Financial Modeling for AI Startups

By Lior Ronen | Founder, Finro Financial Consulting

Financial modeling is a crucial piece of the puzzle for any startup, but when it comes to AI ventures, it’s even more essential.

AI startups face unique financial challenges, from the high costs of data processing and cloud infrastructure to the need for continuous R&D. Without a solid financial plan, even the most innovative AI companies can struggle to get off the ground or scale effectively.

This guide is designed to break down the complexities of financial modeling for AI startups.

We’ll walk through the key elements you need to consider—from revenue projections to cash flow management—so that you can build a model that not only attracts investors but also guides your day-to-day decisions.

AI startups require a comprehensive approach to financial management, including precise financial models, cash flow oversight, and strategic cost management. Finro offers tailored financial consulting, addressing the specific challenges of tech companies. Their expertise spans payroll, forecasting, and overall financial planning, ensuring startups can navigate market shifts and innovation pressures. This approach helps AI ventures make smarter decisions, stay competitive, and remain prepared for growth and investment opportunities.

- Revenue Forecast for AI Startups

- AI Startup Business Models

- Pricing Models in AI

- Revenue Forecasting Methods

- Finro's User-Journey Method for Revenue Forecasting

- COGS (Cost of Revenues) for AI Startups

- Non-Payroll Expenses for AI Startups

- Payroll Expenses for AI Startups

- Putting It All Together: Building an Income Statement for AI Startups

- Managing Cash Flow in Capital-Intensive AI Startups

- Measuring and Reporting AI Startup Financials

- Key Financial Metrics for AI Startups

- Building Effective Financial Dashboards

- Regular Financial Reviews with Stakeholders

- Why AI Startups Should Choose Finro for Financial Modeling

- Conclusion

Revenue Forecast for AI Startups

Revenue is the lifeblood of any startup, and AI startups are no exception. However, the way AI companies generate revenue can vary significantly depending on their business model and target market.

Forecasting revenue for AI startups is particularly challenging due to the innovative nature of AI technologies and the unpredictability of adoption rates.

In this section, we’ll explore the main business models AI startups tend to adopt, the common methods for forecasting revenue, and how Finro’s user-journey method offers a practical, dynamic approach to revenue forecasting for AI startups.

AI Startup Business Models

AI startups tend to adopt one of several key business models, each with its own approach to generating revenue. Choosing the right model can have a significant impact on how revenue is forecasted and managed. Below are the most common business models AI startups typically adopt:

AI-as-a-Service (AIaaS)

Much like the SaaS model, AIaaS allows companies to offer AI-powered tools and services to customers through a subscription or usage-based pricing structure.

In this model, customers pay based on their usage or on a recurring subscription basis, making revenue more predictable and stable. The AIaaS model works particularly well for startups offering APIs for machine learning, natural language processing, or data analytics, where customers tap into these AI services as needed.

Examples of AIaaS offerings include cloud-based AI platforms, data processing services, and automated decision-making tools.

The recurring revenue nature of this model makes it attractive to investors, as it provides a stable, predictable revenue stream, although forecasting should account for potential fluctuations in customer usage.

Enterprise AI Solutions

Enterprise AI solutions typically involve custom-built AI tools tailored to meet the specific needs of large businesses.

This business model usually entails longer sales cycles and higher upfront costs, as AI startups work closely with enterprise clients to integrate and customize AI technology into their operations. Revenue in this model is often project-based or structured through long-term contracts, with substantial one-time fees and potentially ongoing maintenance or support payments.

While revenue can be significant, the unpredictable nature of enterprise sales and the lengthy implementation periods make forecasting challenging. Businesses must account for the time between landing a contract and realizing revenue, which can span months or even years.

Product-Based AI Models

In product-based models, AI startups sell tangible or digital products that incorporate AI technology, such as robotics, autonomous systems, or AI-powered software solutions. Revenue is generated through product sales, with potential opportunities for recurring revenue through updates, maintenance, or added services.

For instance, a robotics company might sell hardware equipped with AI that requires periodic software updates or offers additional features at a cost. Forecasting revenue in this model involves estimating product sales volume, customer acquisition rates, and any recurring revenue from after-sales services.

Data Monetization

Data is often considered the fuel for AI, and some AI startups capitalize on this by selling proprietary data, insights, or analytics. In the data monetization model, startups may gather and sell large volumes of industry-specific data or offer analytics platforms that transform raw data into actionable insights for businesses.

The pricing structures can vary—startups might charge for access to raw datasets, offer subscriptions for data analytics services, or provide pay-per-insight models. This business model is attractive because of the high value that businesses place on data, but the challenge is ensuring consistent and reliable data quality, which is essential for driving demand. Forecasting revenue in this model requires an understanding of market demand for specific datasets and analytics.

Each of these business models has a different structure, and AI startups may use one or combine multiple models to create hybrid approaches. Choosing the right model directly affects revenue streams, cash flow, and the way the company should approach its financial projections.

| Business Model | Revenue Source | Sales Cycle | Revenue Predictability | Key Challenges |

|---|---|---|---|---|

| AI-as-a-Service (AIaaS) | Subscription or usage-based pricing | Short to medium | High (recurring revenue) | Managing cloud costs, scaling infrastructure |

| Enterprise AI Solutions | Custom AI solutions for businesses | Long (complex negotiations) | Medium (contract-based) | Lengthy sales cycles, high upfront costs |

| Product-Based AI | Sale of AI-powered products | Medium | Medium (product sales + services) | Predicting sales volume, after-sales support costs |

| Data Monetization | Selling proprietary data or insights | Short to medium | Low to medium (data demand-driven) | Ensuring data quality, maintaining demand for datasets |

AI Startup Business Models

After selecting a business model, AI startups must decide how to price their offerings. The pricing model plays a crucial role in defining revenue streams, customer acquisition, and long-term profitability. The right pricing strategy will depend on the type of AI product or service, the target market, and the competitive landscape. Below are the common pricing models used by AI startups.

Subscription-Based Pricing

This is a widely used model, especially for AI-as-a-Service (AIaaS) startups. Customers pay a recurring fee, typically monthly or annually, for access to AI tools, platforms, or APIs. This model provides a steady and predictable revenue stream, which is attractive to both startups and investors.

Advantages: Recurring revenue, customer loyalty, easier to forecast revenue.

Challenges: High customer retention is necessary to maintain revenue; potential customer churn could hurt long-term profitability.

