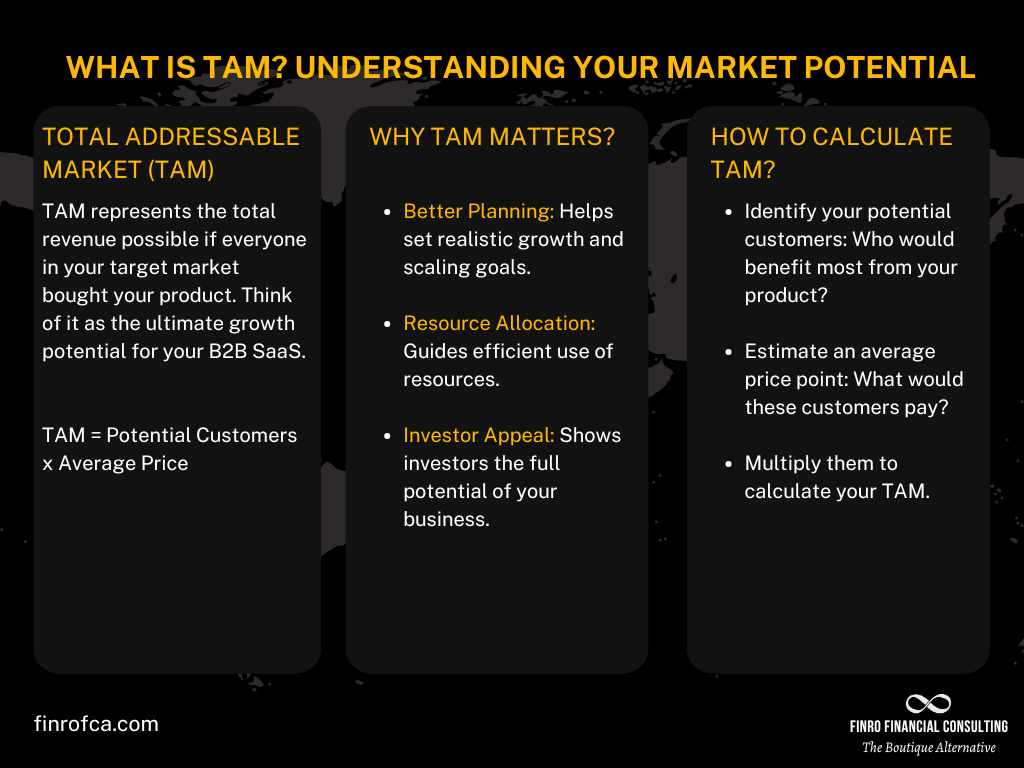

For B2B SaaS founders, understanding TAM (Total Addressable Market) is critical to unlocking real growth potential.

TAM represents the total revenue opportunity if you were to capture 100% of your market—a helpful way to quantify demand, map out expansion, and assess long-term profitability. Think of TAM as a benchmark, not a target to conquer fully, but a guide that illustrates what’s possible.

Calculating TAM isn’t just a hypothetical exercise; it’s a foundational step that impacts almost every business decision. When you know the size of your market, you’re better equipped to focus your resources effectively, prioritize high-potential opportunities, and set realistic goals for scaling.

Without this insight, your growth efforts risk being misaligned or under-optimized, especially in the competitive B2B SaaS space.

Even though achieving complete market saturation isn’t realistic—especially with competitors in the picture—a well-defined TAM is still indispensable. It serves as a practical guide, helping founders make informed, data-backed decisions on growth strategy, marketing, and resource allocation.

Whether your goal is to increase market share or secure investment, TAM provides the big-picture perspective needed to set you on the right path.

How TAM Drives Success for Founders?

For B2B SaaS founders, having a clear picture of your Total Addressable Market (TAM) can be a game-changer. It’s not just a figure on a spreadsheet; it’s a guiding metric that influences how you approach growth, allocate resources, and prioritize your efforts.

