Joseph Baldassarra

Managing Partner, Broad Street Global Fund

By Lior Ronen | Founder, Finro Financial Consulting

When it comes to investing in tech startups, knowing what you’re getting into is crucial. That’s where startup due diligence comes in.

It's essentially your deep-dive into a startup's financials, legal matters, operations, and tech setup to make sure everything checks out before you commit your funds.

In this article, we'll walk you through the what, why, and how of due diligence, highlighting its importance at various stages of startup growth and for different types of investors.

Startup due diligence is essentially a thorough background check on a tech startup, covering every crucial aspect of the business before making an investment. This process is not just about scrutinizing numbers; it’s about understanding the story behind them, the technology underpinning the business, and the people steering the ship.

The due diligence process typically spans several key areas:

Financial Due Diligence: Examining financial statements, funding history, revenue models, and future financial projections to ensure the financials are robust and the projections are realistic.

Legal Due Diligence: Reviewing legal documents to verify intellectual property rights, assess litigation risks, and ensure compliance with applicable laws, thus avoiding potential legal surprises.

Operational Due Diligence: Assessing the business model, market positioning, competitive environment, and operational effectiveness, including thoroughly evaluating the management team’s capabilities.

Technical Due Diligence: Particularly critical for tech startups, this involves reviewing the technology itself—its architecture, code base, development processes, and scalability—to ensure it is not only innovative but also viable long-term.

|

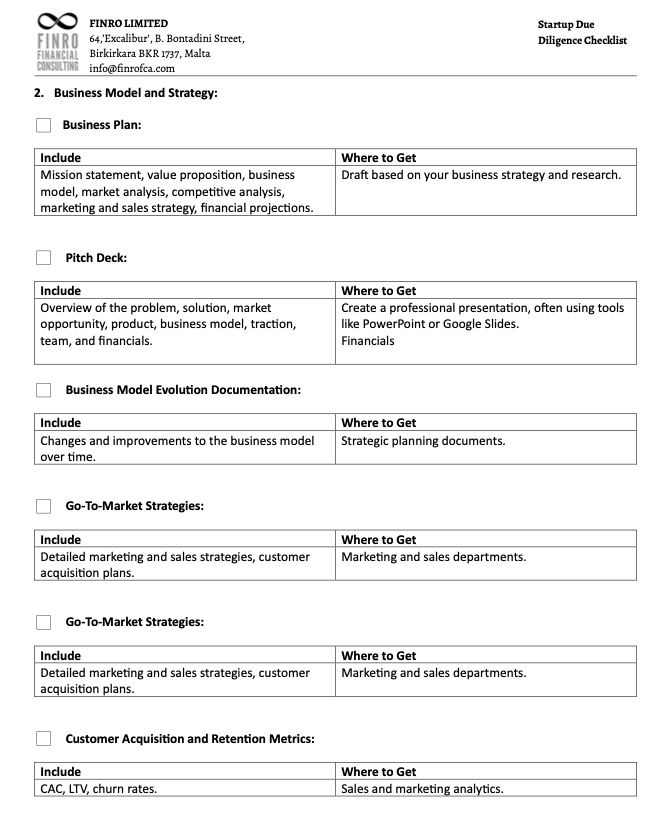

Click to Recieve The Full Checklist Now: Finro Startup Due Diligence Checklist |

The focus of due diligence significantly shifts depending on the maturity of the startup.

For early-stage startups, the process centers on the potential of the business concept and the founding team's vision and expertise.

With often limited financial data available, this stage of due diligence leans more toward a qualitative analysis. It explores the uniqueness of the product or service and assesses the feasibility of the proposed business model, ensuring the foundational ideas are sound and capable of scaling.

As startups move into their mid-stage, having developed and begun to validate their business models, due diligence becomes a mix of both qualitative and quantitative analyses.

