Unlocking the Power of Angel Investors: Benefits and Challenges for Startups

By Lior Ronen | Founder, Finro Financial Consulting

Angel investors are cornerstone players in the startup ecosystem, providing that crucial financial lifeline at a stage where many other investors hesitate.

Their contributions extend beyond merely supplying seed capital. The most impactful angel investors enrich startups with invaluable insights, mentorship, networking assistance, and hands-on support, catalyzing their journey from nascent ideas to burgeoning enterprises.

But what sets angel investors apart from other types of investors?

In this article, we delve into the realm of angel investing, shedding light on what drives these unique investors and how startups can leverage their extensive expertise.

We will also navigate through the process of identifying and collaborating with angel investors, illuminating how their investments have been instrumental in bringing some of the most groundbreaking ideas of our time to fruition.

Angel investors are key financial supporters in the startup world, often likened to daring knights for their role in nurturing new ventures with their funds and expertise. Originating from the Broadway scene, where they saved productions, these investors now back diverse fields like tech and healthcare. They're not just wealthy retirees but include successful entrepreneurs and professionals, motivated by various factors from financial adventure to industry shaping.

Angel investing involves high risks but can yield significant returns, especially for startups that eventually go public or get acquired. Understanding the unique investment style of these 'financial crusaders' is crucial for startups seeking fruitful partnerships and navigating the early-stage investment landscape.

What are Angel Investors?

Picture angel investors as the daring knights of the startup realm, riding in with their personal treasure chests to propel fledgling ventures into realms of success. Their backgrounds are as diverse as the ventures they back, spanning finance, technology, real estate, and healthcare, often accompanied by a seasoned understanding of the entrepreneurial battlefield.

But ever wondered about the origins of the term 'angel investors'?

The tag 'angel' hails from the vibrant Broadway theater scene, coined for the affluent patrons who swooped in with funds to rescue productions on the brink of closure. The term sailed into the entrepreneurial waters in 1978 when William Wetzel, a scholar at the University of New Hampshire, spotlighted these benefactors in his seminal study on seed capital generation in the US.

Now, with a dash of history under our belts, let's delve into what molds these financial angels.

Breaking away from cliches, angel investors aren’t always millionaires or boardroom veterans enjoying retirement.

More often, they are triumphant entrepreneurs or savvy professionals keen on channeling their wealth and wisdom to uplift the next cohort of innovators.

Their investment sagas are colored by diverse motivations. The allure of embarking on a financial adventure with young, audacious companies captivates many. Others view angel investing as a stepping stone towards a grander venture capital voyage.

The investment narratives also unfurl a spectrum of motives, ranging from a sheer passion for high-stake investment gambles to a noble intent of giving back to the startup sphere or sculpting the future of an industry.