Setting Realistic Growth Goals: TAM gives you a grounded view of what’s possible. Instead of chasing vague growth targets, you can focus on achievable milestones that align with the actual size of your market. This way, every goal is rooted in reality, keeping your team aligned and your growth path clear.

Allocating Resources Effectively: Knowing your TAM allows you to direct your resources—time, money, and manpower—where they’ll have the most impact. Instead of spreading efforts too thin or chasing opportunities that don’t move the needle, TAM helps you prioritize initiatives that align with your market’s potential.

Communicating Value to Stakeholders: Investors want to know the market opportunity behind your business. When you have a well-defined TAM, you’re able to present a compelling case for why your product matters and how much growth potential exists. It shows investors you’ve done your homework and understand both your market and your strategy.

Ultimately, TAM is more than a number; it’s a strategic tool. It enables you to make informed, data-backed decisions that can guide your B2B SaaS toward sustainable growth and increased investor interest.

The Investors' Perspective: TAM and the Path to Buy-In

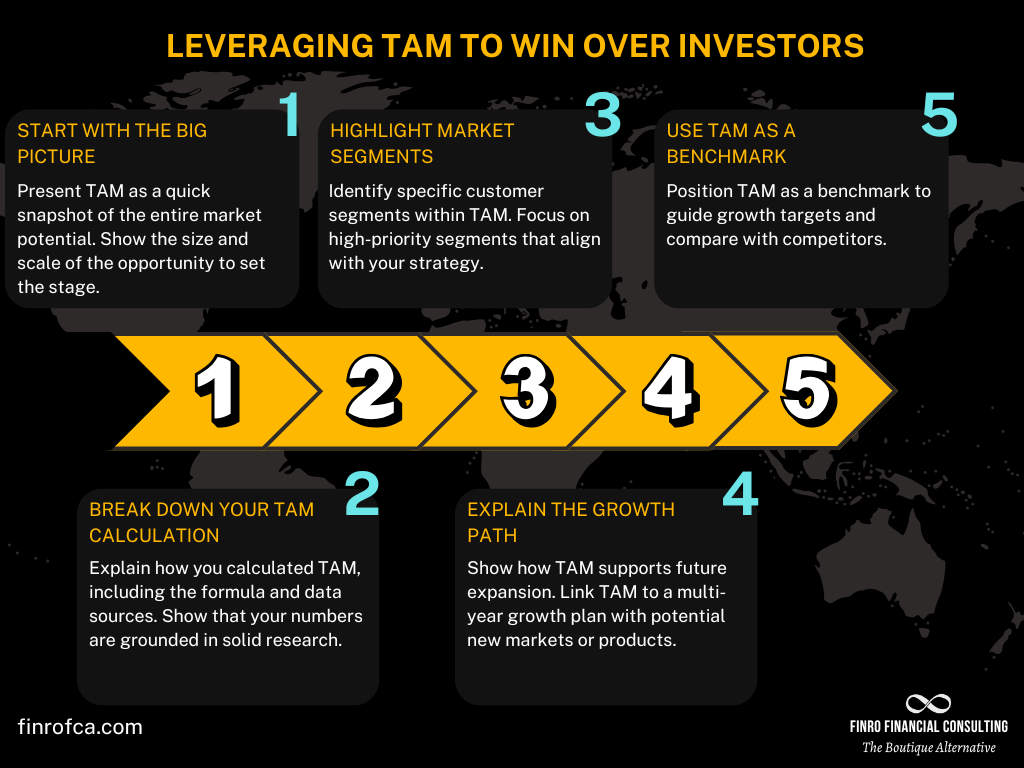

By now, we’ve covered how understanding your TAM helps you set realistic goals and allocate resources effectively. But when it comes to securing funding, TAM becomes more than just an internal tool. It’s a powerful way to communicate value to investors.