This phase examines key growth metrics, such as customer acquisition costs and the lifetime value of customers, along with the scalability of the business model. This blend helps investors gauge how well the startup manages its growth and what challenges it may face as it expands.

Due diligence is more rigorous for established startups, involving a detailed examination of financial performance, market penetration, and operational stability.

This thorough analysis is crucial to verify that the business has a sustainable model, a stable customer base, and a clear pathway to further growth or potential exit strategies such as public offerings or acquisitions. It ensures that the company maintains its market position and is poised for future success.

As we've explored the various facets of due diligence and how they adapt across different stages of a startup's lifecycle, it's clear that the process is dynamic and indispensable. With these fundamentals in place, let's dive deeper into the specific components of startup due diligence.

In the following section, we will detail the critical areas of financial, legal, operational, and technical due diligence, highlighting best practices and key considerations to ensure a thorough evaluation.

| Stage | Focus of Due Diligence | Key Elements of Analysis |

|---|---|---|

| Early-Stage | Potential of business concept and team's vision | Vision and expertise of the founding team Uniqueness of product/service Feasibility of business model |

| Mid-Stage | Operational effectiveness and growth metrics | Growth metrics (e.g., customer acquisition costs, lifetime value) Scalability of business model Management of growth |

| Established | Financial performance and market penetration | Detailed financial analysis Market share and competitive positioning Operational stability and sustainability of business model |

Before making an investment decision, it's crucial to dissect a startup's different components.

This thorough scrutiny, spanning financial, legal, operational, and technical aspects, ensures a comprehensive understanding of the startup's potential and risks.

Let’s take a look into these critical areas to understand their specific roles and the insights they offer.

Financial due diligence is a cornerstone of startup valuation. It involves thoroughly analyzing the company's financial statements, funding history, revenue models, and future projections.

The aim is to ascertain the startup's financial health, ensuring that the financial statements are accurate and the projections are realistic and attainable. This process helps investors understand the startup's burn rate, profitability potential, and long-term financial sustainability.

Finro specializes in startup financial due diligence for both buy-side (VCs, private equity funds, angel investors) and sell-side (startups). Contact us today to learn more about how we can assist you with your needs.

Legal due diligence is crucial to uncover any potential legal issues that could impact the startup's success or value. It covers a review of intellectual property rights, ensuring that the startup actually owns or has licenses for the technology it uses or sells.

Additionally, it involves checking for ongoing or potential litigation, compliance with laws (such as employment laws and data protection laws), and the scrutiny of any contractual obligations with third parties.

This diligence ensures that the startup has addressed all legal risks that could affect its operations or financial standing.

Operational due diligence assesses the effectiveness of the startup's business operations. It looks at the organizational structure, the capabilities of’s capabilities, market positioning, and the competitive landscape.

The goal is to evaluate the startup's market positioning, and an operational review helps determine scalability. Th the startup has the operational prowess to execute its business plan and achieve its projected growth.

Technical due diligence is particularly important for tech startups. This evaluation focuses on the technology stack, software architecture, code quality, and security measures.

It assesses whether the technology is scalable, secure, and capable of supporting the startup's growth ambitions without significant reengineering. Additionally, it checks for any technical debts that might impede future development or scalability.

With a deeper understanding of these individual components, investors are better equipped to evaluate a startup's overall viability and potential.

Next, we will explore the common challenges encountered during the due diligence process and provide strategies to navigate these obstacles effectively.

Conducting due diligence on a startup can be a complex and daunting task, fraught with potential challenges that can impact the effectiveness of the investigation. Understanding these challenges and preparing strategies to overcome them are crucial for ensuring a thorough evaluation.

Investors often face a variety of hurdles during the due diligence process. These challenges can arise from the nature of startups themselves—often young, with limited data and high degrees of uncertainty. Common challenges include incomplete information, founder bias, market volatility, and technological feasibility issues. Each of these can obscure the true state of the startup, leading to potential misjudgments and financial risks.