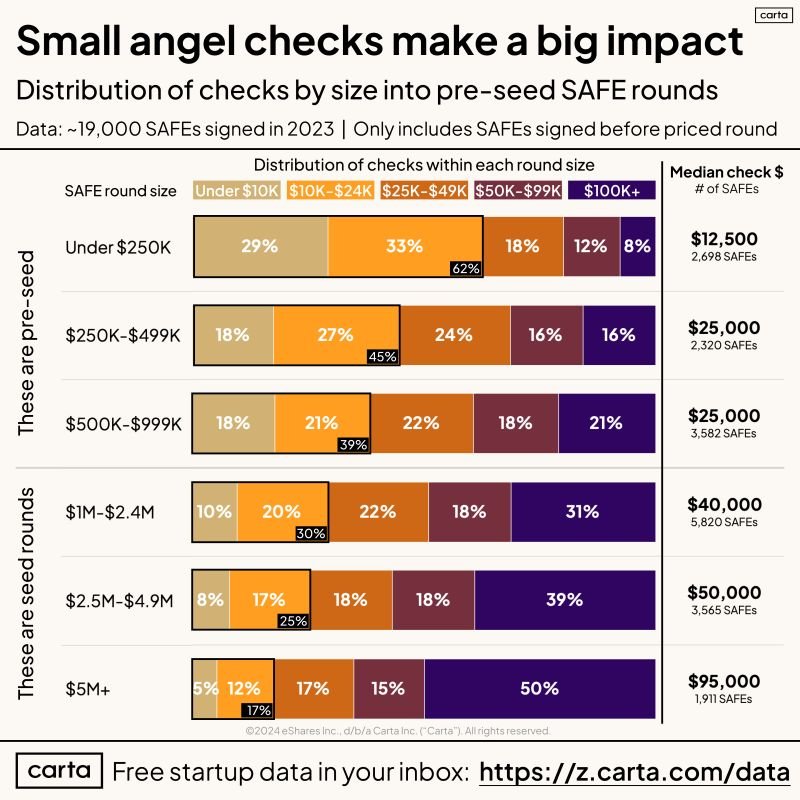

Angel investing is synonymous with embarking on a voyage during the dawn of a startup's journey. With modest check sizes yet grand visions, angel investors often enter the scene when the venture is but a budding idea, enticed by its high-growth prospects and unique value proposition.

Their investment compass may point towards a specific industry or be guided by a distinct investment philosophy. They chase the prospects of hefty returns, undeterred by the towering risks that loom in the startup landscape.

And yes, the venture is fraught with risks. The startup world is a harsh terrain where many ventures stumble. Yet, for the ones that soar, the bounty for angel investors can be monumental. Investing at the cradle stage, the windfall from a startup that hits the jackpot by going public or being acquired is nothing short of a bonanza.

This potential for a jackpot return makes the perilous journey of angel investing a captivating endeavor for many, despite the looming shadows of failed startups and volatile market winds.

Angel investors are a spirited ensemble of financial crusaders, each bringing a unique flavor to the startup ecosystem. Their investment appetites, risk thresholds, and the promise of grand rewards carve a rich narrative, painting a spectrum of opportunities for the budding entrepreneur.

Grasping the essence of their investment demeanor is the key to forging fruitful alliances with angel investors, unlocking a realm of possibilities for both the startups and the angels backing them.

Some Angel Investment Propelled Huge Businesses

There are many famous stories about angel investors and early-stage startup that later became huge. But, to show the importance of angel investing int he startup ecosystem, I wanted to highlight 3 main examples.

These three investment are often cited as some of the most successful angel investments of all time, and serve as examples of the potential rewards of early-stage investing.

Peter Thiel / Facebook

The legendary co-foudner of PayPal made an early investment in Facebook of $500,000 in 2004 and became a mentor to Mark Zuckerberg, the founder of Facebook. He was one of the first outside investors in the social media company and was one of its first board members.

Thiel's early investment in Facebook was instrumental in helping the company to scale and become one of the largest technology companies in the world. He was also a key player in securing later rounds of funding for the company, helping it to grow into the massive success it is today.

Andy Bechtolsheim / Google

The iconic co-founder of Sun Microsystems invested $100,000 in Google before the company had even incorporated. This investment was critical in helping the company to get off the ground and eventually become the tech behemoth it is today.

Bechtolsheim's early investment in Google was made based on his belief in the potential of the company's innovative search technology. His investment helped to validate the company and secure later rounds of funding, leading to Google's growth and success.

Jason Calacanis / Uber

The iconic angel investors was one of the first outside investors in the ride-hailing company and helped to provide critical support and mentorship to the founding team. Calacanis' invested $25,000 in Uber based on his belief in the potential of the company's innovative technology and business model.

Calacanis' early investment in Uber was instrumental in helping the company to scale and become one of the most valuable startups in the world. He was also a key player in securing later rounds of funding for the company, helping it to grow into the massive success it is today.

The Process of Angel Investing

The process of securing investment from an angel investor can be complex, but with the right approach, it can be an incredibly valuable experience for both the startup and the investor.

Angel investors can deliver strategic value by providing connections, guidance or leads. However, finding the right angel investors for your startup can be a challenge, but there are several resources that can help startups connect with potential investors.

One such resource is AngelList, which provides a comprehensive solution for founders and can really save a lot of time, effort and frustration.

On AngelList, founders can manage their cap table, pitch to investors, raise funds, manage expenses, incorporate the business and mange Human Resources for a very reasonable monthly fee. But, AngelList is currently available only for US C-corpotations, international businesses and LLCs need to find another solution.

A popular alternative to AngelList, is Gust, which offers a very similar set of features but most importantly allows you to connect with potential angel investors and raise funds through their platform.

Two underrated alternatives for Gust and AngelList are Twitter and LinkedIn. Both social media platforms are packed with stories of founders that found their first investors there. Founders should be ready to research potential angel investors and contact them through the DMs.

Other very popular channel to find angel investors for your startup include local entrepreneur and startup groups, accelerators, and incubators. Startups can also reach out to their personal network and attend pitch events and conferences to connect with angel investors.