Usage-Based Pricing

Usage-based pricing, also known as pay-per-use, charges customers based on how much they use the AI service. This is common in AIaaS models where customers only pay for what they consume, whether it's API calls, processing power, or data storage.

Advantages: Flexibility for customers, aligns costs with customer value, can attract a wider range of customers.

Challenges: Revenue can fluctuate based on customer usage, making forecasting harder.

Tiered Pricing

Tiered pricing is often used when offering AI services with different levels of access or features. Customers can choose between different pricing plans, with higher tiers offering more advanced features or additional usage capacity. This model is particularly popular for AI platforms and tools.

Advantages: Allows for upselling, customers can grow into higher tiers as they scale, flexibility for a wide range of customers.

Challenges: Requires careful balance between features offered at different pricing tiers to prevent cannibalizing higher-priced options.

Freemium Model

The freemium model offers a basic version of the AI service for free, with the option to upgrade to a paid version for access to more advanced features or higher usage limits. This model works well when the goal is to attract a large user base quickly and convert free users into paying customers.

Advantages: Drives user acquisition, low barrier to entry, easy way to demonstrate value before asking for a payment.

Challenges: Converting free users to paying customers can be difficult, and the free version needs to offer enough value without giving too much away.

Project-Based Pricing

This model is typically used for enterprise AI solutions or custom AI products where the pricing is based on the scope of the project. Each project is customized to the client’s needs, and pricing is negotiated based on the complexity and deliverables.

Advantages: High revenue per project, flexible pricing tailored to client needs, can justify higher costs for customization.

Challenges: Longer sales cycles, unpredictable revenue flow, requires significant upfront investment in customer relationship building.

Performance-Based Pricing

In performance-based pricing, the customer pays based on the results or outcomes achieved through the AI solution. This model is often used in specific industries, such as marketing or healthcare, where AI performance is linked directly to measurable improvements, like increased conversions or reduced error rates.

Advantages: Aligns startup’s incentives with customer success, can command higher prices if performance is proven.

Challenges: Hard to measure and prove the direct impact of AI in some cases, revenue is highly dependent on achieving results.

Data-Based Pricing

AI startups that rely on selling data or insights may adopt a data-based pricing model, where customers pay based on the volume or specificity of the data they access. Pricing may vary depending on how niche or valuable the data is.

Advantages: Scalable revenue based on data volume, potential for high margins if data is proprietary and hard to replicate.

Challenges: Maintaining data quality and relevance is essential, and competition from open-source or free data sources could reduce pricing power.

| Pricing Model | Description | Advantages | Challenges |

|---|---|---|---|

| Subscription-Based | Recurring monthly or annual payments for access to services. | Steady revenue, easier to forecast. | Retention is key, churn can hurt profitability. |

| Usage-Based | Customers pay based on how much they use the service. | Flexibility, aligns costs with value. | Revenue fluctuates, harder to forecast. |

| Tiered Pricing | Different pricing plans offering varying levels of service or features. | Upselling potential, flexible for customers. | Balancing tiers to avoid cannibalizing premium plans. |

| Freemium | Basic services for free with paid upgrades for premium features. | Drives user acquisition, low entry barrier. | Converting free users to paying customers. |

| Project-Based | Pricing based on the scope of custom AI projects. | High revenue per project, flexible pricing. | Longer sales cycles, unpredictable revenue. |

| Performance-Based | Customers pay based on the success or outcome of AI solutions. | Aligns incentives with customer success. | Difficult to measure performance in some cases. |

| Data-Based | Pricing depends on the volume or value of data provided. | Scalable revenue, high margins with proprietary data. | Maintaining data quality and relevance is crucial. |

Revenue Forecasting Methods

Once an AI startup has established its business model, the next step is forecasting revenue. This is a crucial part of financial planning, as it allows startups to predict future income, allocate resources effectively, and communicate their growth potential to investors.

There are two primary methods of revenue forecasting: the top-down approach and the bottom-up approach. Both methods have their strengths and weaknesses, depending on the startup’s stage of growth and available data.

Top-Down Approach

The top-down approach is often used by early-stage startups, especially when they lack historical data to base their forecasts on.

This method starts by estimating the total size of the market (Total Addressable Market or TAM) and then narrowing it down to the share that the startup can realistically capture (Serviceable Available Market or SAM, and Serviceable Obtainable Market or SOM).

This method works well when you're pitching to investors or trying to gauge the overall market potential, but it’s inherently less accurate because it relies on broad market estimates and assumptions about market share.

AI startups using this method must be careful not to overestimate their potential market capture, especially in niche or emerging fields where competition can shift quickly.

Bottom-Up Approach

The bottom-up approach takes a more granular view and is typically preferred for startups that already have some historical data or a clear understanding of their customer acquisition strategy.

Instead of starting with the market size, this method builds revenue forecasts from the ground up by looking at specific factors like customer segments, pricing models, and conversion rates.

For example, an AIaaS startup might start by estimating the number of potential customers in each segment, then predict how many of those customers will subscribe based on conversion rates from marketing and sales efforts.

The bottom-up approach is generally more accurate because it is based on realistic inputs such as current customer acquisition rates, pricing, and projected growth, but it also requires a solid understanding of the business’s operations and sales funnel.

While the top-down approach is often used to communicate market potential to investors, the bottom-up method is preferred for internal financial planning due to its reliance on concrete data and assumptions.

| Aspect | Bottom-Up Forecast | Top-Down Forecast |

|---|---|---|

| Starting Point | Specific customer segments, pricing, and conversion rates. | Total market size (TAM), then narrowing down to target share. |

| Accuracy | More accurate, based on realistic and detailed inputs. | Less accurate, based on broader assumptions and estimates. |

| Data Requirement | Requires detailed internal data (e.g., sales, marketing performance). | Relies on external market research and assumptions. |

| Best for | Established startups with some historical data and clear customer insights. | Early-stage startups with limited historical data, used for investor pitches. |

| Example Metric | Number of customers per segment, multiplied by average price and conversion rate. | Start with TAM, refine to SAM, and estimate potential market share (SOM). |

Finro's User-Journey Method for Revenue Forecasting

At Finro, we recommend a practical, hands-on approach for forecasting revenue—what we call the user-journey method. This method is particularly well-suited for AI startups with a subscription or usage-based model, but it can be adapted for other business models as well.

The user-journey method focuses on breaking down the entire customer journey, from acquisition through to retention, and estimating the revenue potential at each stage.