Investors look for opportunities where growth potential is clear and substantial. They want to see a market big enough to support scaling, with room for returns that justify the risk. When you present a well-defined TAM, you’re showing them exactly that—a clear snapshot of the market opportunity behind your B2B SaaS startup.

A strong TAM figure makes your pitch more credible. It shows you’re not just hoping for success; you’re basing your vision on real data. This is a key signal to investors. It tells them you’re not guessing or inflating numbers. You’ve done the research, you understand your market, and you’ve put in the work to calculate what’s possible.

For investors, a well-researched TAM helps mitigate some of their biggest concerns. They’re often wary of startups that lack a clear path to growth or operate in overly niche markets. With a solid TAM, you’re proactively answering their questions about scalability and market reach. You’re not waiting for them to ask; you’re leading with confidence in the size and potential of your market.

In essence, TAM isn’t just a number on a slide deck. It’s a reassurance to investors that your B2B SaaS startup has room to expand and thrive. It’s proof that you’re ready for the next stage of growth, equipped with both the data and the strategy to make it happen.

Calculating TAM: Approaches and Challenges

So far, we've explored how TAM can guide your B2B SaaS strategy—shaping growth goals, resource allocation, and investor pitches. But calculating TAM accurately isn’t always straightforward. It’s a nuanced process that requires careful selection of data and methodology.

There are three main approaches to calculating TAM, each suited to different contexts and types of data: Top-Down, Bottom-Up, and Value Theory.

The Top-Down approach starts with industry-wide data and narrows down. Think of it as starting with a bird’s-eye view, using general market figures from industry reports and applying filters based on your specific audience and product. While it can give a broad sense of market size, this method has its limitations. Industry reports might be too general or may not reflect the specific needs of your niche, leading to rough estimates rather than precise figures.

The Bottom-Up approach takes a different path. Here, you work from your own data—like sales figures or customer metrics—to build up to a market estimate. By estimating the number of potential customers and multiplying that by an average price point, you arrive at a TAM that’s closely aligned with your business reality. This approach is often more accurate, but it requires solid internal data. For early-stage startups, collecting enough data to use this method effectively can be challenging.

Then there’s the Value Theory approach, a bit unconventional but useful for truly innovative products. Instead of relying on existing market size, this method estimates the potential value of solving a specific problem. By calculating what your target customers would be willing to pay to resolve a pressing need, you create a hypothetical market value. This approach is ideal for products in uncharted territories, but it also carries some risks. Without substantial validation, it can be tough to back up these numbers convincingly.

Choosing the right method—or even a mix—depends on your business model, market specifics, and available data. It’s a complex process, but it can make all the difference in accurately presenting your startup’s market potential.

With a solid understanding of how to approach TAM calculation, let’s move to an essential question: What if your TAM turns out to be small? Does that limit your potential, or could it be an advantage for your B2B SaaS strategy?

| Approach | Description | Best For | Challenges |

|---|---|---|---|

| Top-Down | Uses broad industry data, narrowing down by applying filters. | General market overview | May lack precision for niche markets. |

| Bottom-Up | Builds TAM from internal data (e.g., sales, customer metrics). | Data-rich startups with specific metrics | Requires robust internal data, which early-stage startups may lack. |

| Value Theory | Estimates TAM based on the value customers place on solving a specific problem. | Innovative or disruptive products | Difficult to validate without thorough research. |

Small TAM, Big Impact: Thriving in a Niche Market

Now that you understand how to calculate TAM, you might be wondering: what if your TAM turns out to be small? Many founders worry that a small TAM will limit their growth or make their startup less attractive to investors.

But in the world of B2B SaaS, a small TAM doesn’t have to be a disadvantage. In fact, it can be a unique advantage—if you approach it with the right mindset.