Incomplete Information: Startups, especially in their early stages, may not have comprehensive financial records or detailed operational histories. This lack of data can make it difficult to assess the company's true health and potential.

Founder Bias: Founders are typically highly optimistic about their ventures, which can lead to overstated capabilities and undervalued risks. This bias can skew the information presented to investors, making it challenging to get an objective view.

Market Volatility: The tech industry is particularly susceptible to rapid changes in market trends and consumer behaviors. This volatility can drastically affect a startup’s potential, making it hard to predict long-term success.

Technological Feasibility: Startups often push the envelope on technology, leading to uncertainties about the feasibility and scalability of their tech solutions. Assessing the actual viability of the technology can be complex and requires specialized expertise.

Regulatory and Legal Issues: Startups may not fully comply with all industry regulations, posing significant legal risks. Investors need to ensure that all legal aspects are covered to avoid future complications.

Utilize Qualitative Assessments: When dealing with incomplete information, supplement the data gaps with qualitative assessments such as interviews with founders, early customers, and industry experts. This can provide valuable insights into the startup’s potential and operational realities.

Corroborate Information: To counter founder bias, corroborate the claims made by the founders with independent research, market analysis, and third-party evaluations. Cross-referencing multiple sources can help ensure objectivity.

Conduct Thorough Market Analysis: To manage market volatility, conduct in-depth market analysis focusing on recent trends and future projections. Understanding the competitive landscape and market dynamics can help gauge the startup’s potential resilience.

Employ Technical Experts: For technological feasibility, involve technical experts to conduct detailed reviews of the technology stack, development practices, and scalability potential. This specialized evaluation can identify potential technical debts and scalability issues.

Perform Detailed Legal Reviews: Address regulatory and legal issues by performing comprehensive legal reviews to identify any compliance gaps and understand the potential legal ramifications. Ensuring that the startup is legally sound is crucial for risk mitigation.

Understanding the real-world implications of inadequate due diligence can provide valuable lessons for investors.

By examining notable cases where insufficient scrutiny led to significant financial and reputational damage, we can better appreciate the critical importance of thorough due diligence. Here, we explore two infamous examples: Theranos and Wirecard.

A notable example of inadequate due diligence is Theranos. This biotechnology company, founded by Elizabeth Holmes, claimed to have developed revolutionary blood-testing technology. Investors poured in over $700 million, driven by the promise of a groundbreaking product.

However, thorough due diligence was lacking. Key red flags—such as the technology's viability and the claims' accuracy—were overlooked. When the truth about the non-functional technology emerged, Theranos collapsed, leading to significant financial losses and legal consequences for its investors.

This case underscores the critical importance of rigorous due diligence. It highlights how skipping thorough evaluations and relying on optimistic projections can result in severe financial and reputational damage. By learning from such cautionary tales, investors can better appreciate the value of meticulous due diligence in safeguarding their investments.

Wirecard, a once-celebrated fintech company based in Germany, presents another stark example of what can go wrong without proper due diligence. At its peak, Wirecard was valued at over €24 billion and was considered a beacon of innovation in the payment processing industry. However, the company was involved in a massive accounting scandal, with over €1.9 billion missing from its balance sheets.

Investors and regulatory bodies failed to detect the financial irregularities due to insufficient scrutiny and oversight. Key warning signs were overlooked, such as inconsistencies in financial reports and dubious accounting practices. When the scandal broke, Wirecard declared insolvency, causing massive financial losses and shaking investor confidence in the regulatory framework.

The Wirecard scandal highlights the necessity of in-depth financial due diligence, including verifying the authenticity of reported assets and revenues. It reminds us that even companies with high market valuations and apparent success can harbor significant risks if not properly vetted.

Both cases underscore the necessity of comprehensive due diligence across all aspects of a startup—financial, legal, operational, and technical. Learning from the failures of Theranos and Wirecard reinforces the need for meticulous evaluation to protect investments and ensure sustainable success.