Customer Acquisition

The first step is to estimate how many potential customers you can acquire and at what cost. This involves looking at your lead generation strategies, marketing channels, and conversion rates.

For example, if you’re using online marketing to attract leads, you’d estimate how many visitors your website gets, how many sign up for a demo or free trial, and how many convert into paying customers. Customer Acquisition Cost (CAC) is a critical metric here, as it will help you gauge how much revenue you need to generate to cover the cost of acquiring each new customer.

Onboarding & Conversion

Once a customer is acquired, the next step in the user-journey method is onboarding and converting them into regular, paying users. Here, you’ll want to estimate how long it takes for a customer to go from initial interest to making a purchase.

You’ll also want to account for any free trials, freemium models, or onboarding processes that might delay revenue. For AIaaS startups, usage-based pricing might mean customers take time to ramp up their usage, so this stage requires careful consideration when projecting revenue.

Customer Retention

Customer retention is where the user-journey method shines, as it allows startups to model long-term revenue based on churn rates, retention efforts, and customer lifetime value (LTV).

By calculating how long you expect customers to stay subscribed and factoring in churn rates, you can create a more dynamic and realistic revenue forecast. Monthly Recurring Revenue (MRR) and Annual Recurring Revenue (ARR) also come into play here, giving you a clear picture of stable, predictable income from retained customers.

Dynamic Forecasting

Unlike static forecasts that assume steady growth, the user-journey method enables dynamic forecasting by continuously updating revenue estimates as you optimize each stage of the customer journey.

For instance, if you improve your conversion rate or reduce churn, your revenue projections automatically adjust upward.

Finro's user-journey method offers a practical, data-driven approach to revenue forecasting, giving AI startups a clearer, more accurate picture of how their business is likely to grow. By focusing on each stage of the customer journey, you can pinpoint where to invest resources, what improvements will have the biggest impact, and how to set realistic revenue targets.

COGS (Cost of Revenues) for AI Startups

In AI startups, understanding and managing the Cost of Goods Sold (COGS) or Cost of Revenues is critical to maintaining profitability and sustainability.

COGS refers to the direct costs incurred in delivering the AI products or services to customers. For AI startups, this can include cloud infrastructure, data acquisition, licensing fees, and customer support.

Accurately calculating COGS allows AI startups to understand their gross margin, which directly impacts profitability.

Key Components of COGS for AI Startups

The COGS for AI startups typically involve several core cost components that scale with customer usage or product delivery. Here are the top 4 elements that contribute to COGS of IA startups:

Cloud Infrastructure Costs

AI startups rely heavily on cloud computing for data processing, storage, and model training. Cloud infrastructure is often the most significant portion of COGS for AI companies, especially those offering AI-as-a-Service (AIaaS) or enterprise AI solutions. Services such as AWS, Google Cloud, and Microsoft Azure charge based on usage—CPU/GPU hours, storage, and bandwidth, all of which can accumulate rapidly as data and model complexity grow.

Example: A startup running deep learning models for natural language processing (NLP) might require substantial GPU processing power to train their models, increasing cloud costs dramatically as usage scales.

Data Acquisition and Processing

Data is the backbone of any AI product, and acquiring high-quality, labeled data can be expensive. Whether an AI startup is purchasing proprietary datasets, paying for data labeling services, or developing data collection pipelines, these costs are directly tied to product delivery and scalability. Additionally, processing this data—cleaning, organizing, and preparing it for AI models—adds to the total cost of revenues.

Example: An AI healthcare startup purchasing specialized medical datasets may face significant upfront and recurring data acquisition costs, contributing directly to their COGS.

Licensing Fees for AI Tools

AI startups often use third-party tools, platforms, or algorithms that require licensing. This is particularly common for startups that leverage pre-built models or external machine learning platforms to accelerate development. Licensing fees for AI frameworks, libraries, or specialized software tools can be a considerable expense, especially as usage scales with more customers.

Example: A computer vision startup may use a licensed facial recognition API, where fees increase as the startup processes more images for its clients.

Customer Support and Technical Assistance

For AI startups, especially those offering AIaaS, customer support is a crucial part of ensuring customer success and retaining long-term contracts. The cost of providing technical support, onboarding services, and handling customer inquiries forms part of COGS. Startups may need dedicated support engineers or customer success teams to help clients integrate and maintain AI systems.

Example: An AIaaS company offering natural language processing APIs may need a dedicated support team to assist customers with integration, troubleshooting, and optimization, contributing to ongoing costs.

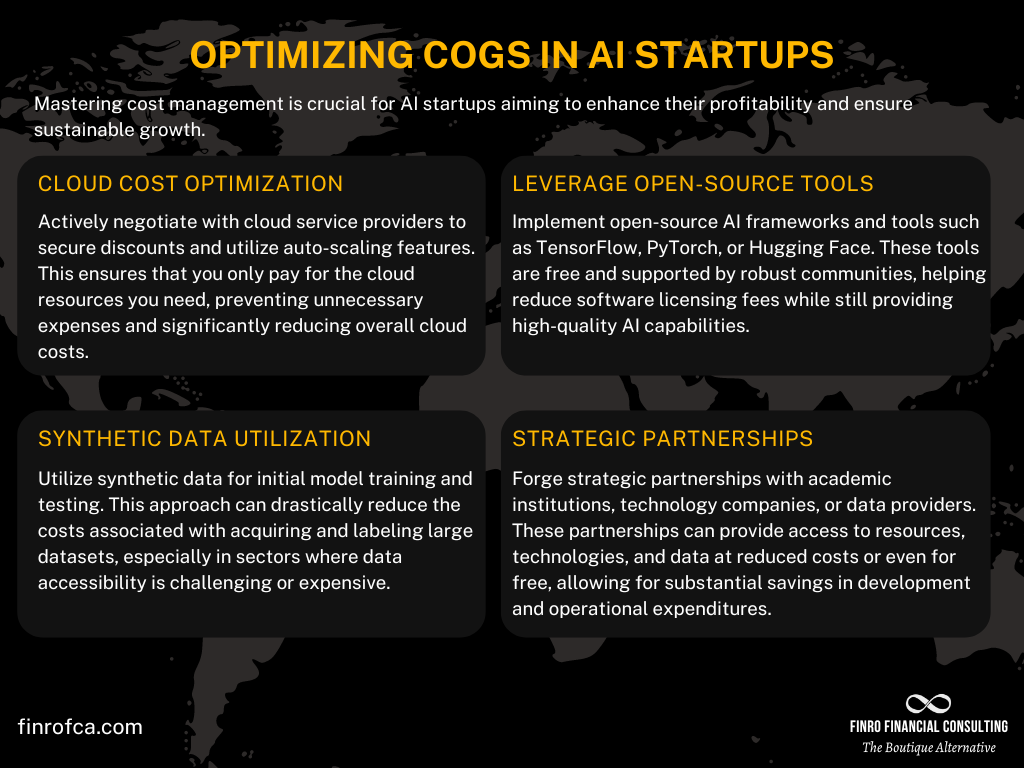

Managing and Reducing COGS for AI Startups

Effectively managing and reducing COGS is vital for improving gross margins and achieving profitability.