Once a startup has found an angel investor interested in their business, the next step is to engage in due diligence and negotiations.

Due diligence is the process of gathering information about the startup and its market to assess the risk and potential return of the investment.

Traditional due diligence includes reviewing the business plan, market research, financial projections, and more. But, angel investors' due diligence is significantly different from the due diligence of large investment funds.

First, they don't have the same resources to comb through every aspect of the business's past, present, and future. Second, they typically get involved so early that the company doesn't have enough juice for investors to dig into.

Typically angel investors' due diligence runs around the idea's potential success, the founders' personalities, and whether they can lead the business to reach its goals.

Once the due diligence is done, the two parties negotiate the deal price, structure, and other terms.

Once due diligence and negotiations are complete, the deal can be closed, and the investment funds can be released to the startup. This is just the beginning of the relationship between the startup and the angel investor.

In most cases, the post-investment support from angel investors is as important as the funding itself. Post-investment activities may include regular check-ins, mentorship and support, and ongoing engagement with the startup as it grows and develops.

Overall, the angel investing process can be complex and time-consuming, but with the right approach, it can be an incredibly valuable experience for both the startup and the investor.

By understanding the key steps involved, startups can increase their chances of securing investment and build strong, productive relationships with their angel investors.

Benefits and Challenges of Angel Investing

Angel investing can offer significant benefits for both startups and investors, but it is not without its challenges. Understanding these benefits and challenges is key to making informed investment decisions and maximizing the returns from angel investing.

Benefits of angel investing:

Early-stage funding: Angel investors provide much-needed funding for startups that are too early-stage for traditional venture capital or bank loans. This early funding can be crucial for startups to get their businesses off the ground and start growing.

Mentorship and support: In addition to capital, angel investors can provide valuable mentorship and support to startups. This can include advice on business strategy, marketing, and operations, as well as introductions to other investors, customers, and partners.

Potential for high returns: Angel investments can offer the potential for high returns, especially if the startup is successful and experiences significant growth.

Access to a network of investors and entrepreneurs: Angel investors are often well-connected in the startup community, and can provide startups with access to a network of other investors, entrepreneurs, and resources.

Challenges of angel investing:

High risk: Angel investing is inherently risky, as the vast majority of startups fail. This means that investors must be prepared to accept the possibility of losing their entire investment.

Long-term commitment: Angel investments are typically made for a period of several years, and investors must be prepared to hold onto their investment for the long term.

Limited control: Unlike more traditional investments, angel investments usually come with limited control over the business. Investors must be comfortable with having a passive role in the company's decision-making process.

Complex process: The process of securing investment from an angel investor can be complex, and can involve extensive due diligence and negotiations. Startups must be prepared to invest significant time and resources in order to secure funding.

In conclusion, angel investing can offer significant benefits for both startups and investors, but it is not without its challenges. By understanding these benefits and challenges, startups can make informed investment decisions and maximize the returns from angel investing.

| Aspect | Benefits | Challenges |

|---|---|---|

| Funding Stage | Provides crucial early-stage funding for startups. | High risk due to early-stage nature of startups. |

| Mentorship | Offers valuable mentorship, advice, and support. | Long-term commitment required from investors. |

| Return Potential | Potential for high returns with startup success. | Possibility of losing the entire investment. |

| Network Access | Access to a network of investors and entrepreneurs. | Limited control over business decisions. |

| Process | -- | Complex process involving due diligence and negotiations. |

| Long-term Commitment | -- | Investors need to hold onto their investment for several years. |

Valuation Methods Used by Angel Investors

Startup valuation is a critical aspect of angel investing, determining the worth of a startup and influencing the equity share for investors. It's a balance between the potential of the startup and the risks involved, impacting both the investor's return and the startup's future funding opportunities.