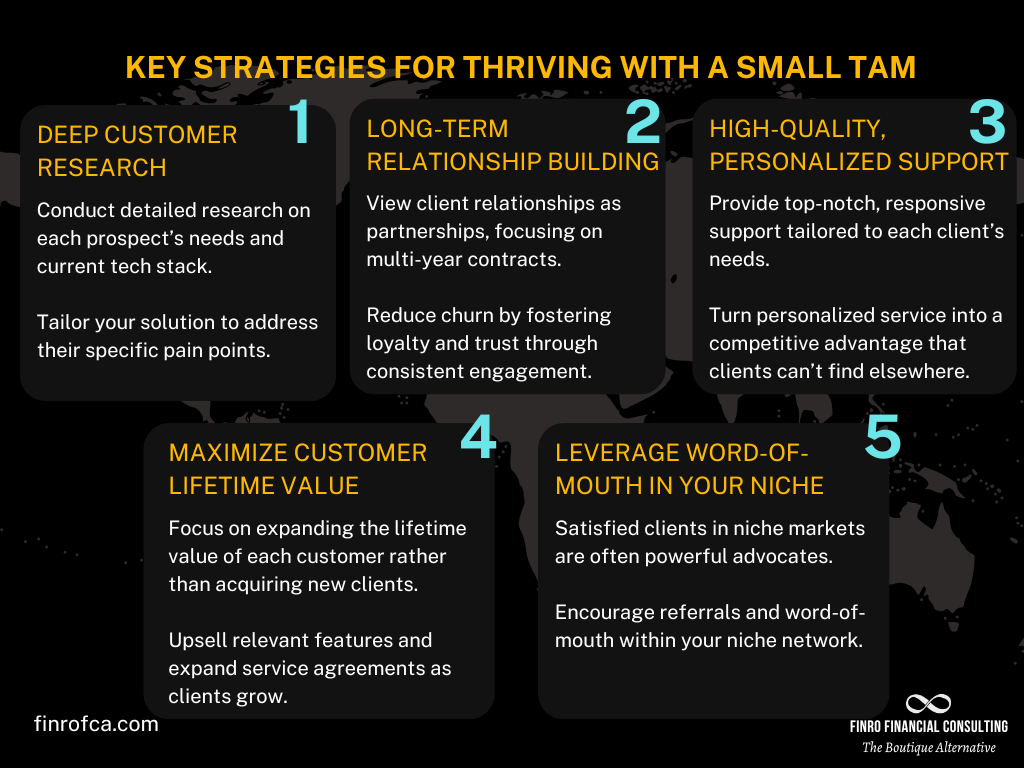

A small TAM usually means you’re working in a highly specific niche, addressing very targeted needs. And while it’s true that fewer customers may find value in your product, these customers often have a higher willingness to pay for a specialized solution. In niche markets, clients typically face unique pain points that generic solutions don’t address. By deeply understanding and solving these specific issues, you position yourself as an essential partner, not just another vendor.

Take the example of a B2B SaaS startup serving a narrow industry segment, such as compliance software for a specific financial sub-sector. The TAM for this product may be small, but that doesn’t mean the business lacks potential.

In fact, clients in these sectors often sign long-term contracts, appreciate high-quality support, and value expertise that caters specifically to their industry. This can lead to stable, high-margin revenue, as well as high customer retention rates—qualities that many investors find appealing.

For a B2B SaaS business with a small TAM, success comes from maximizing value within the niche rather than trying to stretch into broader markets. Your growth strategy might focus on premium pricing, high-touch customer relationships, or creating custom features that competitors in larger markets overlook. With this approach, a small TAM can lead to deep customer loyalty and strong word-of-mouth, which can fuel growth even without a massive market.

So, if your TAM seems limited, don’t view it as a roadblock.

Instead, see it as an opportunity to specialize, differentiate, and build lasting relationships.

Next, let’s explore a practical example that demonstrates how a niche-focused B2B SaaS can turn a small TAM into a profitable, sustainable business.

Real-World Example: Success with a Small TAM

We’ve discussed the advantages of a small TAM and how it can lead to focused growth and strong customer relationships. Now, let’s look at a real-world example to see these principles in action.