AI startups can adopt various strategies to control these costs without sacrificing the quality of their product or service.

Here are some practical approaches to managing COGS in an AI startup:

Cloud Cost Optimization

Since cloud infrastructure is one of the largest contributors to COGS, optimizing cloud usage is key. Startups can negotiate startup credits or discounts from cloud providers like AWS, Google Cloud, or Microsoft Azure, especially in the early stages. Additionally, adopting cloud cost-saving strategies such as auto-scaling, using reserved instances, and leveraging serverless architectures can help control cloud costs by only using resources when necessary. Monitoring tools like AWS Cost Explorer or Google Cloud’s Billing Console can also help track usage and identify inefficiencies.

Example: An AI startup that auto-scales its cloud resources can reduce costs by automatically shutting down unused instances during low-usage periods.

Leverage Open-Source AI Tools

Rather than relying on costly licensed AI tools, AI startups can adopt open-source alternatives such as TensorFlow, PyTorch, or Hugging Face for machine learning and natural language processing. These tools are well-supported by the developer community and offer a wide range of functionalities without the burden of licensing fees. Open-source tools allow startups to build and train models at a fraction of the cost, reducing overall COGS.

Example: A computer vision startup using TensorFlow for image recognition avoids the recurring fees associated with proprietary tools, reducing their cost of revenues significantly.

Use Synthetic Data for Model Training

In cases where acquiring large volumes of real-world data is expensive or difficult, AI startups can generate synthetic data to train their models. Synthetic data is artificially created but designed to mimic real-world datasets, allowing startups to build and test AI models without relying solely on costly real-world data. This is particularly useful in industries like healthcare or automotive, where obtaining sufficient data is both expensive and time-consuming.

Example: An autonomous driving AI startup can use synthetic driving simulations to train its models, reducing the need to collect real-world driving data, thereby lowering data acquisition costs.

Strategic Partnerships

Forming partnerships with academic institutions, large corporations, or data providers can help reduce costs associated with cloud infrastructure, data acquisition, or software licensing. Partnerships often provide access to shared resources, discounted services, or exclusive datasets, allowing startups to manage their cost structure more effectively.

Example: An AI healthcare startup partnering with a university might gain access to valuable research data for training its models, significantly reducing the costs of purchasing proprietary datasets.

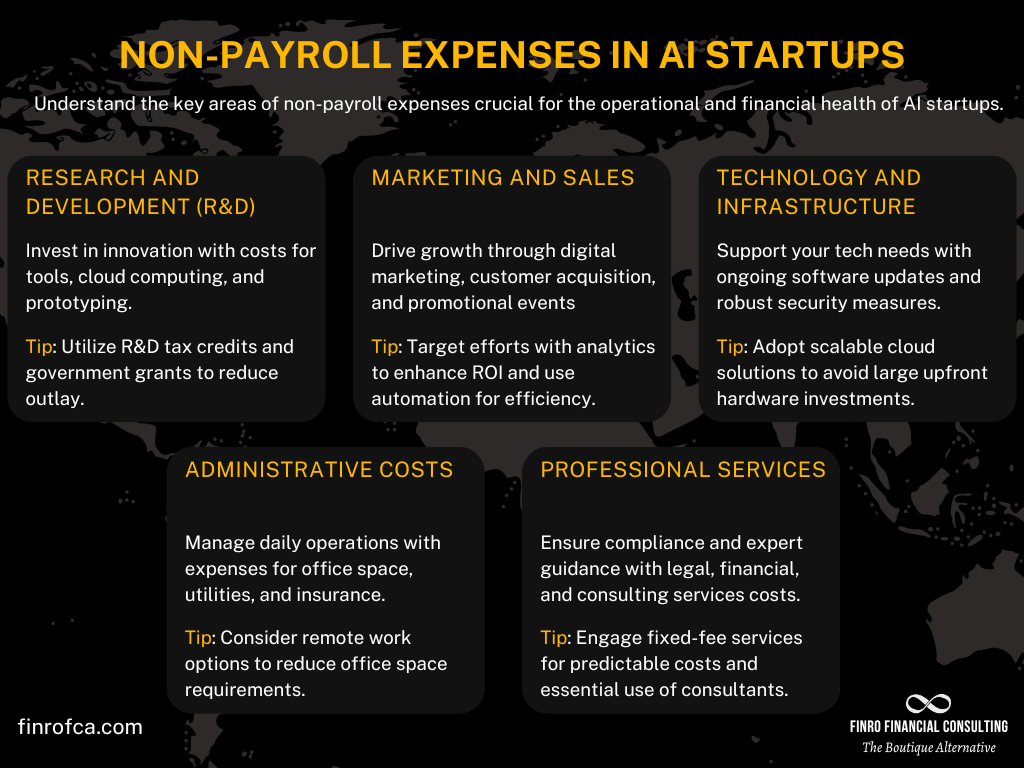

Non-Payroll Expenses for AI Startups

For AI startups, non-payroll expenses encompass a wide range of costs not directly related to employee salaries but are crucial for daily operations and long-term success.

These expenses can vary significantly depending on the nature of the AI product or service, the scale of operations, and the startup's growth phase.

Understanding and managing these expenses are essential for maintaining a healthy cash flow and achieving profitability.

Key Categories of Non-Payroll Expenses

Navigating the landscape of non-payroll expenses is crucial for AI startups, as these costs directly impact operational efficiency and financial health. From research and development to administrative duties, AI companies incur a variety of operational expenses that are essential for sustaining daily functions and supporting strategic growth.

Below, we explore the primary categories where AI startups typically allocate non-payroll funds, outlining both the nature of these costs and strategies for managing them efficiently.

Research and Development (R&D):

Description: In AI startups, R&D expenses are often substantial, as continuous innovation is crucial. These costs include spending on software development tools, cloud computing resources for testing and deployment, and prototyping materials.