By addressing these challenges proactively, investors can significantly reduce risks and make more informed decisions.

| Aspect | Theranos | Wirecard |

|---|---|---|

| Industry | Biotechnology | Fintech |

| Innovation Claims | Revolutionary blood-testing technology | Cutting-edge payment processing solutions |

| Due Diligence Failures | Overlooked technological feasibility and accuracy of claims | Inadequate verification of financial documents and accounting practices |

| Financial Impact | Over $700 million lost by investors | Market valuation exceeded €24 billion before insolvency |

| Legal and Regulatory Impact | Legal action against founders; significant reputational damage | Regulatory scrutiny, legal consequences for executives, loss of confidence in financial systems |

| Key Lessons for Investors | Importance of verifying technological claims and scientific due diligence | Necessity of rigorous financial scrutiny and verification of accounting practices |

Thorough due diligence plays a pivotal role in the investment process, significantly influencing the outcomes and success rates of investments in tech startups. Here’s why it’s crucial:

Comprehensive due diligence allows investors to identify and mitigate potential risks before they become significant. This process involves meticulously examining financial statements, legal standings, operational efficiencies, and technological capabilities, ensuring no stone is left unturned.

By doing so, investors can uncover hidden liabilities, verify the accuracy of reported information, and assess the startup's true potential.

Enhanced investment confidence stems from a clear, detailed understanding of the startup's current and future prospects. This confidence is built on solid evidence and thorough analysis rather than speculation or incomplete data. Investors are better equipped to make informed decisions, align their strategies with the startup’s potential, and commit resources with greater assurance of a positive outcome.

Consider the story of WhatsApp, which underwent rigorous due diligence before its acquisition by Facebook. The due diligence process revealed the app's solid user base growth, high engagement rates, and potential for revenue generation, leading to a $19 billion acquisition that has since proven to be a strategic success for Facebook.

On the flip side, there's the infamous case of Theranos, a biotechnology company that misled investors with exaggerated claims about its blood-testing technology. Inadequate due diligence allowed these misrepresentations to go unchecked, leading to significant financial losses and legal troubles when the truth came to light. The Theranos debacle underscores the potential dangers of skipping thorough due diligence.

Jane Rosenthal, an expert at Propel(x), emphasizes, “The more research you do, the better informed you will be. Thorough due diligence helps to reduce the potential for loss and increases the chances of identifying a successful investment opportunity.” This sentiment highlights the critical nature of due diligence in safeguarding investments.

Similarly, experts at WOWS Global state, “Due diligence is essential for uncovering red flags and ensuring that the startup’s claims match up with the available data. It is a fundamental step that can prevent costly mistakes.” Their insights reinforce the necessity of a meticulous approach to evaluating potential investments.

These expert insights and real-world examples illustrate that thorough due diligence is indispensable for making well-informed, strategic investment decisions. It enhances the likelihood of successful outcomes and mitigates the risks associated with startup investments.

By emphasizing the importance of a meticulous due diligence process, this section aims to convey that the stakes are high and the rewards significant for those who invest the time and resources to evaluate their potential startup investments thoroughly.

The landscape of startup due diligence is evolving rapidly, driven by emerging technologies and innovative methodologies. These advancements are enhancing the accuracy and efficiency of due diligence processes and opening new avenues for evaluating startups.

Let's explore some of the most impactful trends and innovations shaping the future of investment due diligence.

The adoption of cutting-edge technologies is revolutionizing due diligence. Traditional methods, while still valuable, are being complemented and, in some cases, replaced by more advanced techniques that leverage the power of modern technology. These innovations are helping investors perform more thorough, efficient, and insightful analyses.

Artificial Intelligence (AI): AI transforms due diligence by automating data collection and analysis. AI algorithms can sift through vast amounts of data, identifying patterns and anomalies that might be missed by human analysts. This capability speeds up the due diligence process and enhances its thoroughness.