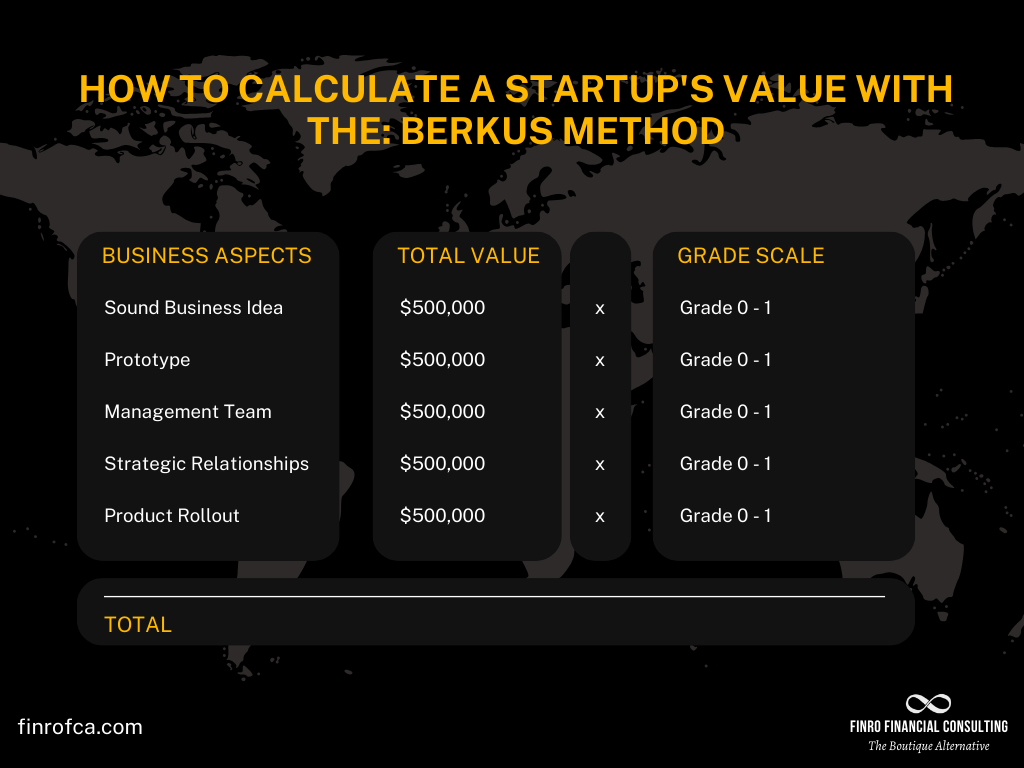

The Berkus Model

Developed by Dave Berkus, this model evaluates startups based on five key elements:

Basic value

Technology

Execution

strategic relationships

Product rollout or sales.

Each element can add a specific value to the company, simplifying valuation for early-stage companies with limited operational history. The Berkus Model is particularly advantageous for its simplicity but may not capture all the nuances of a startup's potential.

Payne Scorecard Method

This method, created by Bill Payne, involves scoring various criteria such as the management team, size of the opportunity, product/technology, competitive environment, marketing/sales channels, and the need for additional investment.

These factors are scored and weighted to calculate a more comprehensive valuation. The Payne Scorecard Method offers a more detailed analysis than the Berkus Model, but it requires more information and can be subjective.

The Venture Capital (VC) Method

Often used by venture capitalists, this method calculates the startup's future exit value and discounts it to the present value. It incorporates the expected rate of return on investment to determine the company's valuation.

While the VC method provides a detailed valuation projection, it relies heavily on assumptions about future performance and market conditions, which can be uncertain for early-stage startups.

| Criteria | Berkus Model | Payne Scorecard Method | VC Method |

|---|---|---|---|

| Approach | Qualitative | Mixed (Qualitative & Quantitative) | Quantitative |

| Complexity | Low | Medium | High |

| Data Requirements | Minimal | Moderate | Extensive |

| Typical Use Cases | Early-stage startups with limited history | Startups with some operational history | More mature startups with clearer future projections |

| Main Advantage | Simplicity and ease of use | Balanced and comprehensive | Detailed future value projection |

| Main Limitation | May overlook complex factors | Subjective scoring | Relies on assumptions about future |

Each valuation method offers unique perspectives, catering to different stages and types of startups. Understanding these methods enables both investors and startups to navigate the complexities of valuation in the dynamic world of angel investing.

Conclusion

In conclusion, angel investing is an early-stage investment strategy that can provide many benefits to startups and investors alike.

Angel investors provide much-needed funding and valuable mentorship and support to startups, while offering the potential for high returns to investors. Even though angel investing can be a risky and challenging undertaking, it can be rewarding for both parties when approached with a clear understanding of the process and expectations.

By understanding the characteristics of angel investors, the angel investing process, and the benefits and challenges of angel investing, startups and investors can make informed investment decisions and maximize the returns from their investments.

For startup entrepreneurs and investors alike, angel investing can be a valuable tool for realizing their goals.