Management Strategy: To control R&D costs, AI startups can leverage government grants, R&D tax credits, and strategic partnerships with universities or research institutions which can provide access to resources and cutting-edge technology at a reduced cost.

Marketing and Sales:

Description: Marketing and sales expenses are vital for the growth and scalability of AI startups. This category includes costs associated with digital marketing, customer acquisition, promotional events, and sales team salaries.

Management Strategy: AI startups can optimize these costs by focusing on digital marketing strategies with high ROI, using analytics to target marketing efforts more effectively, and employing automation tools to reduce manpower costs.

Technology and Infrastructure:

Description: Beyond cloud expenses included in R&D, this category covers ongoing costs for maintaining and upgrading hardware and software, purchasing new equipment, and investing in security to protect intellectual property and customer data.

Management Strategy: Startups can reduce these expenses by adopting cloud-based solutions that offer scalability and security without the need for heavy upfront investment in physical infrastructure.

Administrative Costs:

Description: These include office rent, utilities, insurance, legal fees, and other general administrative expenses. As startups grow, these costs tend to increase, especially when expanding into new markets or scaling operations.

Management Strategy: Effective management involves streamlining operations, possibly through outsourcing administrative functions, negotiating better terms with service providers, or transitioning to remote work models to reduce office space requirements.

Professional Services:

Description: AI startups often incur costs for services provided by accountants, lawyers, consultants, and other professionals. These services are crucial for navigating complex regulatory environments, especially in highly regulated industries like healthcare or finance.

Management Strategy: To manage these costs, startups can consider fixed-fee services when possible, use software tools for routine tasks, and engage consultants only for essential tasks that cannot be automated or handled in-house.

Strategic Approaches to Managing Non-Payroll Expenses

Effectively managing non-payroll expenses is key to ensuring the financial health and scalability of an AI startup. While non-payroll costs can vary depending on the nature and stage of the business, having a clear strategy in place allows startups to allocate resources efficiently and avoid unnecessary expenditures.

Below, we explore four key approaches to managing these expenses, starting with budgeting and forecasting.

Budgeting and Forecasting: Efficient budgeting and accurate financial forecasting are crucial for AI startups to manage non-payroll expenses effectively. Startups should employ robust financial planning tools that offer real-time insights into spending and help forecast future expenditures.

Cost-Benefit Analysis: Conducting regular cost-benefit analyses helps startups prioritize expenses based on their potential return on investment. This approach ensures that funds are allocated to areas that drive the most value, enhancing financial efficiency and supporting strategic business goals.

Vendor Management and Negotiation: Startups should regularly review their vendor contracts and seek to negotiate better terms. Bulk purchasing, long-term contracts, and early payment discounts can lead to significant savings on non-payroll expenses.

Regular Review and Optimization: Continuously monitoring and reviewing non-payroll expenses enables startups to identify cost-saving opportunities and avoid unnecessary expenditures. Implementing lean methodologies can help in minimizing waste and enhancing operational efficiency.

Get your expert support now!

Payroll Expenses for AI Startups

For AI startups, payroll expenses are often one of the most significant costs to manage, especially given the highly specialized talent needed in this sector. Payroll expenses go beyond just salaries—they also encompass bonuses, commissions, stock options, and various benefits such as healthcare and retirement contributions.

Effectively forecasting and managing these expenses is essential for maintaining financial stability, attracting top talent, and scaling the business efficiently.

Understanding Payroll Components

AI startups typically face unique challenges when it comes to staffing, as the talent pool is often highly specialized and competitive.

Let’s break down the key components of payroll for AI startups:

Base Salary

Description: The core of payroll expenses, base salaries for AI professionals—such as data scientists, machine learning engineers, and AI researchers—are generally higher than those in other industries due to the demand for technical expertise.

Consideration: Startups need to stay competitive in their salary offerings to attract top talent while balancing these costs with the company’s overall financial health. The geographical location of the talent may also affect salary ranges, especially in areas with a high cost of living.

Bonuses and Commissions

Description: Performance-based bonuses and sales commissions are common in many startups. For AI startups, bonuses may be tied to the achievement of technical milestones, such as reaching specific model accuracy targets or successful product launches.

Consideration: These variable payments should be forecasted as part of your payroll expenses to avoid cash flow surprises, especially during product launches or other high-performance periods.

Stock-Based Compensation (SBC)

Description: Stock options and equity grants are widely used in AI startups to incentivize employees and align their interests with the company’s long-term success. SBC allows startups to offer additional compensation without immediately impacting cash flow.

Consideration: Although it doesn’t immediately affect cash flow, SBC has significant long-term financial implications, particularly in terms of equity dilution. Startups should forecast the impact of stock-based compensation on their capitalization table and future financing rounds.

Employee Benefits

Description: Employee benefits such as healthcare, retirement plans, and wellness programs are an integral part of total compensation packages in the AI industry. Offering competitive benefits helps retain top talent, especially in a market where highly skilled employees have many options.

Consideration: These benefits typically add between 15% to 30% to total payroll costs. AI startups should assess their benefit offerings based on company size and stage, ensuring they offer sufficient perks to attract talent while managing costs.

Recruitment and Training Costs

Description: Attracting and hiring AI talent often involves additional costs, such as recruitment agency fees, advertising job listings, and onboarding expenses. Additionally, ongoing employee training is critical for keeping the team up-to-date with rapidly evolving AI technologies.

Consideration: These costs should be factored into overall payroll budgeting. Developing in-house recruitment processes and investing in training programs can reduce reliance on expensive external services in the long run.

Employer Taxes and Contributions

Description: Payroll taxes and employer contributions, such as social security, healthcare, and pension contributions, represent a significant part of payroll expenses. These vary by country and region and can represent a large portion of total payroll costs.

Consideration: AI startups must stay compliant with local employment laws and ensure they accurately forecast these expenses, which typically range from 7% to 20% of total payroll, depending on the location.

Forecasting Payroll for AI Startups

For AI startups, forecasting payroll can be challenging but is critical to aligning financial strategies with growth. By breaking it down into manageable steps, you can accurately project your staffing costs and plan ahead for future talent needs.

Let's dive into the essential steps to ensure an accurate payroll forecast that reflects both current operations and future growth.

Step 1: Analyzing the Current State

The first step in forecasting payroll is to thoroughly understand your business’s current operations. You’ll want to map out all active roles, departments, and their associated payroll costs. This includes identifying how many employees are dedicated to specific tasks and categorizing these roles into broad areas like customer support, product development, marketing and sales, and general administration.