For example, AI can analyze financial documents, legal contracts, and market data for a comprehensive risk assessment. According to Deloitte, AI tools can significantly reduce the time required for due diligence, enabling faster and more informed decision-making.

Blockchain Technology: Blockchain offers a secure and transparent way to verify and store information. In the context of due diligence, blockchain can verify the authenticity of documents and track the ownership history of assets. This reduces the risk of fraud and ensures that all parties can access accurate and immutable records. For instance, smart contracts on blockchain can automate compliance verification with contractual terms, providing real-time updates and reducing the need for manual checks.

Big Data Analytics: Big data analytics allows investors to process and analyze large volumes of information from diverse sources. This capability is crucial for understanding market trends, customer behavior, and competitive dynamics. By integrating data from social media, market reports, financial news, and other sources, big data analytics can provide a holistic view of a startup’s potential and risks. This comprehensive analysis helps in making more informed investment decisions.

Integrating AI, blockchain, and big data is not just enhancing the due diligence process but fundamentally changing the investment landscape. Here’s how:

Enhanced Accuracy: These technologies improve the accuracy of due diligence by providing deeper insights and reducing human error. AI's predictive analytics, for example, can forecast future performance based on historical data, helping investors to identify potential high-growth startups.

Increased Efficiency: Automation through AI and blockchain significantly speeds up the due diligence process. Tasks traditionally took weeks can now be completed in days or even hours, allowing investors to make quicker decisions and capitalize on opportunities faster.

Greater Transparency and Security: Blockchain ensures that all data used in the due diligence process is secure and verifiable, reducing the risk of fraud. This transparency builds trust between investors and startups, facilitating smoother transactions.

Data-Driven Decision Making: The ability to analyze large datasets enables investors to base their decisions on comprehensive and up-to-date information. This data-driven approach minimizes reliance on intuition and anecdotal evidence, leading to more rational and objective investment choices.

As these technologies continue to evolve, their impact on due diligence will only grow, making the process more robust, reliable, and efficient. Investors who embrace these innovations will be better equipped to navigate the complexities of the startup ecosystem, ensuring that their investment decisions are well-informed and strategically sound.

In the following section, we will recap the key points discussed and emphasize the importance of thorough due diligence in making successful investment decisions.

Joseph Baldassarra

Managing Partner, Broad Street Global Fund

As a fund manager, purchasing investments in the pre-ipo market where company financials are not published, it is often difficult to assess a company.

However, one of the solutions that help guide me is Lior and Finro. I think without Lior's guidance, the success that we have achieved would have been much more difficult.

The firm has incredible customer service and guidance and I recommend the service for anyone in the space.

Always available, always intelligent and always within budget. What a winning combination!

This article has explored the multifaceted nature of startup due diligence, emphasizing its critical components—financial, legal, operational, and technical. Each of these areas provides a vital piece of the puzzle, helping investors understand the true potential and risks associated with a startup.

We discussed how the focus of due diligence shifts depending on the maturity of the startup, from assessing visionary leadership and market potential in early-stage companies to examining financial stability and operational efficiency in more established startups. Recognizing these stages and adapting the due diligence process accordingly is essential for accurate evaluation.

The impact of thorough due diligence cannot be overstated. Effective due diligence not only mitigates risks but also enhances investment confidence, allowing investors to commit resources with a clear understanding of the potential returns and pitfalls. The cautionary tales of Theranos and Wirecard serve as stark reminders of the consequences of inadequate due diligence, highlighting the financial and reputational damage that can result from overlooked red flags and insufficient scrutiny.

Moreover, the future of due diligence is being shaped by emerging technologies such as AI, blockchain, and big data analytics. These innovations are streamlining the process, enhancing accuracy, and providing deeper insights, thus transforming the landscape of investment due diligence.