One of our clients, a European B2B SaaS company in the fintech sector, offers a highly specialized solution for a specific type of financial institution. At first glance, their TAM appeared small, and many would have assumed this was a limiting factor. But instead of seeing it as a constraint, they embraced it as an opportunity to excel in their niche.

This company understood that with fewer potential clients, they needed to go deep rather than wide. They dedicated substantial resources to researching each prospect’s specific needs and existing technology stack before making their pitch. This preparation allowed them to tailor their solution precisely to their clients’ pain points, making it more than just a product—it became an essential tool for their clients' operations.

Furthermore, the company leveraged the long sales cycles typical of B2B. They approached each client relationship as a long-term partnership, often securing multi-year contracts. Knowing that switching costs are high for their clients, they focused on building strong loyalty and trust, which reduced churn and increased lifetime customer value.

To reinforce this loyalty, they prioritized high-quality customer support. With a limited client base, they could provide each customer with personalized attention and fast response times. This level of service became a competitive advantage and led to high client satisfaction. Many clients not only renewed their contracts but also recommended the product to others within their network.

Today, this fintech company generates millions in recurring revenue from a small, loyal client base. Their success is a testament to the power of a small TAM, showing that a niche market, when approached with expertise and focus, can be as profitable and sustainable as larger markets.

This example illustrates that a small TAM doesn’t have to hold your business back. It’s all about the strategy and how you leverage that niche. Next, let’s summarize the key takeaways on how a clear understanding of TAM can shape your B2B SaaS success.

Conclusion

Understanding your Total Addressable Market (TAM) is more than just an exercise in market sizing—it’s a foundational tool that drives strategy, shapes investor conversations, and guides your path to sustainable growth. By leveraging TAM effectively, you can approach your B2B SaaS business with clarity and confidence, whether you’re targeting a vast market or operating within a highly specialized niche.

TAM helps you set realistic growth goals, allocate resources where they matter most, and make a compelling case to investors. As we’ve seen, even a small TAM can lead to big success when combined with a focused, relationship-driven approach. Rather than limiting your potential, a niche market can become a source of strength, allowing you to deeply understand customer needs and create lasting loyalty.

In a competitive B2B SaaS landscape, the value of TAM lies in its ability to ground your decisions in data and strategy, keeping your team aligned and your growth efforts focused. Whether you’re calculating TAM to validate your initial market, seeking funding, or defining your long-term roadmap, understanding your market potential sets you up for success.

As you move forward, remember that TAM is not a one-time calculation. Markets evolve, customer needs shift, and new opportunities emerge. Revisiting your TAM regularly can help you stay agile and responsive to change, ensuring that your growth strategy remains aligned with the latest market dynamics.

If you’re ready to unlock your B2B SaaS startup’s full potential, consider partnering with experts who can guide you through the nuances of TAM analysis, financial modeling, and strategic planning. With the right tools and insights, you can confidently navigate the path to sustainable growth and maximize the impact of your unique market opportunity.

Key Takeaways

TAM Guides Strategic Growth: Setting realistic goals with TAM aligns growth efforts and resource allocation.

Investor Appeal: A strong TAM calculation attracts investors by demonstrating market opportunity.

Niche Market Advantage: Small TAMs enable focused customer relationships and high retention.

Customer-Centric Strategy: Deeply understanding customer needs drives loyalty and revenue.

Ongoing TAM Reassessment: Regularly updating TAM keeps strategies relevant amid market shifts.

Answers to The Most Asked Questions

-

TAM represents the total revenue opportunity if a business captures 100% of its target market.

-

TAM can be calculated using top-down, bottom-up, or value theory approaches, depending on available data and market specifics.

-

TAM helps founders set realistic growth goals, allocate resources effectively, and build a strong case for investors.

-

Yes! Niche markets with smaller TAMs can lead to high-value, loyal customer relationships and stable revenue.

-

Regularly. As markets and customer needs evolve, updating TAM keeps growth strategies aligned with new opportunities.