This analysis will give you a clear picture of your current payroll baseline and help you understand where your business is today before projecting future needs. It's important to break this down into functional areas so you can track costs against key business activities.

Step 2: Align Payroll Forecast with the Product Roadmap

Your product roadmap is a powerful tool for predicting future staffing needs. As your startup develops new features or launches products, additional hires in development, sales, or customer support may be required.

For example, if your product roadmap shows a major feature release in six months, you’ll need to onboard talent a few months prior to ensure readiness. This alignment helps you schedule hiring and anticipate costs based on future milestones, ensuring that staffing aligns with business growth and product development timelines.

Step 3: Estimating the Direct Headcount Impact

Once you’ve identified key milestones in your product roadmap, it’s time to estimate the direct headcount impact. This involves forecasting how many additional employees you’ll need and when you’ll need them.

By assessing the timing of your product launches and related activities, you can predict when new hires should start and adjust your forecast accordingly. For instance, if you plan to launch a new AI-based product, you might need additional machine learning engineers or data scientists. Make sure to include the costs for recruitment and training during this step.

Step 4: Assessing the Indirect Headcount Impact

Beyond direct hiring, new product development can also have ripple effects across your company. Expanding your offerings may require additional support in other areas like customer service, marketing, or finance.

For example, launching a new AI product could increase customer support inquiries, necessitating the hiring of additional support staff. Likewise, marketing may need more resources to handle campaigns for the new product. Accounting for these indirect headcount impacts is crucial for comprehensive payroll forecasting.

Step 5: Calculating Payroll Per Employee

Now that you have a clear idea of both direct and indirect headcount needs, it's time to calculate payroll per employee. AI talent, such as machine learning engineers or data scientists, often commands higher-than-average salaries, so it’s important to factor in realistic salary ranges for each role. Don’t forget to include other forms of compensation, like bonuses, commissions, and stock-based compensation (SBC).

Make sure to account for geographical differences in salaries, as employees in tech hubs like Silicon Valley may have higher salary expectations compared to those in other regions.

Step 6: Factoring in Employer Contributions

A complete payroll forecast also includes employer contributions such as taxes, social security, and benefits. Employer taxes and mandatory benefits vary by country and region, and they can significantly increase your total payroll costs. Depending on the region, these can add 7% to 20% to your payroll budget.

In addition to taxes, benefits like healthcare, retirement plans, and other perks must be included in your payroll forecast. For AI startups, offering a competitive benefits package is key to attracting top talent in a competitive market.

This step-by-step approach ensures that you’re not just forecasting salaries but building a comprehensive view of all costs related to your growing team. By aligning payroll forecasting with your product roadmap, considering direct and indirect headcount impacts, and factoring in all forms of compensation and employer contributions, you can create an accurate and reliable payroll forecast for your AI startup.

Putting It All Together: Building an Income Statement for AI Startups

Now that we've broken down the key cost elements—COGS, non-payroll expenses, and payroll—it's time to see how all of these fit together in the context of an income statement.

For AI startups, the income statement serves as a financial snapshot, helping you assess your profitability by combining revenues and costs into a single view.

Structuring the Income Statement

An income statement typically consists of the following key sections:

Revenue: This is where you record all income generated by your AI startup’s operations. It includes product sales, service fees, subscription income, and other revenue streams. Revenue forecasts are typically broken down by the business models discussed earlier, such as SaaS, API services, or product sales.

Cost of Goods Sold (COGS): COGS includes the direct costs associated with delivering your AI product or service, such as cloud infrastructure, data acquisition, or model training. By subtracting COGS from your revenue, you get your gross profit—a critical measure of your startup’s financial efficiency.

Gross Profit: Gross profit tells you how efficiently your startup generates revenue relative to its direct costs. For AI startups, high gross margins are often expected due to the scalable nature of digital products, but this varies based on the type of AI service or product.

Operating Expenses:

Payroll Expenses: As covered earlier, these are your staffing costs, including base salaries, bonuses, stock-based compensation, and benefits.

Non-Payroll Expenses: This includes your R&D expenses, sales and marketing costs, and general and administrative costs (such as office rent, legal fees, and software tools). These are essential for maintaining the business but aren't directly tied to revenue generation.

Operating Profit (EBIT): Subtracting operating expenses from your gross profit gives you Earnings Before Interest and Taxes (EBIT). This is an indicator of how profitable your startup is from its core operations. A positive EBIT means your business can potentially sustain itself without relying on outside funding.

Interest, Taxes, Depreciation, and Amortization

Interest and Taxes: Any interest payments on loans or other debt obligations, along with taxes, are factored in here. Taxes might be minimal for early-stage AI startups, but it’s important to account for them as the business grows.

Depreciation and Amortization: These are non-cash expenses that account for the reduction in value of assets over time, like any hardware or intellectual property you may own.

Net Income: After all expenses, what remains is your net income—the ultimate bottom line that shows whether your AI startup is profitable. For early-stage startups, it's common for this number to be negative as you invest heavily in R&D, infrastructure, and talent.

Using the Income Statement for Decision Making

The income statement is a powerful tool for decision-making in AI startups. It highlights where your biggest expenses lie and how efficiently you're generating revenue. By tracking these metrics over time, you can:

Optimize gross margins: By improving COGS efficiency, such as reducing cloud infrastructure costs or optimizing data acquisition.

Control operating expenses: As your startup scales, keep a close watch on payroll and non-payroll expenses to prevent overspending.

Set financial goals: Track EBIT and net income to set clear targets for profitability and ensure that you have a roadmap toward a sustainable business.

While the income statement gives you a solid understanding of your profitability, it doesn’t show you how much cash your startup has on hand. That's where cash flow management comes into play.

For AI startups, managing cash flow is critical to ensure that you have enough liquidity to cover operating expenses, even if your net income is negative in the early stages. In the next section, we'll dive into cash flow management, exploring how you can keep the lights on and fuel growth by managing your inflows and outflows strategically.

Managing Cash Flow in Capital-Intensive AI Startups

For AI startups, managing cash flow effectively is crucial for survival and growth. AI ventures often operate with significant upfront investments, long sales cycles, and unpredictable revenue streams, making cash flow management particularly challenging.