By integrating these advanced methodologies and learning from past mistakes, investors can navigate the complexities of startup investments more effectively. Embracing a comprehensive, technology-driven approach to due diligence not only protects investments but also paves the way for identifying and nurturing the next generation of successful tech startups.

In conclusion, rigorous due diligence is the cornerstone of successful investment strategies in the tech startup ecosystem. It empowers investors to make well-informed decisions, fostering sustainable growth and innovation. As the investment landscape continues to evolve, staying abreast of the latest trends and technologies in due diligence will be key to maintaining a competitive edge and achieving long-term success.

Thorough due diligence mitigates risks and boosts investment confidence.

Focus varies by startup stage: early (potential), mid (growth), late (stability).

Financial, legal, operational, and technical aspects are critical.

Emerging technologies like AI and blockchain enhance due diligence.

Learn from case studies like Theranos and Wirecard to avoid pitfalls.

The due diligence process for startups involves a thorough background check on the business, covering key areas such as financials, legal compliance, operations, and technology. It aims to understand the story behind the numbers, the technology underpinning the business, and the people steering the company. The focus shifts depending on the startup's maturity, ranging from potential and visionary leadership in early stages to financial performance and market penetration in more established companies.

The financial due diligence checklist for startups includes:

Initial Funding Sources: Details of seed funding, grants, loans, and angel investments.

Financial Projections: Projected income statements, balance sheets, and cash flow statements for the next 3-5 years.

Burn Rate and Runway Calculations: Monthly expenses and how long current funds will last.

Financial Statements: Income statements, balance sheets, and cash flow statements for the past 3-5 years.

Revenue Streams and Profitability Analysis: Breakdown of revenue sources and profit margins.

Funding Rounds and Cap Table: Details of previous funding rounds and capitalization table.

Download the startup checklist here:

https://www.finrofca.com/reports/startup-due-diligence-checklist

A due diligence checklist is a comprehensive list of documents and information that needs to be gathered and reviewed during the due diligence process. It ensures that all critical aspects of the business, such as financials, legal compliance, operations, market analysis, and technology, are thoroughly examined before making an investment decision.

Download the startup due diligence checklist here:

https://www.finrofca.com/reports/startup-due-diligence-checklist

Investors look for several key aspects during due diligence:

Financial Health: Accurate financial statements and realistic projections.

Legal Compliance: Verification of legal documents and intellectual property rights.

Operational Effectiveness: Evaluation of the business model, market positioning, and management team capabilities.

Technology Viability: Review of the technology, its architecture, development processes, and scalability.

Market Potential: Market research reports, competitive analysis, and customer validation data.

To create a successful due diligence:

Prepare Comprehensive Documentation: Gather all necessary documents and ensure they are up-to-date and accurate.

Engage Experts: Work with financial advisors, legal counsel, and technical experts to review and validate the information.

Be Transparent: Provide clear and honest information to build trust with investors.

Focus on Key Areas: Prioritize financial health, legal compliance, operational effectiveness, and technology viability.

Learn from Case Studies: Understand the lessons from successful and failed startups to avoid common pitfalls.

VC firms perform due diligence by:

Financial Analysis: Reviewing financial statements, projections, and funding history.

Market Assessment: Evaluating market potential, competition, and customer validation.

Operational Review: Examining the business model, management team, and operational scalability.

Legal and Compliance Check: Verifying legal documents, intellectual property, and compliance with regulations.

Technical Evaluation: Assessing the technology stack, development processes, and scalability.

To perform financial due diligence:

Review Financial Statements: Examine past income statements, balance sheets, and cash flow statements.

Analyze Projections: Evaluate future financial projections and assess their realism.

Check Funding History: Look into previous funding rounds and current capitalization table.

Calculate Burn Rate and Runway: Determine monthly expenses and how long the current funds will last.

Assess Revenue Streams: Analyze the sources of revenue and their sustainability.

Identify Risks: Look for any financial red flags or inconsistencies that could indicate potential issues.