While profitability is essential for any business, AI startups must focus on cash flow to keep operations running smoothly. Even if your income statement shows potential profitability, a cash shortfall can prevent you from covering day-to-day expenses, resulting in operational disruptions or forced fundraising at unfavorable terms.

For AI startups, high R&D costs, cloud infrastructure expenses, and the need for top-tier talent mean that cash can be depleted quickly. Efficient cash flow management ensures that you have enough liquidity to keep innovating, growing, and scaling while also paying your bills.

Let’s explore how to manage this delicate balance between outflows and inflows in a capital-intensive environment.

Key Strategies for Managing Cash Flow

1. Phased Investment Approach

AI startups often require significant R&D expenditures for model development and data acquisition. Instead of a large upfront investment, adopt a phased approach:

Minimum Viable Product (MVP): Start by launching a smaller-scale MVP or proof of concept. This allows you to validate your AI solution in the market without excessive initial costs. Once you have proof of traction, you can allocate more funds to further development.

Optimize Cloud Usage: AI models rely heavily on cloud infrastructure, and costs can escalate quickly as your model scales. Implement auto-scaling features to only pay for cloud resources when they’re actively used. Additionally, explore startup credits or discounted cloud services from providers like AWS, Google Cloud, or Microsoft Azure to save costs in the early stages.

2. Prioritize Cash Flow Forecasting

To effectively manage cash flow, build a detailed forecast that separates fixed from variable costs:

Fixed Costs: These include long-term expenses like salaries, office rent, or software subscriptions that remain consistent month to month.

Variable Costs: Cloud services, data acquisition, and hardware purchases often fluctuate based on the intensity of AI development and usage. By predicting these variations, you can better anticipate potential shortfalls.

This distinction allows you to foresee periods of higher cash outflows, especially during key development phases like AI model training or expansion.

3. Implement Usage-Based Pricing or Subscriptions

Given the high costs of AI development, it's essential to create a stable and predictable revenue stream. One effective method is to implement a subscription or usage-based pricing model:

Subscription Model: Offering AI services via a subscription guarantees recurring revenue each month. This is especially effective if you offer AI-as-a-Service (AIaaS) or SaaS products.

Usage-Based Pricing: Charge customers based on the actual use of your AI services or products. This aligns costs with customer activity and can attract businesses that prefer a more flexible approach.

Both pricing models provide predictable income, helping to offset the unpredictability of costs like cloud services and data acquisition.

4. Align Fundraising with Milestones

For AI startups, raising capital is essential, but the timing can make a significant difference in valuation and negotiation strength. Aligning your fundraising with key milestones ensures that you seek funding when you have maximum leverage:

Early-Stage Milestones: Raise capital after achieving product validation or signing your first customers, as this shows traction and reduces risk for investors.

Late-Stage Milestones: Raise later rounds when you’ve scaled operations, increased revenue, and need to accelerate growth. Having clear product or revenue milestones helps you negotiate better terms.

In addition, explore non-dilutive funding options such as government grants, R&D tax credits, or venture debt. These can provide additional cash flow without giving up equity, especially when you're in capital-intensive phases.

5. Minimizing Cash Burn through Strategic Cost Management

AI startups can manage cash burn by keeping a close eye on where the money is going and identifying areas for cost optimization:

Outsource Non-Core Activities: In the early stages, consider outsourcing non-core tasks to freelancers or agencies. This reduces payroll expenses while allowing you to access top-tier talent on a flexible basis. For example, tasks such as data labeling, IT services, or content creation for marketing can be outsourced, while your in-house team focuses on product development.

Use Open-Source Tools and Datasets: Leverage open-source tools like TensorFlow, PyTorch, or Hugging Face to reduce software costs. Similarly, start with publicly available datasets for model training before acquiring proprietary data to reduce upfront expenses.

6. Accelerating Cash Inflows

One of the most effective ways to manage cash flow is to accelerate your inflows. AI startups can do this by:

Customer Prepayments: Offer discounts or incentives for early payments or longer-term contracts. This provides immediate liquidity that can be used to fund operations.

Pilot Projects and Early Contracts: Secure early-stage pilot projects with potential clients to generate early cash inflows while refining your product. These initial clients may also provide valuable feedback and validation for your product.

Diversify Revenue Streams: Consider offering consulting or AI-related services while your core product is still under development. This provides an additional income stream to support ongoing R&D.

7. Building Cash Reserves and Financial Runway

Cash reserves are your startup's buffer against unexpected challenges, whether it's a delayed fundraising round, product development setback, or slower-than-expected customer acquisition. Building cash reserves helps you weather these storms:

Target a 6-12 Month Runway: Ideally, you should maintain enough cash to cover operating expenses for 6 to 12 months. This ensures you can continue operations even during lean periods.

Monitor Burn Rate: Keep a close eye on your burn rate (the rate at which you’re using cash). If you notice it increasing rapidly, reassess your expenses to ensure they are essential for growth.

Conclusion: Balancing Growth and Cash Flow Management

Managing cash flow in capital-intensive AI startups requires strategic planning, prioritization, and careful monitoring.

The key to success lies in balancing investments in AI development with available cash while also ensuring that revenue generation is aligned with the startup’s growth trajectory.

By forecasting cash flow accurately, optimizing costs, and raising capital at the right times, AI startups can build a financial runway that allows them to innovate and scale without running out of cash.

Measuring and Reporting AI Startup Financials

Navigating an AI startup's financial landscape requires generating revenue and effective measurement and reporting to gauge success and steer the venture toward sustainability and growth.

This section delves into the vital financial metrics, how to visualize financial health through dashboards, and the importance of regular financial reviews.

Key Financial Metrics for AI Startups

For AI startups, certain financial metrics become pivotal in assessing the health and trajectory of the business. These metrics help founders, investors, and stakeholders understand where the business stands and what strategic adjustments are needed.

Critical Metrics Include:

Monthly Recurring Revenue (MRR): A key performance indicator for AI startups with subscription-based models, reflecting stable revenue streams.

Burn Rate: Measures how quickly a startup goes through its capital, indicating when additional funding or revenue is required.

Customer Acquisition Cost (CAC): Essential for evaluating the efficiency of marketing strategies and the scalability of the business model.

Lifetime Value (LTV): Projects the total revenue a single customer is expected to generate over their relationship with the startup, which is crucial for balancing against CAC.

Gross Margin: Highlights the profitability of the AI products or services after accounting for the cost of goods sold (COGS).

Building Effective Financial Dashboards

Financial dashboards provide a real-time snapshot of a company’s financial performance and health, enabling quick and informed decision-making.

Key Components of an Effective Dashboard:

Revenue Streams: Breaks down different sources of income to pinpoint growth areas.

Expense Tracking: Monitors outgoing cash flow to manage budgets effectively.

Profitability Metrics: Combines various data points to assess overall financial health.

Custom KPIs: Tailor-made metrics specific to the AI industry or the particular startup’s operational focus.

Regular Financial Reviews with Stakeholders

Regular financial reviews ensure that all stakeholders are aligned with the financial direction and operational strategies of the startup.

Components of Effective Reviews:

Quarterly Financial Statements: Detailed reports on income, expenses, cash flow, and equity changes.

Benchmarking Performance: Comparing actual performance against budgets, forecasts, and industry peers.

Strategic Discussions: Focusing on financial results to guide strategic decisions and future financial planning.

Engagement with Stakeholders:

Internal Reviews: Regular meetings with team leaders to align operational and financial objectives.

Investor Meetings: Annual or bi-annual reviews to keep investors informed and engaged in the startup’s progress.

Effective financial measurement and reporting are not just about keeping score; they are crucial tools for strategic management, ensuring that AI startups remain on a path to long-term success.

Implementing robust financial tracking mechanisms and maintaining open lines of communication with stakeholders can significantly enhance the startup’s ability to adapt to market changes and seize new opportunities.

Why AI Startups Should Choose Finro for Financial Modeling

In the labyrinth of startup growth and venture sustainability, financial modeling is akin to a navigator, indispensable for charting a clear path through complex fiscal landscapes.

AI startups, with their unique challenges and intricacies, find this tool particularly vital.

1. Specialized Knowledge in Tech and AI: Finro isn’t just another financial consultancy; we specialize in the tech sector, with a deep dive into the AI landscape. This expertise allows us to build financial models that are not only precise but also intricately tailored to the specifics of AI technologies and market dynamics.

2. Comprehensive Financial Modeling: Our approach goes beyond basic spreadsheets. We integrate various financial aspects—from revenue forecasting and cash flow analysis to risk assessment and investment scalability. Each model is crafted to reflect your AI startup’s unique trajectory and business strategy, ensuring that you are equipped to meet both current and future financial challenges.

3. Dual Purpose of Models: At Finro, we understand that a financial model serves two critical roles. Internally, it is your strategic guide, helping navigate through financial forecasting and scenario planning. Externally, it becomes a crucial document during fundraising or M&A activities, presenting your startup’s potential and strategic value to investors and partners effectively.

4. Investor-Friendly Presentations: Our financial models resonate with what investors are looking for. With our background in dealing with venture capitals and angel investors, we know how to highlight your startup’s strengths in ways that align with investor expectations, enhancing your credibility and attractiveness as an investment.

5. Avoiding the Pitfalls of Generalist or DIY Modeling: Generalist and DIY financial models often lack the depth and accuracy required for AI startups and can lead to costly mistakes or overlooked opportunities. Finro’s specialized service minimizes these risks, providing a reliable foundation for your financial planning and decision-making processes.

6. Case Studies of Success: Our portfolio includes numerous success stories where we’ve transformed complex financial data into clear, actionable insights for AI startups. These case studies showcase our ability to adapt and deliver high-quality financial models tailored to the unique needs of each client.

Conclusion: Choosing Finro means partnering with experts who bring a focused, tech-centric approach to financial modeling. We don’t just deliver models; we create bespoke financial tools that pave the way for your AI startup’s long-term success. From navigating early-stage funding to scaling operations internationally, our models are designed to support your growth at every stage.

Contact Finro Today: Ready to secure your AI startup’s future with a comprehensive financial model that bridges the gap between innovation and fiscal excellence? Contact Finro Financial Consulting today, and let us help you build a financial foundation that accelerates your path to success.

Aligning with your startup's unique needs and the ever-evolving tech market, Finro Financial Consulting stands as the optimal choice for AI startups seeking precision, foresight, and a strategic financial partner.

Conclusion

In the journey of building and scaling an AI startup, the importance of precise and strategic financial modeling cannot be overstated. Throughout this article, we've explored various facets of financial management that are critical to the success of AI startups, from essential financial metrics and effective cash flow management to the detailed processes involved in payroll and operational expenses. Each section has underlined the need for robust financial strategies that align with both the immediate operational needs and long-term strategic goals of AI ventures.

As we have discussed, choosing the right financial modeling consultant or service is more than a mere operational decision—it's a strategic choice that can define the trajectory of a startup. Finro Financial Consulting, with its specialized focus on tech startups, offers a partnership that extends beyond traditional financial consulting. Our approach combines deep industry knowledge with a tailored methodology that addresses the unique challenges and dynamics of the tech sector, particularly AI startups.

By partnering with Finro, AI startups gain more than just financial expertise; they gain a strategic ally equipped to navigate the complex landscape of innovation, investment, and growth. Our commitment to precision, customization, and understanding the tech industry’s nuances ensures that the financial models we develop are not just tools, but roadmaps to success.

Ultimately, this article serves as a comprehensive guide for AI startups looking to solidify their financial foundations and propel their businesses forward. The insights and strategies discussed are designed to equip founders and their teams with the knowledge and tools necessary for making informed decisions that foster stability and growth.

For AI startups poised at the brink of transformation, strategic financial modeling is not just beneficial—it's essential. It ensures that every financial decision and projection is grounded in reality and aligned with both current capabilities and future aspirations. Finro stands ready to help you turn these financial strategies into a competitive advantage, paving the way for your success in the ever-evolving tech landscape.

By embracing detailed, forward-thinking financial practices, AI startups can navigate the uncertainties of innovation and market dynamics, ensuring that they not only survive but thrive in the competitive tech arena. Remember, in the world of tech startups, a well-crafted financial model is your map to success—make sure it’s drawn by experts who understand the terrain.

Key Takeaways

Strategic Financial Modeling is Essential: Precise modeling is vital for managing operational needs and achieving long-term goals.

Specialized Consultancy Offers Competitive Edge: Finro provides tailored financial services that cater specifically to the dynamic needs of AI startups.

Comprehensive Financial Management: Covering all aspects from cash flow to payroll ensures AI startups maintain liquidity and operational efficiency.

Partnership Beyond Numbers: Finro acts not just as a service provider, but as a strategic ally in the tech sector.

Forward-Thinking Financial Practices: Advanced financial strategies equip AI startups to handle market dynamics and innovation challenges effectively.